3 Reasons FSLY is Risky and 1 Stock to Buy Instead

Fastly trades at $7.27 and has moved in lockstep with the market. Its shares have returned 8.1% over the last six months while the S&P 500 has gained 10.3%.

Is there a buying opportunity in Fastly, or does it present a risk to your portfolio? Get the full stock story straight from our expert analysts, it’s free.

Why Do We Think Fastly Will Underperform?

We're cautious about Fastly. Here are three reasons you should be careful with FSLY and a stock we'd rather own.

1. Long-Term Revenue Growth Disappoints

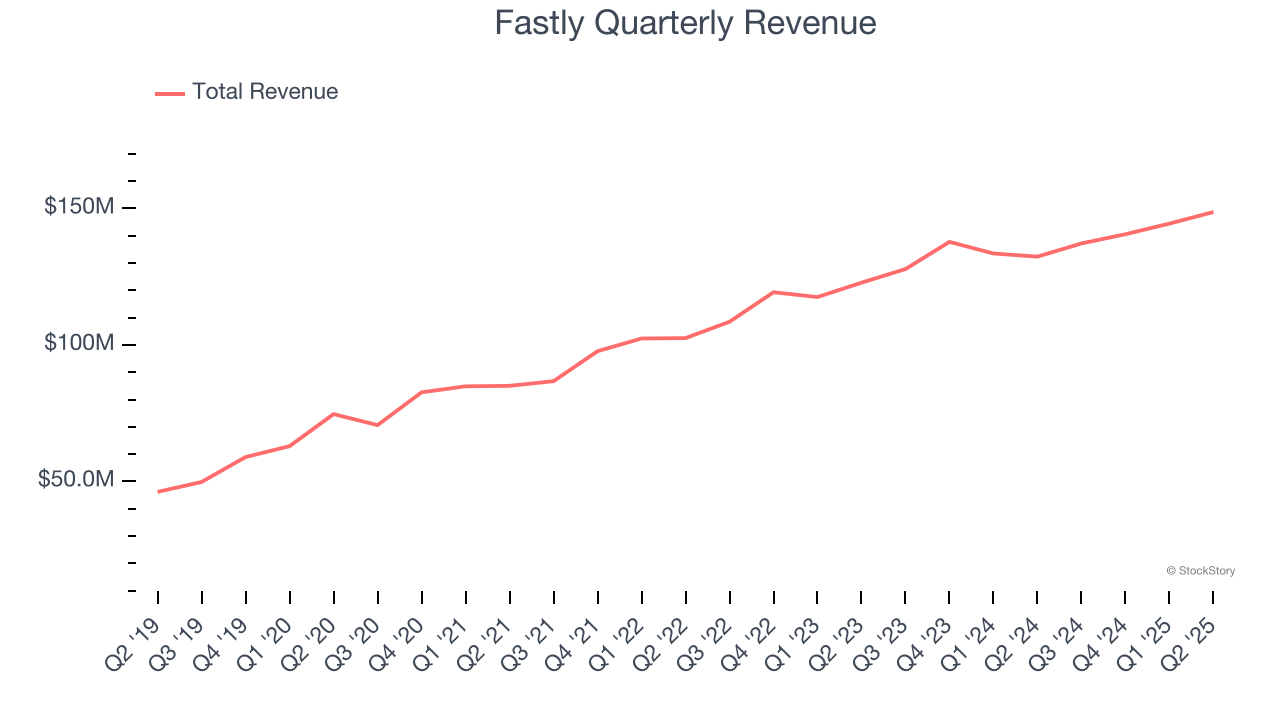

A company’s long-term sales performance is one signal of its overall quality. Any business can have short-term success, but a top-tier one grows for years. Over the last three years, Fastly grew its sales at a 13.6% compounded annual growth rate. Although this growth is acceptable on an absolute basis, it fell short of our standards for the software sector, which enjoys a number of secular tailwinds.

