Erie Indemnity (NASDAQ:ERIE) Reports Sales Below Analyst Estimates In Q2 Earnings

Insurance management company Erie Indemnity (NASDAQ: ERIE) fell short of the market’s revenue expectations in Q2 CY2025, but sales rose 7% year on year to $1.06 billion. Its GAAP profit of $3.34 per share was 5.9% below analysts’ consensus estimates.

Is now the time to buy Erie Indemnity? Find out by accessing our full research report, it’s free.

Erie Indemnity (ERIE) Q2 CY2025 Highlights:

- Revenue: $1.06 billion vs analyst estimates of $1.09 billion (7% year-on-year growth, 2.6% miss)

- Pre-Tax Profit Margin: 20.8% (flat year on year)

- EPS (GAAP): $3.34 vs analyst expectations of $3.55 (5.9% miss)

- Market Capitalization: $18.44 billion

Company Overview

Operating under a unique business model dating back to 1925, Erie Indemnity (NASDAQ: ERIE) serves as the attorney-in-fact for Erie Insurance Exchange, managing policy issuance, claims handling, and investment services for this reciprocal insurer.

Revenue Growth

In general, insurance companies earn revenue from three primary sources. The first is the core insurance business itself, often called underwriting and represented in the income statement as premiums earned. The second source is investment income from investing the “float” (premiums collected upfront not yet paid out as claims) in assets such as fixed-income assets and equities. The third is fees from various sources such as policy administration, annuities, or other value-added services.

