Diversified Financial Services Stocks Q2 Highlights: NCR Atleos (NYSE:NATL)

As the Q2 earnings season wraps, let’s dig into this quarter’s best and worst performers in the diversified financial services industry, including NCR Atleos (NYSE: NATL) and its peers.

Diversified financial services encompass specialized offerings outside traditional categories. These firms benefit from identifying niche market opportunities, developing tailored financial products, and often facing less direct competition. Challenges include scale limitations, regulatory classification uncertainties, and the need to continuously innovate to maintain market differentiation against larger competitors expanding their offerings.

The 10 diversified financial services stocks we track reported a satisfactory Q2. As a group, revenues beat analysts’ consensus estimates by 0.9%.

In light of this news, share prices of the companies have held steady. On average, they are relatively unchanged since the latest earnings results.

NCR Atleos (NYSE: NATL)

Spun off from NCR Voyix in 2023 to focus exclusively on self-service banking technology, NCR Atleos (NYSE: NATL) provides self-directed banking solutions including ATM and interactive teller machine technology, software, services, and a surcharge-free ATM network for financial institutions and retailers.

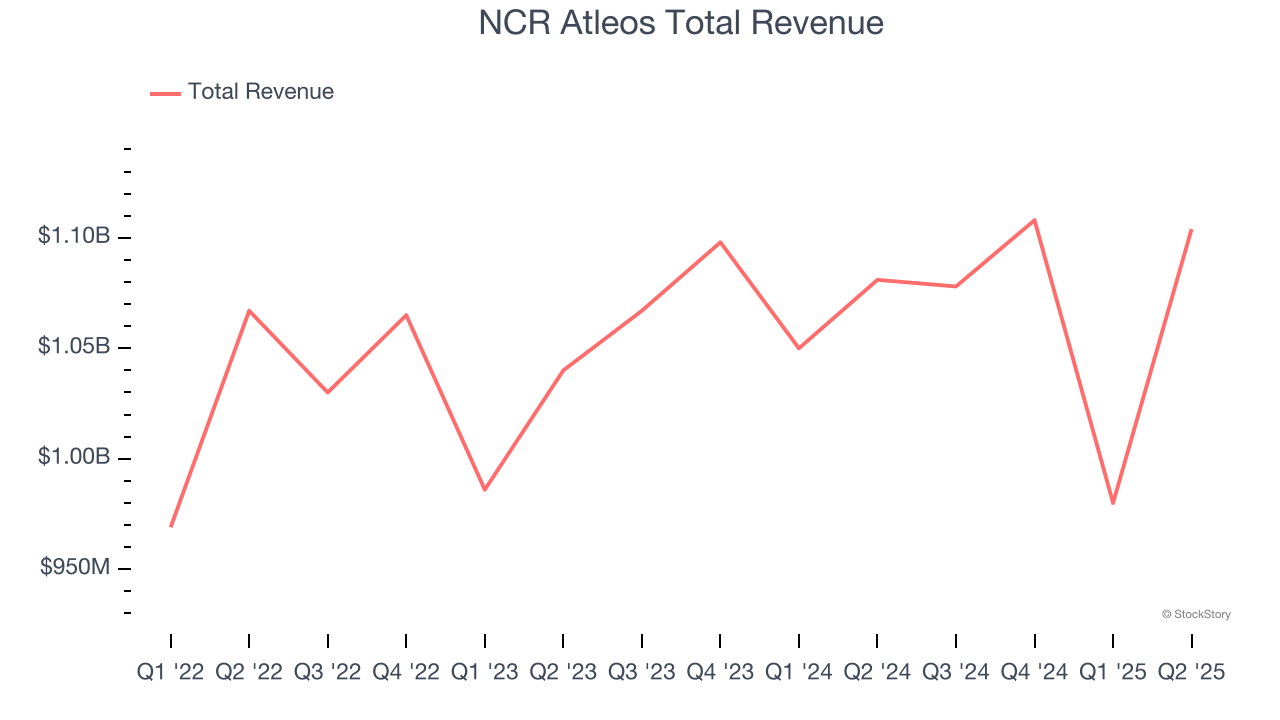

NCR Atleos reported revenues of $1.10 billion, up 2.1% year on year. This print exceeded analysts’ expectations by 2%. Overall, it was an exceptional quarter for the company with a beat of analysts’ EPS and EBITDA estimates.

