CDW (NASDAQ:CDW) Reports Upbeat Q2

IT solutions provider CDW (NASDAQGS:CDW) beat Wall Street’s revenue expectations in Q2 CY2025, with sales up 10.2% year on year to $5.98 billion. Its non-GAAP profit of $2.60 per share was 4.4% above analysts’ consensus estimates.

Is now the time to buy CDW? Find out by accessing our full research report, it’s free.

CDW (CDW) Q2 CY2025 Highlights:

- Revenue: $5.98 billion vs analyst estimates of $5.55 billion (10.2% year-on-year growth, 7.8% beat)

- Adjusted EPS: $2.60 vs analyst estimates of $2.49 (4.4% beat)

- Adjusted Operating Income: $519.7 million vs analyst estimates of $500 million (8.7% margin, 3.9% beat)

- Operating Margin: 7%, in line with the same quarter last year

- Free Cash Flow Margin: 3.5%, similar to the same quarter last year

- Market Capitalization: $21.76 billion

"The team delivered strong performance as we helped customers navigate dynamic market conditions and accomplish mission critical outcomes across the full IT stack and lifecycle," said Christine A. Leahy, chair and chief executive officer, CDW.

Company Overview

Serving as a crucial bridge between technology manufacturers and end users since 1984, CDW (NASDAQ: CDW) is a multi-brand provider of information technology solutions that helps businesses and public sector organizations select, implement, and manage hardware, software, and IT services.

Revenue Growth

A company’s long-term performance is an indicator of its overall quality. Any business can experience short-term success, but top-performing ones enjoy sustained growth for years.

With $21.88 billion in revenue over the past 12 months, CDW is a behemoth in the business services sector and benefits from economies of scale, giving it an edge in distribution. This also enables it to gain more leverage on its fixed costs than smaller competitors and the flexibility to offer lower prices. However, its scale is a double-edged sword because it’s harder to find incremental growth when you’ve penetrated most of the market. For CDW to boost its sales, it likely needs to adjust its prices, launch new offerings, or lean into foreign markets.

