Q2 Earnings Review: Auto Parts Retailer Stocks Led by Monro (NASDAQ:MNRO)

Wrapping up Q2 earnings, we look at the numbers and key takeaways for the auto parts retailer stocks, including Monro (NASDAQ: MNRO) and its peers.

Cars are complex machines that need maintenance and occasional repairs, and auto parts retailers cater to the professional mechanic as well as the do-it-yourself (DIY) fixer. Work on cars may entail replacing fluids, parts, or accessories, and these stores have the parts and accessories or these jobs. While e-commerce competition presents a risk, these stores have a leg up due to the combination of broad and deep selection as well as expertise provided by sales associates. Another change on the horizon could be the increasing penetration of electric vehicles.

The 5 auto parts retailer stocks we track reported a mixed Q2. As a group, revenues beat analysts’ consensus estimates by 0.9%.

In light of this news, share prices of the companies have held steady as they are up 1.6% on average since the latest earnings results.

Best Q2: Monro (NASDAQ: MNRO)

Started as a single location in Rochester, New York, Monro (NASDAQ: MNRO) provides common auto services such as brake repairs, tire replacements, and oil changes.

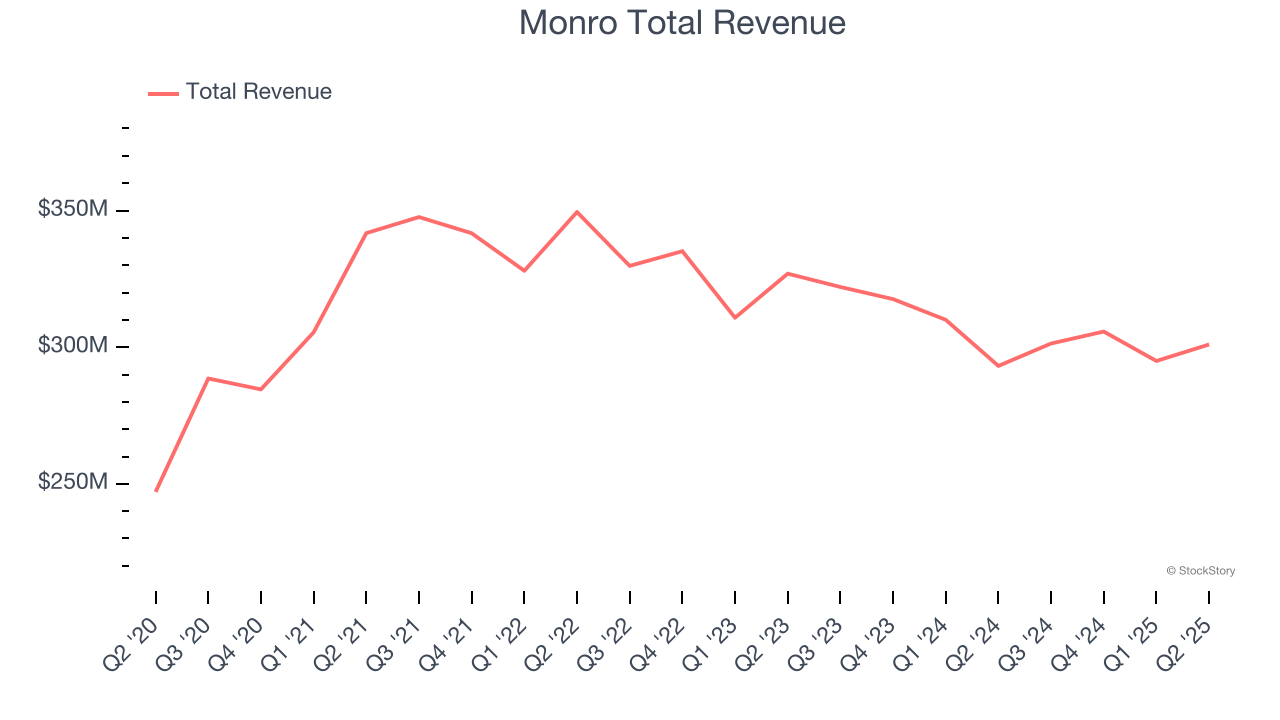

Monro reported revenues of $301 million, up 2.7% year on year. This print exceeded analysts’ expectations by 1.7%. Overall, it was an exceptional quarter for the company with a beat of analysts’ EPS estimates and an impressive beat of analysts’ EBITDA estimates.

