3 Reasons to Sell FULT and 1 Stock to Buy Instead

Since March 2025, Fulton Financial has been in a holding pattern, posting a small return of 2.3% while floating around $18.80. The stock also fell short of the S&P 500’s 15.7% gain during that period.

Is there a buying opportunity in Fulton Financial, or does it present a risk to your portfolio? Get the full stock story straight from our expert analysts, it’s free.

Why Is Fulton Financial Not Exciting?

We don't have much confidence in Fulton Financial. Here are three reasons we avoid FULT and a stock we'd rather own.

1. Projected Net Interest Income Growth Is Slim

Forecasted net interest income by Wall Street analysts signals a company’s potential. Predictions may not always be accurate, but accelerating growth typically boosts valuation multiples and stock prices while slowing growth does the opposite.

Over the next 12 months, sell-side analysts expect Fulton Financial’s net interest income to rise by 1.9%, a deceleration versus its 8.2% annualized growth for the past two years. This projection is below its 8.2% annualized growth rate for the past two years.

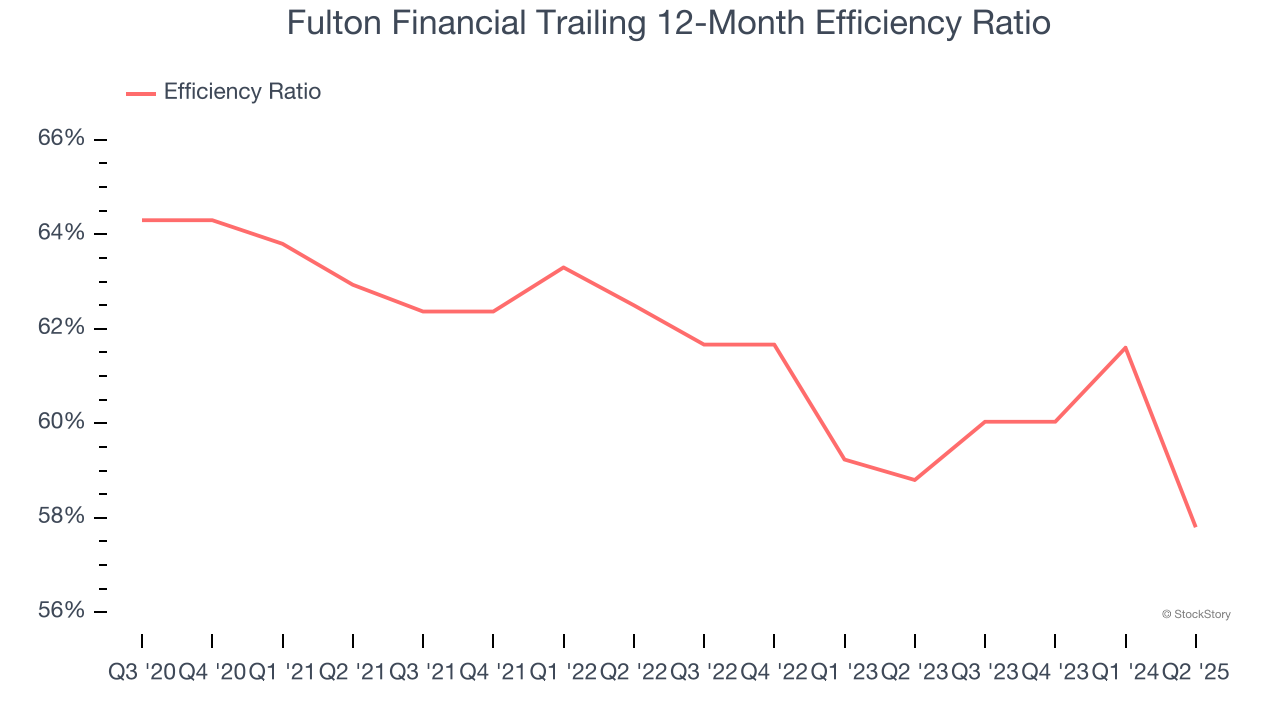

2. Efficiency Ratio Expected to Falter

Topline growth carries importance, but the overall profitability behind this expansion determines true value creation. For banks, the efficiency ratio captures this relationship by measuring non-interest expenses, including salaries, facilities, technology, and marketing, against total revenue.

Markets emphasize efficiency ratio trends over static measurements, recognizing that revenue compositions drive different expense bases. Lower efficiency ratios signal superior performance by indicating that banks are controlling costs effectively relative to their income.

For the next 12 months, Wall Street expects Fulton Financial to become less profitable as it anticipates an efficiency ratio of 60.6% compared to 57.8% over the past year.

