Axos Financial (NYSE:AX) Posts Better-Than-Expected Sales In Q2

Digital banking company Axos Financial (NYSE: AX) reported Q2 CY2025 results topping the market’s revenue expectations, with sales up 10.5% year on year to $321.4 million. Its non-GAAP profit of $1.94 per share was 7% above analysts’ consensus estimates.

Is now the time to buy Axos Financial? Find out by accessing our full research report, it’s free.

Axos Financial (AX) Q2 CY2025 Highlights:

- Net Interest Income: $280.2 million vs analyst estimates of $280.1 million (7.7% year-on-year growth, in line)

- Net Interest Margin: 4.8% vs analyst estimates of 4.7% (9.7 basis point beat)

- Revenue: $321.4 million vs analyst estimates of $310.8 million (10.5% year-on-year growth, 3.4% beat)

- Efficiency Ratio: 46.9% vs analyst estimates of 47.7% (0.8 percentage point beat)

- Adjusted EPS: $1.94 vs analyst estimates of $1.81 (7% beat)

- Market Capitalization: $4.83 billion

“We grew loans by $856 million in the quarter ended June 30, 2025,” stated Greg Garrabrants, President and Chief Executive Officer of Axos.

Company Overview

Originally founded as Bank of Internet USA in 1999 before rebranding in 2018, Axos Financial (NYSE: AX) is a diversified financial services company that provides digital banking, securities clearing, and investment advisory solutions to retail and business customers nationwide.

Sales Growth

Net interest income and and fee-based revenue are the two pillars supporting bank earnings. The former captures profit from the gap between lending rates and deposit costs, while the latter encompasses charges for banking services, credit products, wealth management, and trading activities.

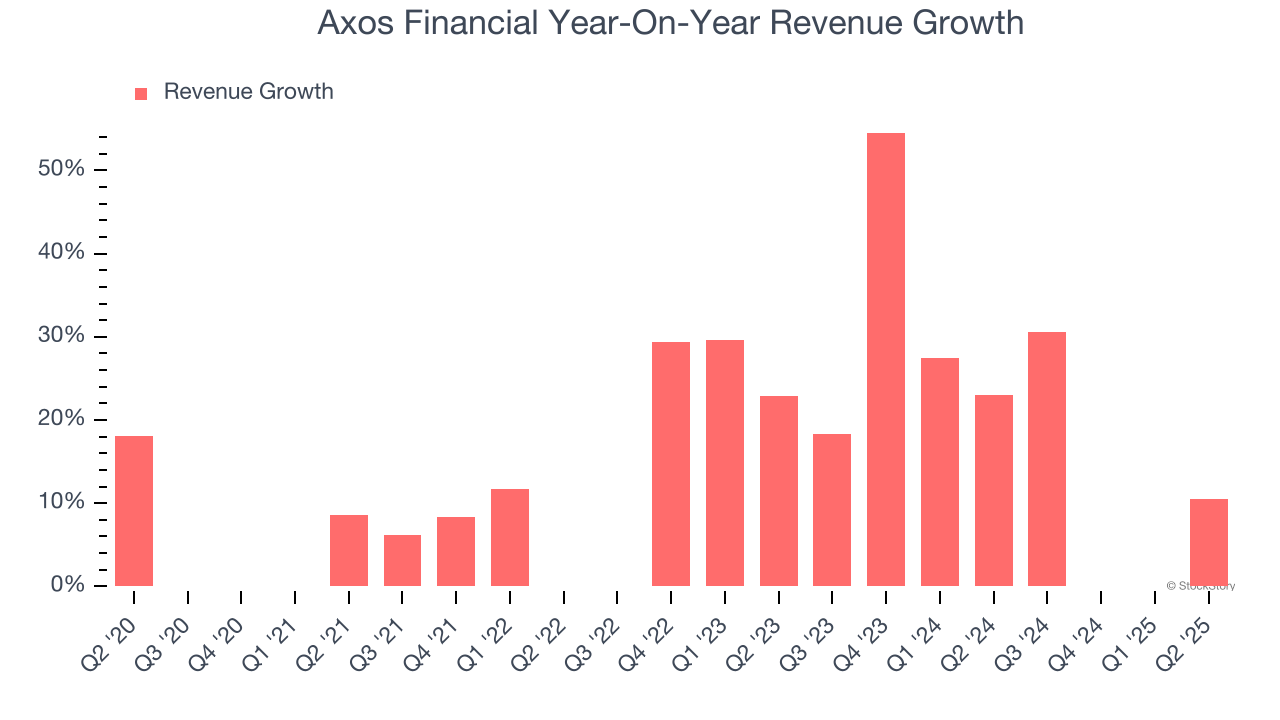

Luckily, Axos Financial’s revenue grew at an incredible 16.7% compounded annual growth rate over the last five years. Its growth surpassed the average bank company and shows its offerings resonate with customers, a great starting point for our analysis.

