Unpacking Q2 Earnings: Elanco (NYSE:ELAN) In The Context Of Other Pharmaceuticals Stocks

Quarterly earnings results are a good time to check in on a company’s progress, especially compared to its peers in the same sector. Today we are looking at Elanco (NYSE: ELAN) and the best and worst performers in the pharmaceuticals industry.

The pharmaceuticals sector develops, manufactures, and distributes drugs, benefiting from diversified portfolios of branded and generic medications. Looking ahead, growth will be driven by innovations in precision medicine, such as genetic therapies and advanced biologics, and the increasing use of AI to speed and increase the efficiency of drug discovery. These could specifically magnify the advantages of the most scaled players. Conversely, the sector faces considerable headwinds from intense, bipartisan political pressure on drug pricing, scrutiny of patent practices, and growing competition from biosimilars. These could specifically stymie the growth of smaller companies or ones facing patent expirations on key drugs.

The 16 pharmaceuticals stocks we track reported a strong Q2. As a group, revenues beat analysts’ consensus estimates by 2.9% while next quarter’s revenue guidance was in line.

Luckily, pharmaceuticals stocks have performed well with share prices up 13.3% on average since the latest earnings results.

Elanco (NYSE: ELAN)

Originally established as a division of pharmaceutical giant Eli Lilly before becoming independent in 2018, Elanco Animal Health (NYSE: ELAN) develops and sells medications, vaccines, and other health products for pets and farm animals across more than 90 countries.

