Potbelly’s (NASDAQ:PBPB) Q2: Beats On Revenue, Stock Soars

Casual sandwich chain Potbelly (NASDAQ: PBPB) reported Q2 CY2025 results topping the market’s revenue expectations, with sales up 3.4% year on year to $123.7 million. Its non-GAAP profit of $0.09 per share was in line with analysts’ consensus estimates.

Is now the time to buy Potbelly? Find out by accessing our full research report, it’s free.

Potbelly (PBPB) Q2 CY2025 Highlights:

- Revenue: $123.7 million vs analyst estimates of $122.6 million (3.4% year-on-year growth, 0.9% beat)

- Adjusted EPS: $0.09 vs analyst estimates of $0.09 (in line)

- Adjusted EBITDA: $9.63 million vs analyst estimates of $9.19 million (7.8% margin, 4.9% beat)

- EBITDA guidance for the full year is $34.5 million at the midpoint, above analyst estimates of $33.57 million

- Operating Margin: 3%, in line with the same quarter last year

- Free Cash Flow was $7.91 million, up from -$1.57 million in the same quarter last year

- Locations: 440 at quarter end, up from 425 in the same quarter last year

- Same-Store Sales rose 3.2% year on year (0.4% in the same quarter last year)

- Market Capitalization: $334.6 million

Bob Wright, President and Chief Executive Officer of the Company, commented, “We are thrilled with our strong second quarter performance. From continued top-line momentum that includes positive traffic and new unit growth for the quarter that was ahead of our expectations, to year-over-year shop-level margin expansion and adjusted EBITDA near the high-end of our quarterly guidance range, our results truly reflect the growth engine we’ve been building over the past five years by leveraging our Five-Pillar Operating Strategy. As we look ahead, our focus remains on actions that will continue to drive accelerated growth through menu innovation, investments in our consumer-facing digital assets, growing and modernizing our shop footprint, and exercising prudent cost controls to achieve balanced growth while pushing incremental flow-through to our corporate earnings. The future is bright for Potbelly and we believe we are well positioned to capitalize on the immense opportunity ahead of us.”

Company Overview

With a unique origin story where the company actually started as an antique shop, Potbelly (NASDAQ: PBPB) today is a chain known for its toasty sandwiches.

Revenue Growth

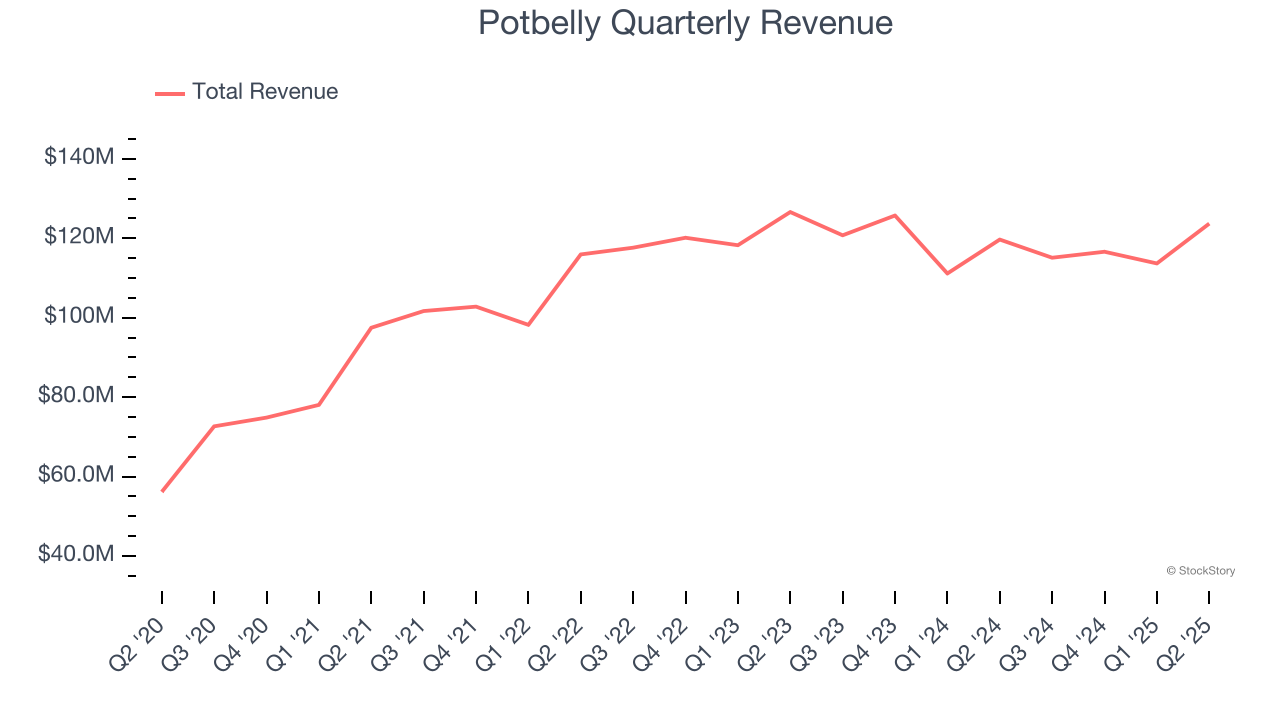

A company’s long-term sales performance can indicate its overall quality. Any business can experience short-term success, but top-performing ones enjoy sustained growth for years.

