Frontdoor’s (NASDAQ:FTDR) Q2 Sales Top Estimates, Stock Soars

Home warranty company Frontdoor (NASDAQ: FTDR) reported Q2 CY2025 results topping the market’s revenue expectations, with sales up 13.8% year on year to $617 million. Guidance for next quarter’s revenue was optimistic at $610 million at the midpoint, 2.5% above analysts’ estimates. Its non-GAAP profit of $1.63 per share was 12% above analysts’ consensus estimates.

Is now the time to buy Frontdoor? Find out by accessing our full research report, it’s free.

Frontdoor (FTDR) Q2 CY2025 Highlights:

- Revenue: $617 million vs analyst estimates of $603.3 million (13.8% year-on-year growth, 2.3% beat)

- Adjusted EPS: $1.63 vs analyst estimates of $1.45 (12% beat)

- Adjusted EBITDA: $199 million vs analyst estimates of $186.6 million (32.3% margin, 6.6% beat)

- The company lifted its revenue guidance for the full year to $2.07 billion at the midpoint from $2.04 billion, a 1.2% increase

- EBITDA guidance for the full year is $540 million at the midpoint, above analyst estimates of $508.9 million

- Operating Margin: 29.8%, up from 23.8% in the same quarter last year

- Free Cash Flow Margin: 19.4%, up from 16.8% in the same quarter last year

- Market Capitalization: $4.30 billion

“Frontdoor continues to perform exceptionally well, and we delivered another quarter of outstanding financial performance," said Chairman and Chief Executive Officer Bill Cobb.

Company Overview

Established in 2018 as a spin-off from ServiceMaster Global Holdings, Frontdoor (NASDAQ: FTDR) is a provider of home warranty and service plans.

