Ruger (NYSE:RGR) Posts Better-Than-Expected Sales In Q2

American firearm manufacturing company Ruger (NYSE: RGR) announced better-than-expected revenue in Q2 CY2025, with sales up 1.3% year on year to $132.5 million. Its non-GAAP profit of $0.41 per share was 7.9% above analysts’ consensus estimates.

Is now the time to buy Ruger? Find out by accessing our full research report, it’s free.

Ruger (RGR) Q2 CY2025 Highlights:

- This quarter was the first full quarter for the new CEO, and his focus included "a thorough inventory rationalization, reassessing its raw materials, work-in-process, and finished goods to identify and reserve for excess, obsolete, or discontinued inventory"

- Revenue: $132.5 million vs analyst estimates of $117.9 million (1.3% year-on-year growth, 12.4% beat)

- Adjusted EPS: $0.41 vs analyst estimates of $0.38 (7.9% beat)

- Adjusted EBITDA: $2.25 million vs analyst estimates of $12.74 million (1.7% margin, 82.3% miss)

- Operating Margin: -15.6%, down from 6.9% in the same quarter last year

- Free Cash Flow Margin: 6.9%, similar to the same quarter last year

- Market Capitalization: $578.1 million

Company Overview

Founded in 1949, Ruger (NYSE: RGR) is an American manufacturer of firearms for the commercial sporting market.

