Q2 Earnings Outperformers: Applied Industrial (NYSE:AIT) And The Rest Of The Engineered Components and Systems Stocks

Wrapping up Q2 earnings, we look at the numbers and key takeaways for the engineered components and systems stocks, including Applied Industrial (NYSE: AIT) and its peers.

Engineered components and systems companies possess technical know-how in sometimes narrow areas such as metal forming or intelligent robotics. Lately, automation and connected equipment collecting analyzable data have been trending, creating new demand. On the other hand, like the broader industrials sector, engineered components and systems companies are at the whim of economic cycles. Consumer spending and interest rates, for example, can greatly impact the industrial production that drives demand for these companies’ offerings.

The 13 engineered components and systems stocks we track reported a mixed Q2. As a group, revenues along with next quarter’s revenue guidance were in line with analysts’ consensus estimates.

In light of this news, share prices of the companies have held steady as they are up 2.6% on average since the latest earnings results.

Applied Industrial (NYSE: AIT)

Formerly called The Ohio Ball Bearing Company, Applied Industrial (NYSE: AIT) distributes industrial products–everything from power tools to industrial valves–and services to a wide variety of industries.

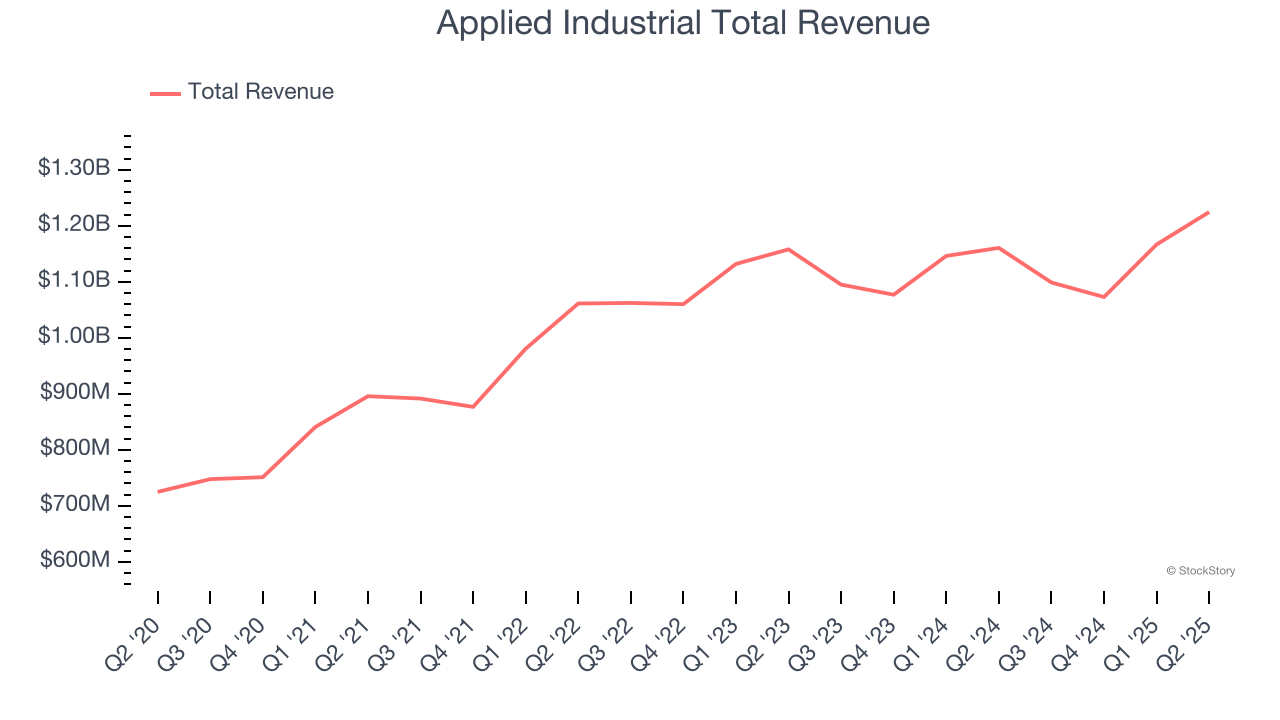

Applied Industrial reported revenues of $1.22 billion, up 5.5% year on year. This print exceeded analysts’ expectations by 3.5%. Overall, it was a strong quarter for the company with a solid beat of analysts’ organic revenue estimates and a decent beat of analysts’ EBITDA estimates.

