2 Reasons to Watch FFBC and 1 to Stay Cautious

Over the last six months, First Financial Bancorp’s shares have sunk to $23.55, producing a disappointing 16.8% loss - a stark contrast to the S&P 500’s 4.5% gain. This may have investors wondering how to approach the situation.

Following the pullback, is now a good time to buy FFBC? Find out in our full research report, it’s free.

Why Does First Financial Bancorp Spark Debate?

Tracing its roots back to 1863 during the Civil War era, First Financial Bancorp (NASDAQ: FFBC) is a bank holding company that provides commercial banking, lending, deposit services, and wealth management to individuals and businesses.

Two Positive Attributes:

1. Outstanding Long-Term EPS Growth

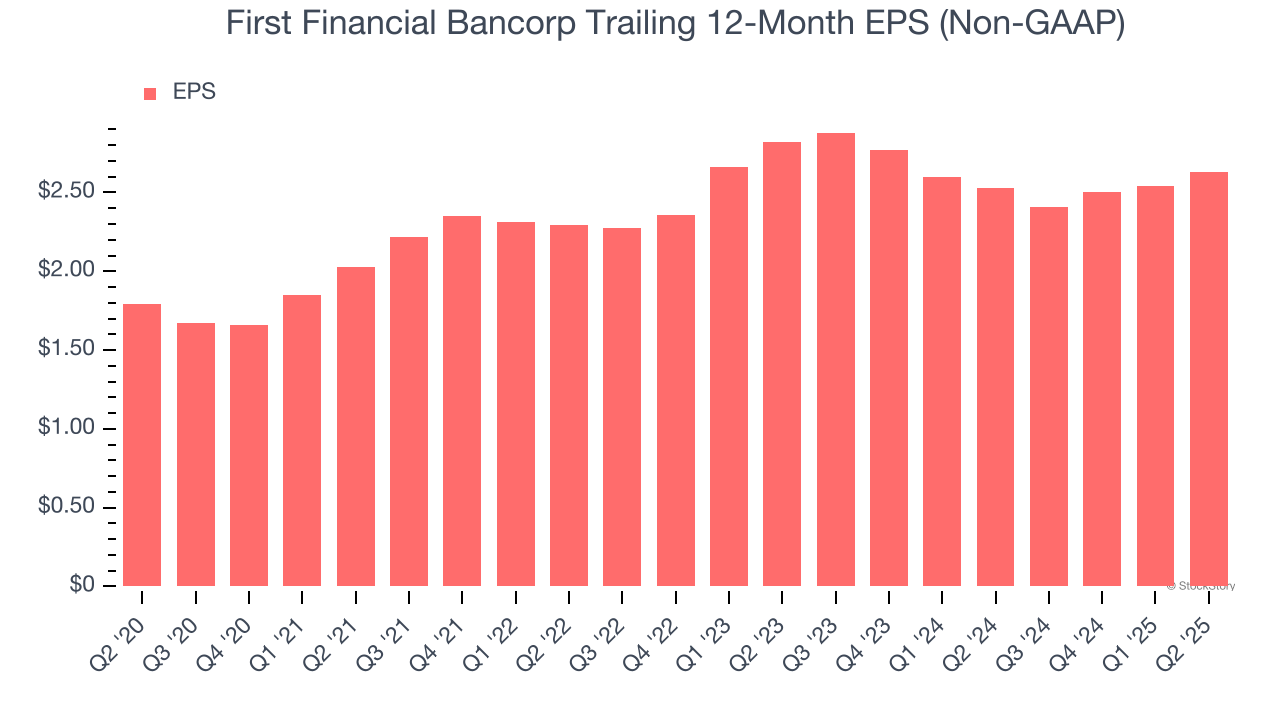

We track the long-term change in earnings per share (EPS) because it highlights whether a company’s growth is profitable.

First Financial Bancorp’s remarkable 8% annual EPS growth over the last five years aligns with its revenue performance. This tells us it maintained its per-share profitability as it expanded.