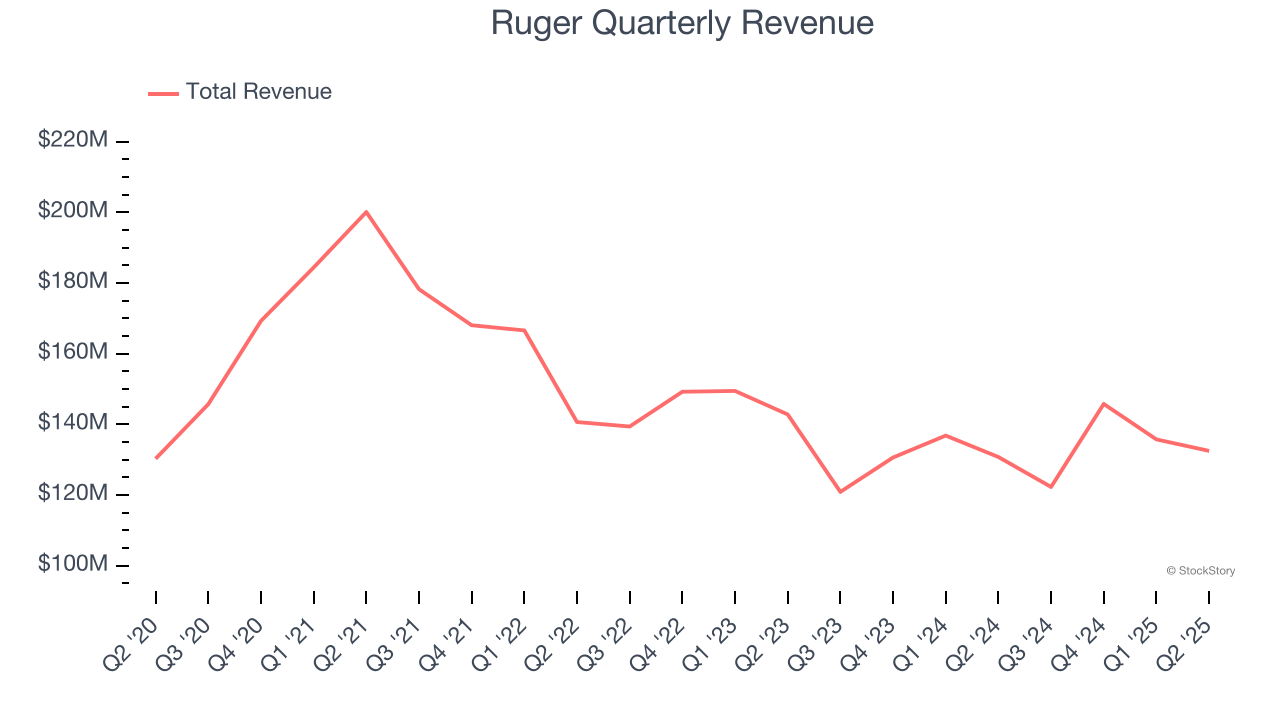

Revenue Growth

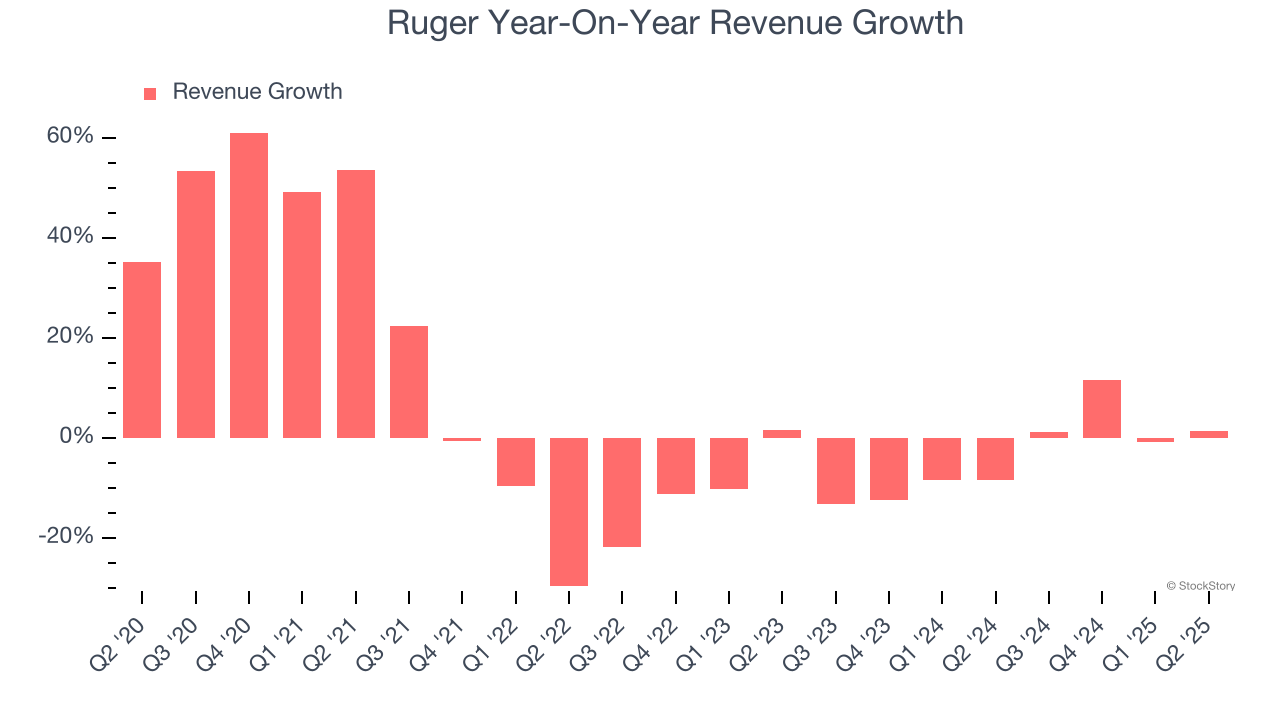

A company’s long-term sales performance is one signal of its overall quality. Any business can have short-term success, but a top-tier one grows for years. Unfortunately, Ruger’s 3.4% annualized revenue growth over the last five years was sluggish. This was below our standard for the consumer discretionary sector and is a tough starting point for our analysis.

Long-term growth is the most important, but within consumer discretionary, product cycles are short and revenue can be hit-driven due to rapidly changing trends and consumer preferences. Ruger’s performance shows it grew in the past but relinquished its gains over the last two years, as its revenue fell by 3.9% annually.

This quarter, Ruger reported modest year-on-year revenue growth of 1.3% but beat Wall Street’s estimates by 12.4%.

