Asure (NASDAQ:ASUR) Reports Sales Below Analyst Estimates In Q2 Earnings

Online payroll and human resource software provider Asure (NASDAQ: ASUR) missed Wall Street’s revenue expectations in Q2 CY2025, but sales rose 7.4% year on year to $30.12 million. On the other hand, next quarter’s outlook exceeded expectations with revenue guided to $36 million at the midpoint, or 6.2% above analysts’ estimates. Its GAAP loss of $0.22 per share was significantly below analysts’ consensus estimates.

Is now the time to buy Asure? Find out by accessing our full research report, it’s free.

Asure (ASUR) Q2 CY2025 Highlights:

- Revenue: $30.12 million vs analyst estimates of $31.14 million (7.4% year-on-year growth, 3.2% miss)

- EPS (GAAP): -$0.22 vs analyst estimates of -$0.10 (significant miss)

- Adjusted EBITDA: $5.24 million vs analyst estimates of $5.48 million (17.4% margin, 4.4% miss)

- The company lifted its revenue guidance for the full year to $140 million at the midpoint from $136 million, a 2.9% increase

- EBITDA guidance for Q3 CY2025 is $8 million at the midpoint, below analyst estimates of $8.70 million

- Operating Margin: -15.4%, in line with the same quarter last year

- Free Cash Flow was -$747,000 compared to -$965,000 in the previous quarter

- Market Capitalization: $263.4 million

“We are pleased to report another solid performance for the second quarter where our revenues of $30.1 million increased 7% from the prior year second quarter and excluding the impact of ERTC, revenue growth was 10%. Our results were driven by continued strong performances coming from our Payroll Tax Management product line and improving attach rates of our HCM products,” said Asure Chairman and CEO Pat Goepel.

Company Overview

Created from the merger of two small workforce management companies in 2007, Asure (NASDAQ: ASUR) provides cloud based payroll and HR software for small and medium-sized businesses (SMBs).

Revenue Growth

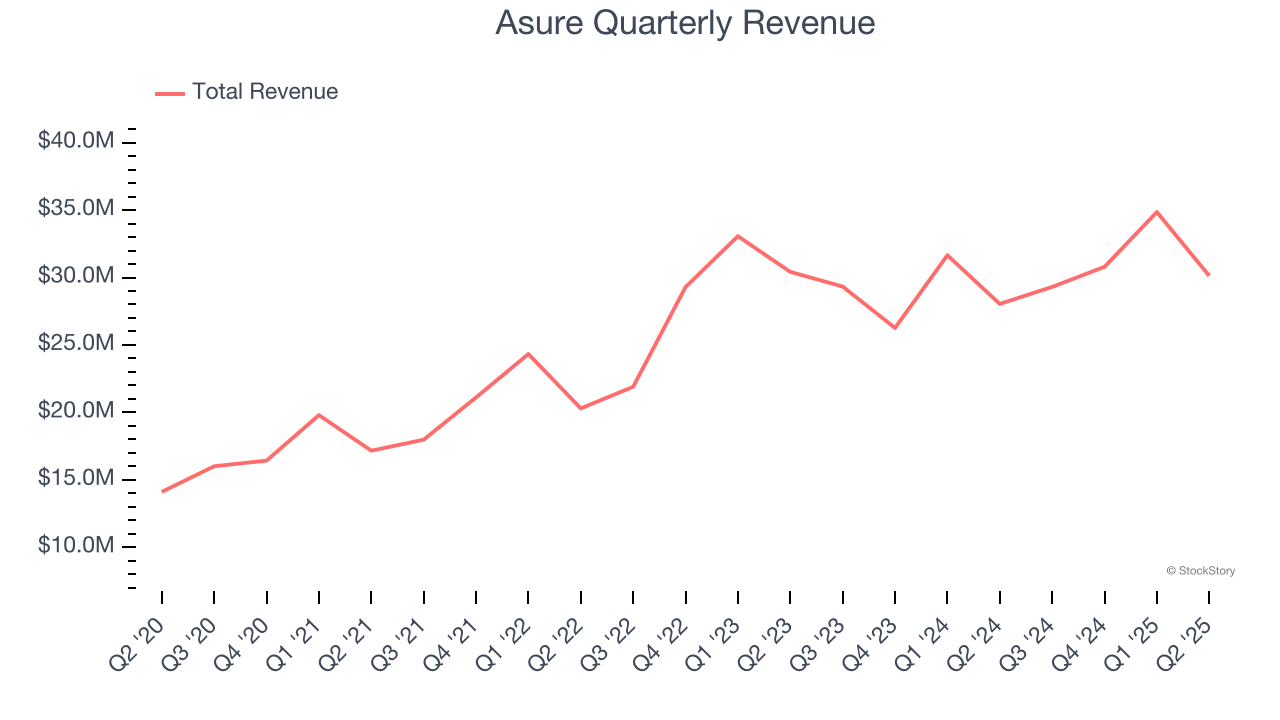

Reviewing a company’s long-term sales performance reveals insights into its quality. Any business can put up a good quarter or two, but the best consistently grow over the long haul. Over the last three years, Asure grew its sales at a 14.3% compounded annual growth rate. Although this growth is acceptable on an absolute basis, it fell short of our standards for the software sector, which enjoys a number of secular tailwinds.

This quarter, Asure’s revenue grew by 7.4% year on year to $30.12 million, missing Wall Street’s estimates. Company management is currently guiding for a 22.9% year-on-year increase in sales next quarter.

Looking further ahead, sell-side analysts expect revenue to grow 12.7% over the next 12 months, a slight deceleration versus the last three years. Still, this projection is above average for the sector and suggests the market sees some success for its newer products and services.

Software is eating the world and there is virtually no industry left that has been untouched by it. That drives increasing demand for tools helping software developers do their jobs, whether it be monitoring critical cloud infrastructure, integrating audio and video functionality, or ensuring smooth content streaming. Click here to access a free report on our 3 favorite stocks to play this generational megatrend.

Customer Acquisition Efficiency

The customer acquisition cost (CAC) payback period measures the months a company needs to recoup the money spent on acquiring a new customer. This metric helps assess how quickly a business can break even on its sales and marketing investments.

Asure is extremely efficient at acquiring new customers, and its CAC payback period checked in at 10.9 months this quarter. The company’s rapid recovery of its customer acquisition costs means it can attempt to spur growth by increasing its sales and marketing investments.

Key Takeaways from Asure’s Q2 Results

We were impressed by Asure’s optimistic revenue guidance for next quarter, which blew past analysts’ expectations. We were also glad its full-year revenue guidance exceeded Wall Street’s estimates. On the other hand, its revenue missed and its EBITDA guidance for next quarter fell short of Wall Street’s estimates. Overall, this was a weaker quarter. The stock traded down 2.2% to $9.50 immediately following the results.

Asure underperformed this quarter, but does that create an opportunity to invest right now? The latest quarter does matter, but not nearly as much as longer-term fundamentals and valuation, when deciding if the stock is a buy. We cover that in our actionable full research report which you can read here, it’s free.

More News

View More

Recent Quotes

View More

Quotes delayed at least 20 minutes.

By accessing this page, you agree to the Privacy Policy and Terms Of Service.