“The Monro team drove mid-single-digit comparable store sales growth in the first quarter, which has enabled us to report two consecutive quarters of positive comps for the first time in a couple of years. This was driven by the progress we continue to make with our ConfiDrive digital courtesy inspection process, which resulted in sales and unit growth in our tire category and our high-margin service categories, including front-end shocks, brakes, batteries, and maintenance services. We maintained prudent operating cost control, as reflected in lower store direct costs in the quarter. We reduced inventory levels across the system by approximately $10 million, primarily as a result of reducing our store count. Our profitability on an adjusted diluted earnings per share basis was in-line with the prior year first quarter. These results serve as a solid foundation to build upon as we implement our performance improvement plan to enhance Monro’s operations, drive profitability, and increase operating income and total shareholder returns. Encouragingly, our preliminary fiscal July comps are up 2%, which would result in our sixth consecutive month of consistent comparable store sales growth”, said Peter Fitzsimmons, President and Chief Executive Officer.

Monro pulled off the biggest analyst estimates beat of the whole group. Investor expectations, however, were likely higher than Wall Street’s published projections, leaving some wishing for even better results (analysts’ consensus estimates are those published by big banks and advisory firms, not the investors who make buy and sell decisions). The stock is down 5.7% since reporting and currently trades at $15.40.

Is now the time to buy Monro? Access our full analysis of the earnings results here, it’s free.

Genuine Parts (NYSE: GPC)

Largely targeting the professional customer, Genuine Parts (NYSE: GPC) sells auto and industrial parts such as batteries, belts, bearings, and machine fluids.

