Q2 Earnings Review: Home Furnishings Stocks Led by Purple (NASDAQ:PRPL)

Looking back on home furnishings stocks’ Q2 earnings, we examine this quarter’s best and worst performers, including Purple (NASDAQ: PRPL) and its peers.

A healthy housing market is good for furniture demand as more consumers are buying, renting, moving, and renovating. On the other hand, periods of economic weakness or high interest rates discourage home sales and can squelch demand. In addition, home furnishing companies must contend with shifting consumer preferences such as the growing propensity to buy goods online, including big things like mattresses and sofas that were once thought to be immune from e-commerce competition.

The 5 home furnishings stocks we track reported a mixed Q2. As a group, revenues were in line with analysts’ consensus estimates while next quarter’s revenue guidance was 0.7% above.

Luckily, home furnishings stocks have performed well with share prices up 12.7% on average since the latest earnings results.

Best Q2: Purple (NASDAQ: PRPL)

Founded by two brothers, Purple (NASDAQ: PRPL) creates sleep and home comfort products such as mattresses, pillows, and bedding accessories.

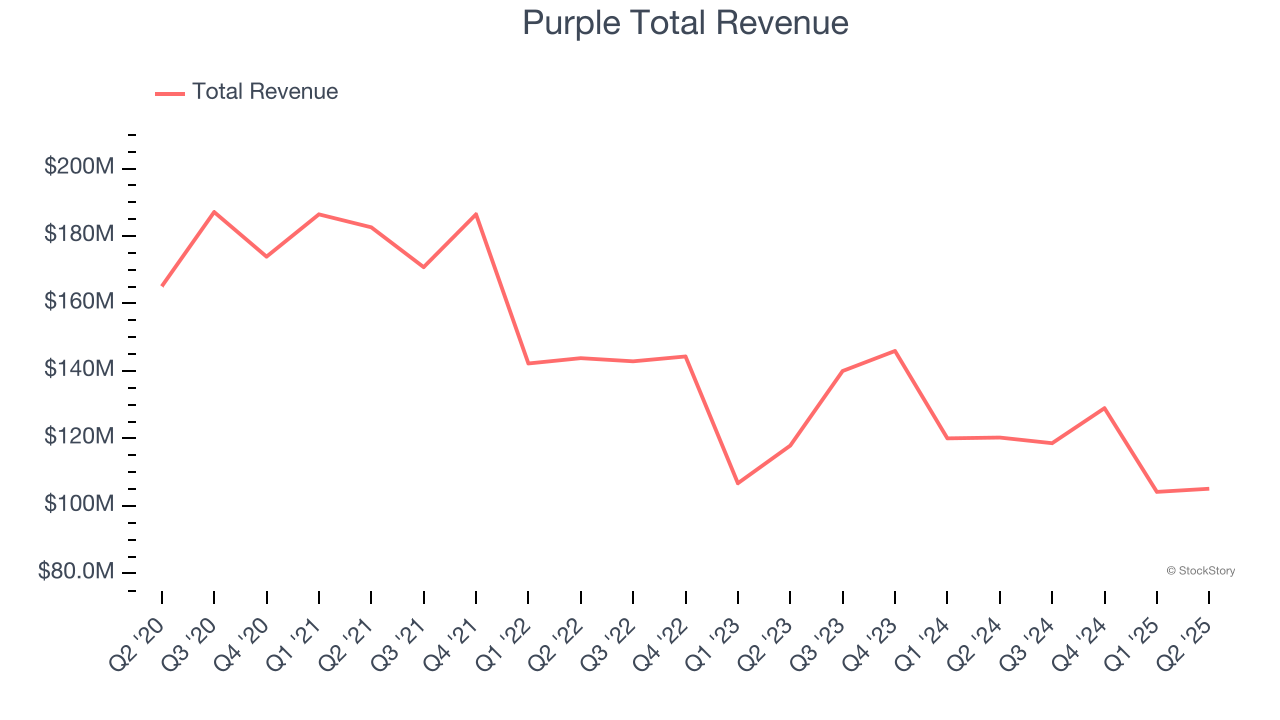

Purple reported revenues of $105.1 million, down 12.6% year on year. This print was in line with analysts’ expectations, and overall, it was an exceptional quarter for the company with an impressive beat of analysts’ adjusted operating income estimates and full-year EBITDA guidance exceeding analysts’ expectations.

"We are pleased with our second quarter performance, which reflects our disciplined execution and continued progress as we build a premium, sustainable, and profitable brand," said Rob DeMartini, CEO of Purple Innovation.

Purple scored the highest full-year guidance raise but had the slowest revenue growth of the whole group. Unsurprisingly, the stock is up 40.9% since reporting and currently trades at $1.20.

Is now the time to buy Purple? Access our full analysis of the earnings results here, it’s free.

Mohawk Industries (NYSE: MHK)

Established in 1878, Mohawk Industries (NYSE: MHK) is a leading producer of floor-covering products for both residential and commercial applications.

