Corcept (NASDAQ:CORT) Misses Q2 Sales Targets

Biopharma company Corcept Therapeutics (NASDAQ: CORT) missed Wall Street’s revenue expectations in Q2 CY2025, but sales rose 18.7% year on year to $194.4 million. The company’s full-year revenue guidance of $875 million at the midpoint came in 2.7% below analysts’ estimates. Its GAAP profit of $0.29 per share was 28.4% above analysts’ consensus estimates.

Is now the time to buy Corcept? Find out by accessing our full research report, it’s free.

Corcept (CORT) Q2 CY2025 Highlights:

- Revenue: $194.4 million vs analyst estimates of $201.5 million (18.7% year-on-year growth, 3.5% miss)

- EPS (GAAP): $0.29 vs analyst estimates of $0.23 (28.4% beat)

- The company dropped its revenue guidance for the full year to $875 million at the midpoint from $925 million, a 5.4% decrease

- Operating Margin: 13.7%, down from 21.7% in the same quarter last year

- Market Capitalization: $7.41 billion

“The second quarter marked another period of robust growth in our hypercortisolism business. Once again, we had a record number of new prescribers and a record number of new patients receiving treatment. Physicians increasingly recognize hypercortisolism’s true prevalence and the necessity of appropriate treatment, which has led to increased screening and diagnosis. Our financial results don’t fully reflect this surge in demand, which outpaced our specialty pharmacy vendor’s capacity. We expect improved performance by our current vendor, as well as contribution from a second pharmacy that is coming online soon, in the coming quarters and have modified our 2025 revenue guidance to $850 – $900 million,” said Joseph K. Belanoff, M.D., Corcept’s Chief Executive Officer.

Company Overview

Focusing on the powerful stress hormone that affects everything from metabolism to immune function, Corcept Therapeutics (NASDAQ: CORT) develops and markets medications that modulate cortisol to treat endocrine disorders, cancer, and neurological diseases.

