Waste Management Stocks Q2 In Review: Enviri (NYSE:NVRI) Vs Peers

Looking back on waste management stocks’ Q2 earnings, we examine this quarter’s best and worst performers, including Enviri (NYSE: NVRI) and its peers.

Waste management companies can possess licenses permitting them to handle hazardous materials. Furthermore, many services are performed through contracts and statutorily mandated, non-discretionary, or recurring, leading to more predictable revenue streams. However, regulation can be a headwind, rendering existing services obsolete or forcing companies to invest precious capital to comply with new, more environmentally-friendly rules. Lastly, waste management companies are at the whim of economic cycles. Interest rates, for example, can greatly impact industrial production or commercial projects that create waste and byproducts.

The 9 waste management stocks we track reported a slower Q2. As a group, revenues missed analysts’ consensus estimates by 0.7%.

In light of this news, share prices of the companies have held steady as they are up 1.5% on average since the latest earnings results.

Enviri (NYSE: NVRI)

Cooling America’s first indoor ice rink in the 19th century, Enviri (NYSE: NVRI) offers steel and waste handling services.

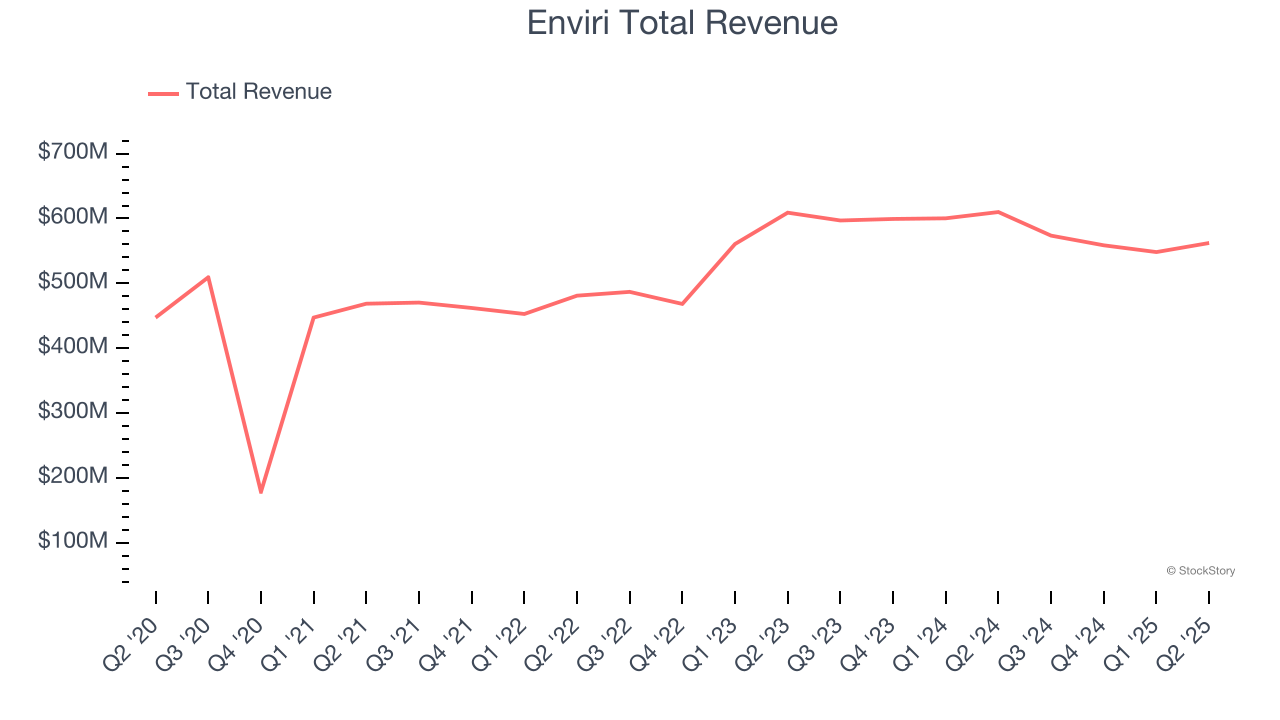

Enviri reported revenues of $562.3 million, down 7.8% year on year. This print fell short of analysts’ expectations by 2.5%. Overall, it was a disappointing quarter for the company with full-year EBITDA guidance missing analysts’ expectations.

“Our environmental businesses performed well in the quarter and in line with our expectations,” said Enviri Chairman and CEO Nick Grasberger.

Interestingly, the stock is up 17.6% since reporting and currently trades at $10.20.

Read our full report on Enviri here, it’s free.

Best Q2: Montrose (NYSE: MEG)

Founded to protect a tree-lined two-lane road, Montrose (NYSE: MEG) provides air quality monitoring, environmental laboratory testing, compliance, and environmental consulting services.

