Business Services & Supplies Stocks Q2 Recap: Benchmarking RB Global (NYSE:RBA)

Quarterly earnings results are a good time to check in on a company’s progress, especially compared to its peers in the same sector. Today we are looking at RB Global (NYSE: RBA) and the best and worst performers in the business services & supplies industry.

This is a sector that encompasses many types of business, and so it follows that a number of trends will impact the space. For industrial and environmental services companies, for example, trends around environmental compliance and increasing corporate ESG commitments matter while for safety and security services companies, the intersection of physical security, cybersecurity, and workplace safety regulations are the topics du jour. Broadly, AI and automation could be tailwinds for companies in the space that invest wisely. On the other hand, shifting regulatory frameworks could force continual changes in go-to-market and costly investments.

The 20 business services & supplies stocks we track reported a strong Q2. As a group, revenues beat analysts’ consensus estimates by 2.7% while next quarter’s revenue guidance was in line.

Thankfully, share prices of the companies have been resilient as they are up 6.2% on average since the latest earnings results.

RB Global (NYSE: RBA)

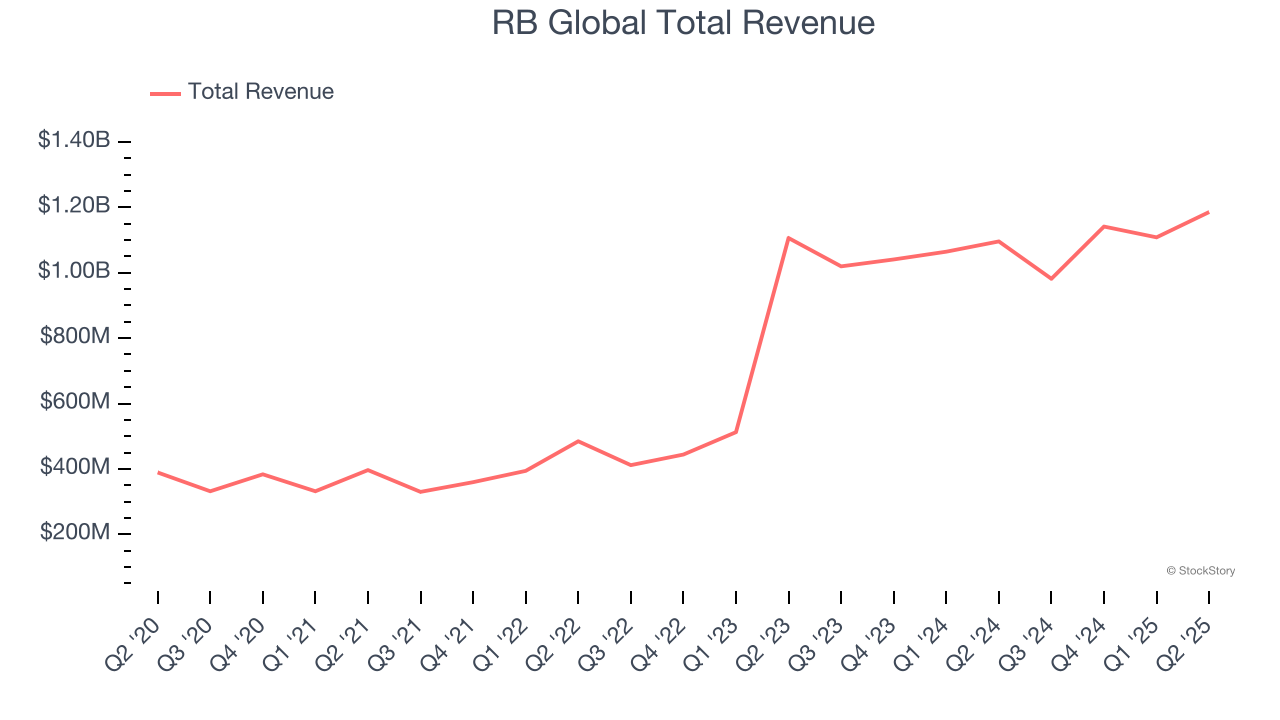

Born from the 1958 founding of Ritchie Bros. Auctioneers and rebranded in 2023, RB Global (NYSE: RBA) operates global marketplaces that connect buyers and sellers of commercial assets, vehicles, and equipment across multiple industries.

RB Global reported revenues of $1.19 billion, up 8.2% year on year. This print exceeded analysts’ expectations by 5%. Overall, it was a stunning quarter for the company with a beat of analysts’ EPS estimates.

Interestingly, the stock is up 8.7% since reporting and currently trades at $118.12.

Best Q2: OPENLANE (NYSE: KAR)