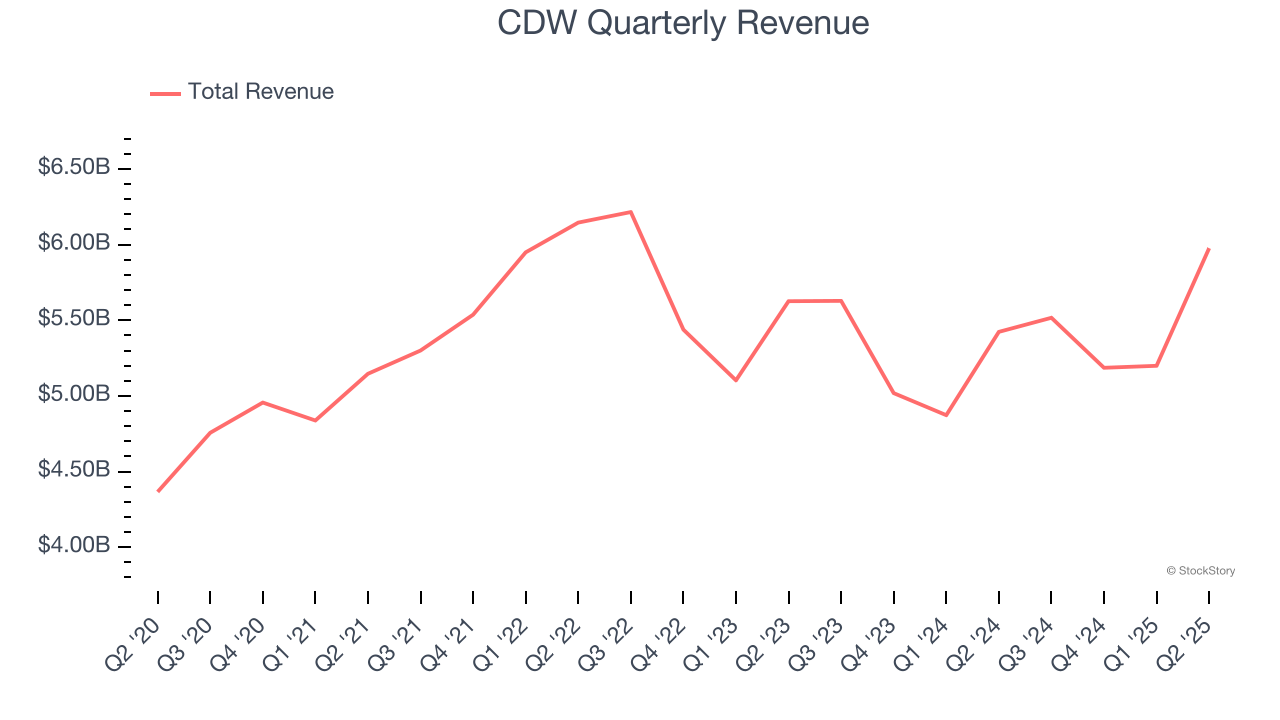

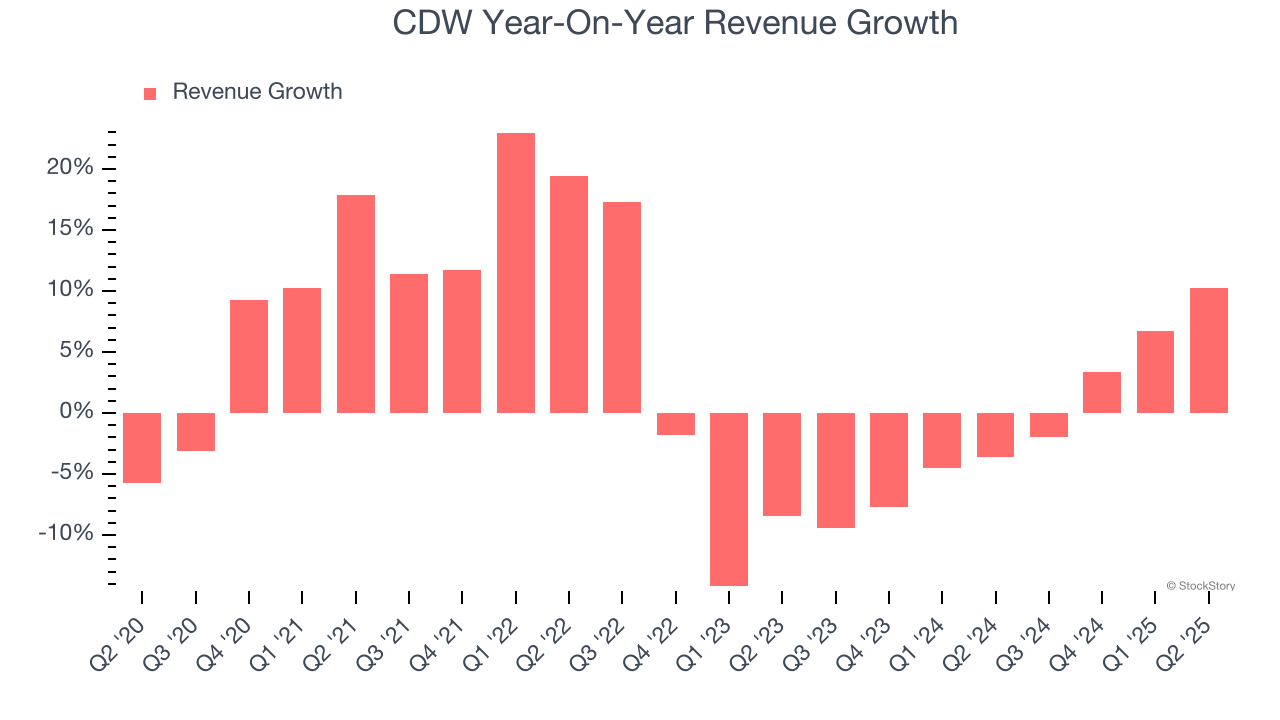

As you can see below, CDW’s sales grew at a tepid 3.8% compounded annual growth rate over the last five years. This shows it failed to generate demand in any major way and is a rough starting point for our analysis.