“NCR Atleos posted another strong quarter and carries strategic momentum into the second half of 2025. Once again, our team delivered revenue and profitability at the high-end of our expectations, all while driving industry-leading service levels, executing productivity initiatives and advancing strategic growth efforts. Robust demand for our self-service banking technology coupled with accelerating interest in ATM outsourcing resulted in a strong order book and backlog. We continue to believe that our full year guidance ranges are appropriate and remain confident that our simple strategy to generate more service revenue from every machine across our leading global installed base will create significant shareholder value,” said Tim Oliver, President and Chief Executive Officer.

Interestingly, the stock is up 19.4% since reporting and currently trades at $38.79.

Is now the time to buy NCR Atleos? Access our full analysis of the earnings results here, it’s free.

Best Q2: Paymentus (NYSE: PAY)

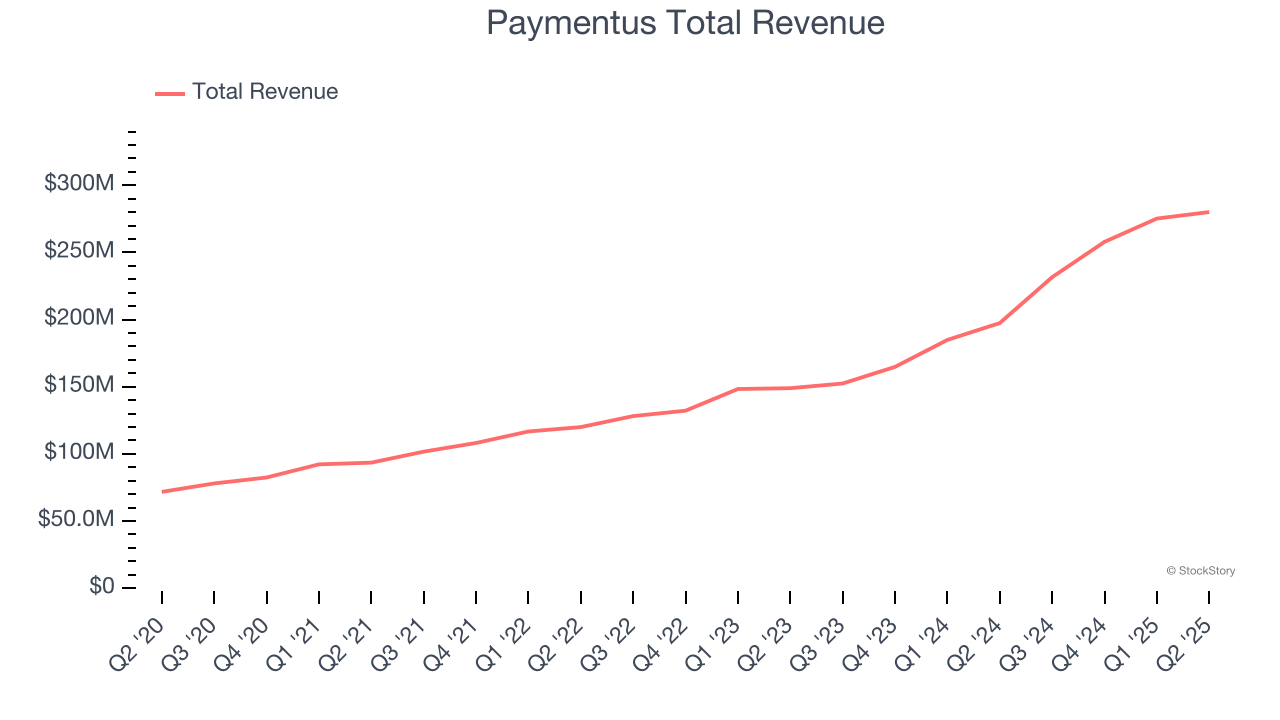

Founded in 2004 to simplify the complex world of bill payments, Paymentus (NYSE: PAY) provides a cloud-based platform that helps utilities, municipalities, and service providers automate billing and payment processes.