Looking ahead, sell-side analysts expect revenue to decline by 1.3% over the next 12 months. Although this projection is better than its two-year trend, it’s hard to get excited about a company that is struggling with demand.

Here at StockStory, we certainly understand the potential of thematic investing. Diverse winners from Microsoft (MSFT) to Alphabet (GOOG), Coca-Cola (KO) to Monster Beverage (MNST) could all have been identified as promising growth stories with a megatrend driving the growth. So, in that spirit, we’ve identified a relatively under-the-radar profitable growth stock benefiting from the rise of AI, available to you FREE via this link.

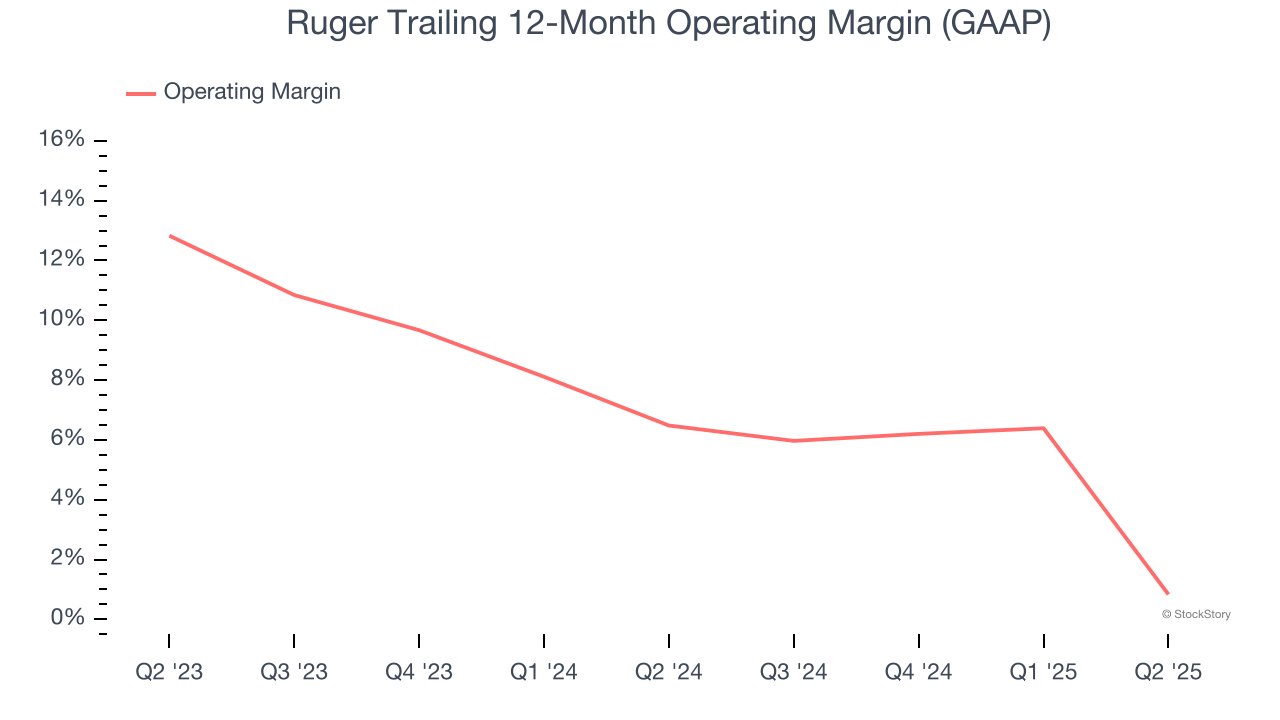

Operating Margin

Ruger’s operating margin has been trending down over the last 12 months and averaged 3.6% over the last two years. The company’s profitability was mediocre for a consumer discretionary business and shows it couldn’t pass its higher operating expenses onto its customers.

This quarter, Ruger generated an operating margin profit margin of negative 15.6%, down 22.5 percentage points year on year. This contraction shows it was less efficient because its expenses grew faster than its revenue.