With $469.1 million in revenue over the past 12 months, Potbelly is a small restaurant chain, which sometimes brings disadvantages compared to larger competitors benefiting from better brand awareness and economies of scale.

As you can see below, Potbelly’s 2.1% annualized revenue growth over the last six years (we compare to 2019 to normalize for COVID-19 impacts) was weak, but to its credit, it opened new restaurants and increased sales at existing, established dining locations.

This quarter, Potbelly reported modest year-on-year revenue growth of 3.4% but beat Wall Street’s estimates by 0.9%.

Looking ahead, sell-side analysts expect revenue to grow 3.3% over the next 12 months, similar to its six-year rate. While this projection implies its newer menu offerings will catalyze better top-line performance, it is still below the sector average.

Unless you’ve been living under a rock, it should be obvious by now that generative AI is going to have a huge impact on how large corporations do business. While Nvidia and AMD are trading close to all-time highs, we prefer a lesser-known (but still profitable) stock benefiting from the rise of AI. Click here to access our free report one of our favorites growth stories.

Restaurant Performance

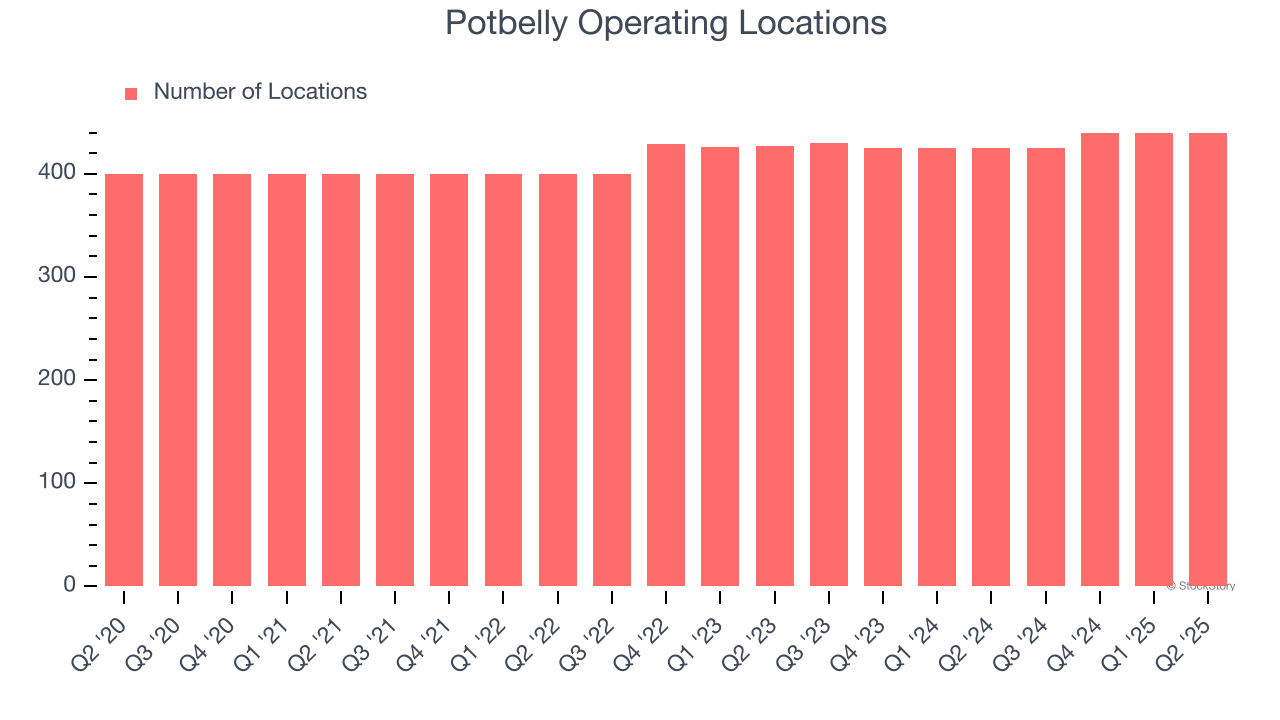

Number of Restaurants

The number of dining locations a restaurant chain operates is a critical driver of how quickly company-level sales can grow.

