Nextdoor (NYSE:KIND) Beats Expectations in Strong Q2

Neighborhood social network Nextdoor (NYSE: KIND) reported revenue ahead of Wall Street’s expectations in Q2 CY2025, with sales up 2.8% year on year to $65.09 million.

Is now the time to buy Nextdoor? Find out by accessing our full research report, it’s free.

Nextdoor (KIND) Q2 CY2025 Highlights:

- Revenue: $65.09 million vs analyst estimates of $61.34 million (2.8% year-on-year growth, 6.1% beat)

- Adjusted EBITDA: -$2.25 million vs analyst estimates of -$9.81 million (-3.5% margin, 77.1% beat)

- Operating Margin: -31.1%, up from -77.4% in the same quarter last year

- Market Capitalization: $673.4 million

Company Overview

Helping residents figure out what's happening on their block in real time, Nextdoor (NYSE: KIND) is a social network that connects neighbors with each other and with local businesses.

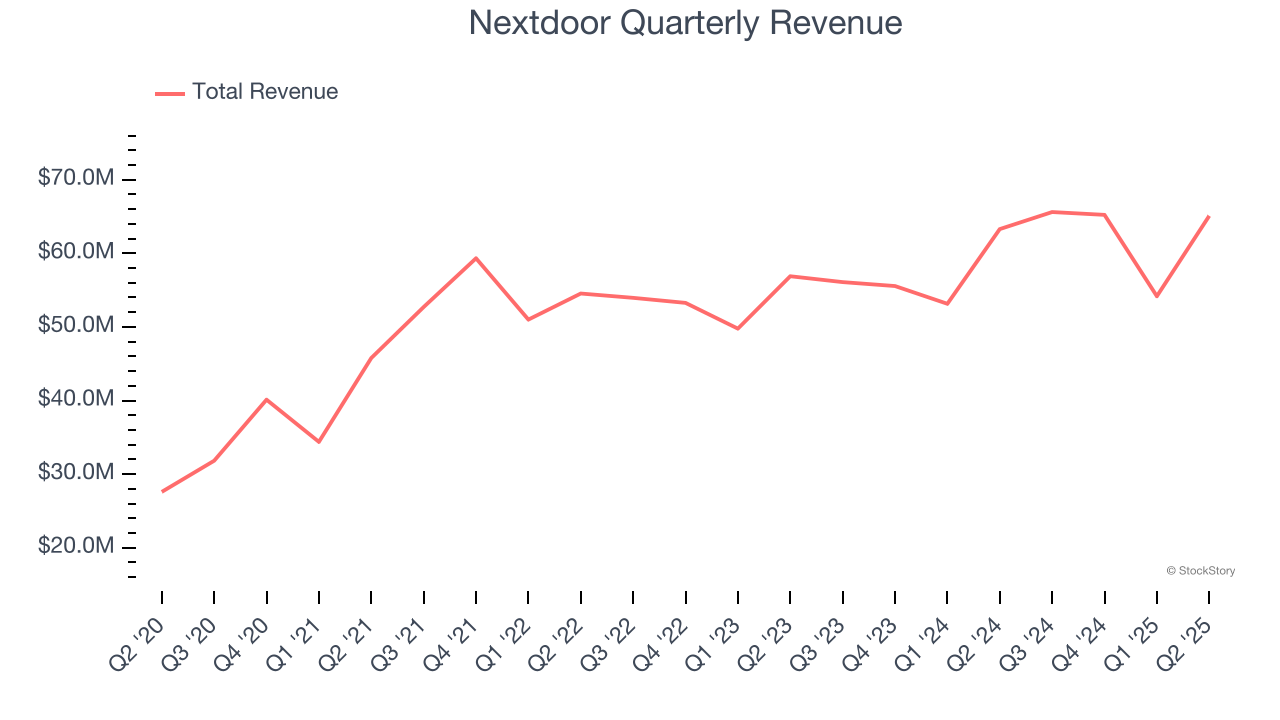

Revenue Growth

A company’s long-term performance is an indicator of its overall quality. Any business can have short-term success, but a top-tier one grows for years. Over the last three years, Nextdoor grew its sales at a sluggish 4.8% compounded annual growth rate. This was below our standard for the consumer internet sector and is a rough starting point for our analysis.

This quarter, Nextdoor reported modest year-on-year revenue growth of 2.8% but beat Wall Street’s estimates by 6.1%.

Looking ahead, sell-side analysts expect revenue to grow 2.8% over the next 12 months, a slight deceleration versus the last three years. This projection is underwhelming and indicates its products and services will face some demand challenges.

