Q1 Water Infrastructure Earnings Review: First Prize Goes to Watts Water Technologies (NYSE:WTS)

Let’s dig into the relative performance of Watts Water Technologies (NYSE: WTS) and its peers as we unravel the now-completed Q1 water infrastructure earnings season.

Trends towards conservation and reducing groundwater depletion are putting water infrastructure and treatment products front and center. Companies that can innovate and create solutions–especially automated or connected solutions–to address these thematic trends will create incremental demand and speed up replacement cycles. On the other hand, water infrastructure and treatment companies are at the whim of economic cycles. Consumer spending and interest rates, for example, can greatly impact the industrial production that drives demand for these companies’ offerings.

The 5 water infrastructure stocks we track reported a mixed Q1. As a group, revenues missed analysts’ consensus estimates by 11.8%.

Thankfully, share prices of the companies have been resilient as they are up 6.6% on average since the latest earnings results.

Best Q1: Watts Water Technologies (NYSE: WTS)

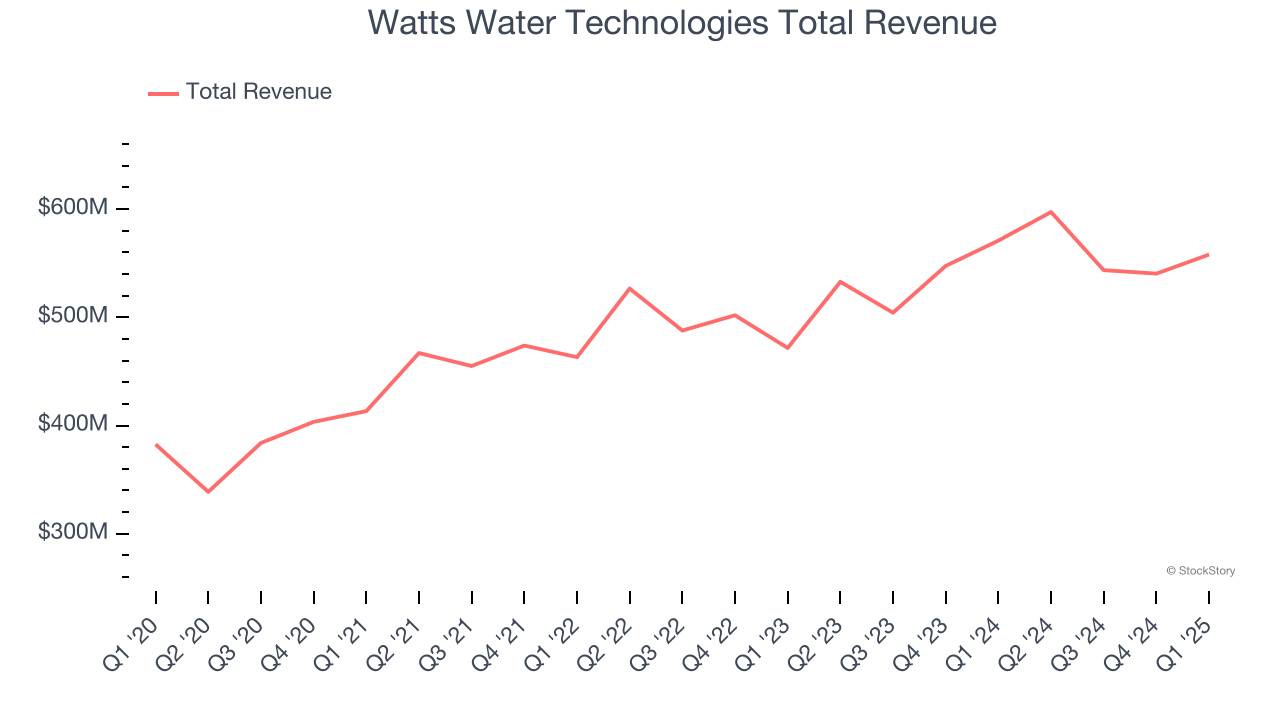

Founded in 1874, Watts Water (NYSE: WTS) specializes in manufacturing water products and systems for residential, commercial, and industrial applications globally.

Watts Water Technologies reported revenues of $558 million, down 2.3% year on year. This print exceeded analysts’ expectations by 1.9%. Overall, it was an exceptional quarter for the company with an impressive beat of analysts’ EBITDA estimates.

Chief Executive Officer Robert J. Pagano Jr. said, “We had a solid start to the year with our first quarter results exceeding expectations as we achieved record adjusted operating income, adjusted operating margin and adjusted EPS.(1) I would like to thank our dedicated employees who continued to execute well against a challenging backdrop.”

Interestingly, the stock is up 19.2% since reporting and currently trades at $252.20.

Is now the time to buy Watts Water Technologies? Access our full analysis of the earnings results here, it’s free.

Mueller Water Products (NYSE: MWA)