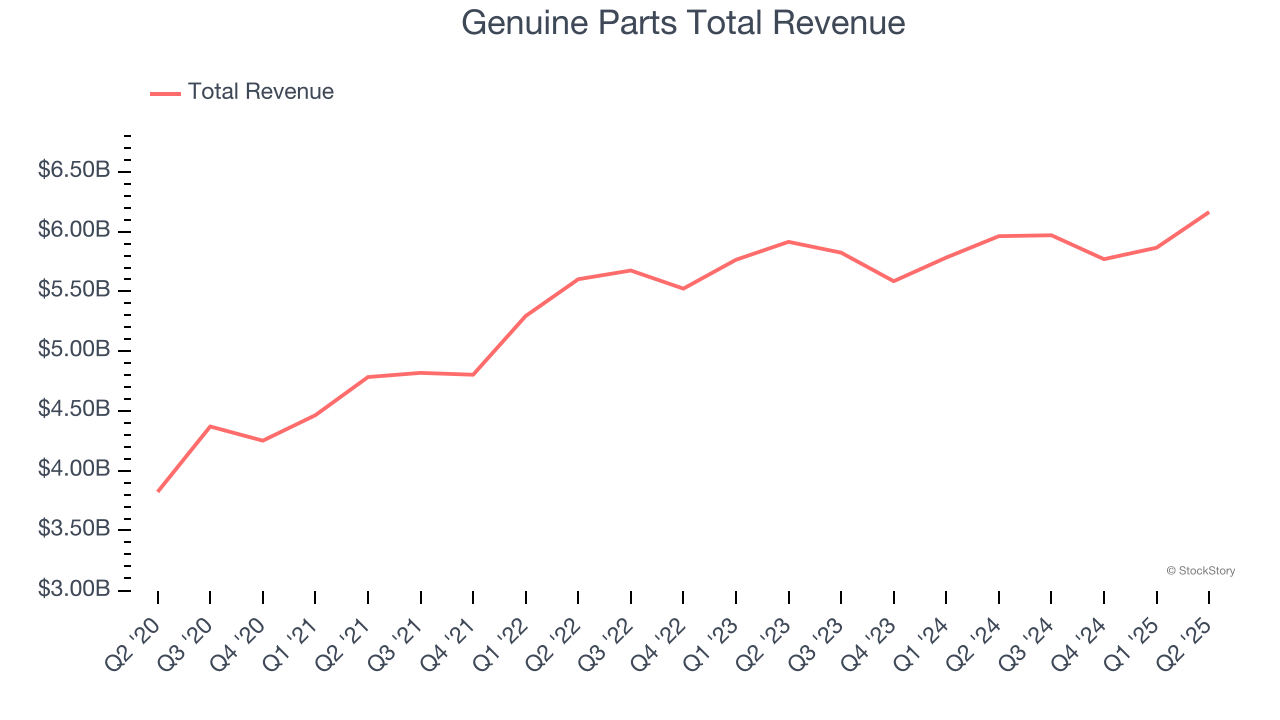

Genuine Parts reported revenues of $6.16 billion, up 3.4% year on year, outperforming analysts’ expectations by 0.9%. The business had a satisfactory quarter with a solid beat of analysts’ gross margin estimates.

The market seems happy with the results as the stock is up 10.7% since reporting. It currently trades at $137.14.

Is now the time to buy Genuine Parts? Access our full analysis of the earnings results here, it’s free.

Weakest Q2: Advance Auto Parts (NYSE: AAP)

Founded in Virginia in 1932, Advance Auto Parts (NYSE: AAP) is an auto parts and accessories retailer that sells everything from carburetors to motor oil to car floor mats.

Advance Auto Parts reported revenues of $2.01 billion, down 7.7% year on year, exceeding analysts’ expectations by 1%. Still, it was a slower quarter as it posted full-year EPS guidance missing analysts’ expectations.

Advance Auto Parts delivered the slowest revenue growth and weakest full-year guidance update in the group. As expected, the stock is down 9.1% since the results and currently trades at $56.21.

Read our full analysis of Advance Auto Parts’s results here.

AutoZone (NYSE: AZO)

Aiming to be a one-stop shop for the DIY customer, AutoZone (NYSE: AZO) is an auto parts and accessories retailer that sells everything from car batteries to windshield wiper fluid to brake pads.

AutoZone reported revenues of $4.46 billion, up 5.4% year on year. This result surpassed analysts’ expectations by 1.1%. Aside from that, it was a slower quarter as it logged a miss of analysts’ EBITDA estimates and a slight miss of analysts’ gross margin estimates.

The stock is up 5.5% since reporting and currently trades at $4,040.

Read our full, actionable report on AutoZone here, it’s free.

O'Reilly (NASDAQ: ORLY)

Serving both the DIY customer and professional mechanic, O’Reilly Automotive (NASDAQ: ORLY) is an auto parts and accessories retailer that sells everything from fuel pumps to car air fresheners to mufflers.

O'Reilly reported revenues of $4.53 billion, up 5.9% year on year. This number met analysts’ expectations. However, it was a slower quarter as it produced a miss of analysts’ EBITDA estimates and full-year EPS guidance slightly missing analysts’ expectations.

O'Reilly delivered the fastest revenue growth and highest full-year guidance raise, but had the weakest performance against analyst estimates among its peers. The stock is up 6.8% since reporting and currently trades at $102.

Read our full, actionable report on O'Reilly here, it’s free.

Market Update

In response to the Fed’s rate hikes in 2022 and 2023, inflation has been gradually trending down from its post-pandemic peak, trending closer to the Fed’s 2% target. Despite higher borrowing costs, the economy has avoided flashing recessionary signals. This is the much-desired soft landing that many investors hoped for. The recent rate cuts (0.5% in September and 0.25% in November 2024) have bolstered the stock market, making 2024 a strong year for equities. Donald Trump’s presidential win in November sparked additional market gains, sending indices to record highs in the days following his victory. However, debates continue over possible tariffs and corporate tax adjustments, raising questions about economic stability in 2025.

Want to invest in winners with rock-solid fundamentals? Check out our 9 Best Market-Beating Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

StockStory is growing and hiring equity analyst and marketing roles. Are you a 0 to 1 builder passionate about the markets and AI? See the open roles here.

More News

View More

Recent Quotes

View More

Quotes delayed at least 20 minutes.

By accessing this page, you agree to the Privacy Policy and Terms Of Service.