Neil A. Schrimsher, Applied’s President & Chief Executive Officer, commented, “We ended fiscal 2025 on an encouraging note with fourth quarter sales and EPS exceeding our expectations. Sales returned to positive organic growth with underlying trends improving as the quarter progressed. This was driven by stronger than expected Engineered Solutions segment sales where our teams executed exceptionally well, including capitalizing on recent order strength and firming demand across several verticals. Service Center segment sales held steady against the muted end-market backdrop with sequential trends seasonally strong. M&A contribution was also encouraging with solid progress continuing to develop at Hydradyne. Lastly, we delivered another solid quarter of cash generation, culminating in record free cash flow in fiscal 2025 that enabled meaningful capital deployment throughout the year. Overall, I am extremely proud of what we accomplished within a challenging demand landscape. Our consistent outperformance reflects our commitment to excellence and ability to create value for all stakeholders in any environment.”

The stock is down 4.4% since reporting and currently trades at $263.58.

Is now the time to buy Applied Industrial? Access our full analysis of the earnings results here, it’s free.

Best Q2: Arrow Electronics (NYSE: ARW)

Founded as a single retail store, Arrow Electronics (NYSE: ARW) provides electronic components and enterprise computing solutions to businesses globally.

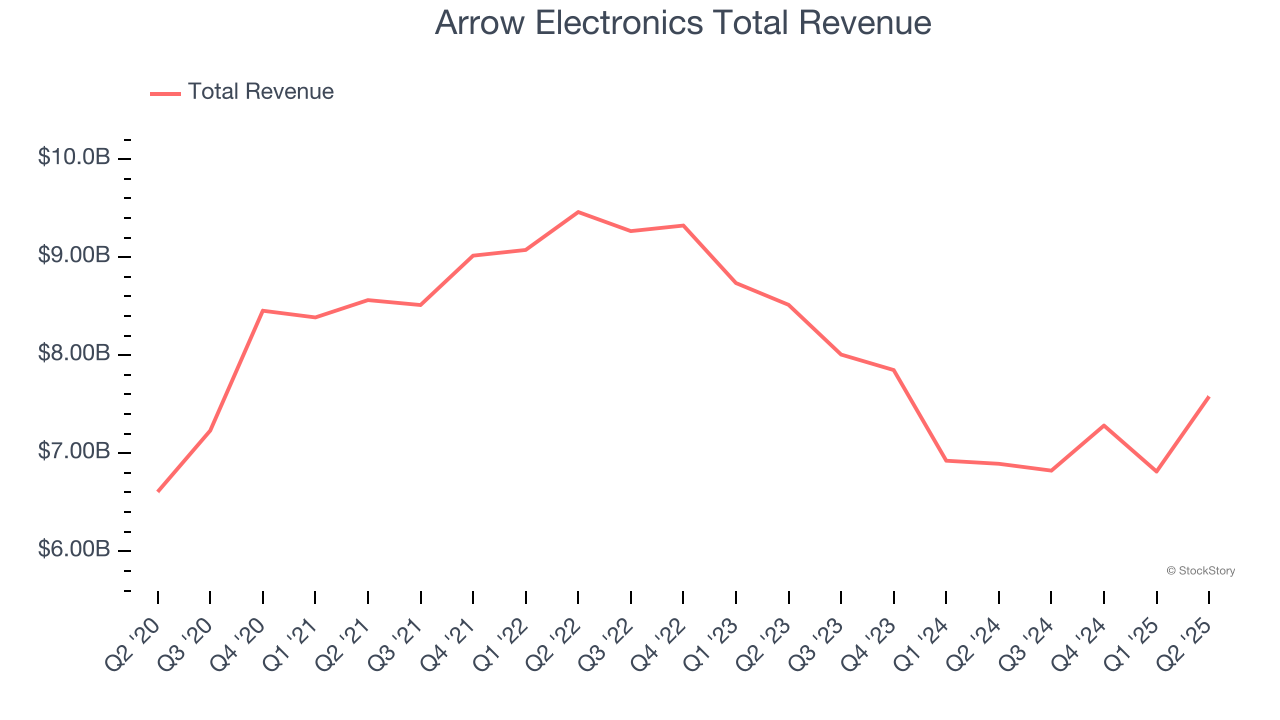

Arrow Electronics reported revenues of $7.58 billion, up 10% year on year, outperforming analysts’ expectations by 5.9%. The business had an exceptional quarter with a beat of analysts’ EPS estimates and an impressive beat of analysts’ ECS revenue estimates.

Arrow Electronics achieved the biggest analyst estimates beat among its peers. Although it had a fine quarter compared its peers, the market seems unhappy with the results as the stock is down 2.8% since reporting. It currently trades at $126.33.

Is now the time to buy Arrow Electronics? Access our full analysis of the earnings results here, it’s free.

Weakest Q2: ESCO (NYSE: ESE)

A developer of the communication systems used in the Batmobile of “The Dark Knight,” ESCO (NYSE: ESE) is a provider of engineered components for the aerospace, defense, and utility sectors.

ESCO reported revenues of $296.3 million, up 13.6% year on year, falling short of analysts’ expectations by 7%. It was a disappointing quarter as it posted full-year revenue guidance missing analysts’ expectations significantly and full-year EPS guidance missing analysts’ expectations significantly.