Long-term growth is the most important, but within business services, a half-decade historical view may miss new innovations or demand cycles. CDW’s performance shows it grew in the past but relinquished its gains over the last two years, as its revenue fell by 1.1% annually.

This quarter, CDW reported year-on-year revenue growth of 10.2%, and its $5.98 billion of revenue exceeded Wall Street’s estimates by 7.8%.

Looking ahead, sell-side analysts expect revenue to remain flat over the next 12 months. While this projection implies its newer products and services will spur better top-line performance, it is still below the sector average.

Unless you’ve been living under a rock, it should be obvious by now that generative AI is going to have a huge impact on how large corporations do business. While Nvidia and AMD are trading close to all-time highs, we prefer a lesser-known (but still profitable) stock benefiting from the rise of AI. Click here to access our free report one of our favorites growth stories.

Adjusted Operating Margin

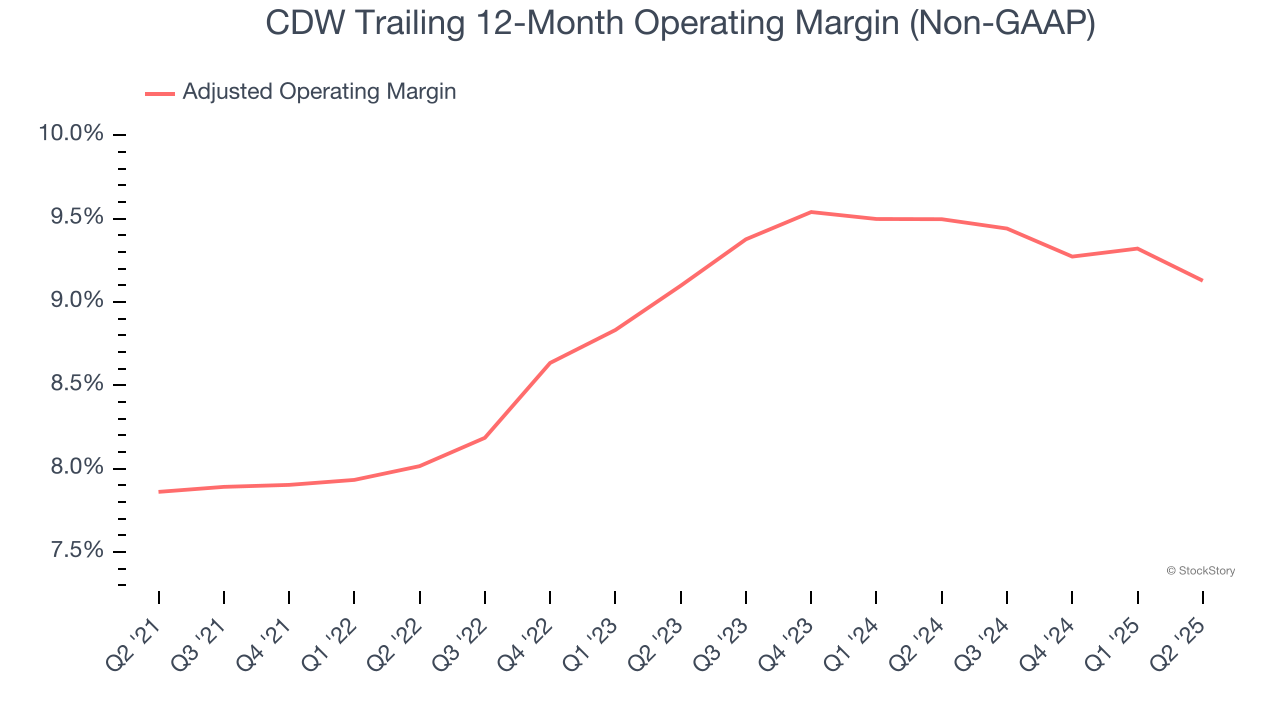

Adjusted operating margin is an important measure of profitability as it shows the portion of revenue left after accounting for all core expenses – everything from the cost of goods sold to advertising and wages. It’s also useful for comparing profitability across companies because it excludes non-recurring expenses, interest on debt, and taxes.

