3 Reasons to Avoid UNM and 1 Stock to Buy Instead

Unum Group currently trades at $80.94 and has been a dream stock for shareholders. It’s returned 423% since July 2020, blowing past the S&P 500’s 97.3% gain. The company has also beaten the index over the past six months as its stock price is up 12.7%.

Is there a buying opportunity in Unum Group, or does it present a risk to your portfolio? Dive into our full research report to see our analyst team’s opinion, it’s free.

Why Is Unum Group Not Exciting?

We’re glad investors have benefited from the price increase, but we're cautious about Unum Group. Here are three reasons why there are better opportunities than UNM and a stock we'd rather own.

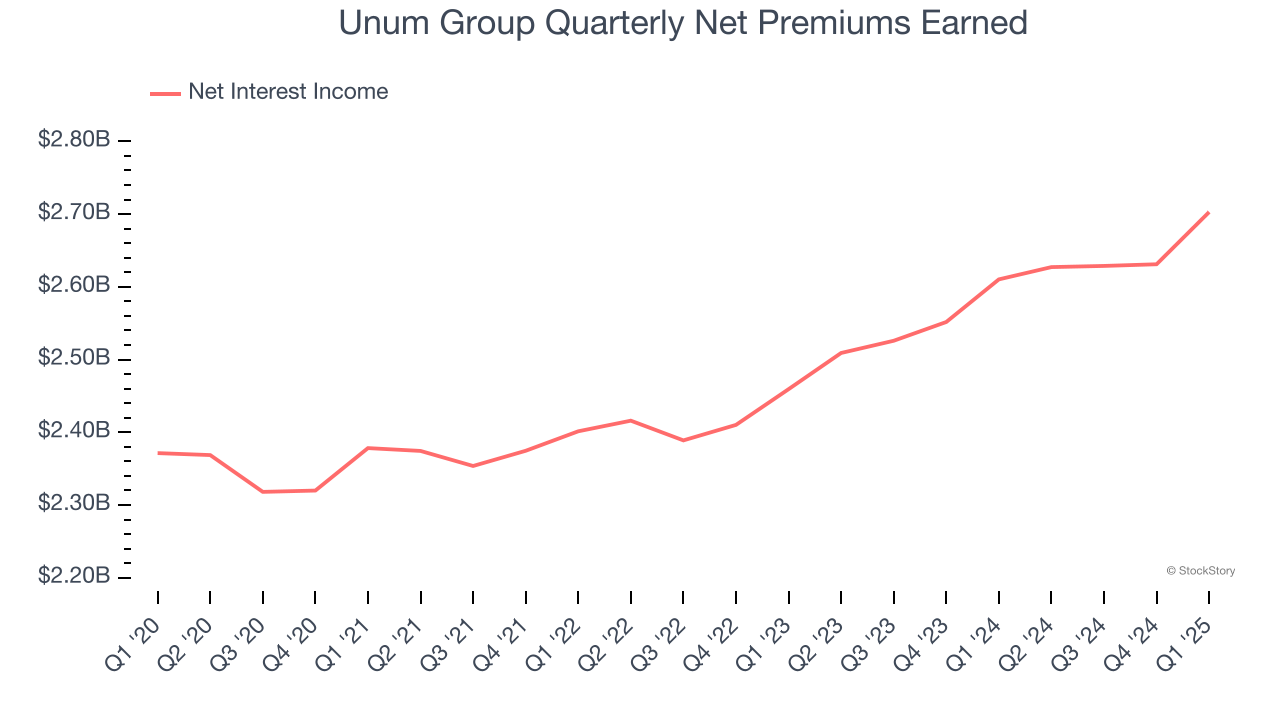

1. Net Premiums Earned Points to Soft Demand

Markets consistently prioritize net premiums earned growth over investment and fee income, recognizing its superior quality as a core indicator of the company’s underwriting success and market penetration.

Unum Group’s net premiums earned has grown at a 3.1% annualized rate over the last four years, worse than the broader insurance industry.

2. Projected Revenue Growth Is Slim

Forecasted revenues by Wall Street analysts signal a company’s potential. Predictions may not always be accurate, but accelerating growth typically boosts valuation multiples and stock prices while slowing growth does the opposite.

Over the next 12 months, sell-side analysts expect Unum Group’s revenue to rise by 2.5%, close to its 4% annualized growth for the past two years. This projection doesn't excite us and implies its newer products and services will not accelerate its top-line performance yet.

