Integral Ad Science (NASDAQ:IAS) Surprises With Q2 Sales

Ad verification company Integral Ad Science (NASDAQ: IAS) reported Q2 CY2025 results exceeding the market’s revenue expectations, with sales up 15.7% year on year to $149.2 million. Guidance for next quarter’s revenue was better than expected at $149 million at the midpoint, 0.6% above analysts’ estimates. Its GAAP profit of $0.10 per share was significantly above analysts’ consensus estimates.

Is now the time to buy Integral Ad Science? Find out by accessing our full research report, it’s free.

Integral Ad Science (IAS) Q2 CY2025 Highlights:

- Revenue: $149.2 million vs analyst estimates of $143.7 million (15.7% year-on-year growth, 3.8% beat)

- EPS (GAAP): $0.10 vs analyst estimates of $0.04 (significant beat)

- Adjusted EBITDA: $51.58 million vs analyst estimates of $46.59 million (34.6% margin, 10.7% beat)

- The company lifted its revenue guidance for the full year to $601 million at the midpoint from $595 million, a 1% increase

- EBITDA guidance for the full year is $211 million at the midpoint, above analyst estimates of $206.5 million

- Operating Margin: 14%, up from 11% in the same quarter last year

- Free Cash Flow Margin: 22.6%, up from 2.2% in the previous quarter

- Market Capitalization: $1.33 billion

"We grew revenue 16% with gains in all of our businesses driven by strong adoption of our AI-powered products by new and existing customers," said Lisa Utzschneider, CEO of IAS.

Company Overview

Founded in 2009, Integral Ad Science (NASDAQ: IAS) provides digital advertising verification and optimization solutions, ensuring that ads are viewable by real people in brand-safe environments across various platforms and devices.

Revenue Growth

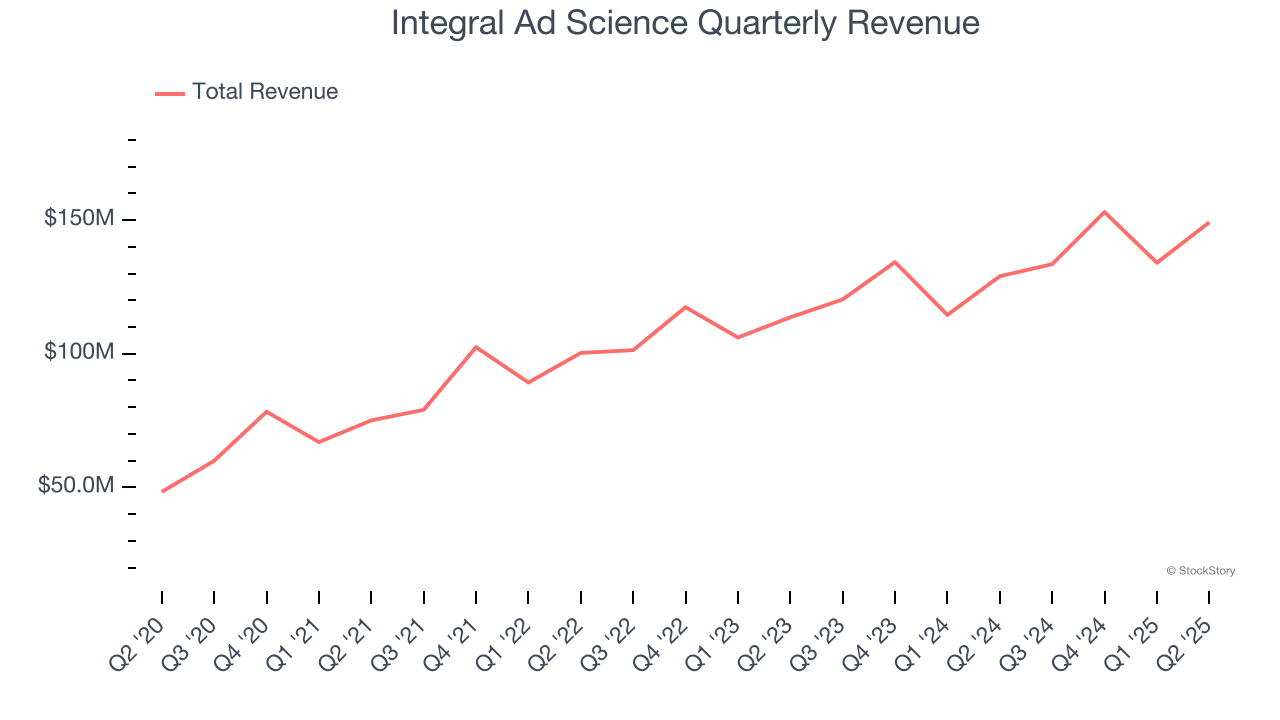

Reviewing a company’s long-term sales performance reveals insights into its quality. Even a bad business can shine for one or two quarters, but a top-tier one grows for years. Over the last three years, Integral Ad Science grew its sales at a 15.4% compounded annual growth rate. Although this growth is acceptable on an absolute basis, it fell slightly short of our standards for the software sector, which enjoys a number of secular tailwinds. Luckily, there are other things to like about Integral Ad Science.

This quarter, Integral Ad Science reported year-on-year revenue growth of 15.7%, and its $149.2 million of revenue exceeded Wall Street’s estimates by 3.8%. Company management is currently guiding for a 11.6% year-on-year increase in sales next quarter.

Looking further ahead, sell-side analysts expect revenue to grow 10% over the next 12 months, a deceleration versus the last three years. This projection is underwhelming and suggests its products and services will face some demand challenges. At least the company is tracking well in other measures of financial health.

Here at StockStory, we certainly understand the potential of thematic investing. Diverse winners from Microsoft (MSFT) to Alphabet (GOOG), Coca-Cola (KO) to Monster Beverage (MNST) could all have been identified as promising growth stories with a megatrend driving the growth. So, in that spirit, we’ve identified a relatively under-the-radar profitable growth stock benefiting from the rise of AI, available to you FREE via this link.

Customer Acquisition Efficiency

The customer acquisition cost (CAC) payback period measures the months a company needs to recoup the money spent on acquiring a new customer. This metric helps assess how quickly a business can break even on its sales and marketing investments.

Integral Ad Science is extremely efficient at acquiring new customers, and its CAC payback period checked in at 8.1 months this quarter. The company’s rapid recovery of its customer acquisition costs means it can attempt to spur growth by increasing its sales and marketing investments.

Key Takeaways from Integral Ad Science’s Q2 Results

We were impressed by how significantly Integral Ad Science blew past analysts’ EBITDA expectations this quarter. We were also glad its full-year EBITDA guidance exceeded Wall Street’s estimates. On the other hand, its EBITDA guidance for next quarter slightly missed. Overall, we think this was still a solid quarter with some key areas of upside. The stock traded up 4.3% to $8.29 immediately after reporting.

Integral Ad Science may have had a good quarter, but does that mean you should invest right now? What happened in the latest quarter matters, but not as much as longer-term business quality and valuation, when deciding whether to invest in this stock. We cover that in our actionable full research report which you can read here, it’s free.

More News

View More

Recent Quotes

View More

Quotes delayed at least 20 minutes.

By accessing this page, you agree to the Privacy Policy and Terms Of Service.