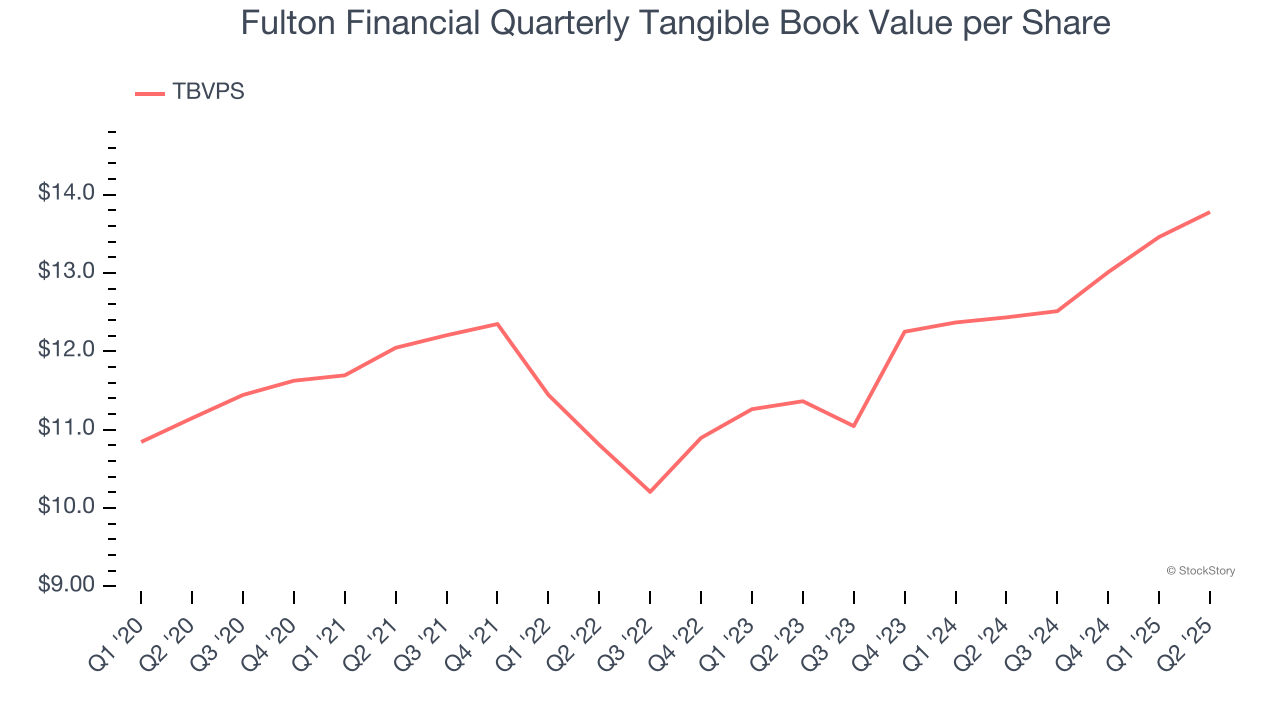

3. TBVPS Growth Demonstrates Strong Asset Foundation

Tangible book value per share (TBVPS) serves as a key indicator of a bank’s financial strength, representing the hard assets available to shareholders after removing intangible assets that could evaporate during financial distress.

Although Fulton Financial’s TBVPS increased by a meager 4.3% annually over the last five years, the good news is that its growth has recently accelerated as TBVPS grew at a decent 10.1% annual clip over the past two years (from $11.36 to $13.78 per share).

Final Judgment

Fulton Financial isn’t a terrible business, but it doesn’t pass our bar. With its shares lagging the market recently, the stock trades at 1× forward P/B (or $18.80 per share). This valuation multiple is fair, but we don’t have much faith in the company. We're fairly confident there are better stocks to buy right now. Let us point you toward our favorite semiconductor picks and shovels play.

Stocks We Like More Than Fulton Financial

Trump’s April 2025 tariff bombshell triggered a massive market selloff, but stocks have since staged an impressive recovery, leaving those who panic sold on the sidelines.

Take advantage of the rebound by checking out our Top 9 Market-Beating Stocks. This is a curated list of our High Quality stocks that have generated a market-beating return of 183% over the last five years (as of March 31st 2025).

Stocks that made our list in 2020 include now familiar names such as Nvidia (+1,545% between March 2020 and March 2025) as well as under-the-radar businesses like the once-micro-cap company Tecnoglass (+1,754% five-year return). Find your next big winner with StockStory today.

StockStory is growing and hiring equity analyst and marketing roles. Are you a 0 to 1 builder passionate about the markets and AI? See the open roles here.

More News

View More

Recent Quotes

View More

Quotes delayed at least 20 minutes.

By accessing this page, you agree to the Privacy Policy and Terms Of Service.