Here at StockStory, we certainly understand the potential of thematic investing. Diverse winners from Microsoft (MSFT) to Alphabet (GOOG), Coca-Cola (KO) to Monster Beverage (MNST) could all have been identified as promising growth stories with a megatrend driving the growth. So, in that spirit, we’ve identified a relatively under-the-radar profitable growth stock benefiting from the rise of AI, available to you FREE via this link.

Cash Is King

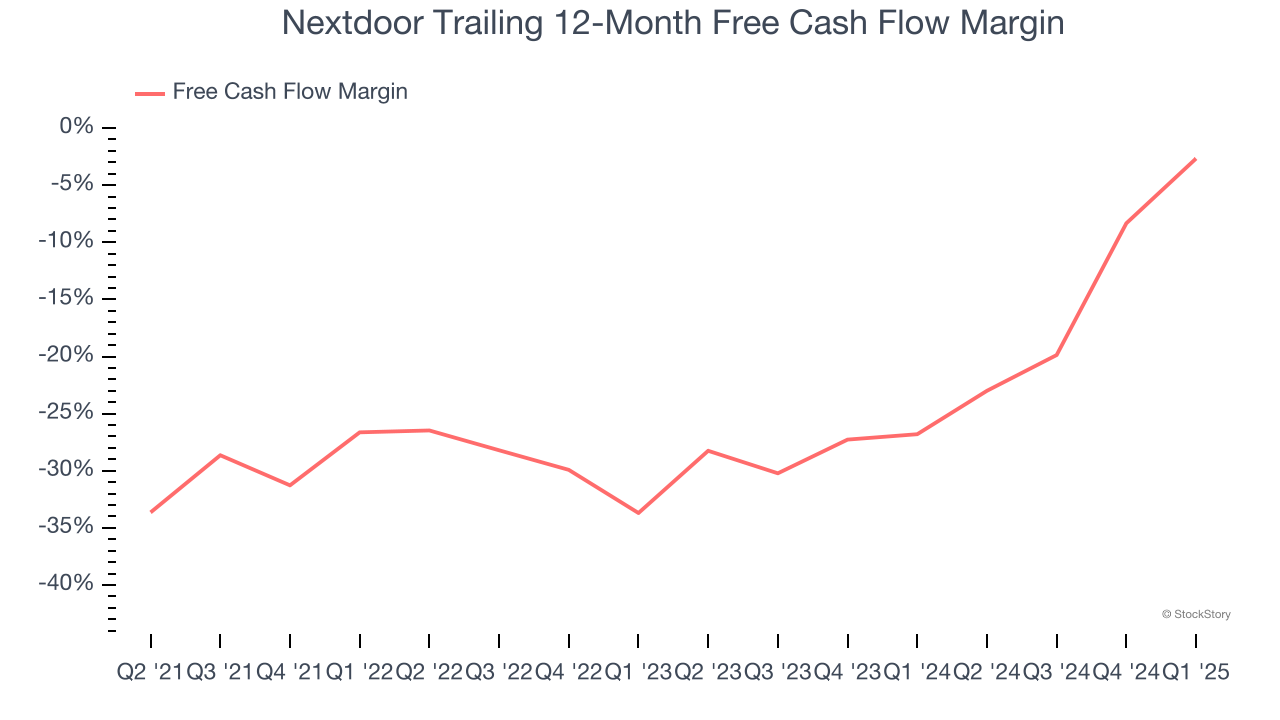

Although EBITDA is undoubtedly valuable for assessing company performance, we believe cash is king because you can’t use accounting profits to pay the bills.

Nextdoor’s demanding reinvestments have drained its resources over the last two years, putting it in a pinch and limiting its ability to return capital to investors. Its free cash flow margin averaged negative 13%, meaning it lit $12.98 of cash on fire for every $100 in revenue.

Taking a step back, an encouraging sign is that Nextdoor’s margin expanded by 20.4 percentage points over the last few years. In light of its glaring cash burn, however, this improvement is a bucket of hot water in a cold ocean.

Key Takeaways from Nextdoor’s Q2 Results

We were impressed by how significantly Nextdoor blew past analysts’ EBITDA expectations this quarter. We were also glad its revenue outperformed Wall Street’s estimates. Zooming out, we think this quarter featured some important positives. The stock remained flat at $1.89 immediately after reporting.

So should you invest in Nextdoor right now? What happened in the latest quarter matters, but not as much as longer-term business quality and valuation, when deciding whether to invest in this stock. We cover that in our actionable full research report which you can read here, it’s free.

More News

View More

Recent Quotes

View More

Quotes delayed at least 20 minutes.

By accessing this page, you agree to the Privacy Policy and Terms Of Service.