Revenue Growth

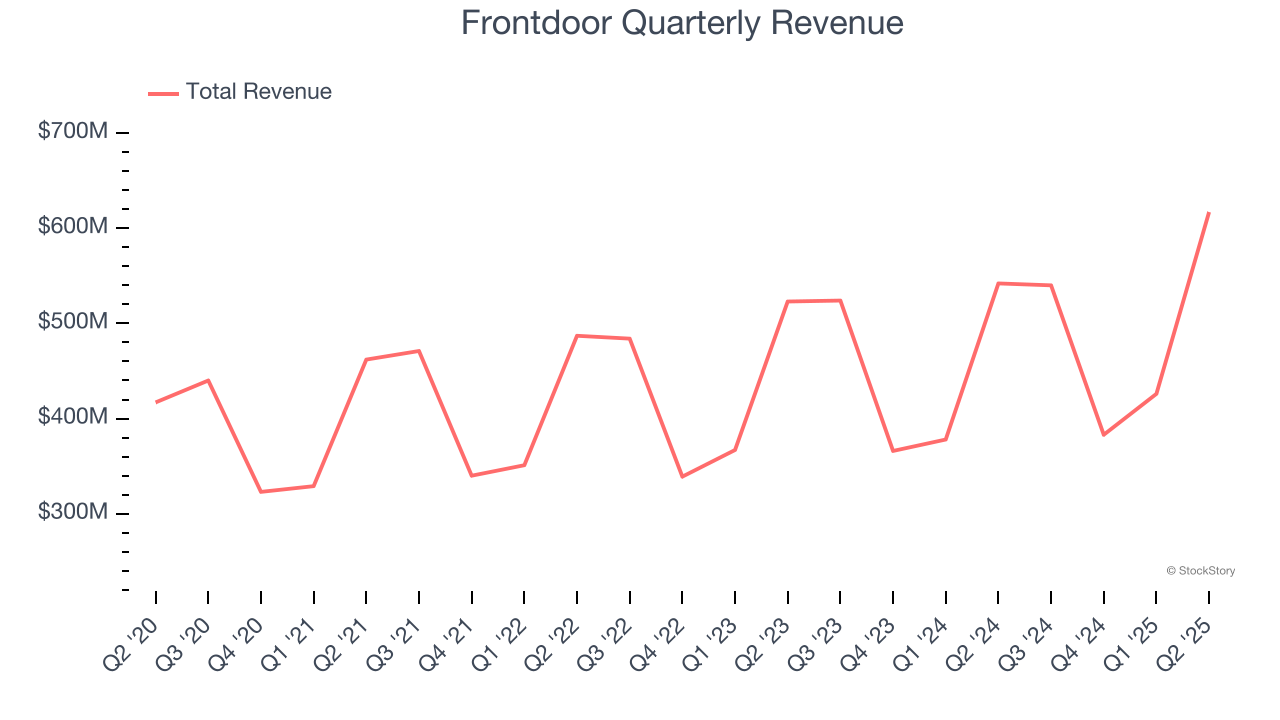

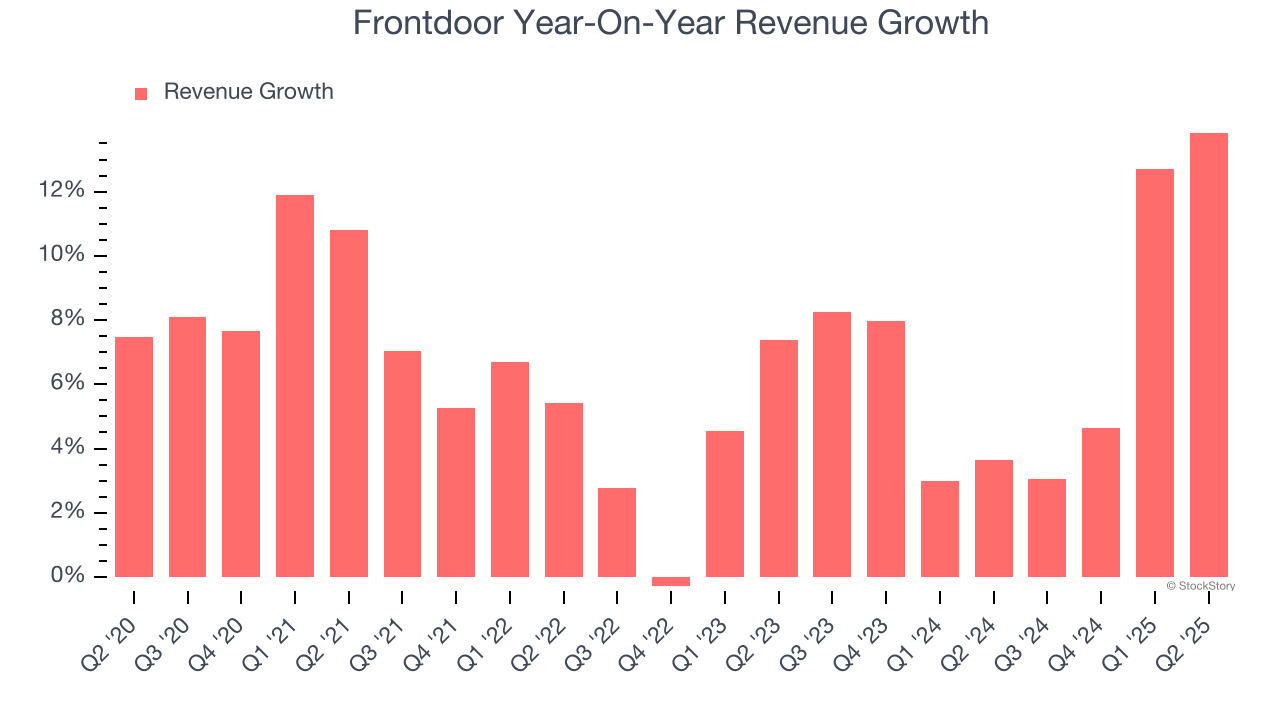

A company’s long-term sales performance can indicate its overall quality. Any business can put up a good quarter or two, but the best consistently grow over the long haul. Over the last five years, Frontdoor grew its sales at a sluggish 6.8% compounded annual growth rate. This fell short of our benchmark for the consumer discretionary sector and is a tough starting point for our analysis.

We at StockStory place the most emphasis on long-term growth, but within consumer discretionary, a stretched historical view may miss a company riding a successful new product or trend. Frontdoor’s annualized revenue growth of 7.1% over the last two years aligns with its five-year trend, suggesting its demand was consistently weak.

This quarter, Frontdoor reported year-on-year revenue growth of 13.8%, and its $617 million of revenue exceeded Wall Street’s estimates by 2.3%. Company management is currently guiding for a 13% year-on-year increase in sales next quarter.