We at StockStory place the most emphasis on long-term growth, but within financials, a half-decade historical view may miss recent interest rate changes, market returns, and industry trends. Axos Financial’s annualized revenue growth of 18% over the last two years is above its five-year trend, suggesting its demand was strong and recently accelerated.  Note: Quarters not shown were determined to be outliers, impacted by outsized investment gains/losses that are not indicative of the recurring fundamentals of the business.

Note: Quarters not shown were determined to be outliers, impacted by outsized investment gains/losses that are not indicative of the recurring fundamentals of the business.

This quarter, Axos Financial reported year-on-year revenue growth of 10.5%, and its $321.4 million of revenue exceeded Wall Street’s estimates by 3.4%.

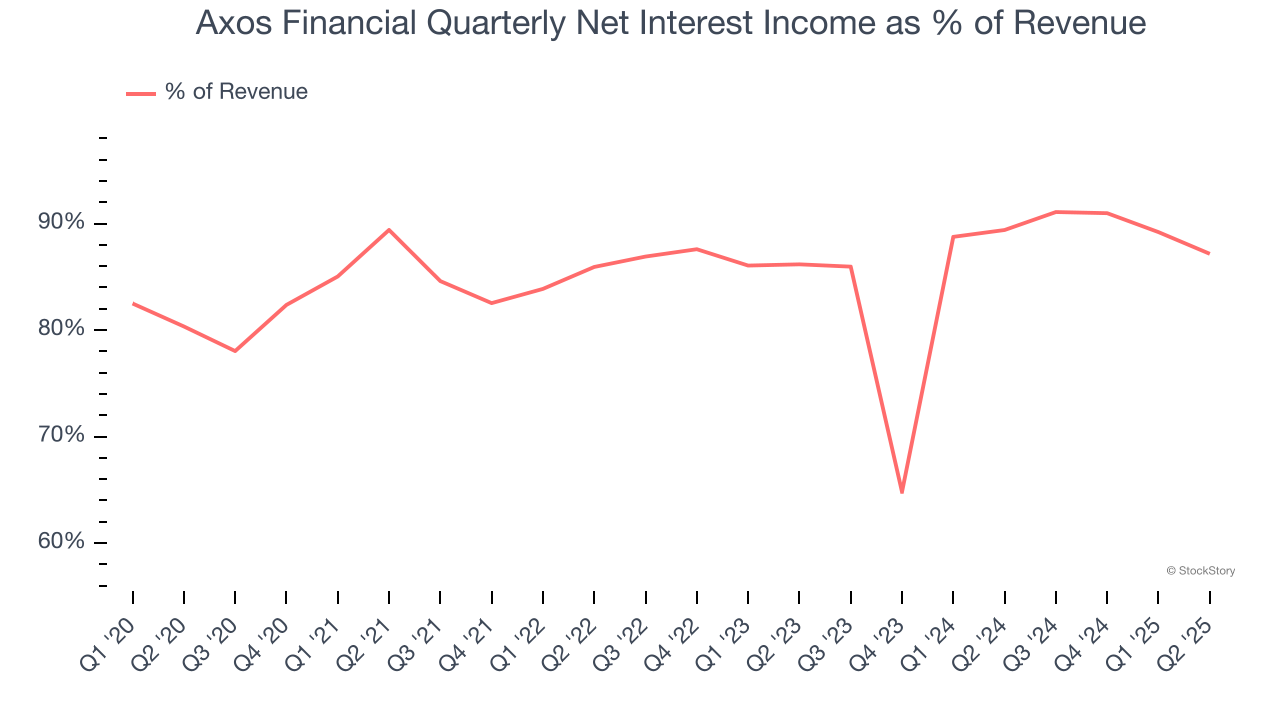

Net interest income made up 85.3% of the company’s total revenue during the last five years, meaning Axos Financial barely relies on non-interest income to drive its overall growth.

Our experience and research show the market cares primarily about a bank’s net interest income growth as non-interest income is considered a lower-quality and non-recurring revenue source.

Unless you’ve been living under a rock, it should be obvious by now that generative AI is going to have a huge impact on how large corporations do business. While Nvidia and AMD are trading close to all-time highs, we prefer a lesser-known (but still profitable) stock benefiting from the rise of AI. Click here to access our free report one of our favorites growth stories.