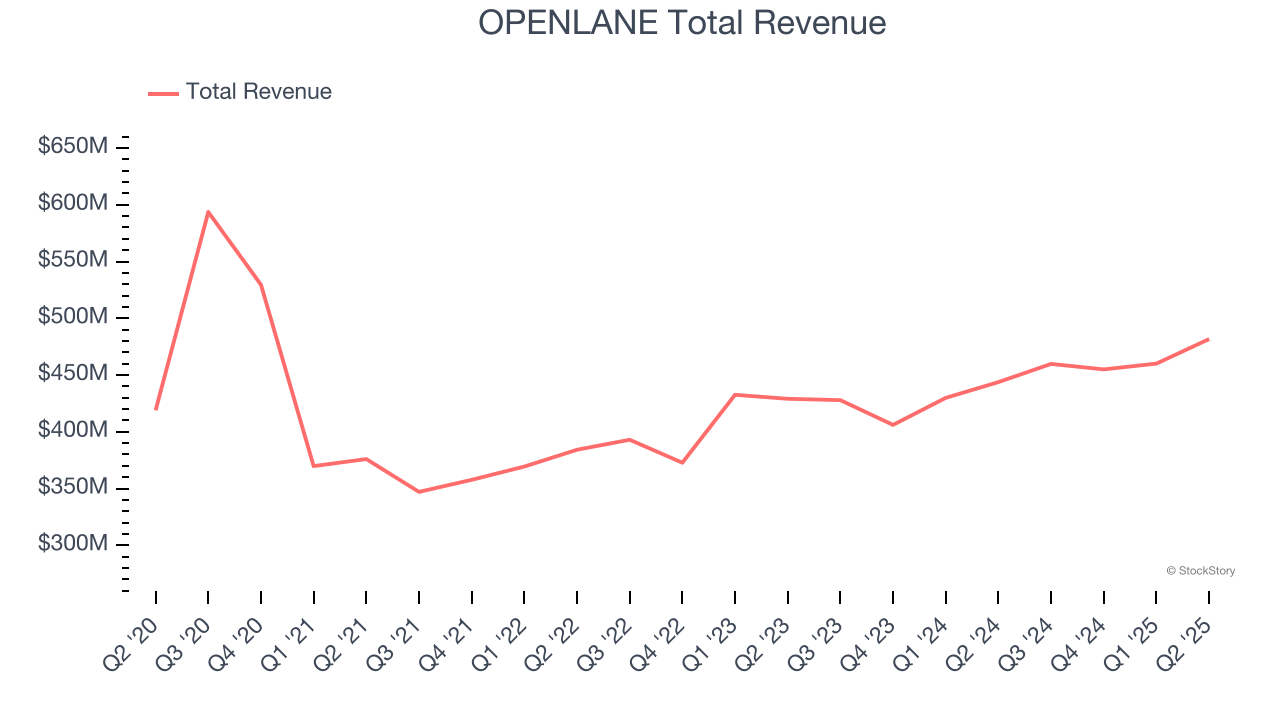

Facilitating the sale of approximately 1.3 million used vehicles in 2023, OPENLANE (NYSE: KAR) operates digital marketplaces that connect sellers and buyers of used vehicles across North America and Europe, facilitating wholesale transactions.

OPENLANE reported revenues of $481.7 million, up 8.5% year on year, outperforming analysts’ expectations by 5.9%. The business had an incredible quarter with a beat of analysts’ EPS estimates and a solid beat of analysts’ full-year EPS guidance estimates.

The market seems happy with the results as the stock is up 13.9% since reporting. It currently trades at $28.53.

Is now the time to buy OPENLANE? Access our full analysis of the earnings results here, it’s free.

Weakest Q2: Pitney Bowes (NYSE: PBI)

With a century-long history dating back to 1920 and processing over 15 billion pieces of mail annually, Pitney Bowes (NYSE: PBI) provides shipping, mailing technology, logistics, and financial services to businesses of all sizes.

Pitney Bowes reported revenues of $461.9 million, down 5.7% year on year, falling short of analysts’ expectations by 2.9%. It was a softer quarter as it posted full-year revenue guidance missing analysts’ expectations and EPS in line with analysts’ estimates.

Pitney Bowes delivered the weakest performance against analyst estimates and slowest revenue growth in the group. The stock is flat since the results and currently trades at $11.34.

Read our full analysis of Pitney Bowes’s results here.

Interface (NASDAQ: TILE)

Pioneering carbon-neutral flooring since its founding in 1973, Interface (NASDAQ: TILE) is a global manufacturer of modular carpet tiles, luxury vinyl tile (LVT), and rubber flooring that specializes in carbon-neutral and sustainable flooring solutions.

Interface reported revenues of $375.5 million, up 8.3% year on year. This print beat analysts’ expectations by 4.6%. Overall, it was a very strong quarter as it also logged a beat of analysts’ EPS estimates and full-year revenue guidance topping analysts’ expectations.

The stock is up 42.8% since reporting and currently trades at $29.45.

Read our full, actionable report on Interface here, it’s free.

Brady (NYSE: BRC)

Founded in 1914 and evolving through more than a century of industrial innovation, Brady (NYSE: BRC) manufactures and supplies identification solutions and workplace safety products that help companies identify and protect their premises, products, and people.

Brady reported revenues of $397.3 million, up 15.7% year on year. This number surpassed analysts’ expectations by 2.7%. It was a strong quarter as it also put up a decent beat of analysts’ full-year EPS guidance estimates and a beat of analysts’ EPS estimates.

The stock is up 3.1% since reporting and currently trades at $80.31.

Read our full, actionable report on Brady here, it’s free.

Market Update

Thanks to the Fed’s rate hikes in 2022 and 2023, inflation has been on a steady path downward, easing back toward that 2% sweet spot. Fortunately (miraculously to some), all this tightening didn’t send the economy tumbling into a recession, so here we are, cautiously celebrating a soft landing. The cherry on top? Recent rate cuts (half a point in September 2024, a quarter in November) have propped up markets, especially after Trump’s November win lit a fire under major indices and sent them to all-time highs. However, there’s still plenty to ponder — tariffs, corporate tax cuts, and what 2025 might hold for the economy.

Want to invest in winners with rock-solid fundamentals? Check out our Top 6 Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

StockStory is growing and hiring equity analyst and marketing roles. Are you a 0 to 1 builder passionate about the markets and AI? See the open roles here.

More News

View More

Recent Quotes

View More

Quotes delayed at least 20 minutes.

By accessing this page, you agree to the Privacy Policy and Terms Of Service.