3 Reasons WING Has Explosive Upside Potential

The past six months have been a windfall for Wingstop’s shareholders. The company’s stock price has jumped 45.8%, hitting $327 per share. This was partly thanks to its solid quarterly results, and the performance may have investors wondering how to approach the situation.

Is now still a good time to buy WING? Or are investors being too optimistic? Find out in our full research report, it’s free.

Why Is WING a Good Business?

The passion project of two chicken wing aficionados in Texas, Wingstop (NASDAQ: WING) is a popular fast-food chain known for its flavorful and crispy chicken wings offered in a variety of sauces and seasonings.

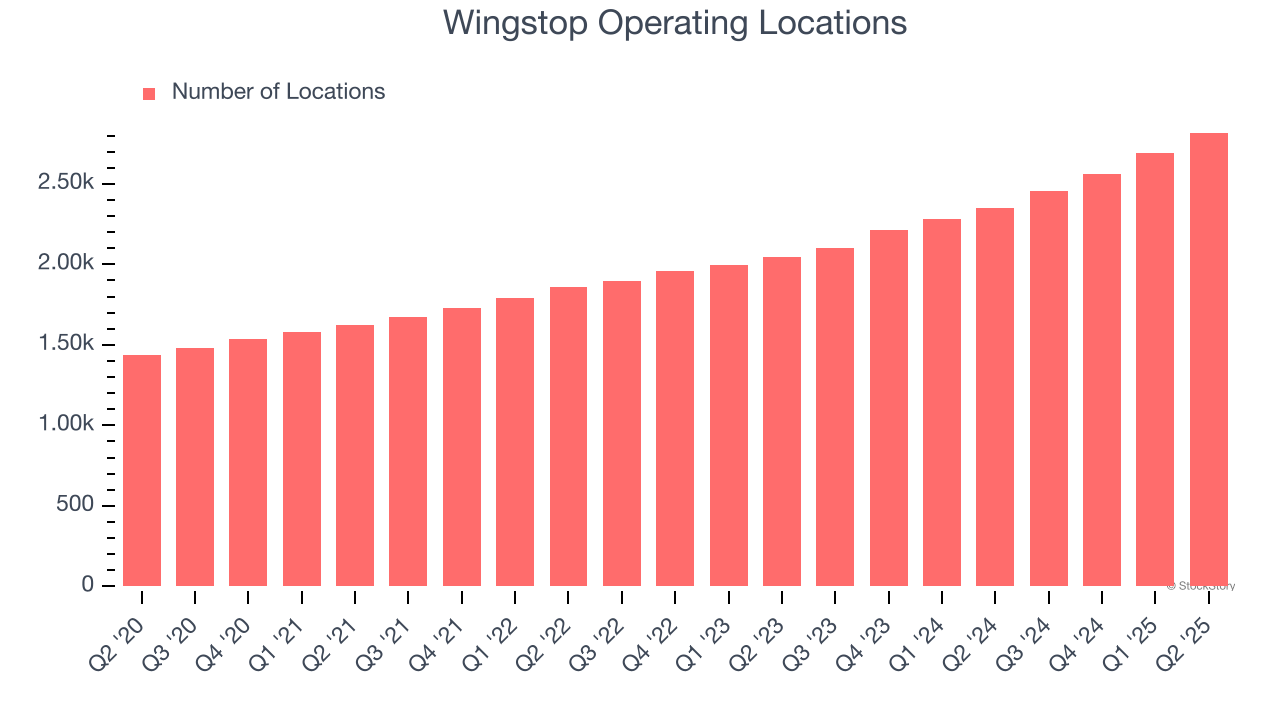

1. New Restaurants Opening at Breakneck Speed

The number of dining locations a restaurant chain operates is a critical driver of how quickly company-level sales can grow.

Wingstop sported 2,818 locations in the latest quarter. Over the last two years, it has opened new restaurants at a rapid clip by averaging 15.4% annual growth, among the fastest in the restaurant sector. This gives it a chance to scale into a mid-sized business over time. Additionally, one dynamic making expansion more seamless is the company’s franchise model, where franchisees are primarily responsible for opening new restaurants while Wingstop provides support.

When a chain opens new restaurants, it usually means it’s investing for growth because there’s healthy demand for its meals and there are markets where its concepts have few or no locations.

