3 Reasons WYNN is Risky and 1 Stock to Buy Instead

The past six months have been a windfall for Wynn Resorts’s shareholders. The company’s stock price has jumped 42.5%, hitting $126.71 per share. This run-up might have investors contemplating their next move.

Is now the time to buy Wynn Resorts, or should you be careful about including it in your portfolio? Dive into our full research report to see our analyst team’s opinion, it’s free.

Why Is Wynn Resorts Not Exciting?

Despite the momentum, we're cautious about Wynn Resorts. Here are three reasons there are better opportunities than WYNN and a stock we'd rather own.

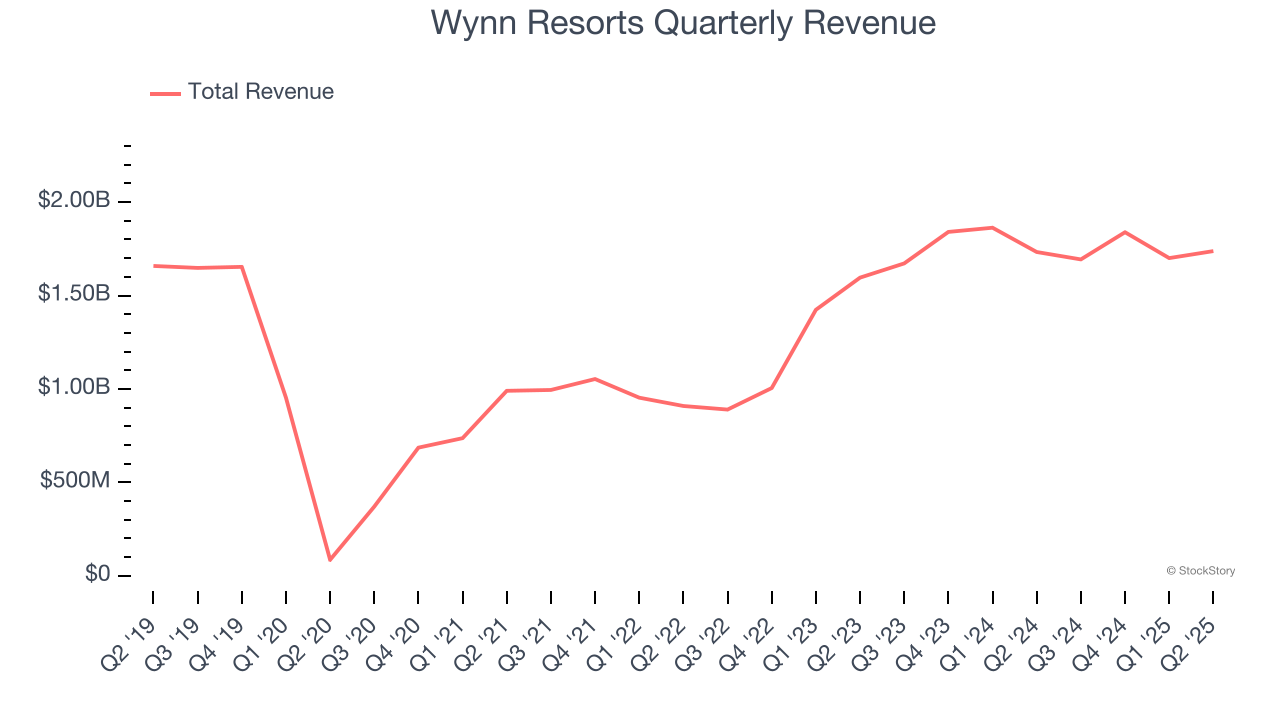

1. Long-Term Revenue Growth Disappoints

A company’s long-term sales performance can indicate its overall quality. Any business can experience short-term success, but top-performing ones enjoy sustained growth for years. Regrettably, Wynn Resorts’s sales grew at a tepid 9.9% compounded annual growth rate over the last five years. This was below our standard for the consumer discretionary sector.

2. Previous Growth Initiatives Haven’t Impressed

Growth gives us insight into a company’s long-term potential, but how capital-efficient was that growth? A company’s ROIC explains this by showing how much operating profit it makes compared to the money it has raised (debt and equity).

Wynn Resorts historically did a mediocre job investing in profitable growth initiatives. Its five-year average ROIC was 4%, lower than the typical cost of capital (how much it costs to raise money) for consumer discretionary companies.