Looking further ahead, sell-side analysts expect revenue to grow 7.2% over the next 12 months, similar to its two-year rate. This projection is underwhelming and suggests its newer products and services will not catalyze better top-line performance yet.

Unless you’ve been living under a rock, it should be obvious by now that generative AI is going to have a huge impact on how large corporations do business. While Nvidia and AMD are trading close to all-time highs, we prefer a lesser-known (but still profitable) stock benefiting from the rise of AI. Click here to access our free report one of our favorites growth stories.

Operating Margin

Operating margin is an important measure of profitability as it shows the portion of revenue left after accounting for all core expenses – everything from the cost of goods sold to advertising and wages. It’s also useful for comparing profitability across companies with different levels of debt and tax rates because it excludes interest and taxes.

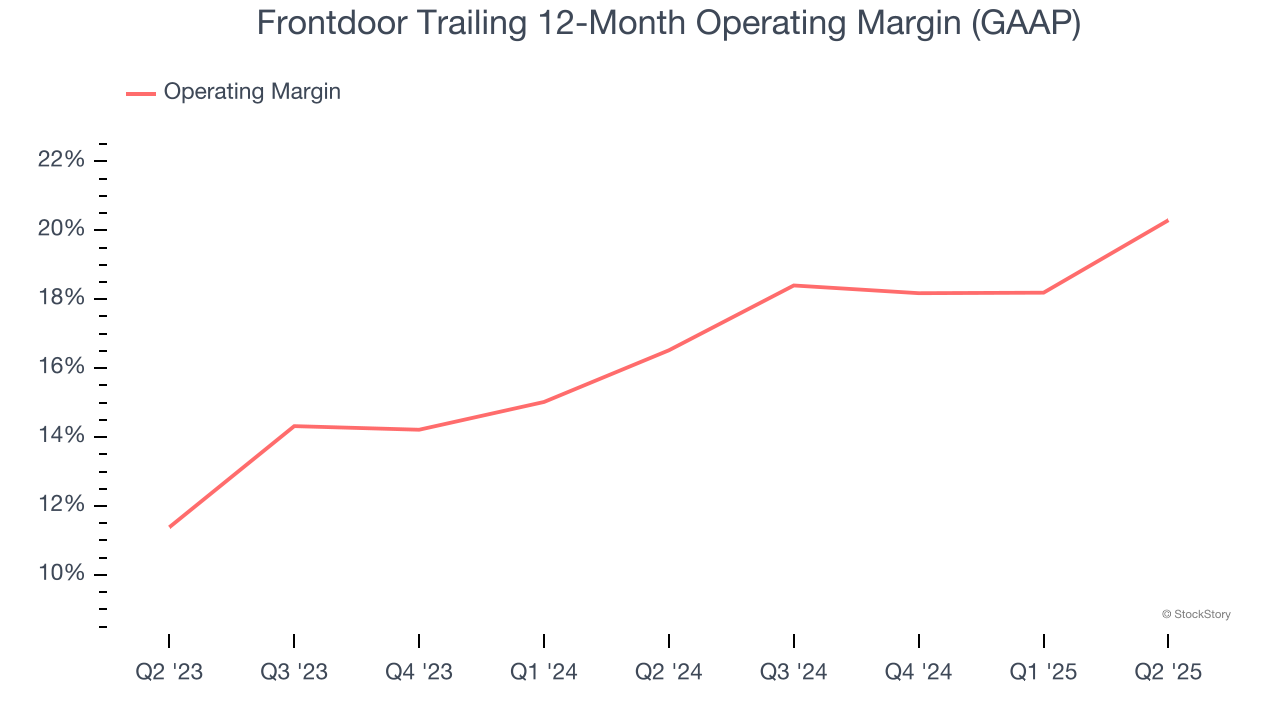

Frontdoor’s operating margin has risen over the last 12 months and averaged 18.5% over the last two years. On top of that, its profitability was top-notch for a consumer discretionary business, showing it’s an well-run company with an efficient cost structure.

In Q2, Frontdoor generated an operating margin profit margin of 29.8%, up 6 percentage points year on year. This increase was a welcome development and shows it was more efficient.

Earnings Per Share

We track the long-term change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth is profitable.

