Jack Henry’s (NASDAQ:JKHY) Q2 Sales Top Estimates

Financial technology provider Jack Henry & Associates (NASDAQ: JKHY) beat Wall Street’s revenue expectations in Q2 CY2025, with sales up 9.9% year on year to $615.4 million. On the other hand, the company’s full-year revenue guidance of $2.49 billion at the midpoint came in 1.2% below analysts’ estimates. Its GAAP profit of $1.75 per share was 10.8% above analysts’ consensus estimates.

Is now the time to buy Jack Henry? Find out by accessing our full research report, it’s free.

Jack Henry (JKHY) Q2 CY2025 Highlights:

- Revenue: $615.4 million vs analyst estimates of $604.8 million (9.9% year-on-year growth, 1.8% beat)

- Pre-tax Profit: $159.9 million (26% margin, 22.7% year-on-year growth)

- EPS (GAAP): $1.75 vs analyst estimates of $1.58 (10.8% beat)

- EPS (GAAP) guidance for the upcoming financial year 2026 is $6.38 at the midpoint, missing analyst estimates by 0.6%

- Market Capitalization: $11.71 billion

Company Overview

Founded in 1976 by two entrepreneurs who saw the need for specialized banking software in the early days of financial computing, Jack Henry & Associates (NASDAQ: JKHY) provides technology solutions that help banks and credit unions innovate, differentiate, and compete while serving the evolving needs of their accountholders.

