3 Reasons PNTG is Risky and 1 Stock to Buy Instead

Over the past six months, The Pennant Group’s stock price fell to $23.22. Shareholders have lost 15.6% of their capital, which is disappointing considering the S&P 500 has climbed by 5.8%. This might have investors contemplating their next move.

Is there a buying opportunity in The Pennant Group, or does it present a risk to your portfolio? See what our analysts have to say in our full research report, it’s free.

Why Is The Pennant Group Not Exciting?

Even though the stock has become cheaper, we don't have much confidence in The Pennant Group. Here are three reasons why you should be careful with PNTG and a stock we'd rather own.

1. Fewer Distribution Channels Limit its Ceiling

Larger companies benefit from economies of scale, where fixed costs like infrastructure, technology, and administration are spread over a higher volume of goods or services, reducing the cost per unit. Scale can also lead to bargaining power with suppliers, greater brand recognition, and more investment firepower. A virtuous cycle can ensue if a scaled company plays its cards right.

With just $748.2 million in revenue over the past 12 months, The Pennant Group is a small company in an industry where scale matters. This makes it difficult to build trust with customers because healthcare is heavily regulated, complex, and resource-intensive.

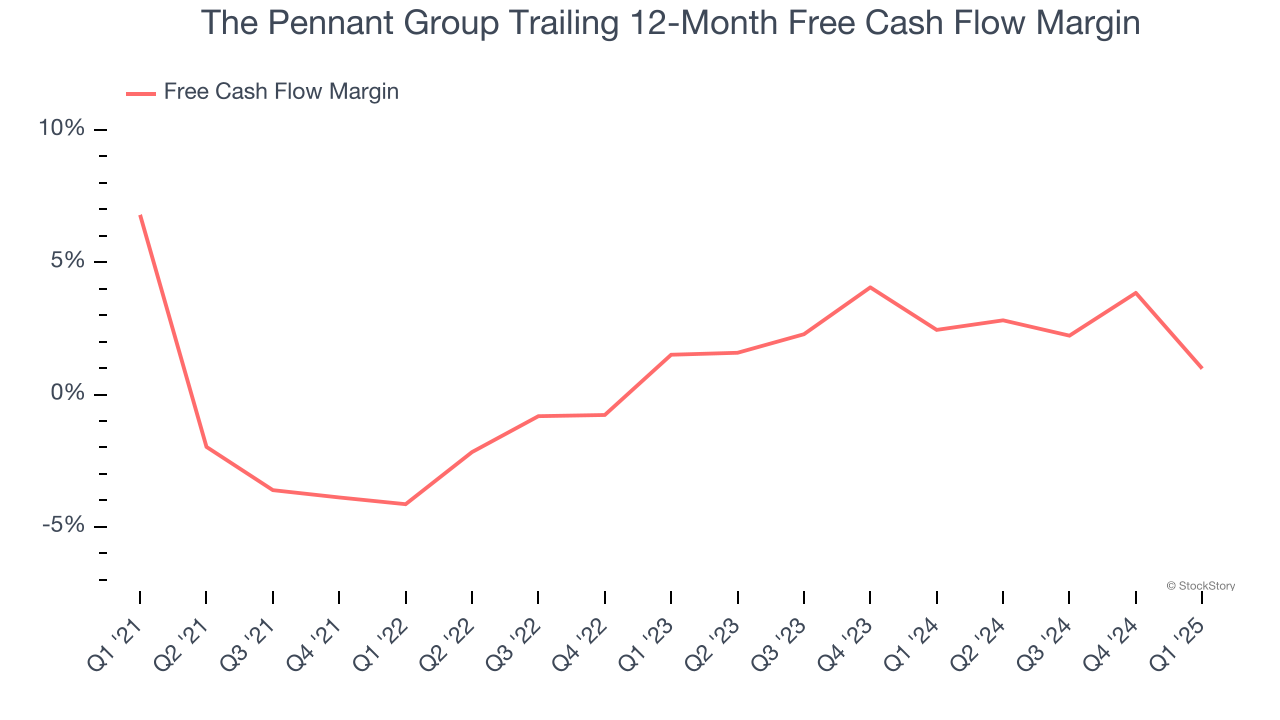

2. Free Cash Flow Margin Dropping

If you’ve followed StockStory for a while, you know we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can’t use accounting profits to pay the bills.

As you can see below, The Pennant Group’s margin dropped by 5.8 percentage points over the last five years. Almost any movement in the wrong direction is undesirable because of its already low cash conversion. If the trend continues, it could signal it’s becoming a more capital-intensive business. The Pennant Group’s free cash flow margin for the trailing 12 months was breakeven.