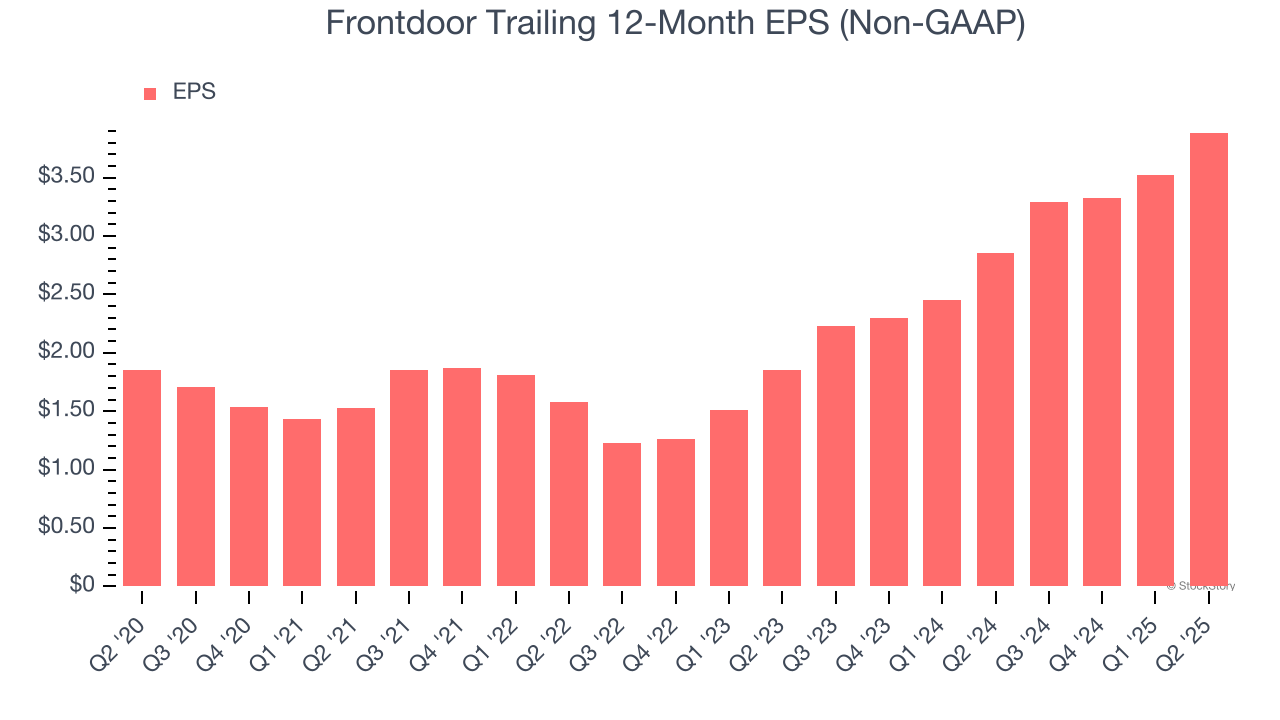

Frontdoor’s EPS grew at a solid 16% compounded annual growth rate over the last five years, higher than its 6.8% annualized revenue growth. This tells us the company became more profitable on a per-share basis as it expanded.

In Q2, Frontdoor reported adjusted EPS at $1.63, up from $1.27 in the same quarter last year. This print easily cleared analysts’ estimates, and shareholders should be content with the results. Over the next 12 months, Wall Street expects Frontdoor’s full-year EPS of $3.88 to shrink by 7.2%.

Key Takeaways from Frontdoor’s Q2 Results

We were impressed by Frontdoor’s revenue, EPS, and EBITDA, which beat analysts’ expectations. We were also glad it lifted its full-year revenue and EBITDA guidance. Overall, we think this was a solid quarter with some key areas of upside. The stock traded up 9.4% to $64 immediately after reporting.

Indeed, Frontdoor had a rock-solid quarterly earnings result, but is this stock a good investment here? If you’re making that decision, you should consider the bigger picture of valuation, business qualities, as well as the latest earnings. We cover that in our actionable full research report which you can read here, it’s free.

More News

View More

Recent Quotes

View More

Quotes delayed at least 20 minutes.

By accessing this page, you agree to the Privacy Policy and Terms Of Service.