PacBio (NASDAQ:PACB) Delivers Strong Q2 Numbers, Stock Soars

Genomics company Pacific Biosciences of California (NASDAQ: PACB) reported Q2 CY2025 results exceeding the market’s revenue expectations, with sales up 10.4% year on year to $39.77 million. Its non-GAAP loss of $0.13 per share was 21.5% above analysts’ consensus estimates.

Is now the time to buy PacBio? Find out by accessing our full research report, it’s free.

PacBio (PACB) Q2 CY2025 Highlights:

- Revenue: $39.77 million vs analyst estimates of $36.96 million (10.4% year-on-year growth, 7.6% beat)

- Adjusted EPS: -$0.13 vs analyst estimates of -$0.17 (21.5% beat)

- Operating Margin: -113%, up from -488% in the same quarter last year

- Market Capitalization: $414.1 million

“PacBio returned to both sequential and year-over-year revenue growth in the second quarter, while also continuing to reduce operating expenses and cash burn,” said Christian Henry, President and Chief Executive Officer.

Company Overview

Pioneering what scientists call "HiFi long-read sequencing," recognized as Nature Methods' method of the year for 2022, Pacific Biosciences (NASDAQ: PACB) develops advanced DNA sequencing systems that enable scientists and researchers to analyze genomes with unprecedented accuracy and completeness.

