2 Reasons to Watch PLAB and 1 to Stay Cautious

Over the past six months, Photronics’s stock price fell to $21.04. Shareholders have lost 6.8% of their capital, which is disappointing considering the S&P 500 has climbed by 5%. This was partly driven by its softer quarterly results and might have investors contemplating their next move.

Following the pullback, is now a good time to buy PLAB? Find out in our full research report, it’s free.

Why Does Photronics Spark Debate?

Sporting a global footprint of facilities, Photronics (NASDAQ: PLAB) is a manufacturer of photomasks, templates used to transfer patterns onto semiconductor wafers.

Two Positive Attributes:

1. Operating Margin Rising, Profits Up

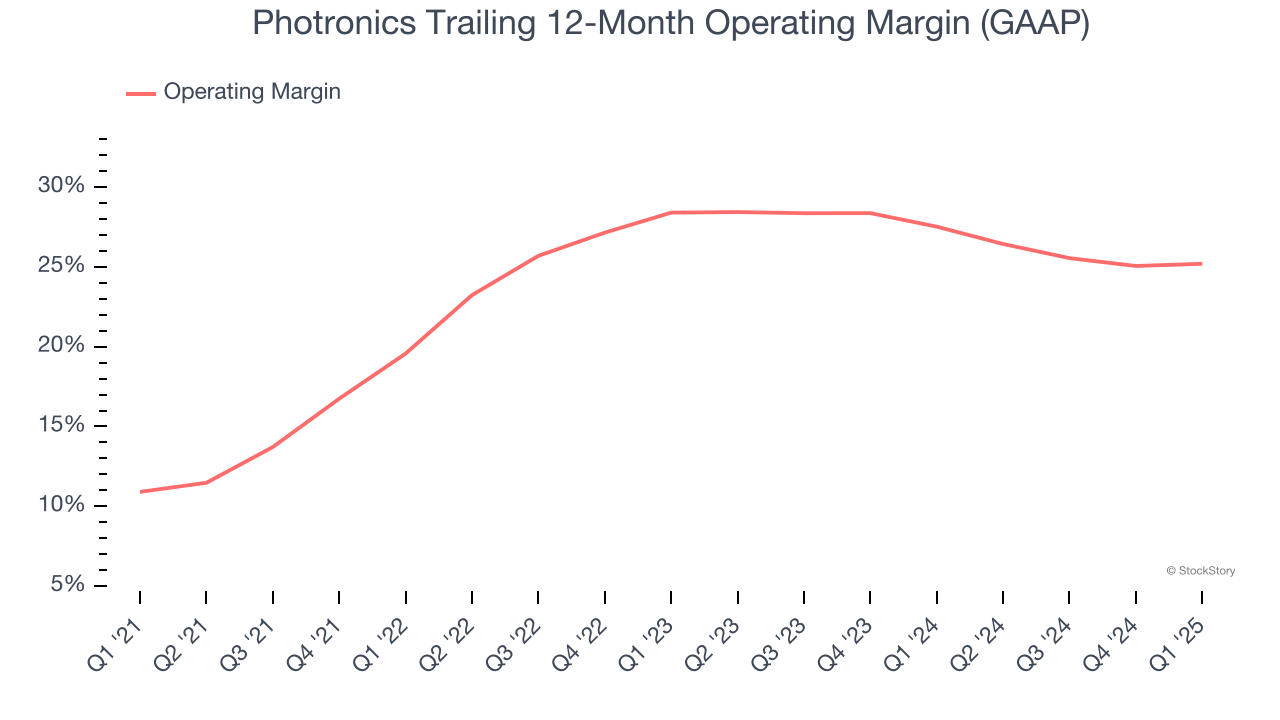

Operating margin is an important measure of profitability as it shows the portion of revenue left after accounting for all core expenses – everything from the cost of goods sold to advertising and wages. It’s also useful for comparing profitability across companies with different levels of debt and tax rates because it excludes interest and taxes.

Analyzing the trend in its profitability, Photronics’s operating margin rose by 14.3 percentage points over the last five years, as its sales growth gave it operating leverage. Its operating margin for the trailing 12 months was 25.2%.