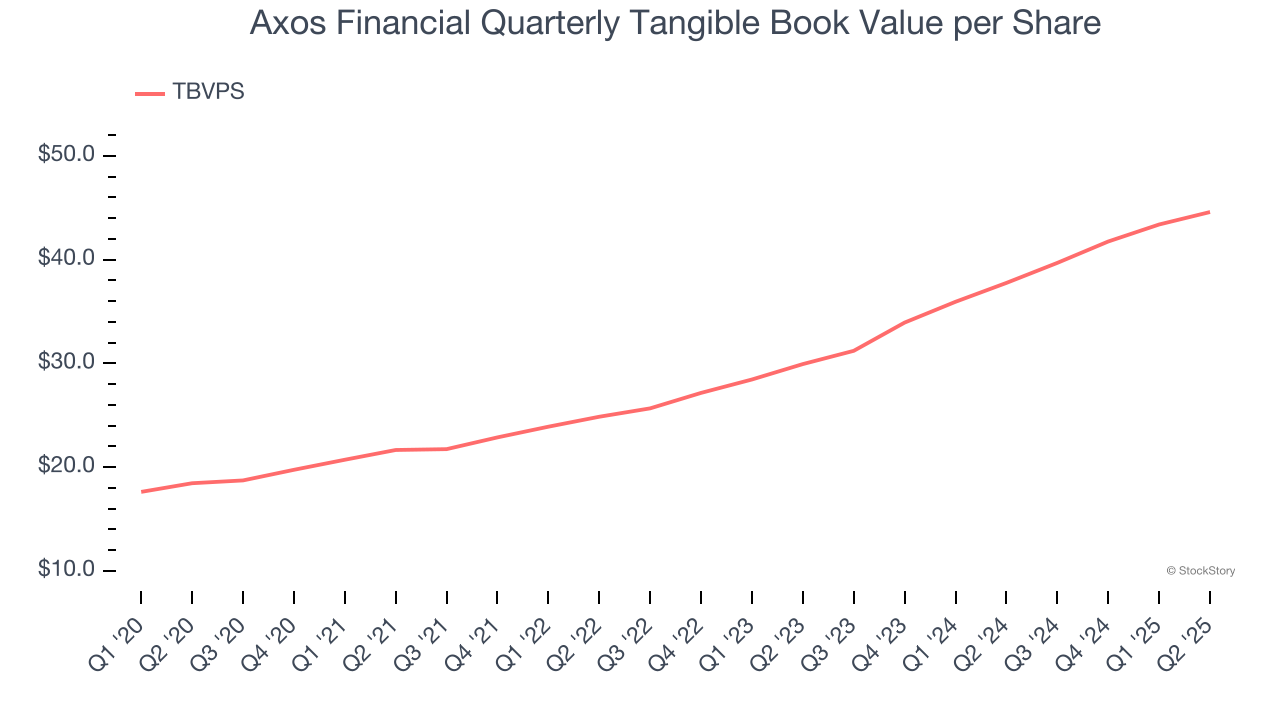

Tangible Book Value Per Share (TBVPS)

Banks are balance sheet-driven businesses because they generate earnings primarily through borrowing and lending. They’re also valued based on their balance sheet strength and ability to compound book value (another name for shareholders’ equity) over time.

This explains why tangible book value per share (TBVPS) stands as the premier banking metric. TBVPS strips away questionable intangible assets, revealing concrete per-share net worth that investors can trust. On the other hand, EPS is often distorted by mergers and flexible loan loss accounting. TBVPS provides clearer performance insights.

Axos Financial’s TBVPS grew at an incredible 19.3% annual clip over the last five years. TBVPS growth has also accelerated recently, growing by 22% annually over the last two years from $29.94 to $44.60 per share.

Over the next 12 months, Consensus estimates call for Axos Financial’s TBVPS to grow by 19.5% to $53.29, elite growth rate.

Key Takeaways from Axos Financial’s Q2 Results

We enjoyed seeing Axos Financial beat analysts’ revenue, EPS, NIM, and efficiency ratio expectations this quarter. On the other hand, its tangible book value per share slightly missed. Overall, this print had some key positives. The stock remained flat at $85.29 immediately following the results.

So do we think Axos Financial is an attractive buy at the current price? When making that decision, it’s important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it’s free.

More News

View More

Recent Quotes

View More

Quotes delayed at least 20 minutes.

By accessing this page, you agree to the Privacy Policy and Terms Of Service.