2. Growing TBVPS Reflects Strong Asset Base

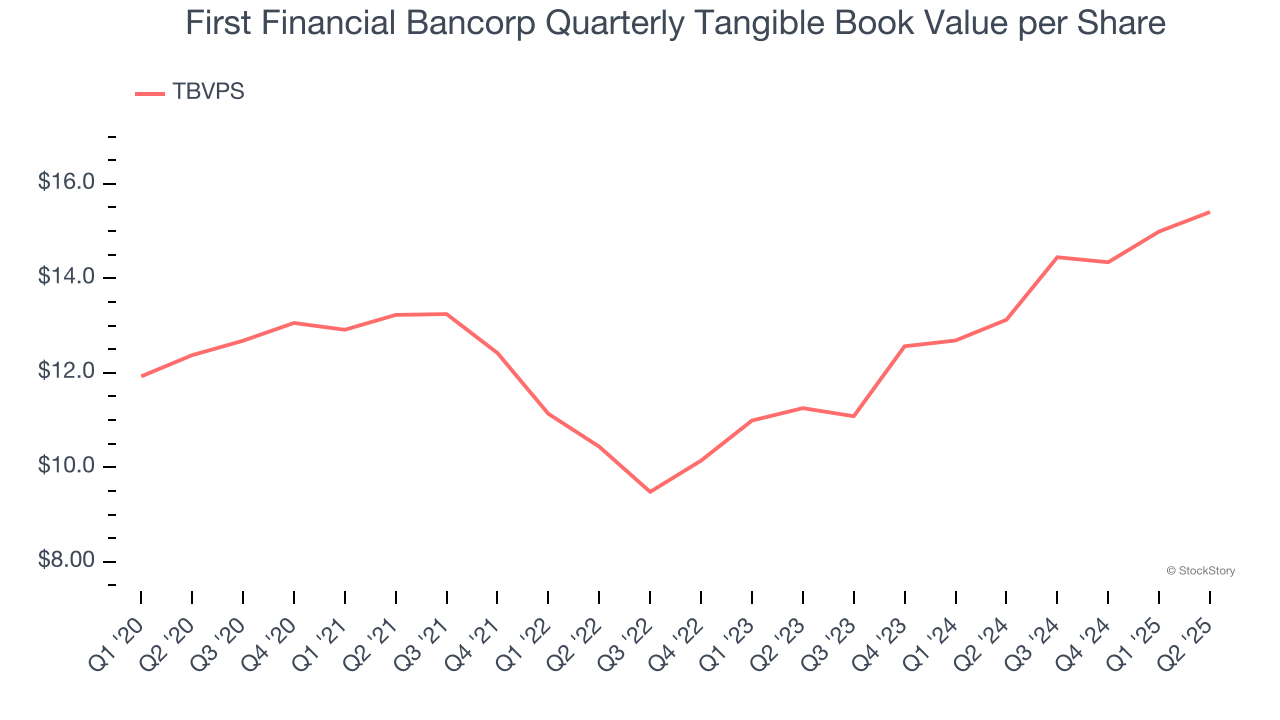

We consider tangible book value per share (TBVPS) the most important metric to track for banks. TBVPS represents the real, liquid net worth per share of a bank, excluding intangible assets that have debatable value upon liquidation.

Although First Financial Bancorp’s TBVPS increased by a meager 4.5% annually over the last five years, the good news is that its growth has recently accelerated as TBVPS grew at an excellent 17% annual clip over the past two years (from $11.25 to $15.40 per share).