Revenue Growth

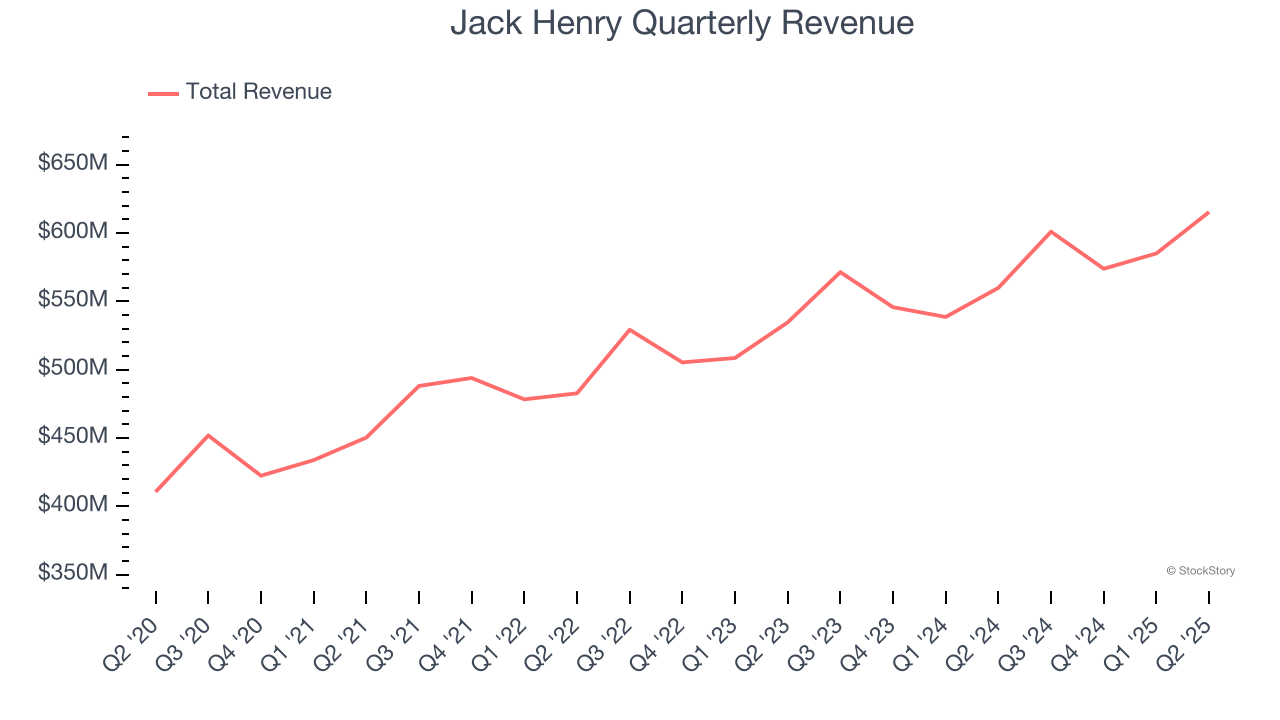

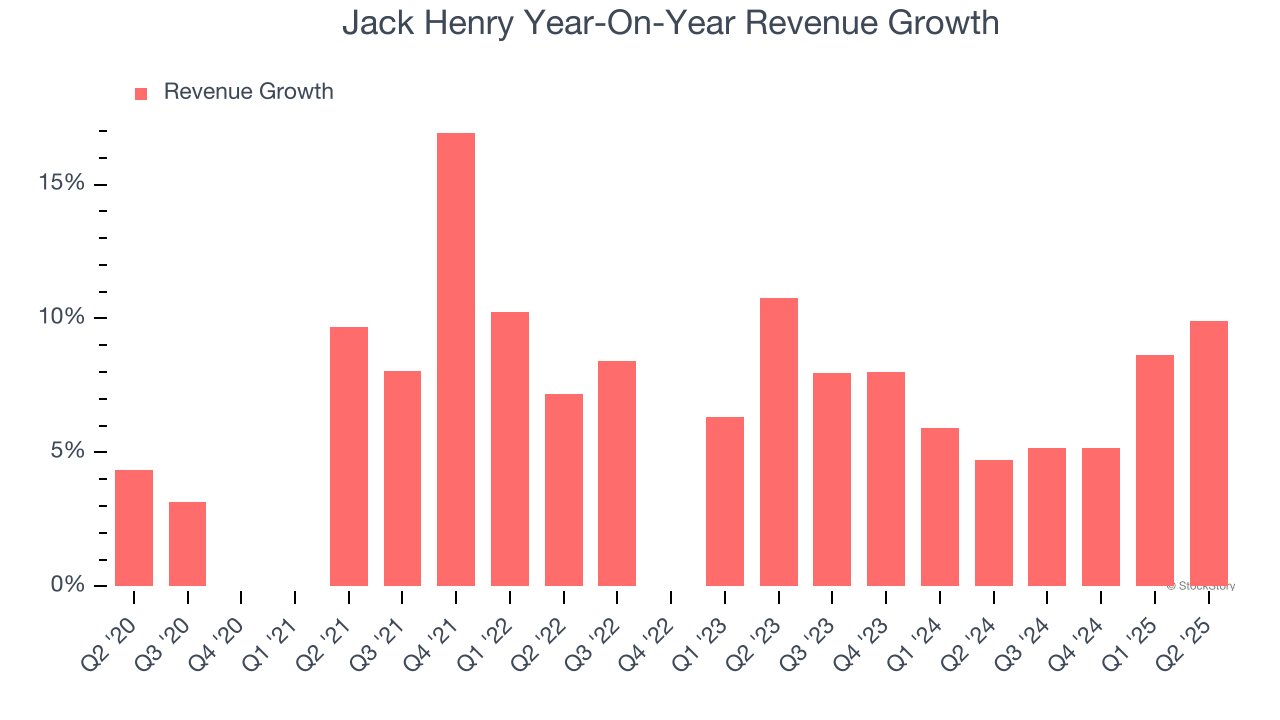

Two primary revenue streams drive bank earnings. While net interest income, which is earned by charging higher rates on loans than paid on deposits, forms the foundation, fee-based services across banking, credit, wealth management, and trading operations provide additional income. Unfortunately, Jack Henry’s 7% annualized revenue growth over the last five years was mediocre. This fell short of our benchmark for the financials sector and is a rough starting point for our analysis.

Long-term growth is the most important, but within financials, a half-decade historical view may miss recent interest rate changes and market returns. Jack Henry’s annualized revenue growth of 6.9% over the last two years aligns with its five-year trend, suggesting its demand was consistently weak.  Note: Quarters not shown were determined to be outliers, impacted by outsized investment gains/losses that are not indicative of the recurring fundamentals of the business.

Note: Quarters not shown were determined to be outliers, impacted by outsized investment gains/losses that are not indicative of the recurring fundamentals of the business.