2. Outstanding Long-Term EPS Growth

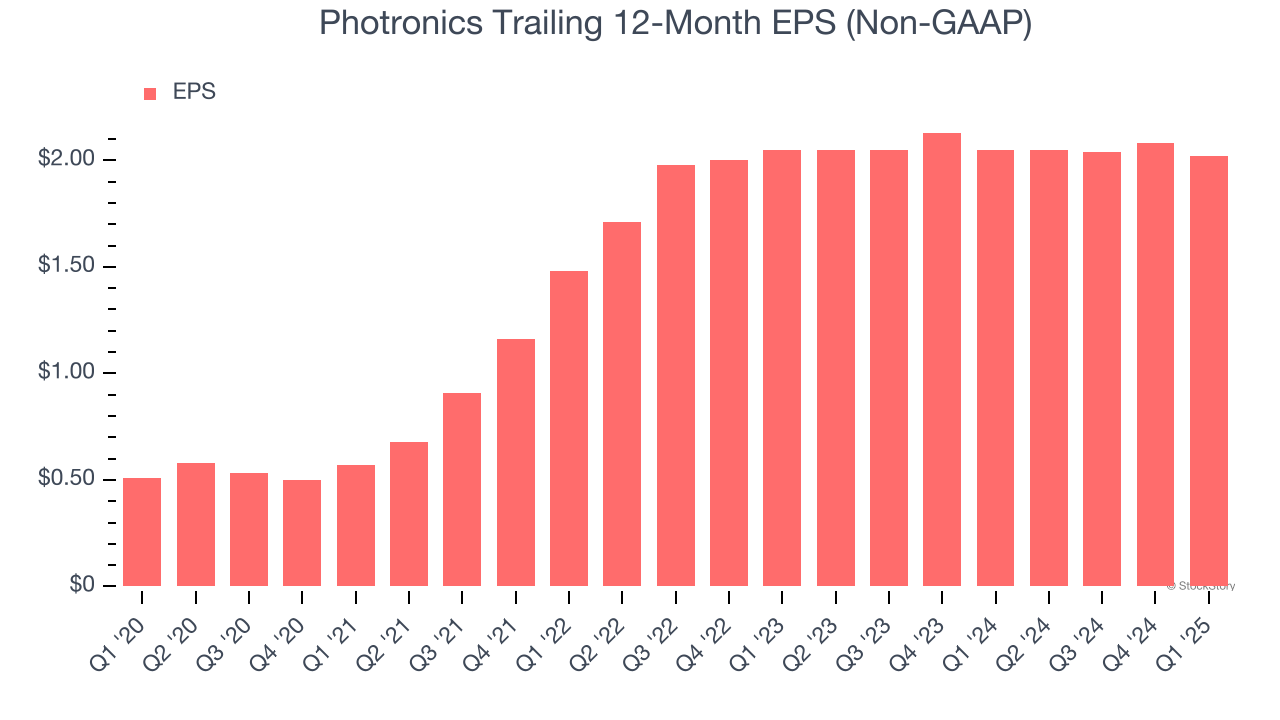

We track the long-term change in earnings per share (EPS) because it highlights whether a company’s growth is profitable.

Photronics’s EPS grew at a spectacular 31.7% compounded annual growth rate over the last five years, higher than its 7.5% annualized revenue growth. This tells us the company became more profitable on a per-share basis as it expanded.

One Reason to be Careful:

