Ladder Capital (NYSE:LADR) Posts Q2 Sales In Line With Estimates

Commercial real estate lender Ladder Capital (NYSE: LADR) met Wall Street’s revenue expectations in Q2 CY2025, but sales fell by 21.4% year on year to $56.3 million. Its GAAP profit of $0.14 per share was 8.7% below analysts’ consensus estimates.

Is now the time to buy Ladder Capital? Find out by accessing our full research report, it’s free.

Ladder Capital (LADR) Q2 CY2025 Highlights:

- Net Interest Income: $21.53 million vs analyst estimates of $23.6 million (6,174% year-on-year growth, 8.8% miss)

- Revenue: $56.3 million vs analyst estimates of $56.18 million (21.4% year-on-year decline, in line)

- EPS (GAAP): $0.14 vs analyst expectations of $0.15 (8.7% miss)

- Market Capitalization: $1.42 billion

“We are very pleased to achieve investment grade status and complete our inaugural unsecured bond offering in the investment grade market,” said Brian Harris, Ladder’s Chief Executive Officer.

Company Overview

Founded during the 2008 financial crisis when traditional lenders retreated from commercial real estate, Ladder Capital (NYSE: LADR) is a real estate investment trust that originates commercial real estate loans, owns commercial properties, and invests in real estate securities.

Sales Growth

From lending activities to service fees, most banks build their revenue model around two income sources. Interest rate spreads between loans and deposits create the first stream, with the second coming from charges on everything from basic bank accounts to complex investment banking transactions.