Potbelly sported 440 locations in the latest quarter. Over the last two years, it has opened new restaurants quickly, averaging 1.9% annual growth. This was faster than the broader restaurant sector.

When a chain opens new restaurants, it usually means it’s investing for growth because there’s healthy demand for its meals and there are markets where its concepts have few or no locations.

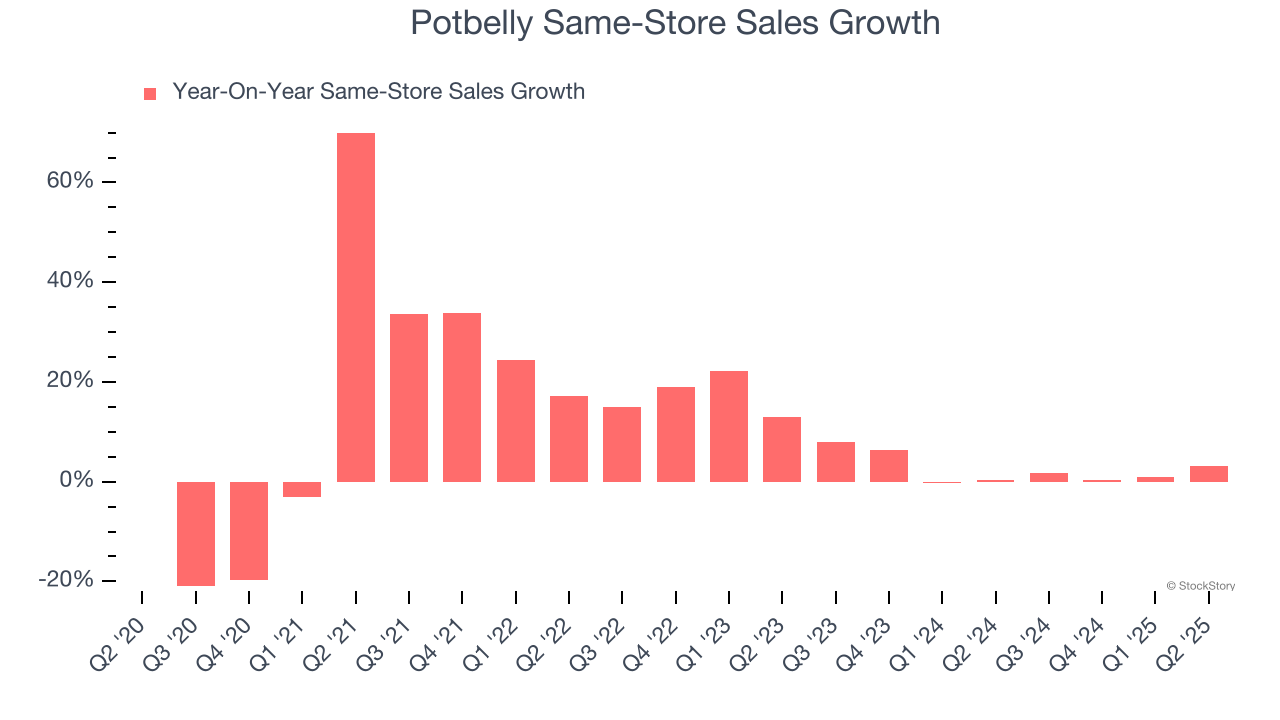

Same-Store Sales

The change in a company's restaurant base only tells one side of the story. The other is the performance of its existing locations, which informs management teams whether they should expand or downsize their physical footprints. Same-store sales provides a deeper understanding of this issue because it measures organic growth at restaurants open for at least a year.

Potbelly’s demand rose over the last two years and slightly outpaced the industry. On average, the company’s same-store sales have grown by 2.6% per year. This performance suggests its rollout of new restaurants could be beneficial for shareholders. When a chain has demand, more locations should help it reach more customers and boost revenue growth.

In the latest quarter, Potbelly’s same-store sales rose 3.2% year on year. This performance was more or less in line with its historical levels.

Key Takeaways from Potbelly’s Q2 Results

We enjoyed seeing Potbelly beat analysts’ EBITDA expectations this quarter. We were also glad its full-year EBITDA guidance exceeded Wall Street’s estimates. Overall, we think this was a solid quarter with some key areas of upside. The stock traded up 8% to $12.45 immediately after reporting.

Indeed, Potbelly had a rock-solid quarterly earnings result, but is this stock a good investment here? We think that the latest quarter is only one piece of the longer-term business quality puzzle. Quality, when combined with valuation, can help determine if the stock is a buy. We cover that in our actionable full research report which you can read here, it’s free.

More News

View More

Recent Quotes

View More

Quotes delayed at least 20 minutes.

By accessing this page, you agree to the Privacy Policy and Terms Of Service.