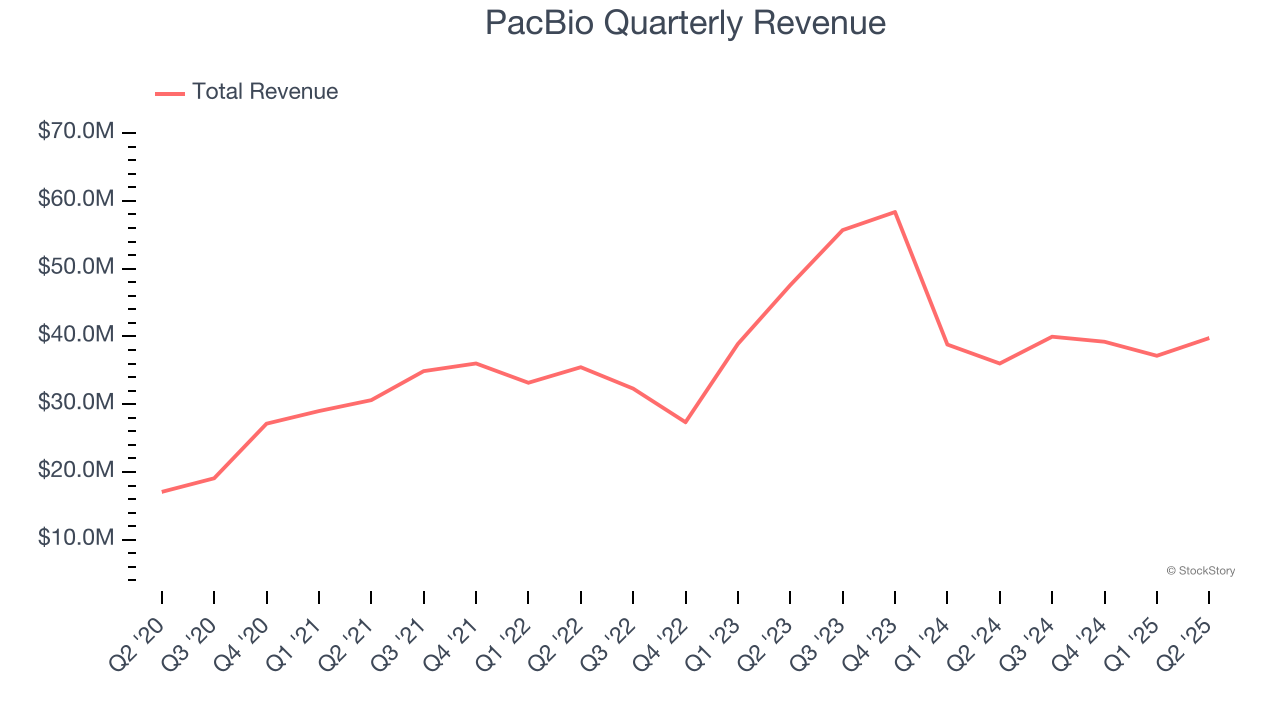

Revenue Growth

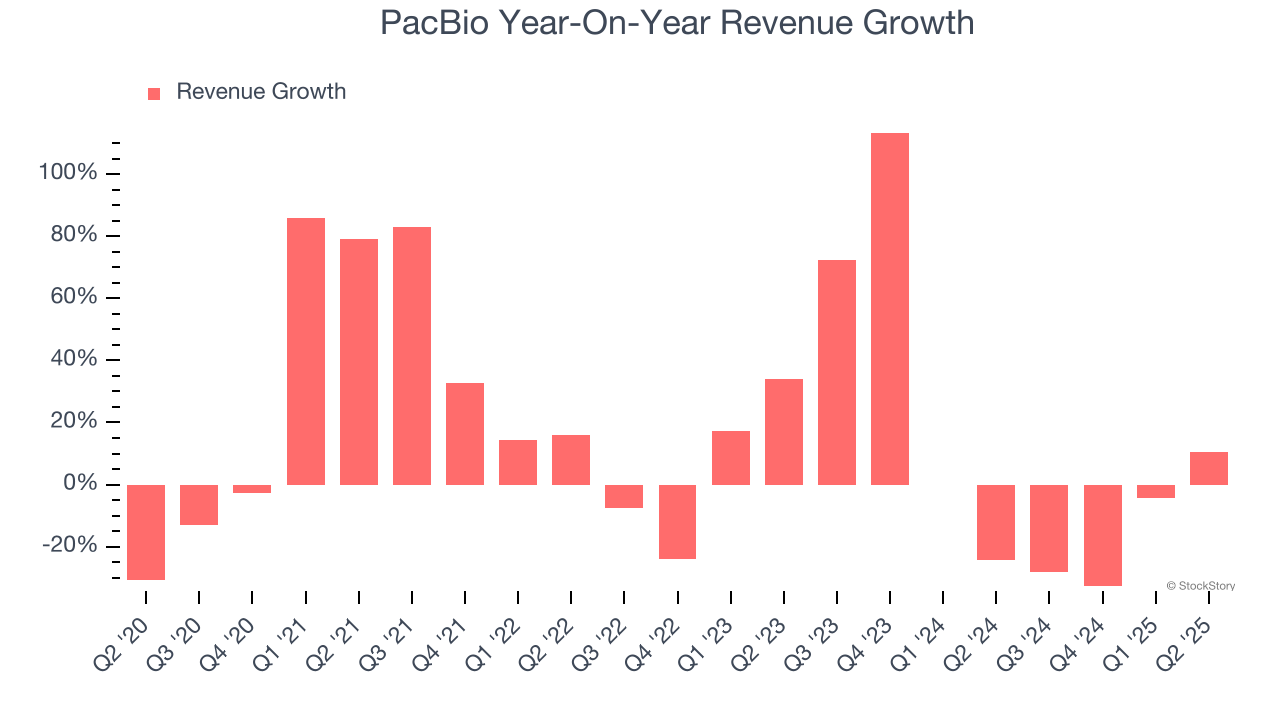

Reviewing a company’s long-term sales performance reveals insights into its quality. Even a bad business can shine for one or two quarters, but a top-tier one grows for years. Thankfully, PacBio’s 13.6% annualized revenue growth over the last five years was solid. Its growth beat the average healthcare company and shows its offerings resonate with customers.

Long-term growth is the most important, but within healthcare, a half-decade historical view may miss new innovations or demand cycles. PacBio’s recent performance shows its demand has slowed as its annualized revenue growth of 3.4% over the last two years was below its five-year trend.

This quarter, PacBio reported year-on-year revenue growth of 10.4%, and its $39.77 million of revenue exceeded Wall Street’s estimates by 7.6%.

Looking ahead, sell-side analysts expect revenue to grow 7.9% over the next 12 months, an improvement versus the last two years. This projection is above average for the sector and implies its newer products and services will fuel better top-line performance.