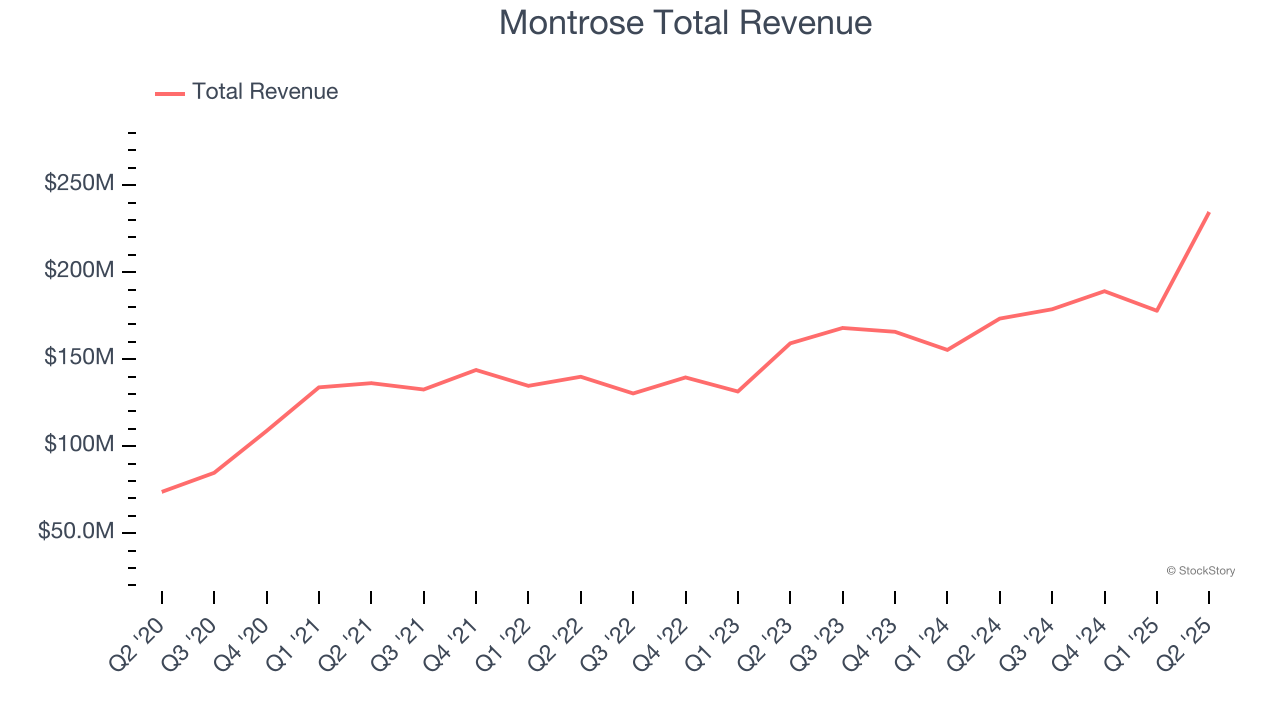

Montrose reported revenues of $234.5 million, up 35.3% year on year, outperforming analysts’ expectations by 24.4%. The business had an incredible quarter with a solid beat of analysts’ organic revenue estimates and a beat of analysts’ EPS estimates.

Montrose achieved the biggest analyst estimates beat, fastest revenue growth, and highest full-year guidance raise among its peers. The market seems happy with the results as the stock is up 18.8% since reporting. It currently trades at $26.85.

Is now the time to buy Montrose? Access our full analysis of the earnings results here, it’s free.

Quest Resource (NASDAQ: QRHC)

Recycling corporate waste to help companies be more sustainable, Quest Resource (NASDAQ: QRHC) is a provider of waste and recycling services.

Quest Resource reported revenues of $59.54 million, down 18.6% year on year, falling short of analysts’ expectations by 17.9%. It was a disappointing quarter as it posted a significant miss of analysts’ EBITDA estimates and a significant miss of analysts’ EPS estimates.

Quest Resource delivered the weakest performance against analyst estimates and slowest revenue growth in the group. As expected, the stock is down 16.3% since the results and currently trades at $1.64.

Read our full analysis of Quest Resource’s results here.

Waste Management (NYSE: WM)

Headquartered in Houston, Waste Management (NYSE: WM) is a provider of comprehensive waste management services in North America.

Waste Management reported revenues of $6.43 billion, up 19% year on year. This number surpassed analysts’ expectations by 1.1%. Taking a step back, it was a mixed quarter as it also logged a decent beat of analysts’ EBITDA estimates but a slight miss of analysts’ adjusted operating income estimates.

The stock is flat since reporting and currently trades at $228.76.

Read our full, actionable report on Waste Management here, it’s free.

Casella Waste Systems (NASDAQ: CWST)

Starting with the founder picking up garbage with a pickup truck he purchased using savings from high school, Casella (NASDAQ: CWST) offers waste management services for businesses, residents, and the government.

Casella Waste Systems reported revenues of $465.3 million, up 23.4% year on year. This print beat analysts’ expectations by 2.4%. Aside from that, it was a mixed quarter as it also produced full-year revenue guidance slightly topping analysts’ expectations but a significant miss of analysts’ adjusted operating income estimates.

The stock is down 9.1% since reporting and currently trades at $98.84.

Read our full, actionable report on Casella Waste Systems here, it’s free.

Market Update

Thanks to the Fed’s rate hikes in 2022 and 2023, inflation has been on a steady path downward, easing back toward that 2% sweet spot. Fortunately (miraculously to some), all this tightening didn’t send the economy tumbling into a recession, so here we are, cautiously celebrating a soft landing. The cherry on top? Recent rate cuts (half a point in September 2024, a quarter in November) have propped up markets, especially after Trump’s November win lit a fire under major indices and sent them to all-time highs. However, there’s still plenty to ponder — tariffs, corporate tax cuts, and what 2025 might hold for the economy.

Want to invest in winners with rock-solid fundamentals? Check out our Top 5 Growth Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

StockStory is growing and hiring equity analyst and marketing roles. Are you a 0 to 1 builder passionate about the markets and AI? See the open roles here.

More News

View More

Recent Quotes

View More

Quotes delayed at least 20 minutes.

By accessing this page, you agree to the Privacy Policy and Terms Of Service.