One Reason to be Careful:

Net Interest Income Points to Soft Demand

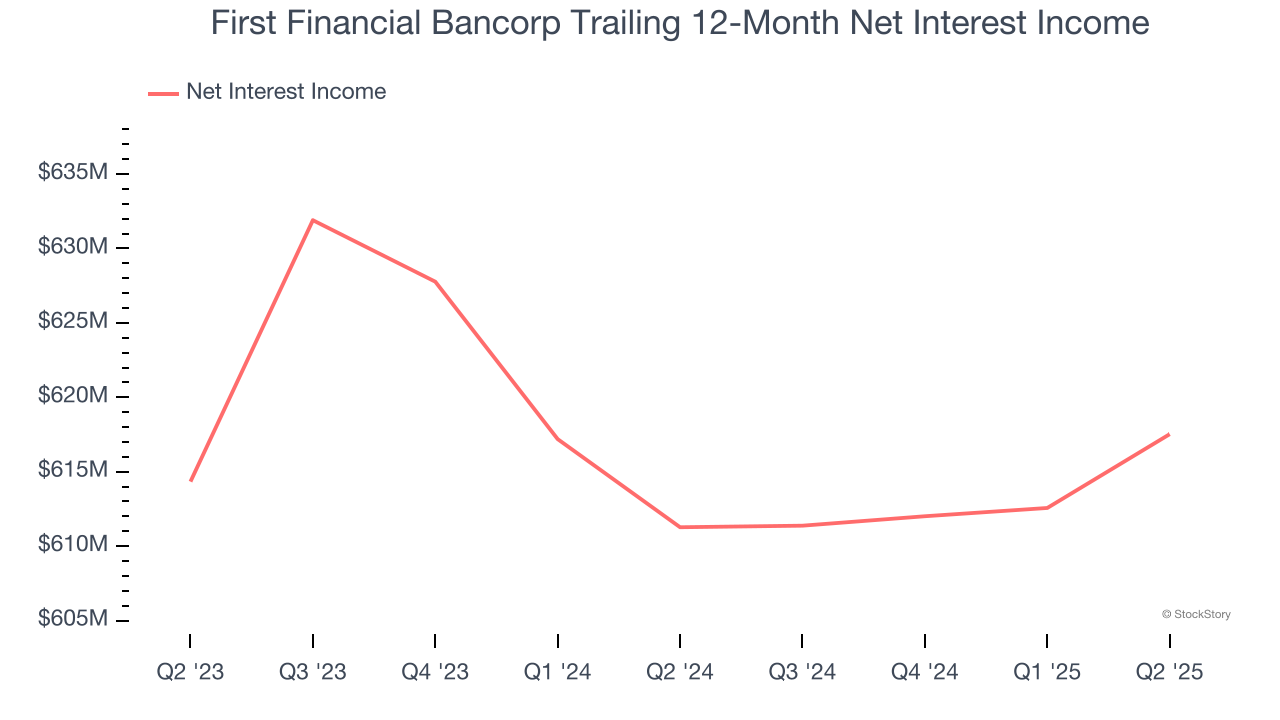

Our experience and research show the market cares primarily about a bank’s net interest income growth as one-time fees are considered a lower-quality and non-recurring revenue source.

First Financial Bancorp’s net interest income has grown at a 6.4% annualized rate over the last five years, slightly worse than the broader bank industry and in line with its total revenue.

Final Judgment

First Financial Bancorp’s merits more than compensate for its flaws. After the recent drawdown, the stock trades at 0.9× forward P/B (or $23.55 per share). Is now a good time to buy? See for yourself in our comprehensive research report, it’s free.

High-Quality Stocks for All Market Conditions

Donald Trump’s April 2024 "Liberation Day" tariffs sent markets into a tailspin, but stocks have since rebounded strongly, proving that knee-jerk reactions often create the best buying opportunities.

The smart money is already positioning for the next leg up. Don’t miss out on the recovery - check out our Top 9 Market-Beating Stocks. This is a curated list of our High Quality stocks that have generated a market-beating return of 183% over the last five years (as of March 31st 2025).

Stocks that made our list in 2020 include now familiar names such as Nvidia (+1,545% between March 2020 and March 2025) as well as under-the-radar businesses like the once-micro-cap company Kadant (+351% five-year return). Find your next big winner with StockStory today.

StockStory is growing and hiring equity analyst and marketing roles. Are you a 0 to 1 builder passionate about the markets and AI? See the open roles here.

More News

View More

Recent Quotes

View More

Quotes delayed at least 20 minutes.

By accessing this page, you agree to the Privacy Policy and Terms Of Service.