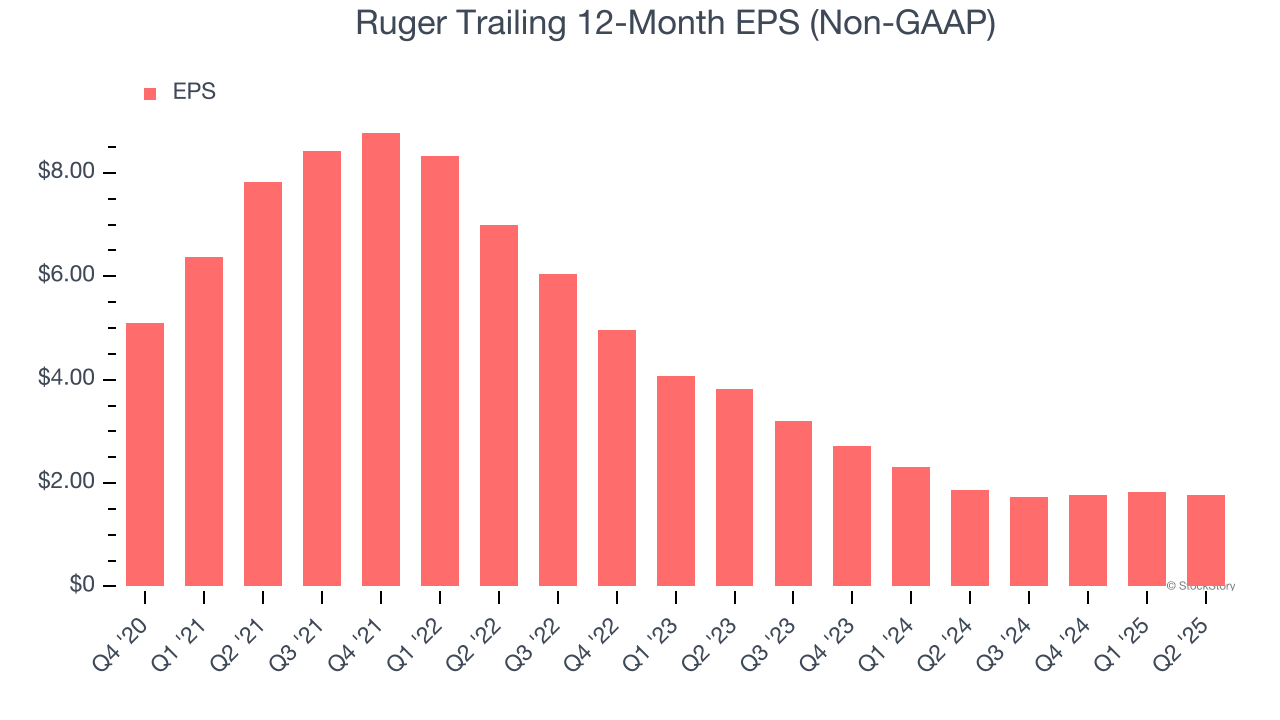

Earnings Per Share

Revenue trends explain a company’s historical growth, but the long-term change in earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

Sadly for Ruger, its EPS declined by 14.6% annually over the last five years while its revenue grew by 3.4%. This tells us the company became less profitable on a per-share basis as it expanded due to non-fundamental factors such as interest expenses and taxes.

In Q2, Ruger reported adjusted EPS at $0.41, down from $0.47 in the same quarter last year. Despite falling year on year, this print beat analysts’ estimates by 7.9%. We also like to analyze expected EPS growth based on Wall Street analysts’ consensus projections, but there is insufficient data.

Key Takeaways from Ruger’s Q2 Results

Both revenue and EPS beat, which made for a solid quarter. This quarter was the first full quarter for the new CEO, and his focus included "a thorough inventory rationalization, reassessing its raw materials, work-in-process, and finished goods to identify and reserve for excess, obsolete, or discontinued inventory". The stock traded up 3.1% to $35.82 immediately after reporting.

Should you buy the stock or not? When making that decision, it’s important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it’s free.

More News

View More

Recent Quotes

View MoreQuotes delayed at least 20 minutes.

By accessing this page, you agree to the Privacy Policy and Terms Of Service.