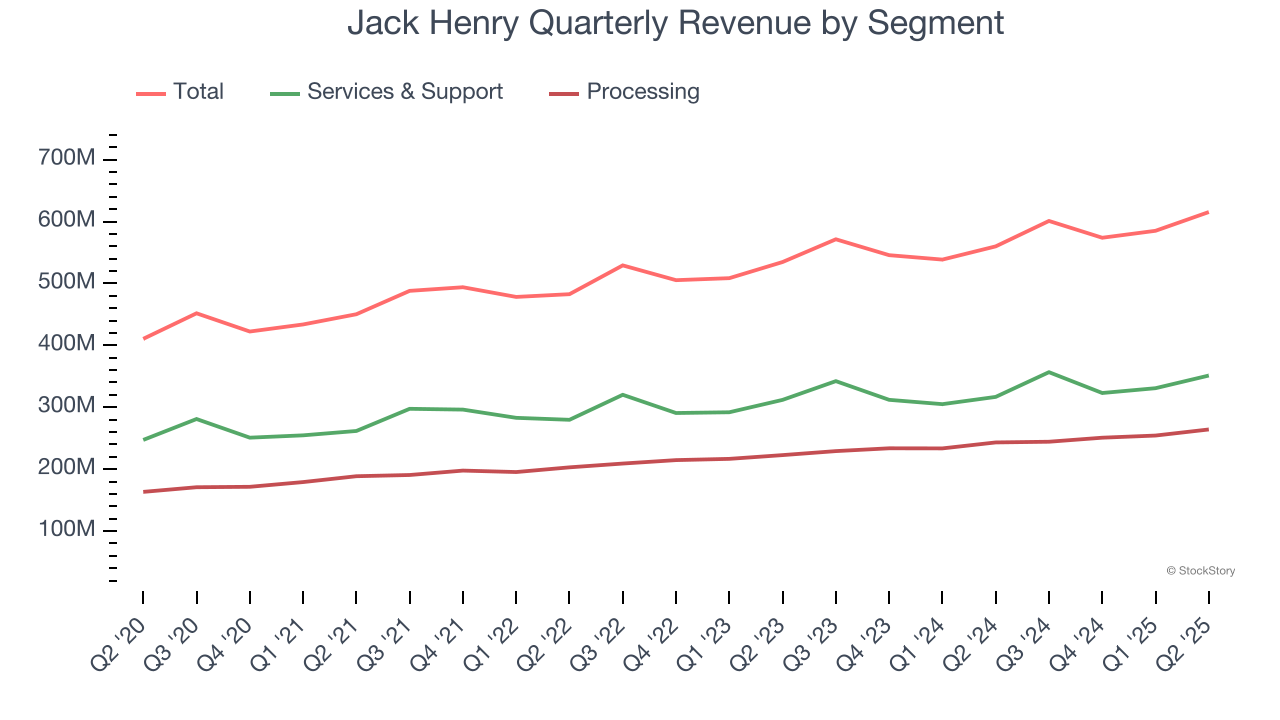

We can dig further into the company’s revenue dynamics by analyzing its most important segments, Services & Support and Processing, which are 57.1% and 42.9% of total revenue. Services & Support revenue grew by 5.3% and 5.9% annually over the past five and two years, respectively. At the same time, Processing revenue increased by 9.4% and 8.4% per year over the past five and two years, respectively.

This quarter, Jack Henry reported year-on-year revenue growth of 9.9%, and its $615.4 million of revenue exceeded Wall Street’s estimates by 1.8%.

Here at StockStory, we certainly understand the potential of thematic investing. Diverse winners from Microsoft (MSFT) to Alphabet (GOOG), Coca-Cola (KO) to Monster Beverage (MNST) could all have been identified as promising growth stories with a megatrend driving the growth. So, in that spirit, we’ve identified a relatively under-the-radar profitable growth stock benefiting from the rise of AI, available to you FREE via this link.

Key Takeaways from Jack Henry’s Q2 Results

We enjoyed seeing Jack Henry beat analysts’ Processing segment expectations this quarter. We were also glad its EPS outperformed Wall Street’s estimates. On the other hand, its its full-year revenue guidance fell slightly short of Wall Street’s estimates. Overall, this print was mixed, and shares traded down 2.2% to $157 immediately following the results.

Big picture, is Jack Henry a buy here and now? If you’re making that decision, you should consider the bigger picture of valuation, business qualities, as well as the latest earnings. We cover that in our actionable full research report which you can read here, it’s free.

More News

View More

Recent Quotes

View More

Quotes delayed at least 20 minutes.

By accessing this page, you agree to the Privacy Policy and Terms Of Service.