2. Low Gross Margin Reveals Weak Structural Profitability

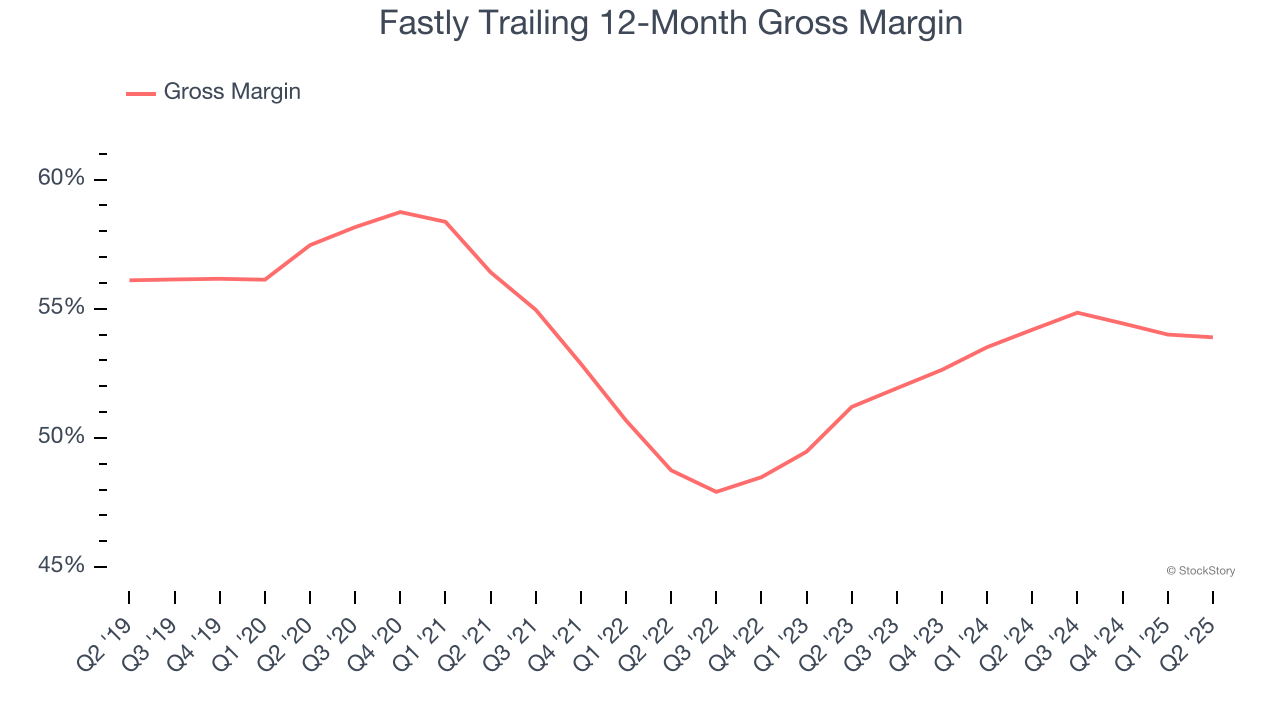

For software companies like Fastly, gross profit tells us how much money remains after paying for the base cost of products and services (typically servers, licenses, and certain personnel). These costs are usually low as a percentage of revenue, explaining why software is more lucrative than other sectors.

Fastly’s gross margin is substantially worse than most software businesses, signaling it has relatively high infrastructure costs compared to asset-lite businesses like ServiceNow. As you can see below, it averaged a 53.9% gross margin over the last year. Said differently, Fastly had to pay a chunky $46.11 to its service providers for every $100 in revenue.