Revenue Growth

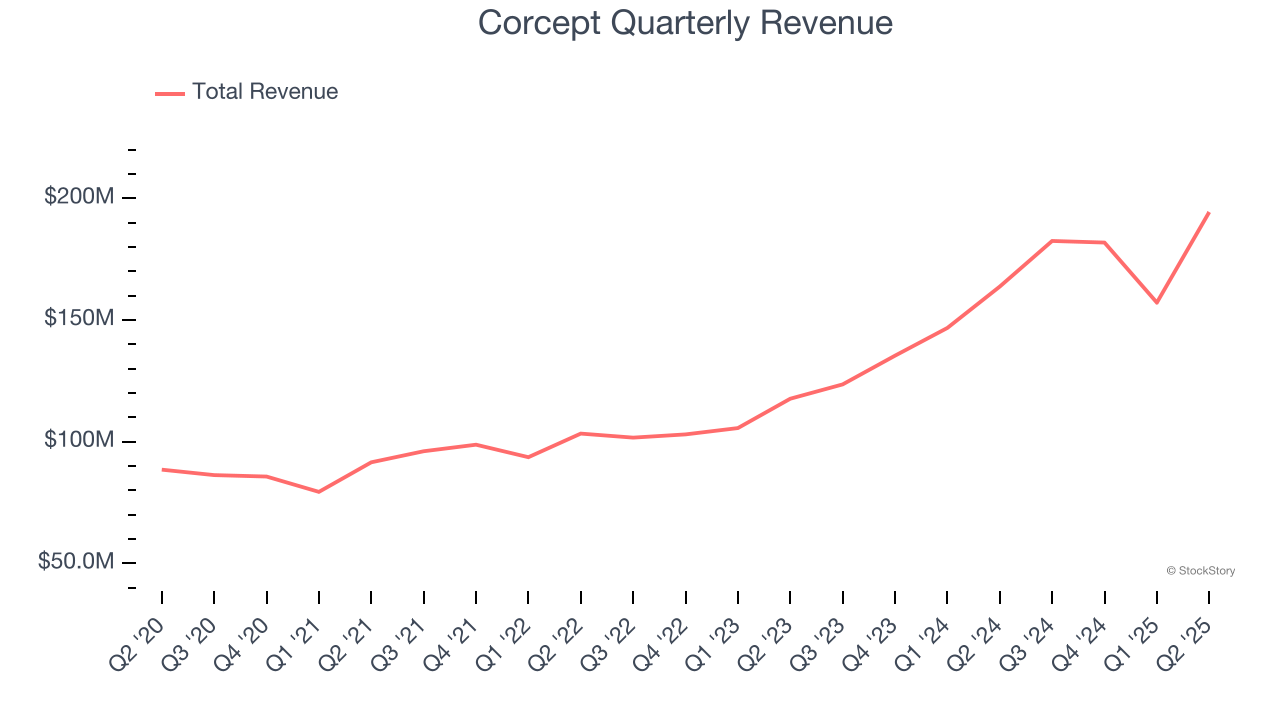

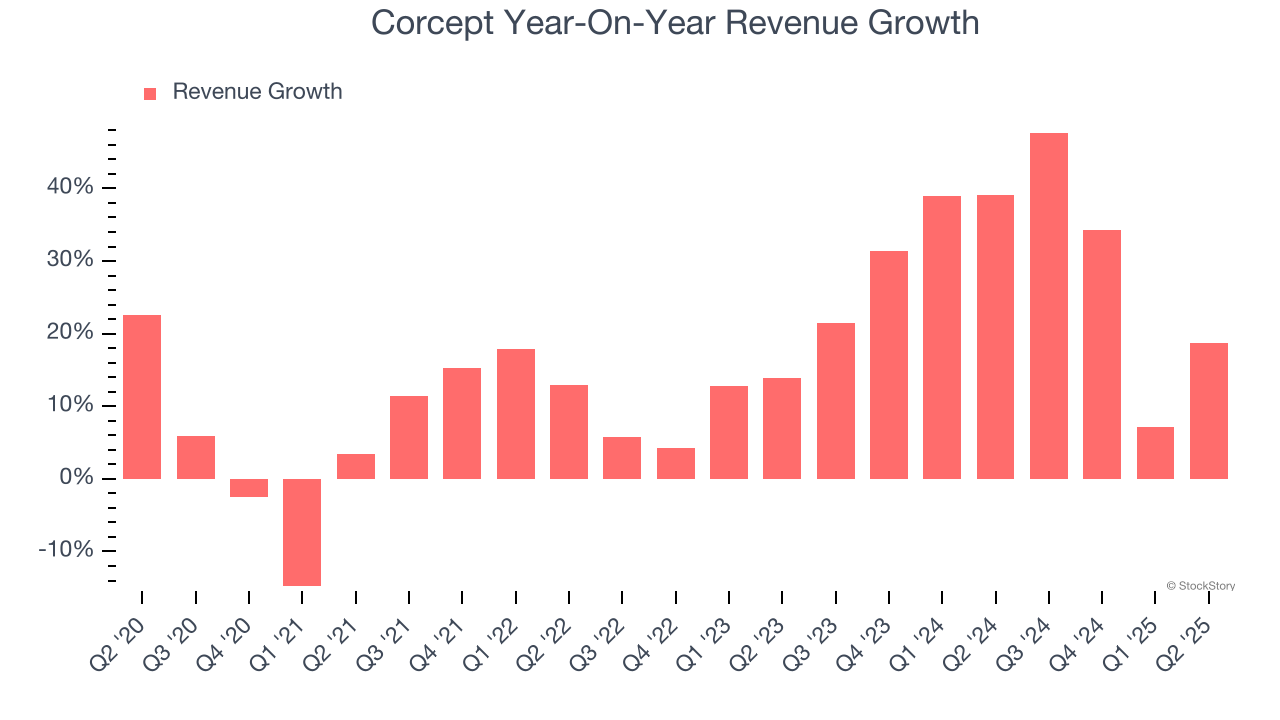

A company’s long-term performance is an indicator of its overall quality. Any business can experience short-term success, but top-performing ones enjoy sustained growth for years. Over the last five years, Corcept grew its sales at a solid 15.3% compounded annual growth rate. Its growth beat the average healthcare company and shows its offerings resonate with customers.

We at StockStory place the most emphasis on long-term growth, but within healthcare, a half-decade historical view may miss recent innovations or disruptive industry trends. Corcept’s annualized revenue growth of 29.3% over the last two years is above its five-year trend, suggesting its demand was strong and recently accelerated.

This quarter, Corcept’s revenue grew by 18.7% year on year to $194.4 million but fell short of Wall Street’s estimates.

Looking ahead, sell-side analysts expect revenue to grow 85.1% over the next 12 months, an improvement versus the last two years. This projection is eye-popping and indicates its newer products and services will spur better top-line performance.