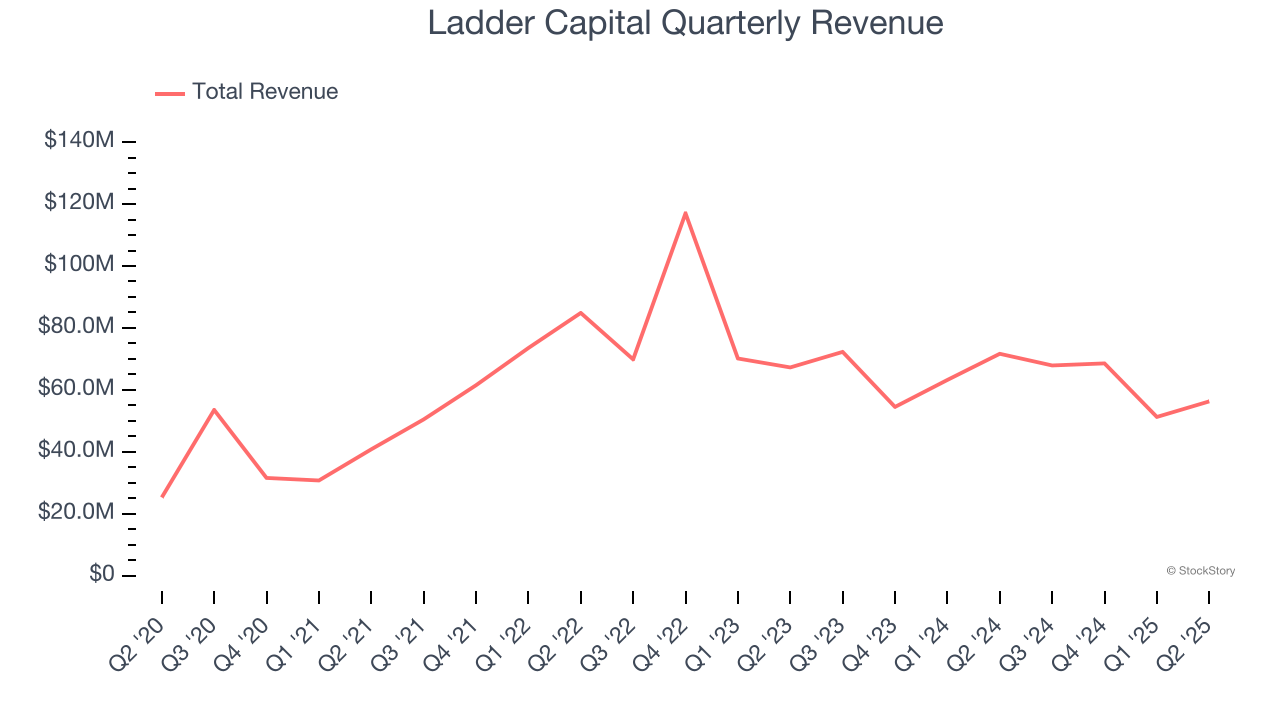

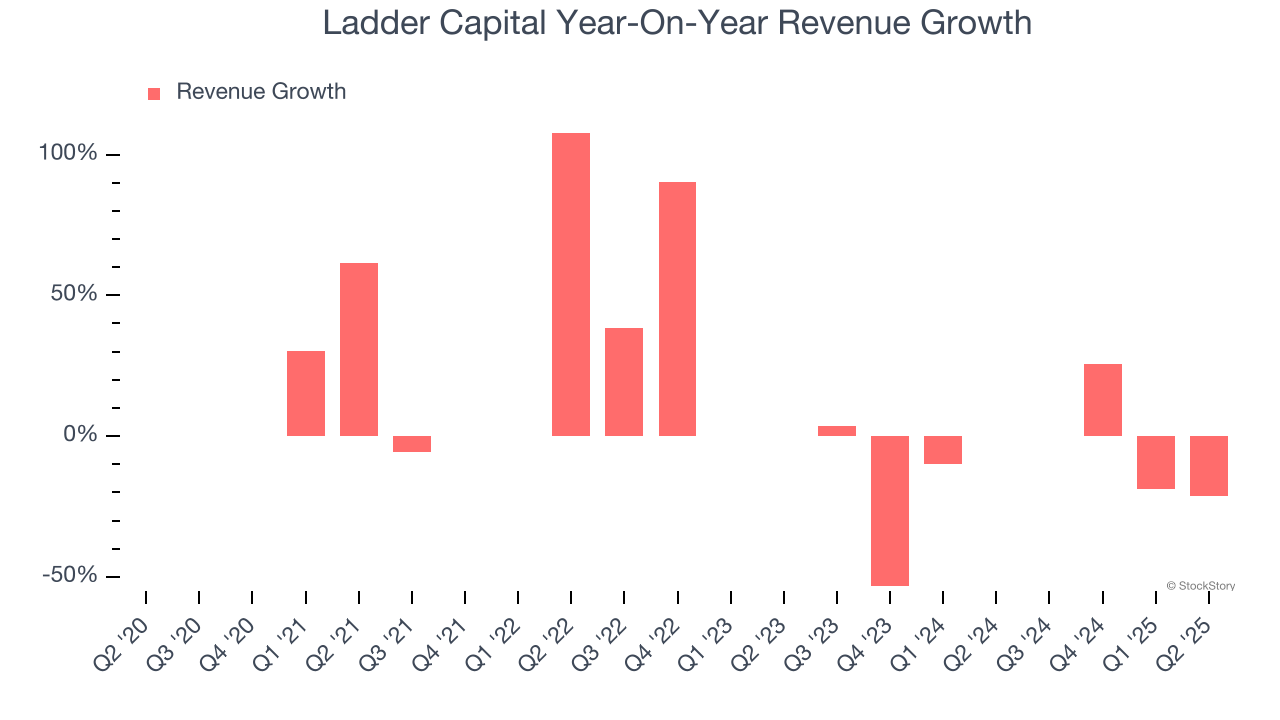

Thankfully, Ladder Capital’s 17.1% annualized revenue growth over the last five years was incredible. Its growth beat the average bank company and shows its offerings resonate with customers.

We at StockStory place the most emphasis on long-term growth, but within financials, a half-decade historical view may miss recent interest rate changes, market returns, and industry trends. Ladder Capital’s recent performance marks a sharp pivot from its five-year trend as its revenue has shown annualized declines of 13.2% over the last two years.  Note: Quarters not shown were determined to be outliers, impacted by outsized investment gains/losses that are not indicative of the recurring fundamentals of the business.

Note: Quarters not shown were determined to be outliers, impacted by outsized investment gains/losses that are not indicative of the recurring fundamentals of the business.

This quarter, Ladder Capital reported a rather uninspiring 21.4% year-on-year revenue decline to $56.3 million of revenue, in line with Wall Street’s estimates.

