Unpacking Q2 Earnings: Simpson (NYSE:SSD) In The Context Of Other Home Construction Materials Stocks

The end of an earnings season can be a great time to discover new stocks and assess how companies are handling the current business environment. Let’s take a look at how Simpson (NYSE: SSD) and the rest of the home construction materials stocks fared in Q2.

Traditionally, home construction materials companies have built economic moats with expertise in specialized areas, brand recognition, and strong relationships with contractors. More recently, advances to address labor availability and job site productivity have spurred innovation that is driving incremental demand. However, these companies are at the whim of residential construction volumes, which tend to be cyclical and can be impacted heavily by economic factors such as interest rates. Additionally, the costs of raw materials can be driven by a myriad of worldwide factors and greatly influence the profitability of home construction materials companies.

The 11 home construction materials stocks we track reported a satisfactory Q2. As a group, revenues missed analysts’ consensus estimates by 1% while next quarter’s revenue guidance was in line.

Thankfully, share prices of the companies have been resilient as they are up 7.6% on average since the latest earnings results.

Simpson (NYSE: SSD)

Aiming to build safer and stronger buildings, Simpson (NYSE: SSD) designs and manufactures structural connectors, anchors, and other construction products.

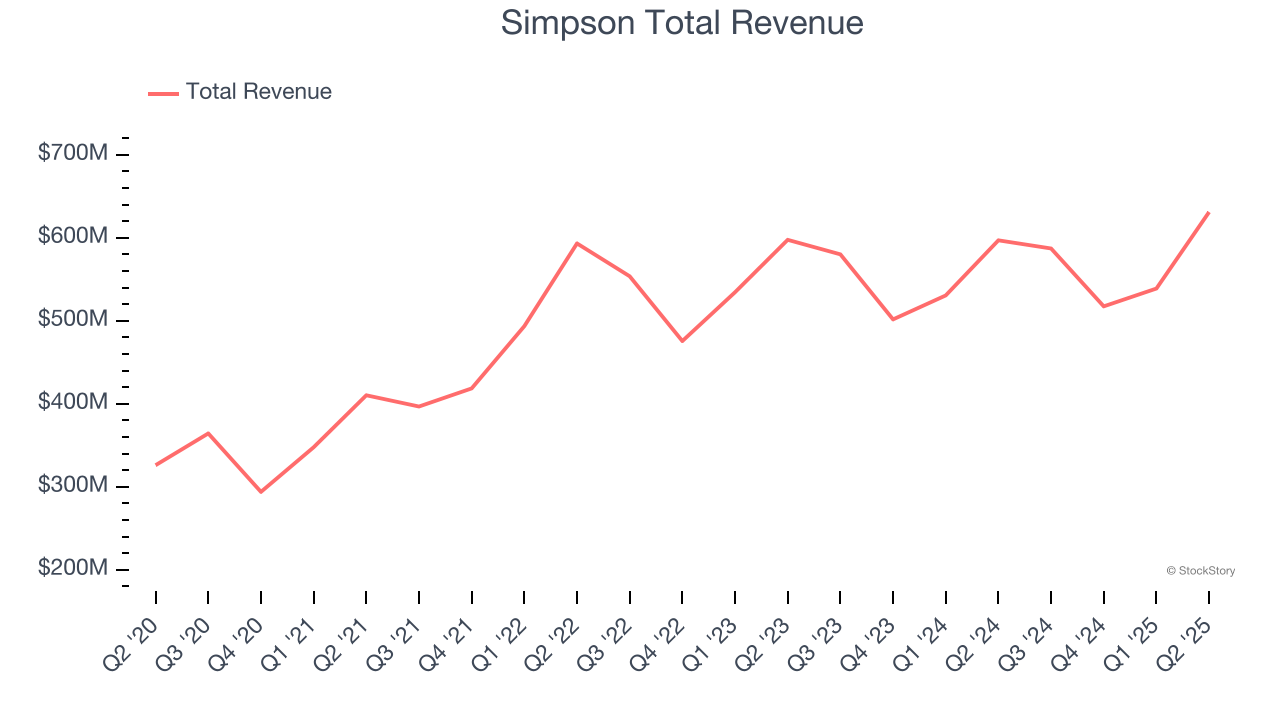

Simpson reported revenues of $631.1 million, up 5.7% year on year. This print exceeded analysts’ expectations by 5.3%. Overall, it was an exceptional quarter for the company with a solid beat of analysts’ EBITDA estimates and a beat of analysts’ EPS estimates.

"Our results underscore the strength and resilience of our business model, as we delivered year-over-year sales growth in a challenging housing market," said Mike Olosky, President and Chief Executive Officer of Simpson Manufacturing Co.,

Simpson pulled off the biggest analyst estimates beat of the whole group. Unsurprisingly, the stock is up 16.1% since reporting and currently trades at $192.94.

Is now the time to buy Simpson? Access our full analysis of the earnings results here, it’s free.