ESCO delivered the fastest revenue growth but had the weakest performance against analyst estimates in the group. Interestingly, the stock is up 5.6% since the results and currently trades at $200.91.

Read our full analysis of ESCO’s results here.

NN (NASDAQ: NNBR)

Formerly known as Nuturn, NN (NASDAQ: NNBR) provides metal components, bearings, and plastic and rubber components to the automotive, aerospace, medical, and industrial sectors.

NN reported revenues of $107.9 million, down 12.3% year on year. This print missed analysts’ expectations by 2.6%. Zooming out, it was actually a strong quarter as it put up a beat of analysts’ EPS estimates and full-year EBITDA guidance exceeding analysts’ expectations.

The stock is up 19.5% since reporting and currently trades at $2.57.

Read our full, actionable report on NN here, it’s free.

Park-Ohio (NASDAQ: PKOH)

Based in Cleveland, Park-Ohio (NASDAQ: PKOH) provides supply chain management services, capital equipment, and manufactured components.

Park-Ohio reported revenues of $400.1 million, down 7.5% year on year. This number came in 1.3% below analysts' expectations. Aside from that, it was a satisfactory quarter as it also logged an impressive beat of analysts’ EBITDA estimates but full-year EPS guidance meeting analysts’ expectations.

Park-Ohio delivered the highest full-year guidance raise among its peers. The stock is up 29.5% since reporting and currently trades at $20.88.

Read our full, actionable report on Park-Ohio here, it’s free.

Market Update

As a result of the Fed’s rate hikes in 2022 and 2023, inflation has come down from frothy levels post-pandemic. The general rise in the price of goods and services is trending towards the Fed’s 2% goal as of late, which is good news. The higher rates that fought inflation also didn't slow economic activity enough to catalyze a recession. So far, soft landing. This, combined with recent rate cuts (half a percent in September 2024 and a quarter percent in November 2024) have led to strong stock market performance in 2024. The icing on the cake for 2024 returns was Donald Trump’s victory in the U.S. Presidential Election in early November, sending major indices to all-time highs in the week following the election. Still, debates around the health of the economy and the impact of potential tariffs and corporate tax cuts remain, leaving much uncertainty around 2025.

Want to invest in winners with rock-solid fundamentals? Check out our Top 5 Quality Compounder Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

StockStory is growing and hiring equity analyst and marketing roles. Are you a 0 to 1 builder passionate about the markets and AI? See the open roles here.

More News

View More

Recent Quotes

View More

Quotes delayed at least 20 minutes.

By accessing this page, you agree to the Privacy Policy and Terms Of Service.