Paymentus reported revenues of $280.1 million, up 41.9% year on year, outperforming analysts’ expectations by 8.7%. The business had an incredible quarter with a beat of analysts’ EPS and EBITDA estimates.

Paymentus achieved the biggest analyst estimates beat and fastest revenue growth among its peers. The market seems happy with the results as the stock is up 18.6% since reporting. It currently trades at $34.71.

Is now the time to buy Paymentus? Access our full analysis of the earnings results here, it’s free.

Weakest Q2: NerdWallet (NASDAQ: NRDS)

Born from founder Tim Chen's frustration with the lack of transparent credit card information when helping his sister in 2009, NerdWallet (NASDAQ: NRDS) is a digital platform that provides financial guidance to help consumers and small businesses make smarter decisions about credit cards, loans, insurance, and other financial products.

NerdWallet reported revenues of $186.9 million, up 24.1% year on year, falling short of analysts’ expectations by 4.4%. It was a disappointing quarter as it posted a significant miss of analysts’ Credit Cards segment estimates.

NerdWallet delivered the weakest performance against analyst estimates in the group. As expected, the stock is down 5.6% since the results and currently trades at $10.47.

Read our full analysis of NerdWallet’s results here.

Donnelley Financial Solutions (NYSE: DFIN)

Born from the need to navigate increasingly complex financial regulations in the digital age, Donnelley Financial Solutions (NYSE: DFIN) provides software and technology-enabled services that help companies comply with SEC regulations and manage financial transactions and reporting requirements.

Donnelley Financial Solutions reported revenues of $218.1 million, down 10.1% year on year. This number missed analysts’ expectations by 3.3%. Overall, it was a slower quarter for the company.

Donnelley Financial Solutions had the slowest revenue growth among its peers. The stock is down 15.3% since reporting and currently trades at $54.08.

Read our full, actionable report on Donnelley Financial Solutions here, it’s free.

Euronet Worldwide (NASDAQ: EEFT)

Operating a global network of over 47,000 ATMs and 821,000 point-of-sale terminals across more than 60 countries, Euronet Worldwide (NASDAQ: EEFT) provides electronic payment solutions including ATM services, prepaid product processing, and international money transfer services.

Euronet Worldwide reported revenues of $1.07 billion, up 8.9% year on year. This result was in line with analysts’ expectations. Zooming out, it was a slower quarter as it logged a significant miss of analysts’ EPS estimates.

The stock is down 9.2% since reporting and currently trades at $89.91.

Read our full, actionable report on Euronet Worldwide here, it’s free.

Market Update

As a result of the Fed’s rate hikes in 2022 and 2023, inflation has come down from frothy levels post-pandemic. The general rise in the price of goods and services is trending towards the Fed’s 2% goal as of late, which is good news. The higher rates that fought inflation also didn't slow economic activity enough to catalyze a recession. So far, soft landing. This, combined with recent rate cuts (half a percent in September 2024 and a quarter percent in November 2024) have led to strong stock market performance in 2024. The icing on the cake for 2024 returns was Donald Trump’s victory in the U.S. Presidential Election in early November, sending major indices to all-time highs in the week following the election. Still, debates around the health of the economy and the impact of potential tariffs and corporate tax cuts remain, leaving much uncertainty around 2025.

Want to invest in winners with rock-solid fundamentals? Check out our Top 5 Quality Compounder Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

StockStory is growing and hiring equity analyst and marketing roles. Are you a 0 to 1 builder passionate about the markets and AI? See the open roles here.

More News

View More

Recent Quotes

View More

Quotes delayed at least 20 minutes.

By accessing this page, you agree to the Privacy Policy and Terms Of Service.