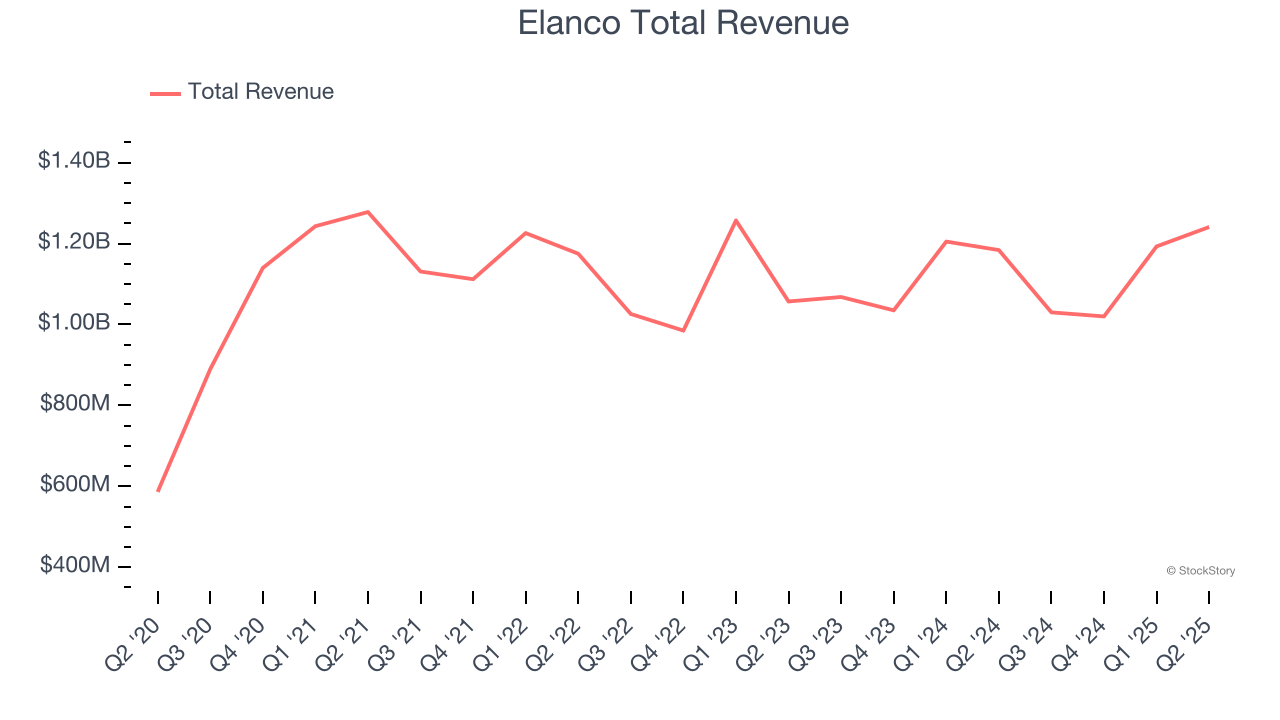

Elanco reported revenues of $1.24 billion, up 4.8% year on year. This print exceeded analysts’ expectations by 4.7%. Overall, it was a very strong quarter for the company with a solid beat of analysts’ constant currency revenue estimates and a beat of analysts’ EPS estimates.

"I'd like to thank our global Elanco team for delivering our 8th straight quarter of growth, driving results beyond expectations," said Jeff Simmons, President and CEO of Elanco.

Interestingly, the stock is up 32.5% since reporting and currently trades at $18.53.

Is now the time to buy Elanco? Access our full analysis of the earnings results here, it’s free.

Best Q2: Supernus Pharmaceuticals (NASDAQ: SUPN)

With a diverse portfolio of eight FDA-approved medications targeting neurological conditions, Supernus Pharmaceuticals (NASDAQ: SUPN) develops and markets treatments for central nervous system disorders including epilepsy, ADHD, Parkinson's disease, and migraine.

