Jack in the Box (NASDAQ:JACK) Misses Q2 Sales Targets

Fast-food chain Jack in the Box (NASDAQ: JACK) missed Wall Street’s revenue expectations in Q2 CY2025, with sales falling 9.8% year on year to $333 million. Its GAAP profit of $1.15 per share was in line with analysts’ consensus estimates.

Is now the time to buy Jack in the Box? Find out by accessing our full research report, it’s free.

Jack in the Box (JACK) Q2 CY2025 Highlights:

- Revenue: $333 million vs analyst estimates of $340 million (9.8% year-on-year decline, 2.1% miss)

- EPS (GAAP): $1.15 vs analyst estimates of $1.15 (in line)

- Adjusted EBITDA: $61.63 million vs analyst estimates of $64.59 million (18.5% margin, 4.6% miss)

- EPS (GAAP) guidance for the full year is $4.64 at the midpoint, beating analyst estimates by 225%

- EBITDA guidance for the full year is $272.5 million at the midpoint, below analyst estimates of $284.3 million

- Operating Margin: 12.2%, up from -27.7% in the same quarter last year

- Free Cash Flow Margin: 32.4%, up from 5.6% in the same quarter last year

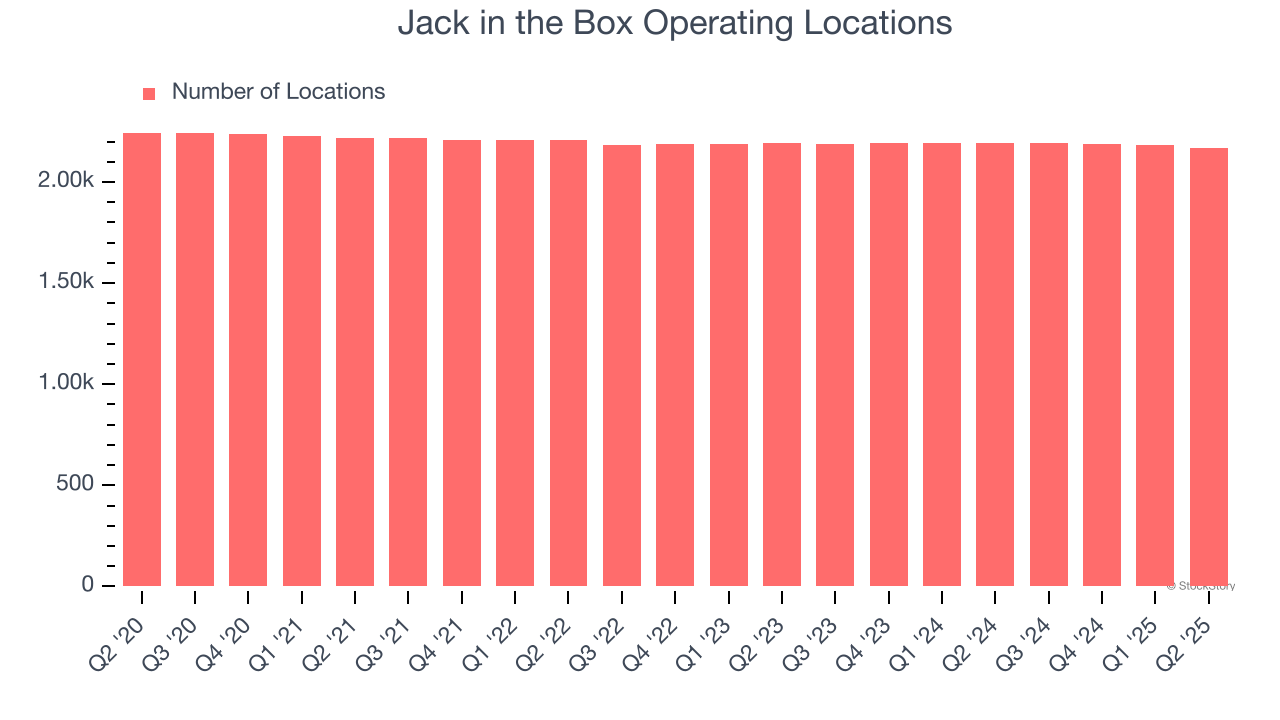

- Locations: 2,168 at quarter end, down from 2,195 in the same quarter last year

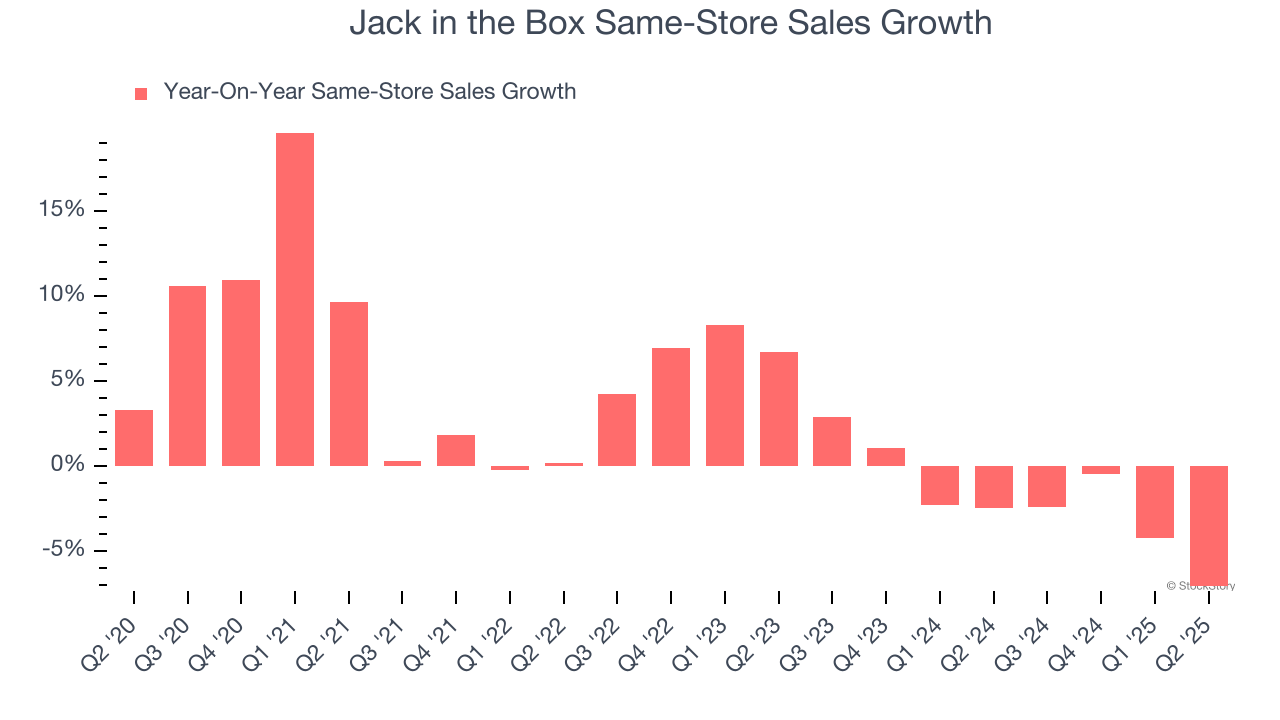

- Same-Store Sales fell 7.1% year on year (-2.5% in the same quarter last year)

- Market Capitalization: $368.1 million

Company Overview

Delighting customers since its inception in 1951, Jack in the Box (NASDAQ: JACK) is a distinctive fast-food chain known for its bold flavors, innovative menu items, and quirky marketing.

Revenue Growth

A company’s long-term sales performance is one signal of its overall quality. Any business can have short-term success, but a top-tier one grows for years.

With $1.49 billion in revenue over the past 12 months, Jack in the Box is a mid-sized restaurant chain, which sometimes brings disadvantages compared to larger competitors benefiting from better brand awareness and economies of scale. On the bright side, it can still flex high growth rates because it’s working from a smaller revenue base.