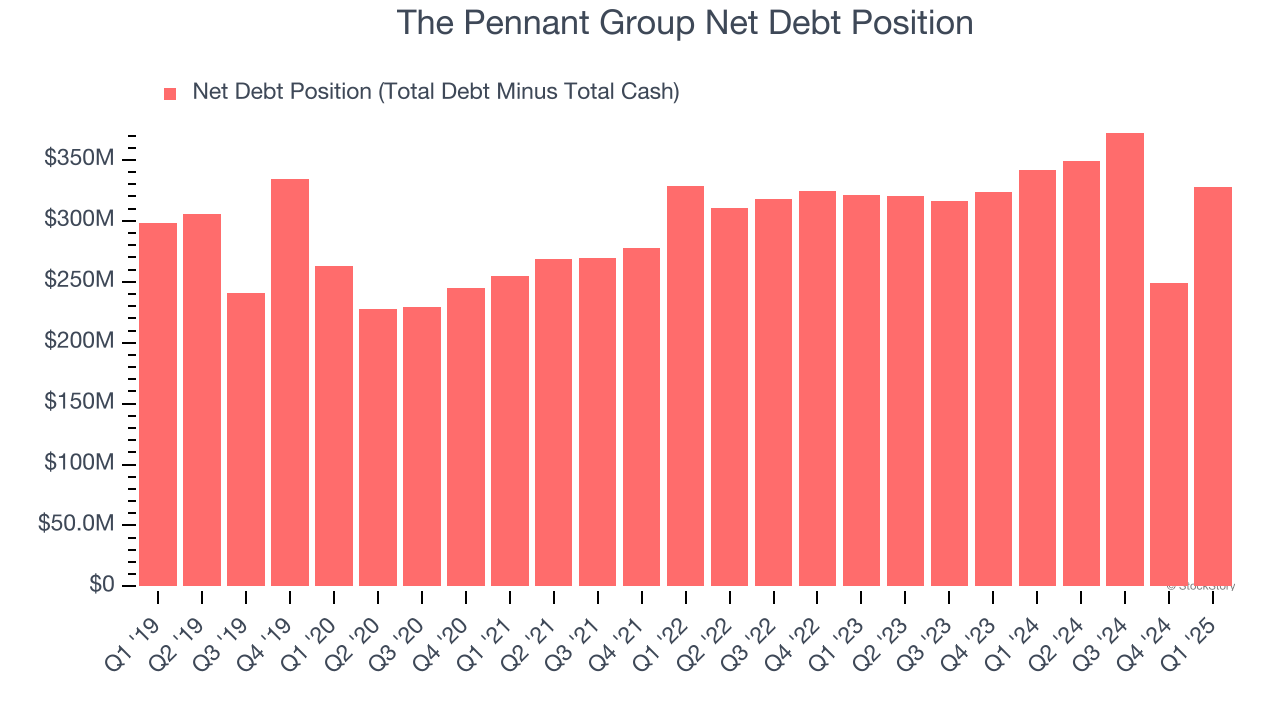

3. High Debt Levels Increase Risk

As long-term investors, the risk we care about most is the permanent loss of capital, which can happen when a company goes bankrupt or raises money from a disadvantaged position. This is separate from short-term stock price volatility, something we are much less bothered by.

The Pennant Group’s $333.3 million of debt exceeds the $5.22 million of cash on its balance sheet. Furthermore, its 6× net-debt-to-EBITDA ratio (based on its EBITDA of $58.44 million over the last 12 months) shows the company is overleveraged.

At this level of debt, incremental borrowing becomes increasingly expensive and credit agencies could downgrade the company’s rating if profitability falls. The Pennant Group could also be backed into a corner if the market turns unexpectedly – a situation we seek to avoid as investors in high-quality companies.

We hope The Pennant Group can improve its balance sheet and remain cautious until it increases its profitability or pays down its debt.

Final Judgment

The Pennant Group isn’t a terrible business, but it isn’t one of our picks. Following the recent decline, the stock trades at 20.5× forward P/E (or $23.22 per share). This multiple tells us a lot of good news is priced in - we think there are better stocks to buy right now. We’d recommend looking at the Amazon and PayPal of Latin America.

Stocks We Like More Than The Pennant Group

Trump’s April 2025 tariff bombshell triggered a massive market selloff, but stocks have since staged an impressive recovery, leaving those who panic sold on the sidelines.

Take advantage of the rebound by checking out our Top 9 Market-Beating Stocks. This is a curated list of our High Quality stocks that have generated a market-beating return of 183% over the last five years (as of March 31st 2025).

Stocks that made our list in 2020 include now familiar names such as Nvidia (+1,545% between March 2020 and March 2025) as well as under-the-radar businesses like the once-small-cap company Exlservice (+354% five-year return). Find your next big winner with StockStory today.

StockStory is growing and hiring equity analyst and marketing roles. Are you a 0 to 1 builder passionate about the markets and AI? See the open roles here.

More News

View More

Recent Quotes

View More

Quotes delayed at least 20 minutes.

By accessing this page, you agree to the Privacy Policy and Terms Of Service.