3. Operating Losses Sound the Alarms

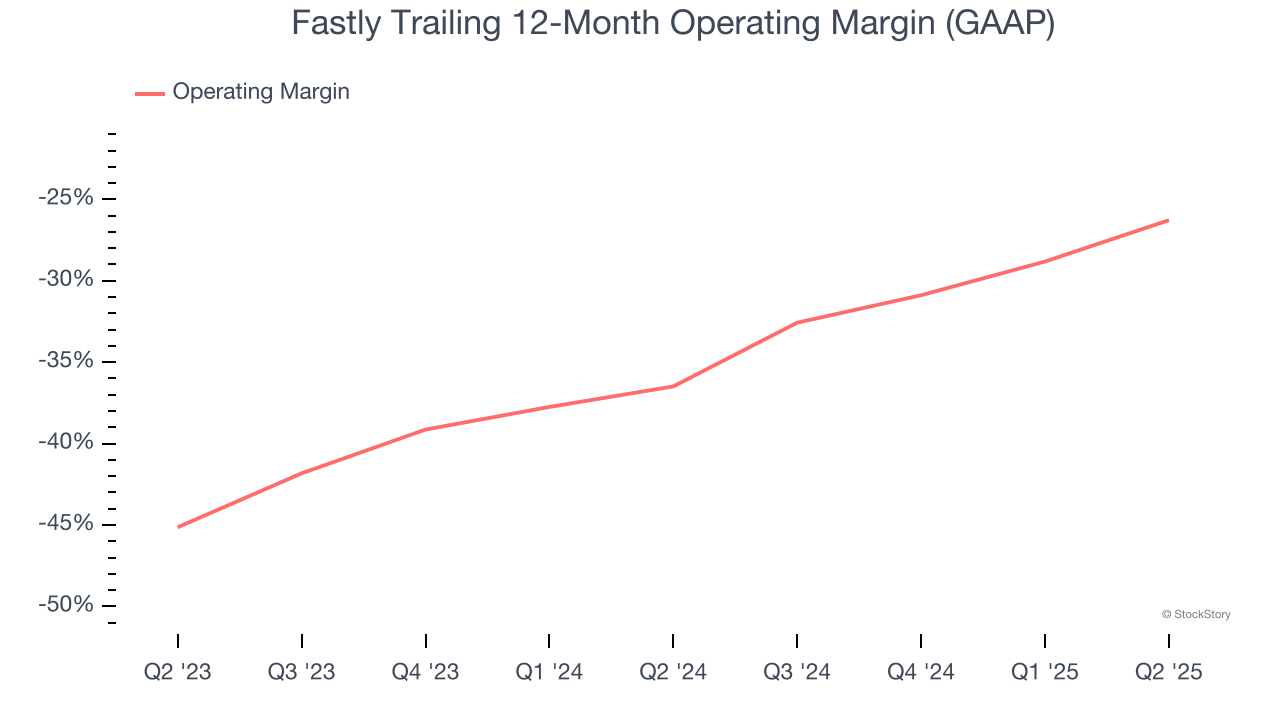

Many software businesses adjust their profits for stock-based compensation (SBC), but we prioritize GAAP operating margin because SBC is a real expense used to attract and retain engineering and sales talent. This metric shows how much revenue remains after accounting for all core expenses – everything from the cost of goods sold to sales and R&D.

Fastly’s expensive cost structure has contributed to an average operating margin of negative 26.3% over the last year. Unprofitable software companies require extra attention because they spend heaps of money to capture market share. As seen in its historically underwhelming revenue performance, this strategy hasn’t worked so far, and it’s unclear what would happen if Fastly reeled back its investments. Wall Street seems to think it will face some obstacles, and we tend to agree.

Final Judgment

We cheer for all companies solving complex business issues, but in the case of Fastly, we’ll be cheering from the sidelines. That said, the stock currently trades at 1.7× forward price-to-sales (or $7.27 per share). This valuation multiple is fair, but we don’t have much confidence in the company. There are better stocks to buy right now. We’d suggest looking at one of our all-time favorite software stocks.

Stocks We Would Buy Instead of Fastly

When Trump unveiled his aggressive tariff plan in April 2025, markets tanked as investors feared a full-blown trade war. But those who panicked and sold missed the subsequent rebound that’s already erased most losses.

Don’t let fear keep you from great opportunities and take a look at Top 5 Strong Momentum Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 183% over the last five years (as of March 31st 2025).

Stocks that made our list in 2020 include now familiar names such as Nvidia (+1,545% between March 2020 and March 2025) as well as under-the-radar businesses like the once-small-cap company Exlservice (+354% five-year return). Find your next big winner with StockStory today.

StockStory is growing and hiring equity analyst and marketing roles. Are you a 0 to 1 builder passionate about the markets and AI? See the open roles here.

More News

View More

Recent Quotes

View More

Quotes delayed at least 20 minutes.

By accessing this page, you agree to the Privacy Policy and Terms Of Service.