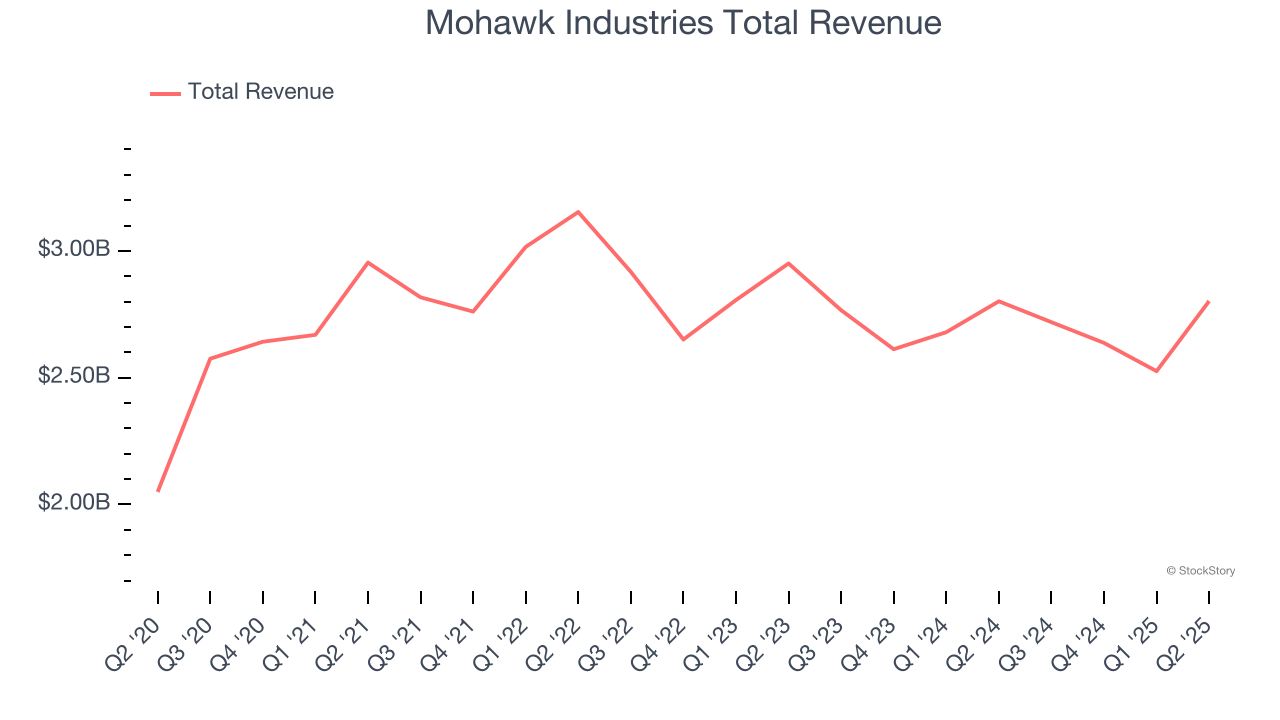

Mohawk Industries reported revenues of $2.80 billion, flat year on year, outperforming analysts’ expectations by 2.2%. The business performed better than its peers, but it was unfortunately a mixed quarter with a beat of analysts’ EPS estimates but EPS guidance for next quarter missing analysts’ expectations.

Mohawk Industries achieved the biggest analyst estimates beat among its peers. The market seems happy with the results as the stock is up 13.3% since reporting. It currently trades at $131.50.

Is now the time to buy Mohawk Industries? Access our full analysis of the earnings results here, it’s free.

Weakest Q2: La-Z-Boy (NYSE: LZB)

The prized possession of every mancave, La-Z-Boy (NYSE: LZB) is a furniture company specializing in recliners, sofas, and seats.

La-Z-Boy reported revenues of $492.2 million, flat year on year, in line with analysts’ expectations. It was a slower quarter as it posted a significant miss of analysts’ EPS estimates and a miss of analysts’ adjusted operating income estimates.

As expected, the stock is down 5.5% since the results and currently trades at $36.97.

Read our full analysis of La-Z-Boy’s results here.

Leggett & Platt (NYSE: LEG)

Founded in 1883, Leggett & Platt (NYSE: LEG) is a diversified manufacturer of products and components for various industries.

Leggett & Platt reported revenues of $1.06 billion, down 6.3% year on year. This number met analysts’ expectations. Aside from that, it was a mixed quarter as it also logged a decent beat of analysts’ adjusted operating income estimates but EPS in line with analysts’ estimates.

Leggett & Platt had the weakest full-year guidance update among its peers. The stock is flat since reporting and currently trades at $9.61.

Read our full, actionable report on Leggett & Platt here, it’s free.

Somnigroup (NYSE: SGI)

Established through the merger of Tempur-Pedic and Sealy in 2012, Somnigroup (NYSE: SGI) is a bedding manufacturer known for its innovative memory foam mattresses and sleep products

Somnigroup reported revenues of $1.88 billion, up 52.5% year on year. This result came in 0.6% below analysts' expectations. More broadly, it was a mixed quarter as it also produced full-year EPS guidance topping analysts’ expectations but a miss of analysts’ EBITDA estimates.

Somnigroup achieved the fastest revenue growth but had the weakest performance against analyst estimates among its peers. The stock is up 14.1% since reporting and currently trades at $83.95.

Read our full, actionable report on Somnigroup here, it’s free.

Market Update

In response to the Fed’s rate hikes in 2022 and 2023, inflation has been gradually trending down from its post-pandemic peak, trending closer to the Fed’s 2% target. Despite higher borrowing costs, the economy has avoided flashing recessionary signals. This is the much-desired soft landing that many investors hoped for. The recent rate cuts (0.5% in September and 0.25% in November 2024) have bolstered the stock market, making 2024 a strong year for equities. Donald Trump’s presidential win in November sparked additional market gains, sending indices to record highs in the days following his victory. However, debates continue over possible tariffs and corporate tax adjustments, raising questions about economic stability in 2025.

Want to invest in winners with rock-solid fundamentals? Check out our Hidden Gem Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

StockStory is growing and hiring equity analyst and marketing roles. Are you a 0 to 1 builder passionate about the markets and AI? See the open roles here.

More News

View More

Recent Quotes

View More

Quotes delayed at least 20 minutes.

By accessing this page, you agree to the Privacy Policy and Terms Of Service.