Unless you’ve been living under a rock, it should be obvious by now that generative AI is going to have a huge impact on how large corporations do business. While Nvidia and AMD are trading close to all-time highs, we prefer a lesser-known (but still profitable) stock benefiting from the rise of AI. Click here to access our free report one of our favorites growth stories.

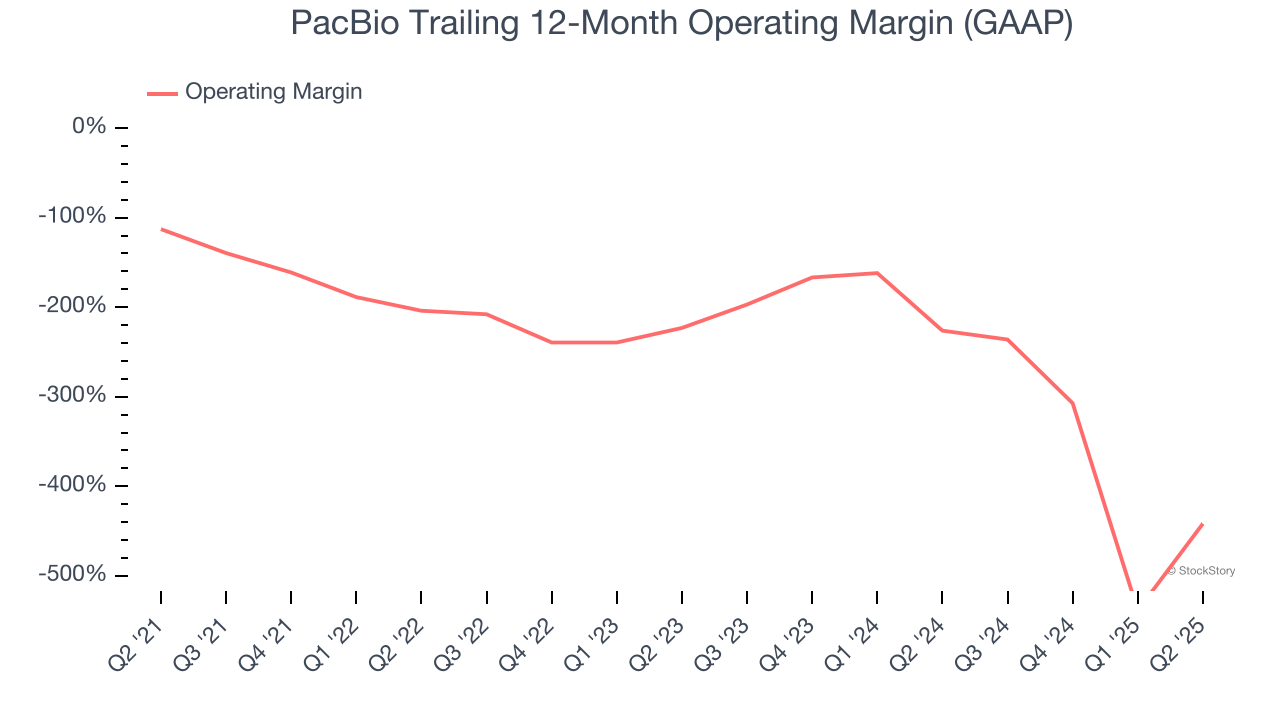

Operating Margin

PacBio’s high expenses have contributed to an average operating margin of negative 251% over the last five years. Unprofitable healthcare companies require extra attention because they could get caught swimming naked when the tide goes out. It’s hard to trust that the business can endure a full cycle.

Analyzing the trend in its profitability, PacBio’s operating margin decreased significantly over the last five years. The company’s two-year trajectory also shows it failed to get its profitability back to the peak as its margin fell by 218.6 percentage points. This performance was poor no matter how you look at it - it shows its expenses were rising and it couldn’t pass those costs onto its customers.

In Q2, PacBio generated a negative 113% operating margin.