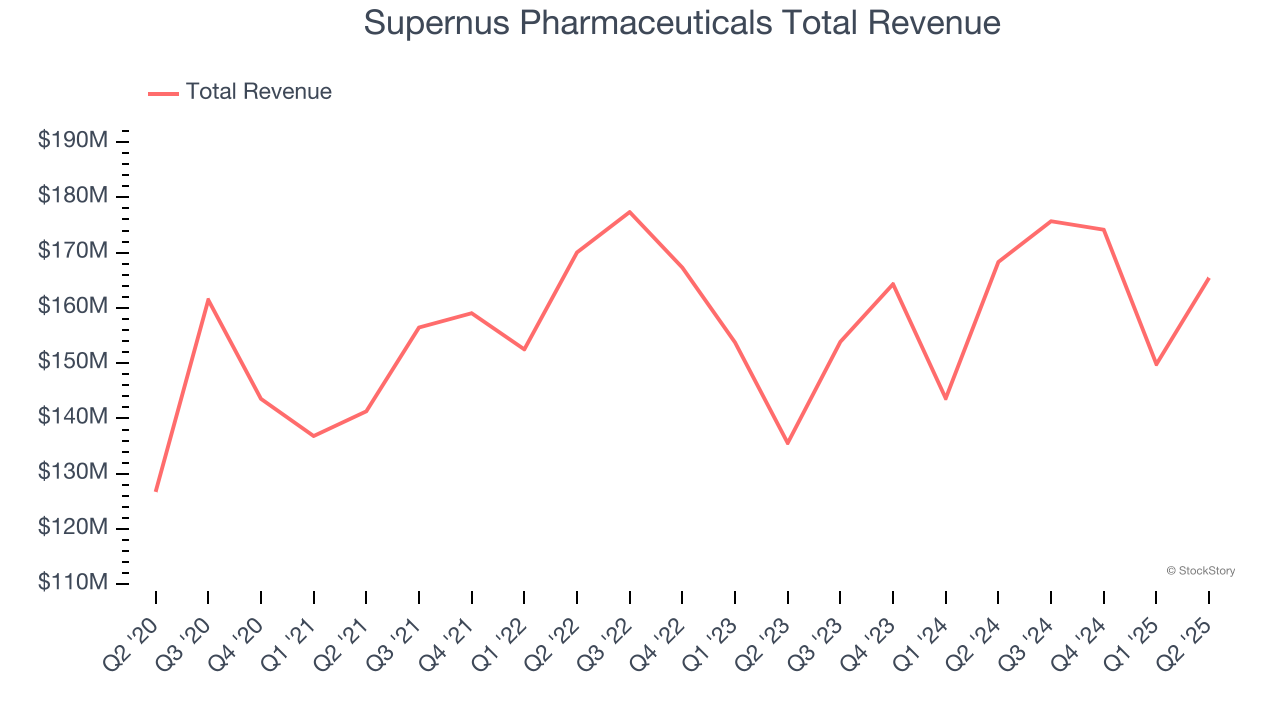

Supernus Pharmaceuticals reported revenues of $165.5 million, down 1.7% year on year, outperforming analysts’ expectations by 7.4%. The business had an incredible quarter with a beat of analysts’ EPS estimates and full-year operating income guidance exceeding analysts’ expectations.

Supernus Pharmaceuticals delivered the highest full-year guidance raise among its peers. The market seems happy with the results as the stock is up 17.5% since reporting. It currently trades at $44.09.

Is now the time to buy Supernus Pharmaceuticals? Access our full analysis of the earnings results here, it’s free.

Corcept (NASDAQ: CORT)

Focusing on the powerful stress hormone that affects everything from metabolism to immune function, Corcept Therapeutics (NASDAQ: CORT) develops and markets medications that modulate cortisol to treat endocrine disorders, cancer, and neurological diseases.

Corcept reported revenues of $194.4 million, up 18.7% year on year, falling short of analysts’ expectations by 3.5%. It was a softer quarter as it posted full-year revenue guidance missing analysts’ expectations.

Corcept delivered the weakest performance against analyst estimates and weakest full-year guidance update in the group. Interestingly, the stock is up 2.8% since the results and currently trades at $68.88.

Read our full analysis of Corcept’s results here.

Zoetis (NYSE: ZTS)

Originally spun off from Pfizer in 2013 as the world's largest pure-play animal health company, Zoetis (NYSE: ZTS) discovers, develops, and sells medicines, vaccines, diagnostic products, and services for pets and livestock animals worldwide.

Zoetis reported revenues of $2.46 billion, up 4.2% year on year. This result surpassed analysts’ expectations by 1.9%. Overall, it was a strong quarter as it also put up a solid beat of analysts’ constant currency revenue estimates and a beat of analysts’ EPS estimates.

The stock is up 2.7% since reporting and currently trades at $156.08.

Read our full, actionable report on Zoetis here, it’s free.

Amneal (NASDAQ: AMRX)

Founded in 2002 and growing into one of America's largest generic drug producers, Amneal Pharmaceuticals (NASDAQ: AMRX) develops, manufactures, and distributes generic medicines, specialty branded drugs, biosimilars, and injectable products for the U.S. healthcare market.

Amneal reported revenues of $724.5 million, up 3.2% year on year. This print came in 2.5% below analysts' expectations. Overall, it was a mixed quarter for the company.

The stock is up 17.8% since reporting and currently trades at $9.40.

Read our full, actionable report on Amneal here, it’s free.

Market Update

Thanks to the Fed’s series of rate hikes in 2022 and 2023, inflation has cooled significantly from its post-pandemic highs, drawing closer to the 2% goal. This disinflation has occurred without severely impacting economic growth, suggesting the success of a soft landing. The stock market thrived in 2024, spurred by recent rate cuts (0.5% in September and 0.25% in November), and a notable surge followed Donald Trump’s presidential election win in November, propelling indices to historic highs. Nonetheless, the outlook for 2025 remains clouded by potential trade policy changes and corporate tax discussions, which could impact business confidence and growth. The path forward holds both optimism and caution as new policies take shape.

Want to invest in winners with rock-solid fundamentals? Check out our Top 5 Quality Compounder Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

StockStory is growing and hiring equity analyst and marketing roles. Are you a 0 to 1 builder passionate about the markets and AI? See the open roles here.

More News

View More

Recent Quotes

View More

Quotes delayed at least 20 minutes.

By accessing this page, you agree to the Privacy Policy and Terms Of Service.