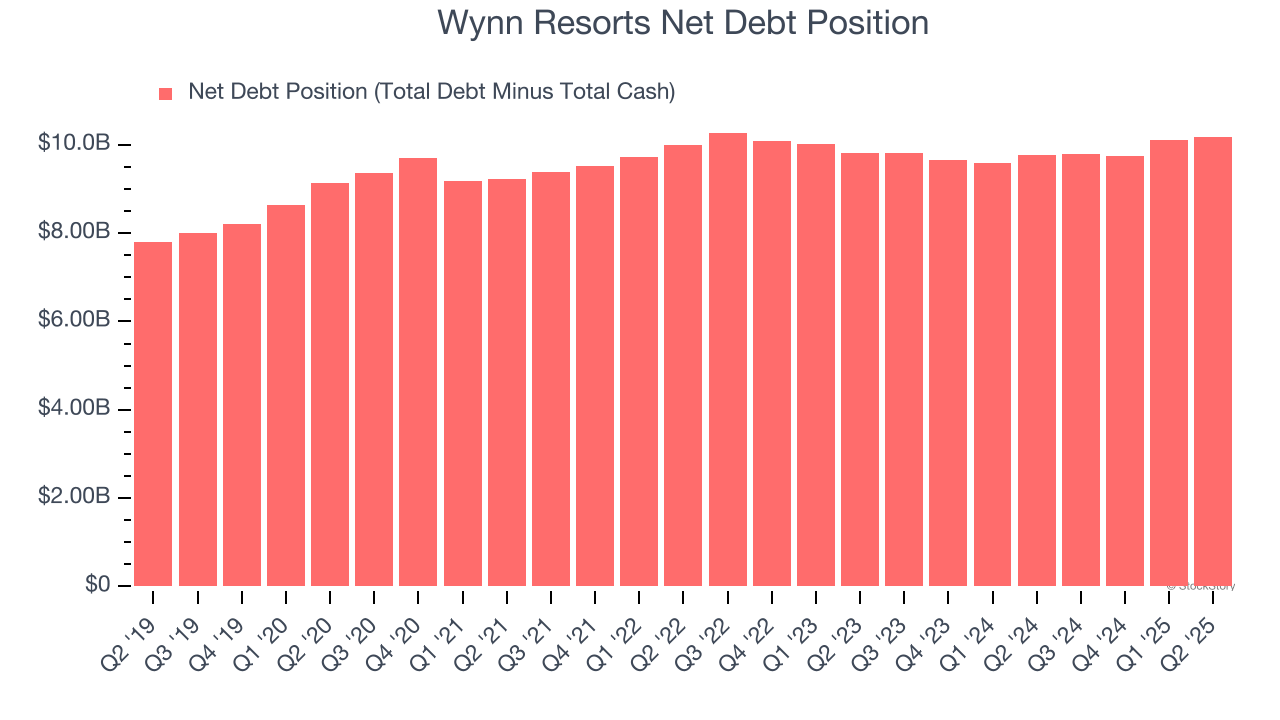

3. High Debt Levels Increase Risk

As long-term investors, the risk we care about most is the permanent loss of capital, which can happen when a company goes bankrupt or raises money from a disadvantaged position. This is separate from short-term stock price volatility, something we are much less bothered by.

Wynn Resorts’s $12.17 billion of debt exceeds the $1.98 billion of cash on its balance sheet. Furthermore, its 5× net-debt-to-EBITDA ratio (based on its EBITDA of $1.86 billion over the last 12 months) shows the company is overleveraged.

At this level of debt, incremental borrowing becomes increasingly expensive and credit agencies could downgrade the company’s rating if profitability falls. Wynn Resorts could also be backed into a corner if the market turns unexpectedly – a situation we seek to avoid as investors in high-quality companies.

We hope Wynn Resorts can improve its balance sheet and remain cautious until it increases its profitability or pays down its debt.

Final Judgment

Wynn Resorts isn’t a terrible business, but it doesn’t pass our quality test. Following the recent surge, the stock trades at 27.2× forward P/E (or $126.71 per share). This valuation multiple is fair, but we don’t have much faith in the company. We're fairly confident there are better stocks to buy right now. We’d suggest looking at the most entrenched endpoint security platform on the market.

High-Quality Stocks for All Market Conditions

When Trump unveiled his aggressive tariff plan in April 2025, markets tanked as investors feared a full-blown trade war. But those who panicked and sold missed the subsequent rebound that’s already erased most losses.

Don’t let fear keep you from great opportunities and take a look at Top 6 Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 183% over the last five years (as of March 31st 2025).

Stocks that made our list in 2020 include now familiar names such as Nvidia (+1,545% between March 2020 and March 2025) as well as under-the-radar businesses like the once-small-cap company Comfort Systems (+782% five-year return). Find your next big winner with StockStory today.

StockStory is growing and hiring equity analyst and marketing roles. Are you a 0 to 1 builder passionate about the markets and AI? See the open roles here.

More News

View More

Recent Quotes

View More

Quotes delayed at least 20 minutes.

By accessing this page, you agree to the Privacy Policy and Terms Of Service.