Best Q2: Masco (NYSE: MAS)

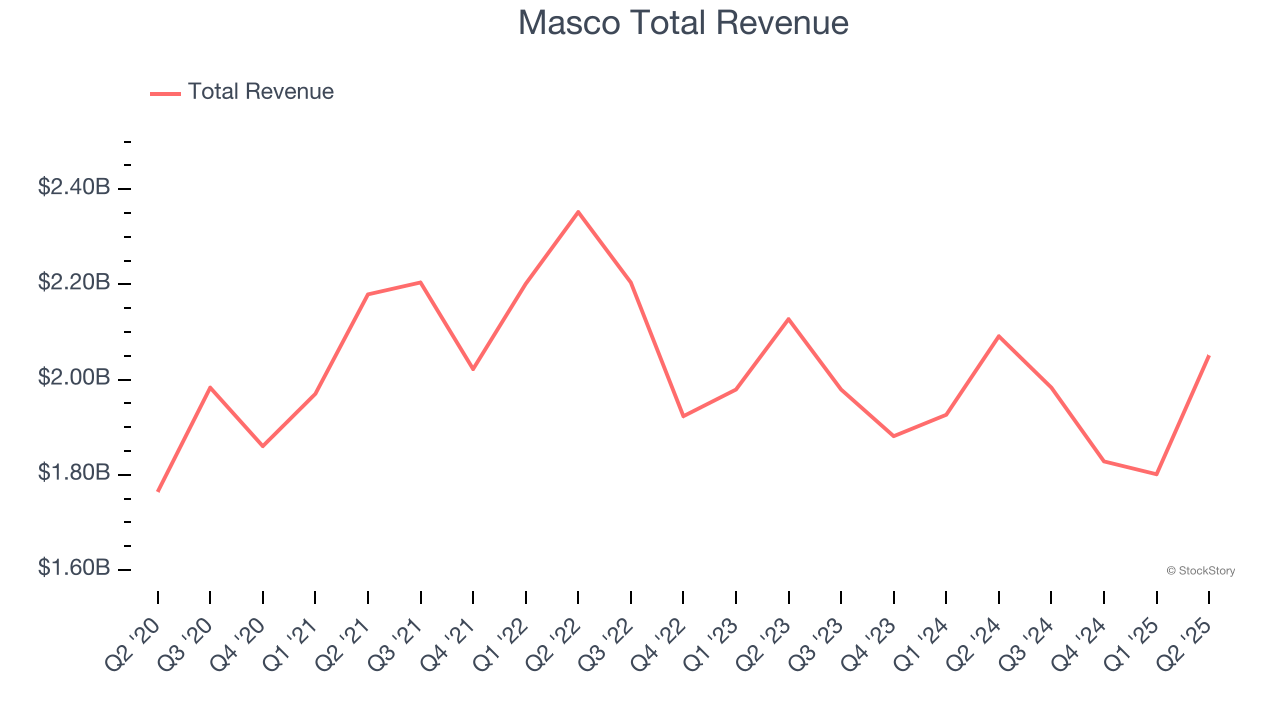

Headquartered just outside of Detroit, MI, Masco (NYSE: MAS) designs and manufactures home-building products such as glass shower doors, decorative lighting, bathtubs, and faucets.

Masco reported revenues of $2.05 billion, down 1.9% year on year, outperforming analysts’ expectations by 2.5%. The business had a stunning quarter with an impressive beat of analysts’ EBITDA estimates and a solid beat of analysts’ adjusted operating income estimates.

The market seems happy with the results as the stock is up 11.8% since reporting. It currently trades at $73.55.

Is now the time to buy Masco? Access our full analysis of the earnings results here, it’s free.

Weakest Q2: Gibraltar (NASDAQ: ROCK)

Gibraltar (NASDAQ: ROCK) makes renewable energy, agriculture technology and infrastructure products. Its mission statement is to make everyday living more sustainable.

Gibraltar reported revenues of $309.5 million, up 13.1% year on year, falling short of analysts’ expectations by 17.9%. It was a disappointing quarter as it posted full-year revenue guidance missing analysts’ expectations significantly and full-year EPS guidance missing analysts’ expectations significantly.

Gibraltar delivered the fastest revenue growth but had the weakest performance against analyst estimates and weakest full-year guidance update in the group. The stock is flat since the results and currently trades at $64.06.

Read our full analysis of Gibraltar’s results here.

JELD-WEN (NYSE: JELD)

Founded in the 1960s as a general wood-making company, JELD-WEN (NYSE: JELD) manufactures doors, windows, and other related building products.

JELD-WEN reported revenues of $823.7 million, down 16.5% year on year. This result beat analysts’ expectations by 1.7%. Overall, it was an exceptional quarter as it also recorded a beat of analysts’ EPS estimates and a solid beat of analysts’ EBITDA estimates.

JELD-WEN scored the highest full-year guidance raise but had the slowest revenue growth among its peers. The stock is up 32% since reporting and currently trades at $6.13.

Read our full, actionable report on JELD-WEN here, it’s free.

Hayward (NYSE: HAYW)

Credited with introducing the first variable-speed pool pump, Hayward (NYSE: HAYW) makes residential and commercial pool equipment and accessories.

Hayward reported revenues of $299.6 million, up 5.3% year on year. This print surpassed analysts’ expectations by 3.4%. It was a strong quarter as it also logged an impressive beat of analysts’ EBITDA estimates and a solid beat of analysts’ adjusted operating income estimates.

The stock is up 8.4% since reporting and currently trades at $16.20.

Read our full, actionable report on Hayward here, it’s free.

Market Update

Thanks to the Fed’s series of rate hikes in 2022 and 2023, inflation has cooled significantly from its post-pandemic highs, drawing closer to the 2% goal. This disinflation has occurred without severely impacting economic growth, suggesting the success of a soft landing. The stock market thrived in 2024, spurred by recent rate cuts (0.5% in September and 0.25% in November), and a notable surge followed Donald Trump’s presidential election win in November, propelling indices to historic highs. Nonetheless, the outlook for 2025 remains clouded by potential trade policy changes and corporate tax discussions, which could impact business confidence and growth. The path forward holds both optimism and caution as new policies take shape.

Want to invest in winners with rock-solid fundamentals? Check out our Top 5 Growth Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

StockStory is growing and hiring equity analyst and marketing roles. Are you a 0 to 1 builder passionate about the markets and AI? See the open roles here.

More News

View More

Recent Quotes

View More

Quotes delayed at least 20 minutes.

By accessing this page, you agree to the Privacy Policy and Terms Of Service.