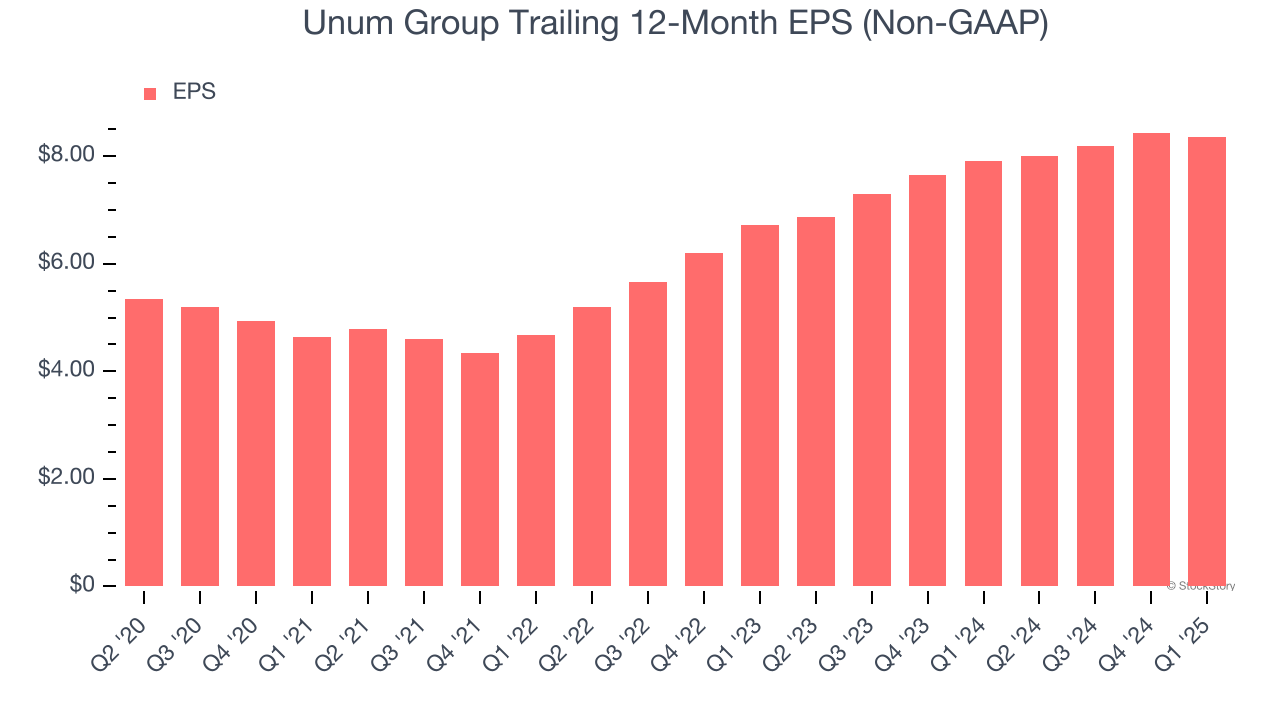

3. EPS Barely Growing

Analyzing the long-term change in earnings per share (EPS) shows whether a company's incremental sales were profitable – for example, revenue could be inflated through excessive spending on advertising and promotions.

Unum Group’s EPS grew at an unimpressive 8.5% compounded annual growth rate over the last five years. On the bright side, this performance was better than its 1.6% annualized revenue growth and tells us the company became more profitable on a per-share basis as it expanded.

Final Judgment

Unum Group isn’t a terrible business, but it isn’t one of our picks. With its shares beating the market recently, the stock trades at 1.2× forward P/B (or $80.94 per share). Beauty is in the eye of the beholder, but we don’t really see a big opportunity at the moment. We're fairly confident there are better stocks to buy right now. We’d recommend looking at the Amazon and PayPal of Latin America.

High-Quality Stocks for All Market Conditions

Donald Trump’s victory in the 2024 U.S. Presidential Election sent major indices to all-time highs, but stocks have retraced as investors debate the health of the economy and the potential impact of tariffs.

While this leaves much uncertainty around 2025, a few companies are poised for long-term gains regardless of the political or macroeconomic climate, like our Top 9 Market-Beating Stocks. This is a curated list of our High Quality stocks that have generated a market-beating return of 183% over the last five years (as of March 31st 2025).

Stocks that made our list in 2020 include now familiar names such as Nvidia (+1,545% between March 2020 and March 2025) as well as under-the-radar businesses like the once-small-cap company Comfort Systems (+782% five-year return). Find your next big winner with StockStory today.

StockStory is growing and hiring equity analyst and marketing roles. Are you a 0 to 1 builder passionate about the markets and AI? See the open roles here.

More News

View More

Recent Quotes

View More

Quotes delayed at least 20 minutes.

By accessing this page, you agree to the Privacy Policy and Terms Of Service.