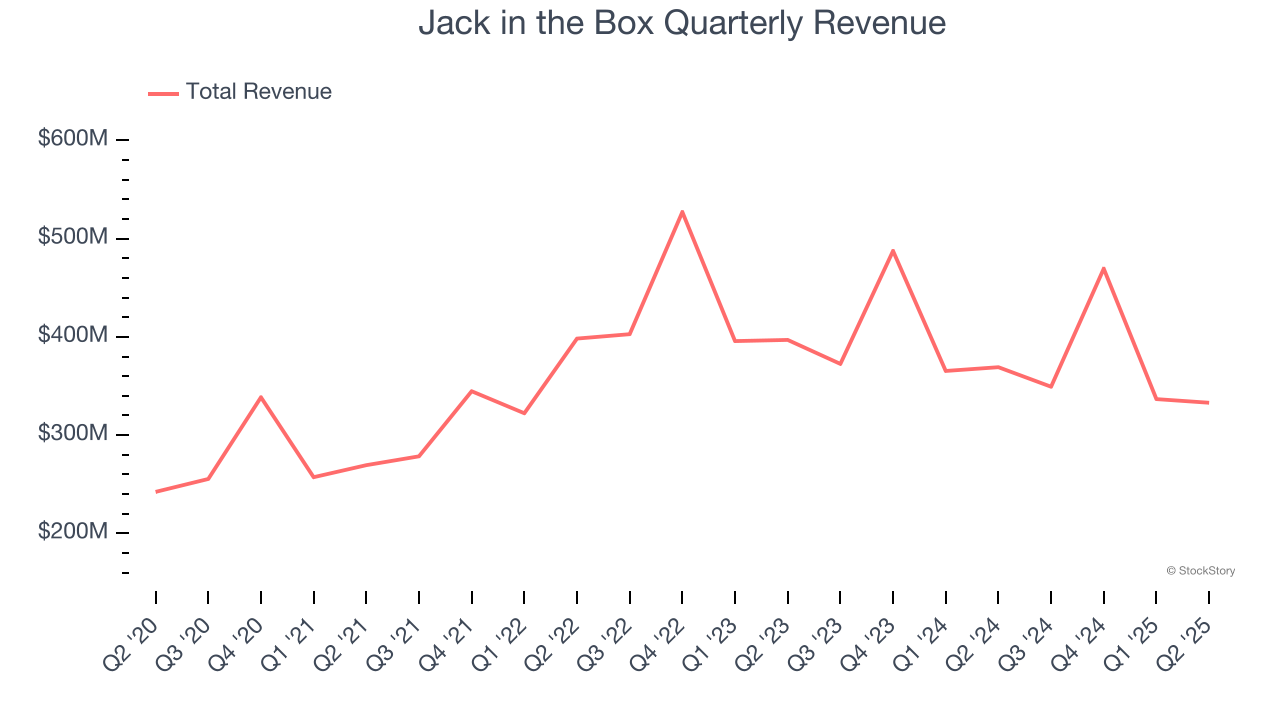

As you can see below, Jack in the Box grew its sales at a decent 7.9% compounded annual growth rate over the last six years (we compare to 2019 to normalize for COVID-19 impacts) despite not opening many new restaurants.

This quarter, Jack in the Box missed Wall Street’s estimates and reported a rather uninspiring 9.8% year-on-year revenue decline, generating $333 million of revenue.

Looking ahead, sell-side analysts expect revenue to decline by 3.4% over the next 12 months, a deceleration versus the last six years. This projection is underwhelming and suggests its menu offerings will see some demand headwinds.

Here at StockStory, we certainly understand the potential of thematic investing. Diverse winners from Microsoft (MSFT) to Alphabet (GOOG), Coca-Cola (KO) to Monster Beverage (MNST) could all have been identified as promising growth stories with a megatrend driving the growth. So, in that spirit, we’ve identified a relatively under-the-radar profitable growth stock benefiting from the rise of AI, available to you FREE via this link.

Restaurant Performance

Number of Restaurants

Jack in the Box operated 2,168 locations in the latest quarter, and over the last two years, has kept its restaurant count flat while other restaurant businesses have opted for growth.

When a chain doesn’t open many new restaurants, it usually means there’s stable demand for its meals and it’s focused on improving operational efficiency to increase profitability.

Same-Store Sales

The change in a company's restaurant base only tells one side of the story. The other is the performance of its existing locations, which informs management teams whether they should expand or downsize their physical footprints. Same-store sales gives us insight into this topic because it measures organic growth at restaurants open for at least a year.

Jack in the Box’s demand has been shrinking over the last two years as its same-store sales have averaged 1.9% annual declines. This performance isn’t ideal, and we’d be concerned if Jack in the Box starts opening new restaurants to artificially boost revenue growth.

In the latest quarter, Jack in the Box’s same-store sales fell by 7.1% year on year. This decrease represents a further deceleration from its historical levels. We hope the business can get back on track.

Key Takeaways from Jack in the Box’s Q2 Results

We struggled to find many positives in these results. Its same-store sales missed and its EBITDA fell short of Wall Street’s estimates. Overall, this was a softer quarter. The stock traded down 3.3% to $18.30 immediately after reporting.

Jack in the Box’s earnings report left more to be desired. Let’s look forward to see if this quarter has created an opportunity to buy the stock. The latest quarter does matter, but not nearly as much as longer-term fundamentals and valuation, when deciding if the stock is a buy. We cover that in our actionable full research report which you can read here, it’s free.

More News

View More

Recent Quotes

View More

Quotes delayed at least 20 minutes.

By accessing this page, you agree to the Privacy Policy and Terms Of Service.