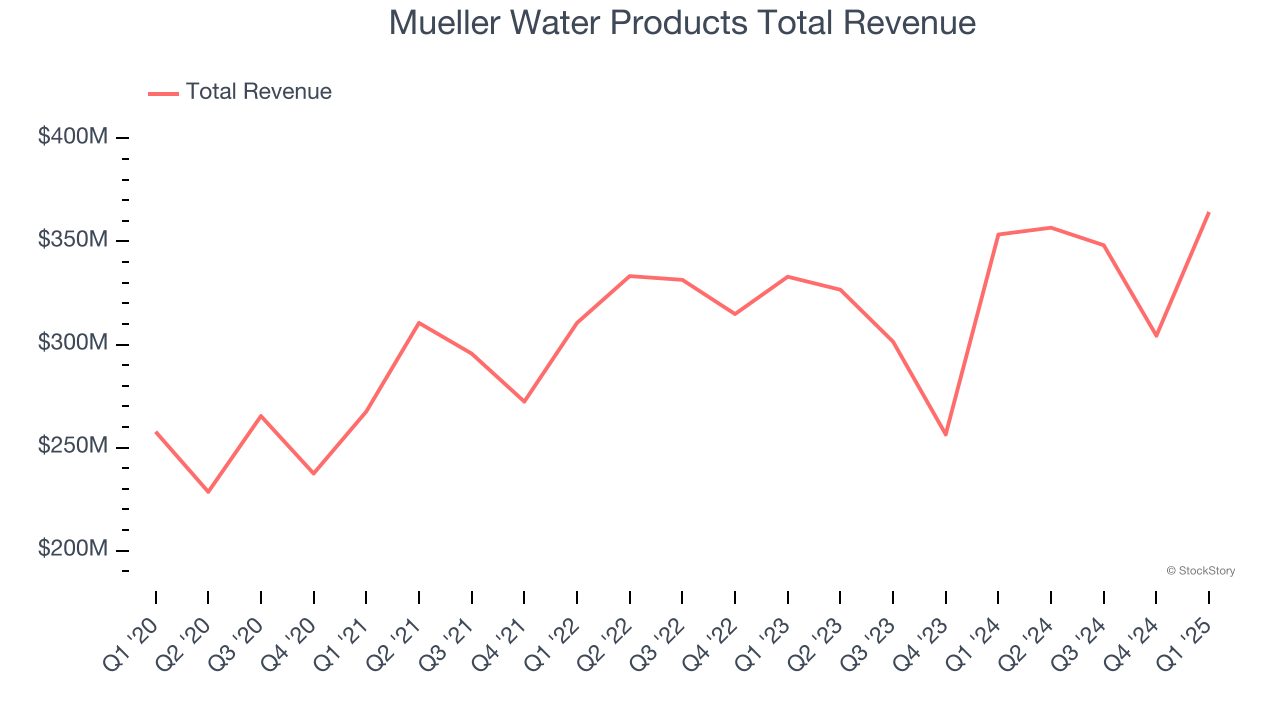

As one of the oldest companies in the water infrastructure industry, Mueller (NYSE: MWA) is a provider of water infrastructure products and flow control systems for various sectors.

Mueller Water Products reported revenues of $364.3 million, up 3.1% year on year, outperforming analysts’ expectations by 2.9%. The business had a very strong quarter with a solid beat of analysts’ organic revenue estimates and an impressive beat of analysts’ EBITDA estimates.

Mueller Water Products pulled off the biggest analyst estimates beat, fastest revenue growth, and highest full-year guidance raise among its peers. Although it had a fine quarter compared its peers, the market seems unhappy with the results as the stock is down 7.8% since reporting. It currently trades at $24.95.

Is now the time to buy Mueller Water Products? Access our full analysis of the earnings results here, it’s free.

Weakest Q1: Energy Recovery (NASDAQ: ERII)

Having saved far more than a trillion gallons of water, Energy Recovery (NASDAQ: ERII) provides energy recovery devices to the water treatment, oil and gas, and chemical processing sectors.

Energy Recovery reported revenues of $8.07 million, down 33.3% year on year, falling short of analysts’ expectations by 63.3%. It was a disappointing quarter as it posted a significant miss of analysts’ EBITDA estimates and a significant miss of analysts’ EPS estimates.

Energy Recovery delivered the weakest performance against analyst estimates and slowest revenue growth in the group. As expected, the stock is down 7.3% since the results and currently trades at $13.94.

Read our full analysis of Energy Recovery’s results here.

Tennant (NYSE: TNC)

As the world’s largest manufacturer of autonomous mobile robots, Tennant (NYSE: TNC) designs, manufactures, and sells cleaning products to various sectors.

Tennant reported revenues of $290 million, down 6.8% year on year. This print missed analysts’ expectations by 2.2%. It was a softer quarter as it also recorded a significant miss of analysts’ EBITDA estimates and a significant miss of analysts’ EPS estimates.

Tennant had the weakest full-year guidance update among its peers. The stock is up 14.7% since reporting and currently trades at $82.72.

Read our full, actionable report on Tennant here, it’s free.

Xylem (NYSE: XYL)

Formed through a spinoff, Xylem (NYSE: XYL) manufactures and services engineered products across a wide variety of applications primarily in the water sector.

Xylem reported revenues of $2.07 billion, up 1.8% year on year. This number beat analysts’ expectations by 1.5%. Overall, it was a very strong quarter as it also logged an impressive beat of analysts’ EBITDA estimates and a solid beat of analysts’ adjusted operating income estimates.

The stock is up 14.2% since reporting and currently trades at $132.26.

Read our full, actionable report on Xylem here, it’s free.

Market Update

The Fed’s interest rate hikes throughout 2022 and 2023 have successfully cooled post-pandemic inflation, bringing it closer to the 2% target. Inflationary pressures have eased without tipping the economy into a recession, suggesting a soft landing. This stability, paired with recent rate cuts (0.5% in September 2024 and 0.25% in November 2024), fueled a strong year for the stock market in 2024. The markets surged further after Donald Trump’s presidential victory in November, with major indices reaching record highs in the days following the election. Still, questions remain about the direction of economic policy, as potential tariffs and corporate tax changes add uncertainty for 2025.

Want to invest in winners with rock-solid fundamentals? Check out our Hidden Gem Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

StockStory is growing and hiring equity analyst and marketing roles. Are you a 0 to 1 builder passionate about the markets and AI? See the open roles here.

More News

View More

Recent Quotes

View More

Quotes delayed at least 20 minutes.

By accessing this page, you agree to the Privacy Policy and Terms Of Service.