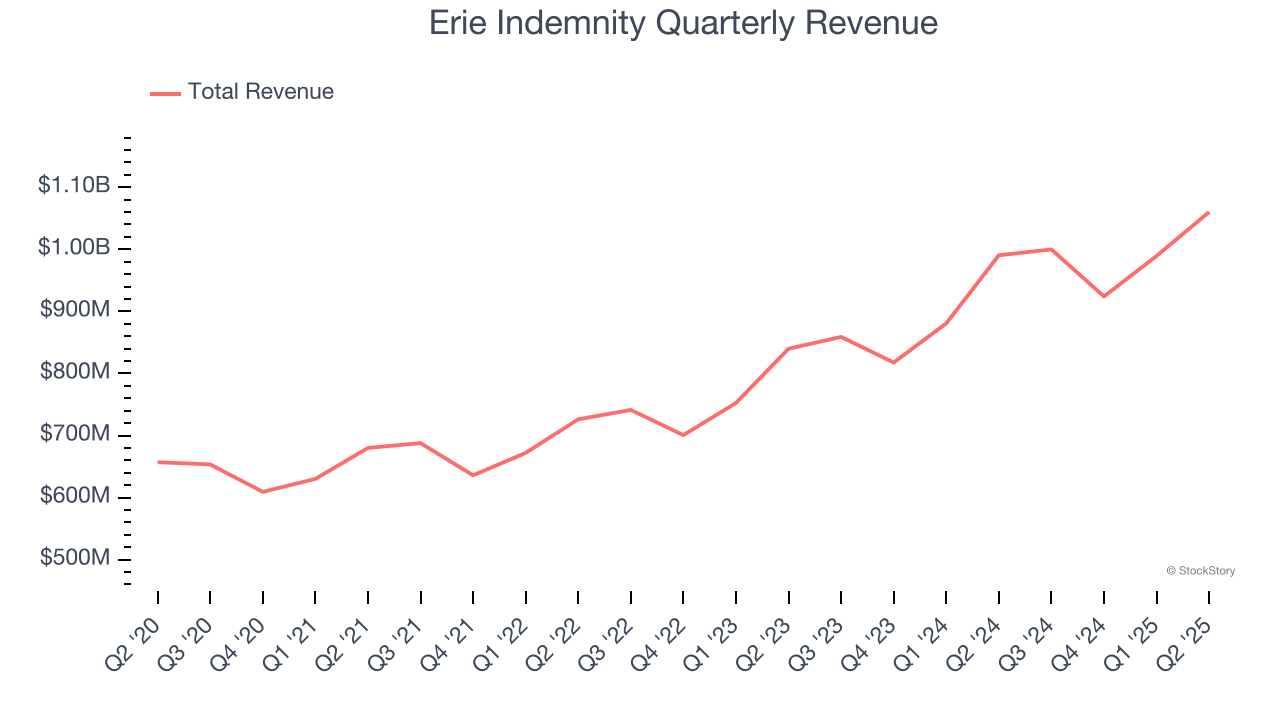

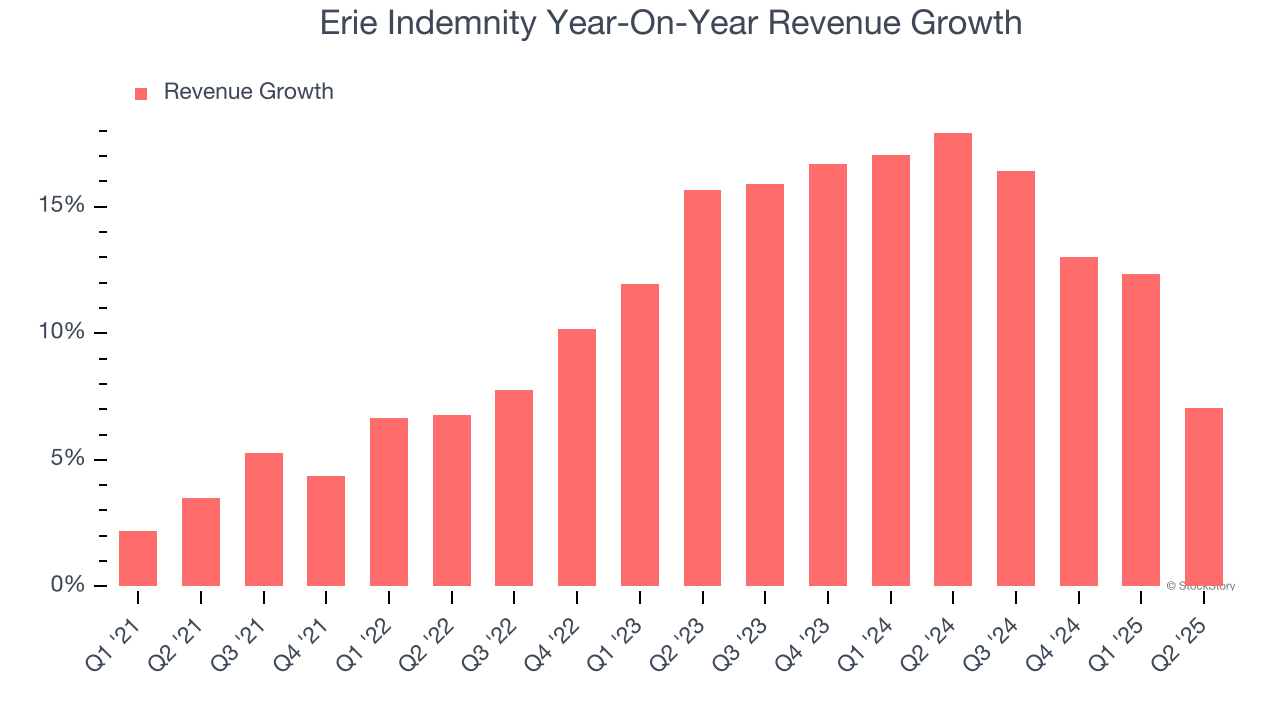

Over the last five years, Erie Indemnity grew its revenue at a solid 10% compounded annual growth rate. Its growth surpassed the average insurance company and shows its offerings resonate with customers, a great starting point for our analysis.

We at StockStory place the most emphasis on long-term growth, but within financials, a half-decade historical view may miss recent interest rate changes, market returns, and industry trends. Erie Indemnity’s annualized revenue growth of 14.4% over the last two years is above its five-year trend, suggesting its demand was strong and recently accelerated.

This quarter, Erie Indemnity’s revenue grew by 7% year on year to $1.06 billion, missing Wall Street’s estimates.

Here at StockStory, we certainly understand the potential of thematic investing. Diverse winners from Microsoft (MSFT) to Alphabet (GOOG), Coca-Cola (KO) to Monster Beverage (MNST) could all have been identified as promising growth stories with a megatrend driving the growth. So, in that spirit, we’ve identified a relatively under-the-radar profitable growth stock benefiting from the rise of AI, available to you FREE via this link.

Key Takeaways from Erie Indemnity’s Q2 Results

We struggled to find many positives in these results. Its revenue missed and its EPS fell short of Wall Street’s estimates. Overall, this was a weaker quarter. The stock traded down 1% to $349 immediately following the results.

Erie Indemnity’s latest earnings report disappointed. One quarter doesn’t define a company’s quality, so let’s explore whether the stock is a buy at the current price. We think that the latest quarter is only one piece of the longer-term business quality puzzle. Quality, when combined with valuation, can help determine if the stock is a buy. We cover that in our actionable full research report which you can read here, it’s free.

More News

View More

Recent Quotes

View More

Quotes delayed at least 20 minutes.

By accessing this page, you agree to the Privacy Policy and Terms Of Service.