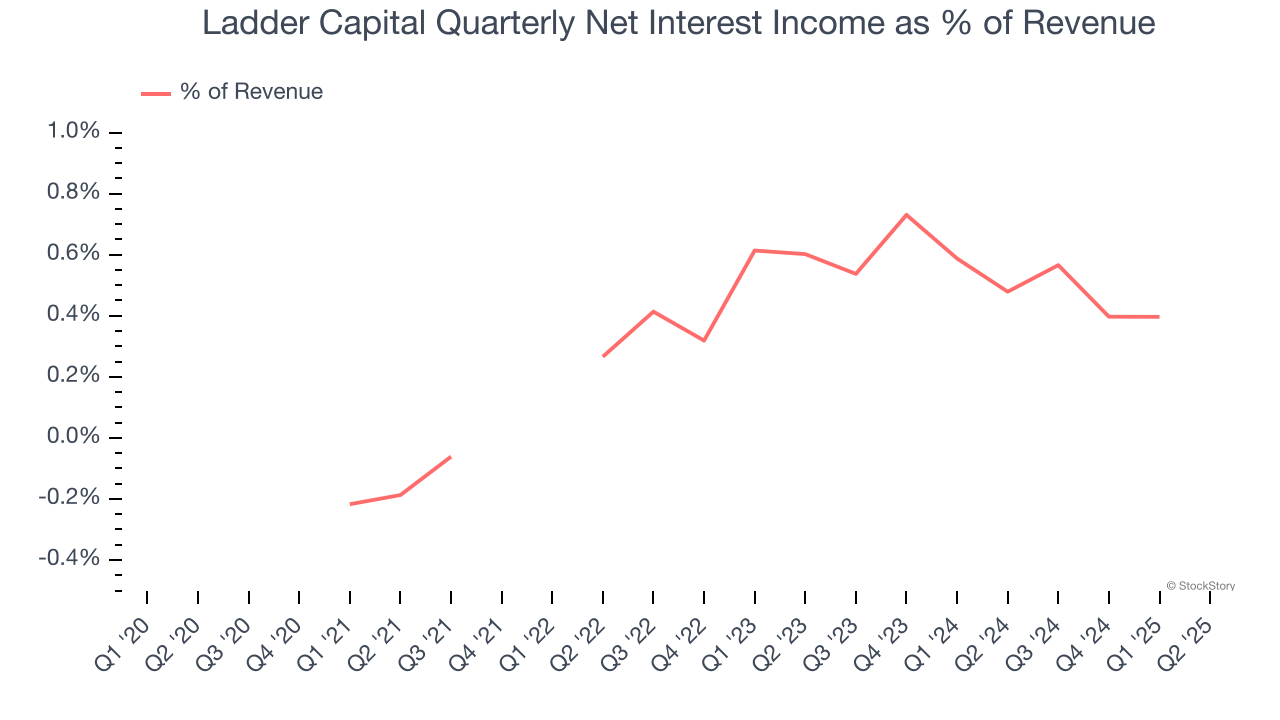

Net interest income made up 2.2% of the company’s total revenue during the last five years, meaning Ladder Capital is well diversified and has a variety of income streams driving its overall growth. Nevertheless, net interest income is critical to analyze for banks because they’re considered a higher-quality, more recurring revenue source by investors.

Note: Quarters not shown were determined to be outliers, impacted by outsized investment gains/losses that are not indicative of the recurring fundamentals of the business.

Note: Quarters not shown were determined to be outliers, impacted by outsized investment gains/losses that are not indicative of the recurring fundamentals of the business.Here at StockStory, we certainly understand the potential of thematic investing. Diverse winners from Microsoft (MSFT) to Alphabet (GOOG), Coca-Cola (KO) to Monster Beverage (MNST) could all have been identified as promising growth stories with a megatrend driving the growth. So, in that spirit, we’ve identified a relatively under-the-radar profitable growth stock benefiting from the rise of AI, available to you FREE via this link.

Key Takeaways from Ladder Capital’s Q2 Results

We struggled to find many positives in these results. Its net interest income missed and its EPS fell short of Wall Street’s estimates. Overall, this quarter could have been better. The stock remained flat at $11.04 immediately following the results.

Ladder Capital may have had a tough quarter, but does that actually create an opportunity to invest right now? We think that the latest quarter is only one piece of the longer-term business quality puzzle. Quality, when combined with valuation, can help determine if the stock is a buy. We cover that in our actionable full research report which you can read here, it’s free.

More News

View More

Recent Quotes

View More

Quotes delayed at least 20 minutes.

By accessing this page, you agree to the Privacy Policy and Terms Of Service.