Earnings Per Share

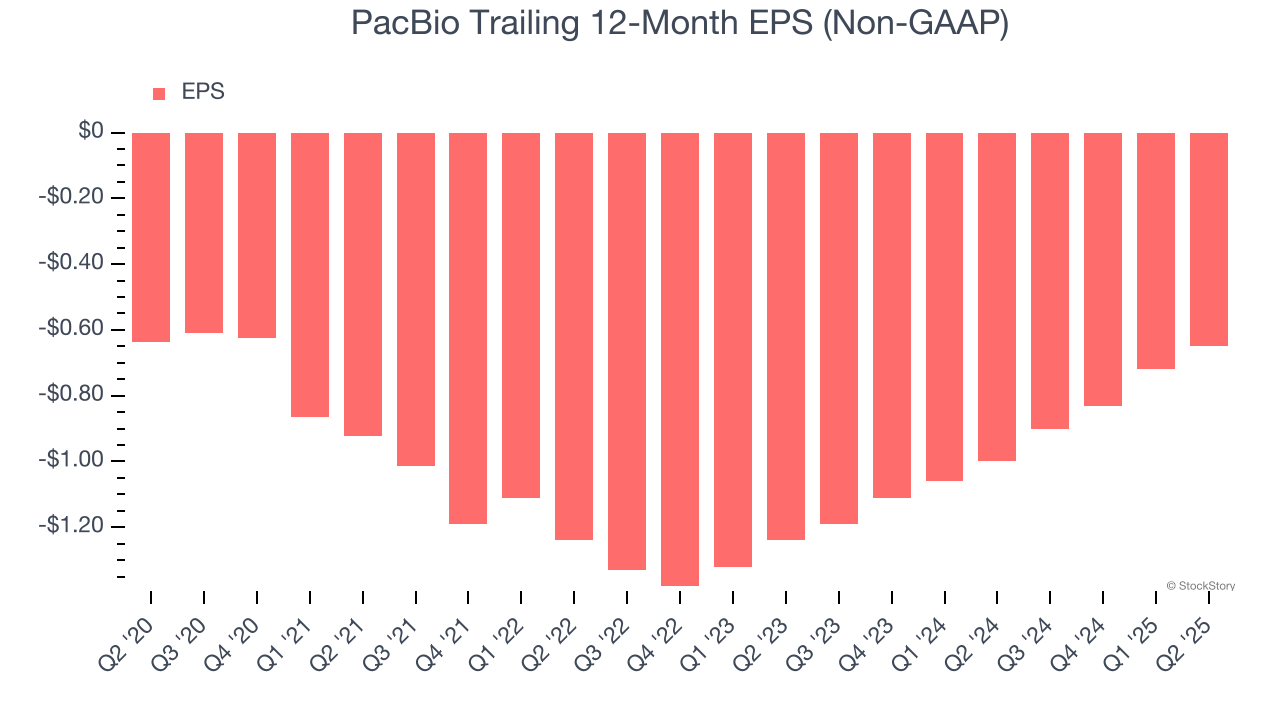

Revenue trends explain a company’s historical growth, but the long-term change in earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

PacBio’s full-year EPS was flat over the last five years. This performance was underwhelming across the board.

In Q2, PacBio reported adjusted EPS at negative $0.13, up from negative $0.20 in the same quarter last year. This print easily cleared analysts’ estimates, and shareholders should be content with the results. Over the next 12 months, Wall Street expects PacBio to improve its earnings losses. Analysts forecast its full-year EPS of negative $0.65 will advance to negative $0.58.

Key Takeaways from PacBio’s Q2 Results

We were impressed by how significantly PacBio blew past analysts’ revenue expectations this quarter. We were also glad its EPS outperformed Wall Street’s estimates. Zooming out, we think this quarter featured some important positives. The stock traded up 8.3% to $1.37 immediately after reporting.

PacBio had an encouraging quarter, but one earnings result doesn’t necessarily make the stock a buy. Let’s see if this is a good investment. When making that decision, it’s important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it’s free.

More News

View More

Recent Quotes

View More

Quotes delayed at least 20 minutes.

By accessing this page, you agree to the Privacy Policy and Terms Of Service.