Long-Term Revenue Growth Disappoints

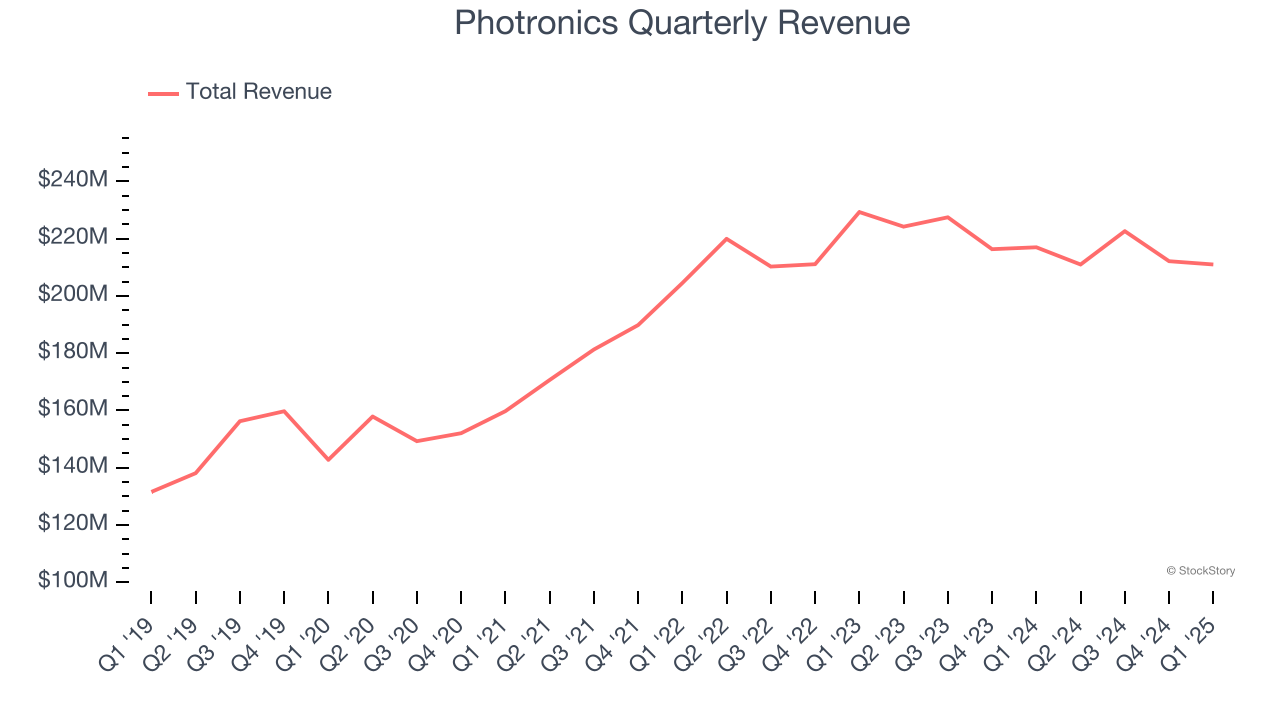

Examining a company’s long-term performance can provide clues about its quality.

Any business can have short-term success, but a top-tier one grows for years.

Regrettably, Photronics’s sales grew at a mediocre 7.5% compounded annual growth rate over the last five years. This wasn’t a great result compared to the rest of the semiconductor sector, but there are still things to like about Photronics. Semiconductors are a cyclical industry, and long-term investors should be prepared for periods of high growth followed by periods of revenue contractions.

Final Judgment

Photronics’s merits more than compensate for its flaws. After the recent drawdown, the stock trades at 10.2× forward P/E (or $21.04 per share). Is now a good time to buy? See for yourself in our in-depth research report, it’s free.

Stocks We Like Even More Than Photronics

When Trump unveiled his aggressive tariff plan in April 2025, markets tanked as investors feared a full-blown trade war. But those who panicked and sold missed the subsequent rebound that’s already erased most losses.

Don’t let fear keep you from great opportunities and take a look at Top 5 Growth Stocks for this month. This is a curated list of our High Quality stocks that have generated a market-beating return of 183% over the last five years (as of March 31st 2025).

Stocks that made our list in 2020 include now familiar names such as Nvidia (+1,545% between March 2020 and March 2025) as well as under-the-radar businesses like the once-small-cap company Exlservice (+354% five-year return). Find your next big winner with StockStory today.

StockStory is growing and hiring equity analyst and marketing roles. Are you a 0 to 1 builder passionate about the markets and AI? See the open roles here.

More News

View More

Recent Quotes

View MoreQuotes delayed at least 20 minutes.

By accessing this page, you agree to the Privacy Policy and Terms Of Service.