Tilray (NASDAQ:TLRY) Reports Sales Below Analyst Estimates In Q2 Earnings

Cannabis company Tilray Brands (NASDAQ: TLRY) missed Wall Street’s revenue expectations in Q2 CY2025, with sales falling 2.3% year on year to $224.5 million. Its GAAP loss of $1.30 per share was significantly below analysts’ consensus estimates.

Is now the time to buy Tilray? Find out by accessing our full research report, it’s free.

Tilray (TLRY) Q2 CY2025 Highlights:

- Revenue: $224.5 million vs analyst estimates of $229.2 million (2.3% year-on-year decline, 2% miss)

- EPS (GAAP): -$1.30 vs analyst estimates of -$0.03 (significant miss)

- Adjusted EBITDA: $27.64 million vs analyst estimates of $23.69 million (12.3% margin, 16.7% beat)

- Operating Margin: -643%, down from -7.2% in the same quarter last year

- Free Cash Flow was -$13.15 million, down from $28.34 million in the same quarter last year

- Market Capitalization: $696.9 million

Irwin D. Simon, Chairman and Chief Executive Officer, stated, “In Fiscal Year 2025, we meaningfully advanced our platform, driving growth in all of our sectors, cannabis, beverage, and wellness. Our progress is rooted in a deep understanding of evolving consumer needs, shaping offerings that not only reflect, but anticipate how people choose to eat, drink, relax, and address their wellbeing. We increased revenue, enhanced efficiency, and boosted gross profit across all our businesses. Our continued investment in growth led to record fiscal year revenue, underscoring the resilience and durability of our strategy.”

Company Overview

Founded in 2013, Tilray Brands (NASDAQ: TLRY) engages in cannabis research, cultivation, and distribution, offering a range of medical and recreational cannabis products, hemp-based foods, and alcoholic beverages.

Revenue Growth

A company’s long-term performance is an indicator of its overall quality. Any business can put up a good quarter or two, but many enduring ones grow for years.

With $821.3 million in revenue over the past 12 months, Tilray is a small consumer staples company, which sometimes brings disadvantages compared to larger competitors benefiting from economies of scale and negotiating leverage with retailers. On the bright side, it can grow faster because it has a longer list of untapped store chains to sell into.

As you can see below, Tilray grew its sales at a decent 9.3% compounded annual growth rate over the last three years. This shows its offerings generated slightly more demand than the average consumer staples company, a useful starting point for our analysis.

This quarter, Tilray missed Wall Street’s estimates and reported a rather uninspiring 2.3% year-on-year revenue decline, generating $224.5 million of revenue.

Looking ahead, sell-side analysts expect revenue to grow 6.3% over the next 12 months, a deceleration versus the last three years. Despite the slowdown, this projection is above average for the sector and suggests the market sees some success for its newer products.

Today’s young investors won’t have read the timeless lessons in Gorilla Game: Picking Winners In High Technology because it was written more than 20 years ago when Microsoft and Apple were first establishing their supremacy. But if we apply the same principles, then enterprise software stocks leveraging their own generative AI capabilities may well be the Gorillas of the future. So, in that spirit, we are excited to present our Special Free Report on a profitable, fast-growing enterprise software stock that is already riding the automation wave and looking to catch the generative AI next.

Cash Is King

Although earnings are undoubtedly valuable for assessing company performance, we believe cash is king because you can’t use accounting profits to pay the bills.