CDW was profitable over the last five years but held back by its large cost base. Its average adjusted operating margin of 8.7% was weak for a business services business.

On the plus side, CDW’s adjusted operating margin rose by 1.3 percentage points over the last five years, as its sales growth gave it operating leverage.

In Q2, CDW generated an adjusted operating margin profit margin of 8.7%, in line with the same quarter last year. This indicates the company’s overall cost structure has been relatively stable.

Earnings Per Share

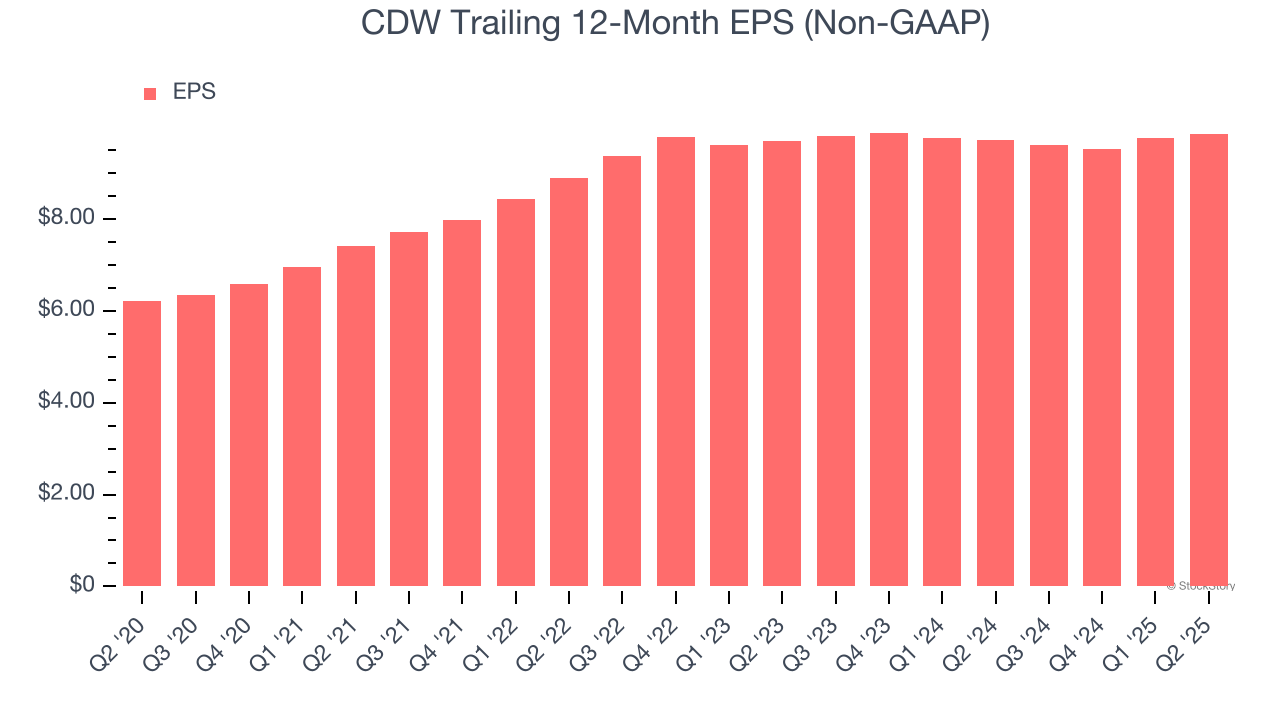

Revenue trends explain a company’s historical growth, but the long-term change in earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

CDW’s EPS grew at a solid 9.7% compounded annual growth rate over the last five years, higher than its 3.8% annualized revenue growth. This tells us the company became more profitable on a per-share basis as it expanded.