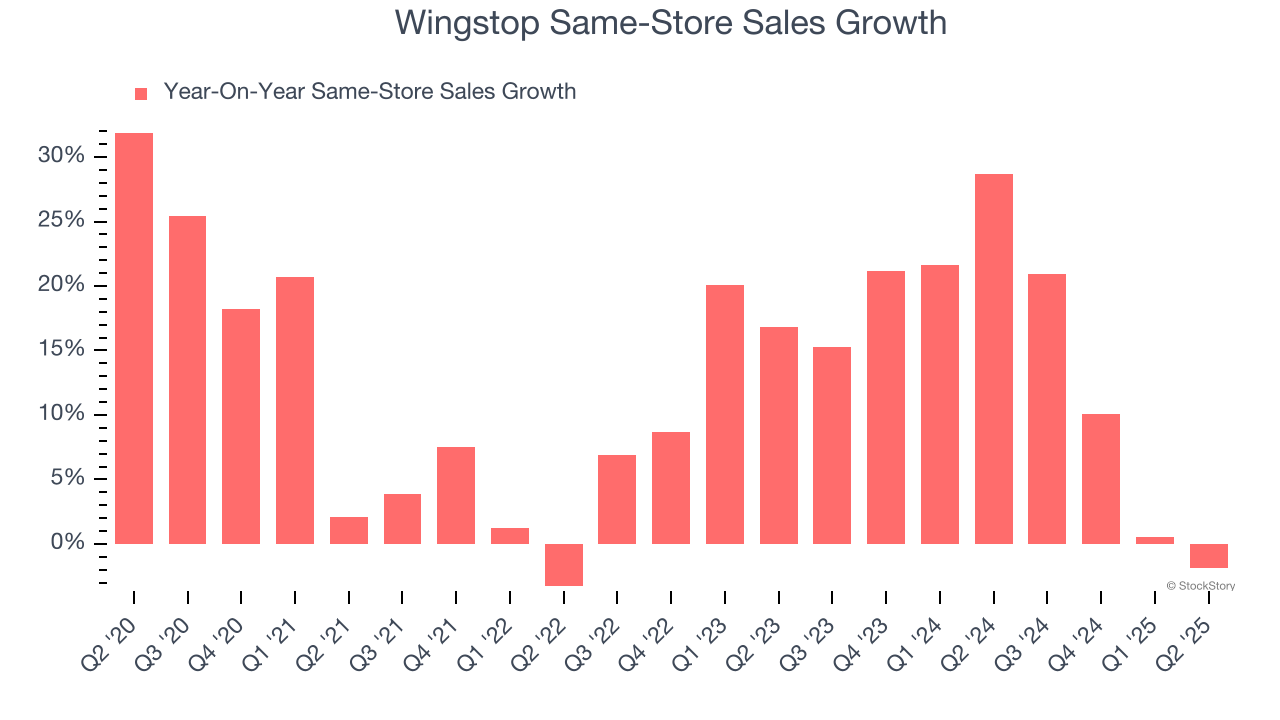

2. Surging Same-Store Sales Show Increasing Demand

Same-store sales is a key performance indicator used to measure organic growth at restaurants open for at least a year.

Wingstop has been one of the most successful restaurant chains over the last two years thanks to skyrocketing demand within its existing dining locations. On average, the company has posted exceptional year-on-year same-store sales growth of 14.6%.

3. Operating Margin Reveals a Well-Run Organization

Operating margin is an important measure of profitability for restaurants as it accounts for all expenses keeping the business in motion, including food costs, wages, rent, advertising, and other administrative costs.

Wingstop has been a well-oiled machine over the last two years. It demonstrated elite profitability for a restaurant business, boasting an average operating margin of 25.5%. This result isn’t surprising as its high gross margin gives it a favorable starting point.

Final Judgment

These are just a few reasons why we think Wingstop is a high-quality business, and with the recent rally, the stock trades at 75.8× forward P/E (or $327 per share). Is now the time to initiate a position? See for yourself in our in-depth research report, it’s free.

Stocks We Like Even More Than Wingstop

When Trump unveiled his aggressive tariff plan in April 2025, markets tanked as investors feared a full-blown trade war. But those who panicked and sold missed the subsequent rebound that’s already erased most losses.

Don’t let fear keep you from great opportunities and take a look at Top 9 Market-Beating Stocks. This is a curated list of our High Quality stocks that have generated a market-beating return of 183% over the last five years (as of March 31st 2025).

Stocks that made our list in 2020 include now familiar names such as Nvidia (+1,545% between March 2020 and March 2025) as well as under-the-radar businesses like the once-small-cap company Exlservice (+354% five-year return). Find your next big winner with StockStory today.

StockStory is growing and hiring equity analyst and marketing roles. Are you a 0 to 1 builder passionate about the markets and AI? See the open roles here.

More News

View More

Recent Quotes

View MoreQuotes delayed at least 20 minutes.

By accessing this page, you agree to the Privacy Policy and Terms Of Service.