Software is eating the world and there is virtually no industry left that has been untouched by it. That drives increasing demand for tools helping software developers do their jobs, whether it be monitoring critical cloud infrastructure, integrating audio and video functionality, or ensuring smooth content streaming. Click here to access a free report on our 3 favorite stocks to play this generational megatrend.

Operating Margin

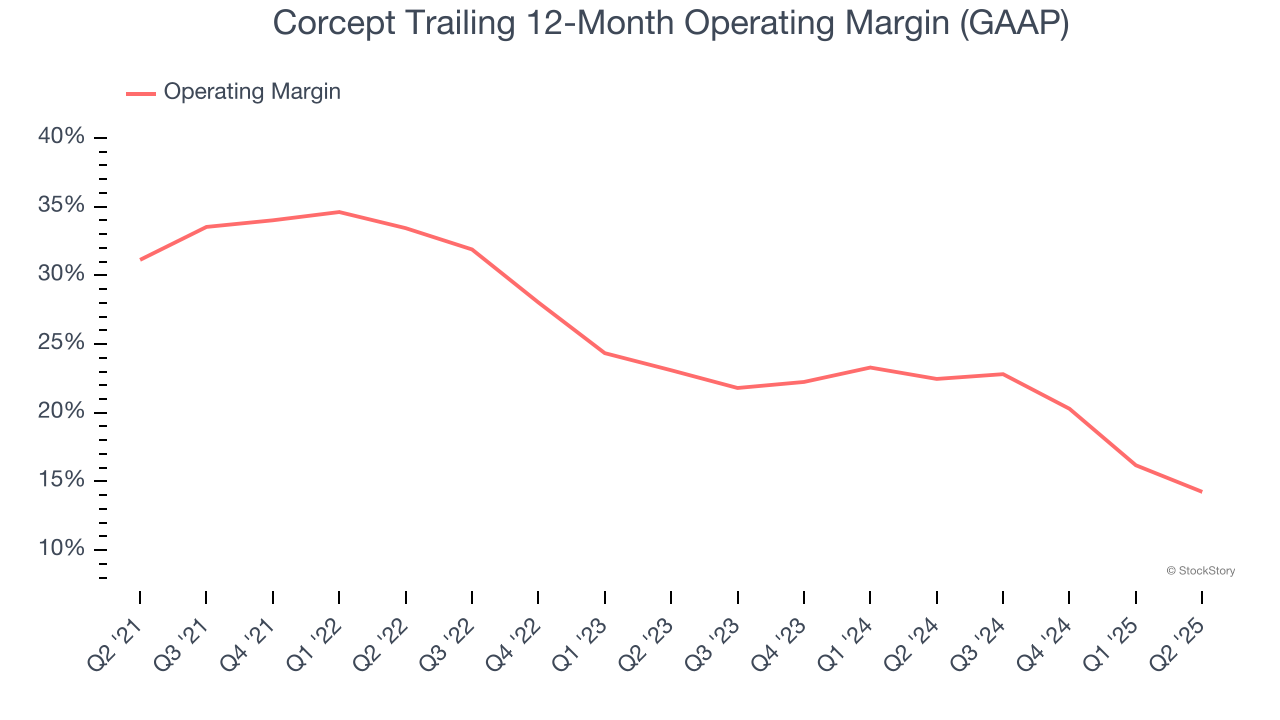

Corcept has been an efficient company over the last five years. It was one of the more profitable businesses in the healthcare sector, boasting an average operating margin of 23.1%.

Looking at the trend in its profitability, Corcept’s operating margin decreased by 16.9 percentage points over the last five years. The company’s two-year trajectory also shows it failed to get its profitability back to the peak as its margin fell by 8.9 percentage points. This performance was poor no matter how you look at it - it shows its expenses were rising and it couldn’t pass those costs onto its customers.

This quarter, Corcept generated an operating margin profit margin of 13.7%, down 8 percentage points year on year. This contraction shows it was less efficient because its expenses grew faster than its revenue.