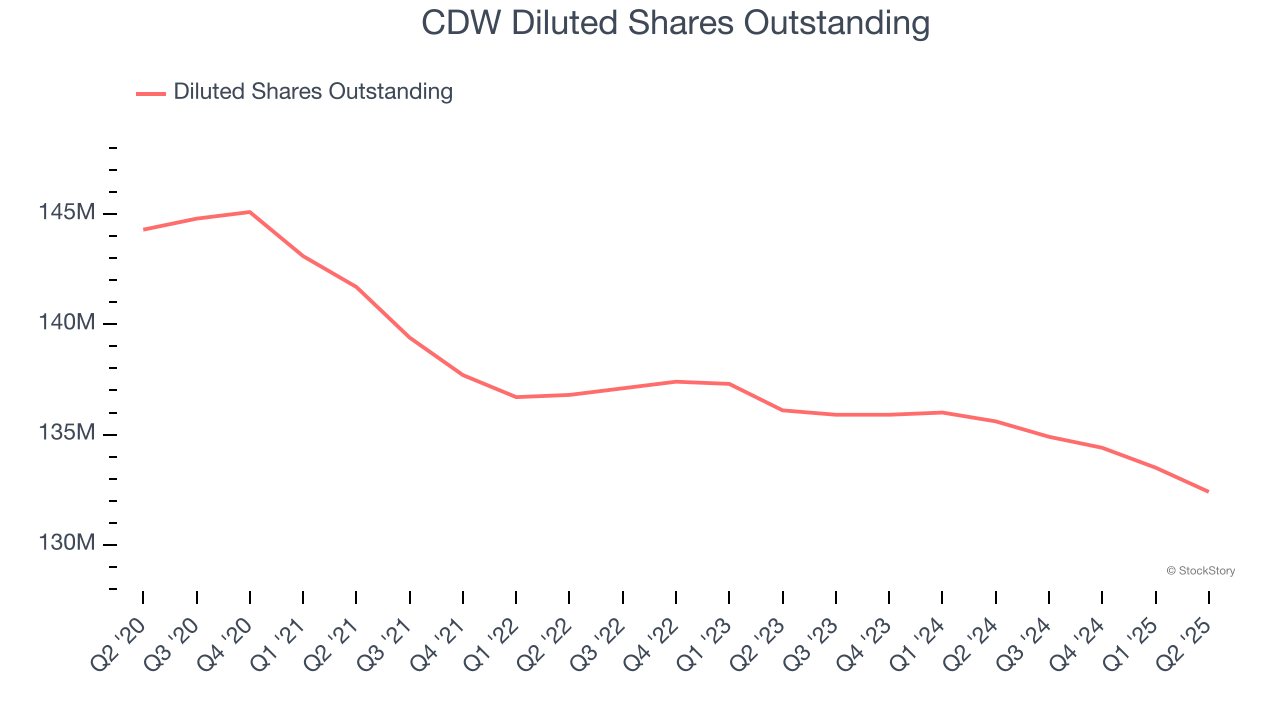

Diving into the nuances of CDW’s earnings can give us a better understanding of its performance. As we mentioned earlier, CDW’s adjusted operating margin was flat this quarter but expanded by 1.3 percentage points over the last five years. On top of that, its share count shrank by 8.2%. These are positive signs for shareholders because improving profitability and share buybacks turbocharge EPS growth relative to revenue growth.

Like with revenue, we analyze EPS over a more recent period because it can provide insight into an emerging theme or development for the business.

For CDW, EPS didn’t budge over the last two years, a regression from its five-year trend. We hope it can revert to earnings growth in the coming years.

In Q2, CDW reported adjusted EPS at $2.60, up from $2.50 in the same quarter last year. This print beat analysts’ estimates by 4.4%. Over the next 12 months, Wall Street expects CDW’s full-year EPS of $9.86 to grow 1.3%.

Key Takeaways from CDW’s Q2 Results

We were impressed by how significantly CDW blew past analysts’ revenue expectations this quarter. We were also happy its EPS outperformed Wall Street’s estimates. Zooming out, we think this quarter featured some important positives. The stock remained flat at $164.85 immediately after reporting.

Is CDW an attractive investment opportunity right now? The latest quarter does matter, but not nearly as much as longer-term fundamentals and valuation, when deciding if the stock is a buy. We cover that in our actionable full research report which you can read here, it’s free.

More News

View More

Recent Quotes

View MoreQuotes delayed at least 20 minutes.

By accessing this page, you agree to the Privacy Policy and Terms Of Service.