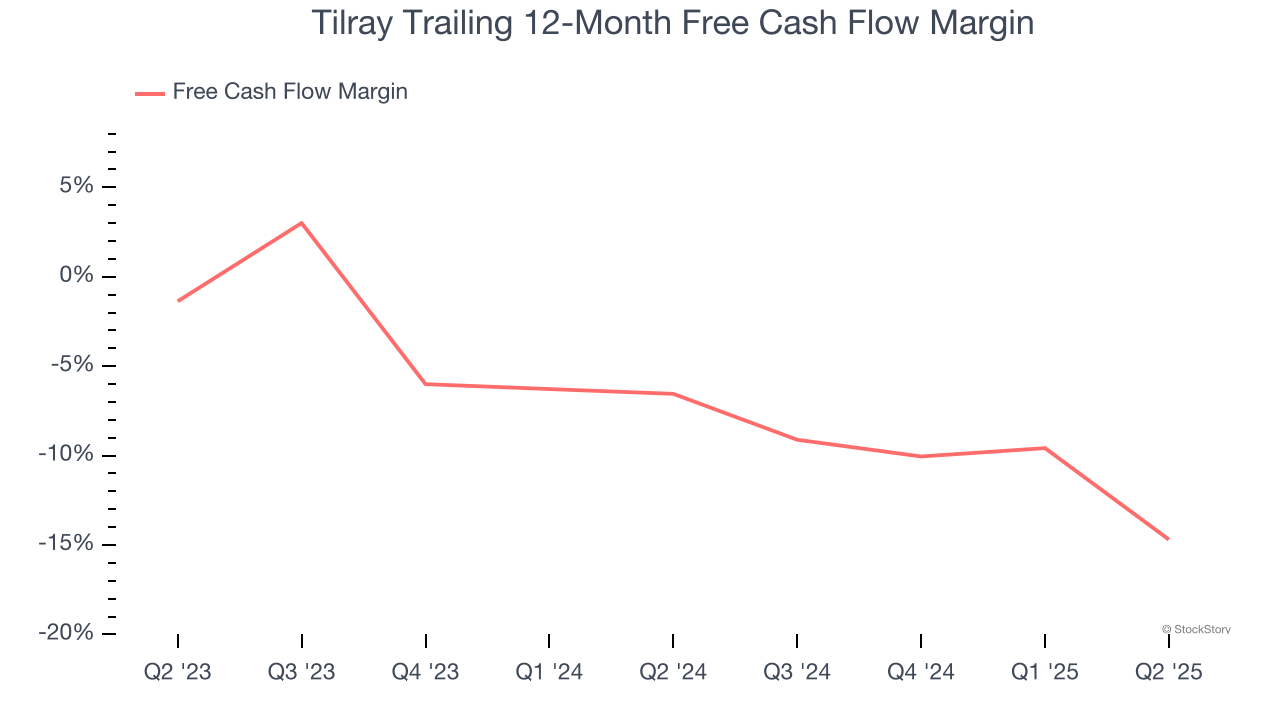

Tilray’s demanding reinvestments have drained its resources over the last two years, putting it in a pinch and limiting its ability to return capital to investors. Its free cash flow margin averaged negative 10.7%, meaning it lit $10.70 of cash on fire for every $100 in revenue.

Taking a step back, we can see that Tilray’s margin dropped by 8.1 percentage points over the last year. Almost any movement in the wrong direction is undesirable because it is already burning cash. If the trend continues, it could signal it’s in the middle of a big investment cycle.

Tilray burned through $13.15 million of cash in Q2, equivalent to a negative 5.9% margin. The company’s cash flow turned negative after being positive in the same quarter last year, but it’s still above its two-year average. We wouldn’t read too much into this quarter’s decline because investment needs can be seasonal, causing short-term swings. Long-term trends carry greater meaning.

Key Takeaways from Tilray’s Q2 Results

We were impressed by how significantly Tilray blew past analysts’ EBITDA expectations this quarter. On the other hand, full-year EBITDA guidance missed. Additionally, its gross margin missed and its EPS fell short of Wall Street’s estimates. Overall, this quarter could have been better. The stock remained flat at $0.69 immediately following the results.

Tilray’s earnings report left more to be desired. Let’s look forward to see if this quarter has created an opportunity to buy the stock. What happened in the latest quarter matters, but not as much as longer-term business quality and valuation, when deciding whether to invest in this stock. We cover that in our actionable full research report which you can read here, it’s free.

More News

View MoreRecent Quotes

View More

Quotes delayed at least 20 minutes.

By accessing this page, you agree to the Privacy Policy and Terms Of Service.