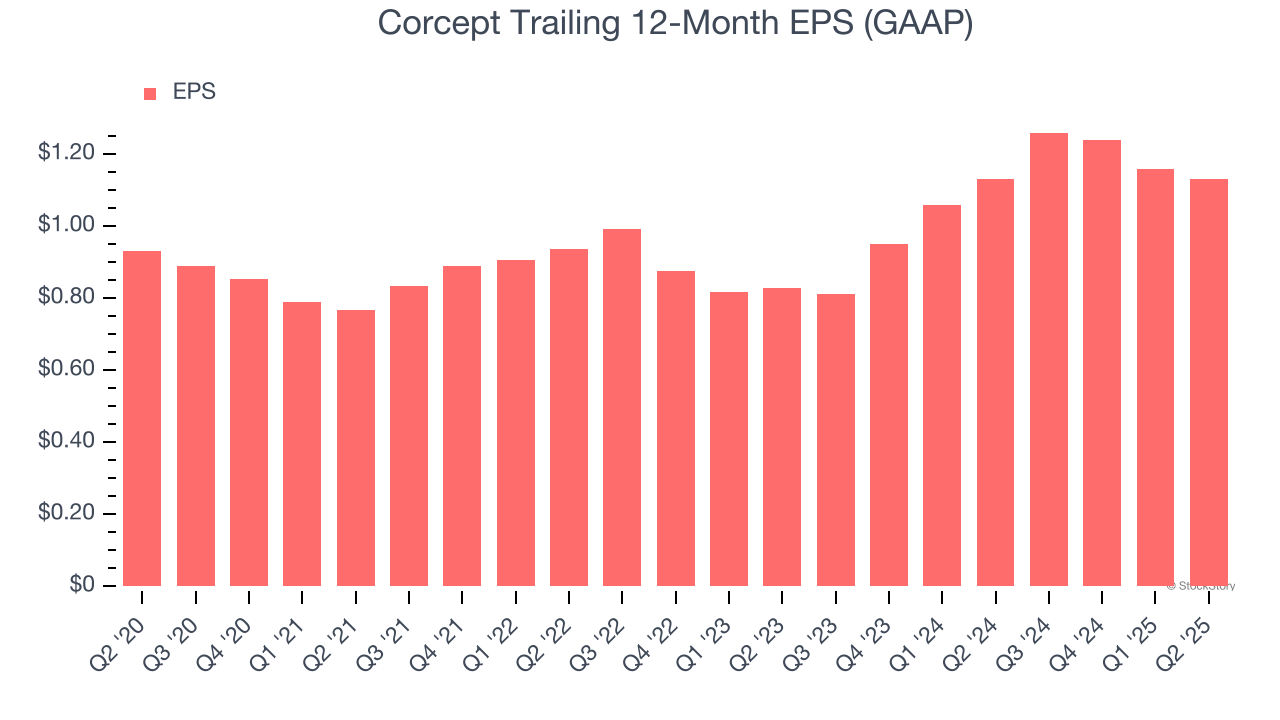

Earnings Per Share

Revenue trends explain a company’s historical growth, but the long-term change in earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

Corcept’s EPS grew at an unimpressive 3.9% compounded annual growth rate over the last five years, lower than its 15.3% annualized revenue growth. This tells us the company became less profitable on a per-share basis as it expanded due to non-fundamental factors such as interest expenses and taxes.

Diving into the nuances of Corcept’s earnings can give us a better understanding of its performance. As we mentioned earlier, Corcept’s operating margin declined by 16.9 percentage points over the last five years. This was the most relevant factor (aside from the revenue impact) behind its lower earnings; interest expenses and taxes can also affect EPS but don’t tell us as much about a company’s fundamentals.

In Q2, Corcept reported EPS at $0.29, down from $0.32 in the same quarter last year. Despite falling year on year, this print easily cleared analysts’ estimates. Over the next 12 months, Wall Street expects Corcept’s full-year EPS of $1.13 to grow 53.5%.

Key Takeaways from Corcept’s Q2 Results

We were impressed by how significantly Corcept blew past analysts’ EPS expectations this quarter. On the other hand, its revenue missed and its full-year revenue guidance fell short of Wall Street’s estimates. Overall, this was a softer quarter. The stock traded down 3.7% to $64.50 immediately following the results.

Corcept didn’t show it’s best hand this quarter, but does that create an opportunity to buy the stock right now? The latest quarter does matter, but not nearly as much as longer-term fundamentals and valuation, when deciding if the stock is a buy. We cover that in our actionable full research report which you can read here, it’s free.

More News

View More

Recent Quotes

View More

Quotes delayed at least 20 minutes.

By accessing this page, you agree to the Privacy Policy and Terms Of Service.