Winners And Losers Of Q2: Enphase (NASDAQ:ENPH) Vs The Rest Of The Renewable Energy Stocks

Quarterly earnings results are a good time to check in on a company’s progress, especially compared to its peers in the same sector. Today we are looking at Enphase (NASDAQ: ENPH) and the best and worst performers in the renewable energy industry.

Renewable energy companies are buoyed by the secular trend of green energy that is upending traditional power generation. Those who innovate and evolve with this dynamic market can win share while those who continue to rely on legacy technologies can see diminishing demand, which includes headwinds from increasing regulation against “dirty” energy. Additionally, these companies are at the whim of economic cycles, as interest rates can impact the willingness to invest in renewable energy projects.

The 15 renewable energy stocks we track reported a strong Q2. As a group, revenues beat analysts’ consensus estimates by 7.7% while next quarter’s revenue guidance was in line.

Luckily, renewable energy stocks have performed well with share prices up 16.5% on average since the latest earnings results.

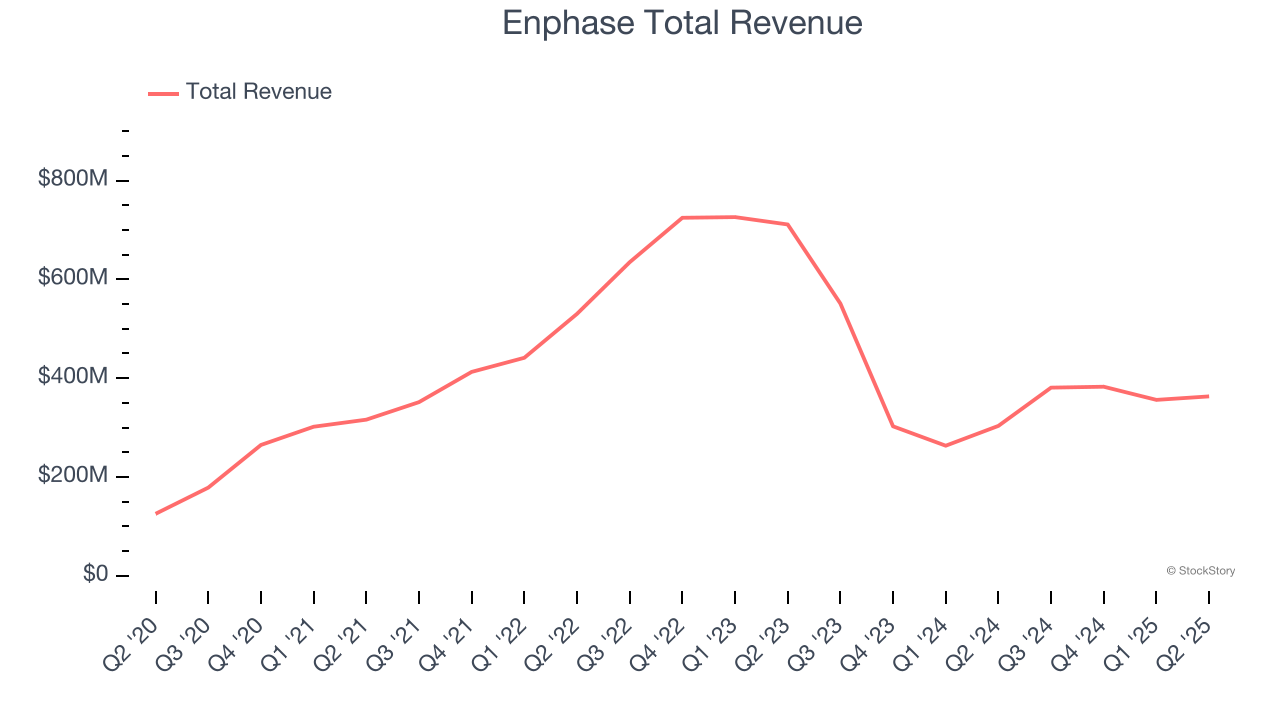

Enphase (NASDAQ: ENPH)

The first company to successfully commercialize the solar micro-inverter, Enphase (NASDAQ: ENPH) manufactures software-driven home energy products.

Enphase reported revenues of $363.2 million, up 19.7% year on year. This print exceeded analysts’ expectations by 1.3%. Despite the top-line beat, it was still a slower quarter for the company with a significant miss of analysts’ EBITDA estimates and a miss of analysts’ sales volume estimates.

Unsurprisingly, the stock is down 13.4% since reporting and currently trades at $36.81.

Read our full report on Enphase here, it’s free.

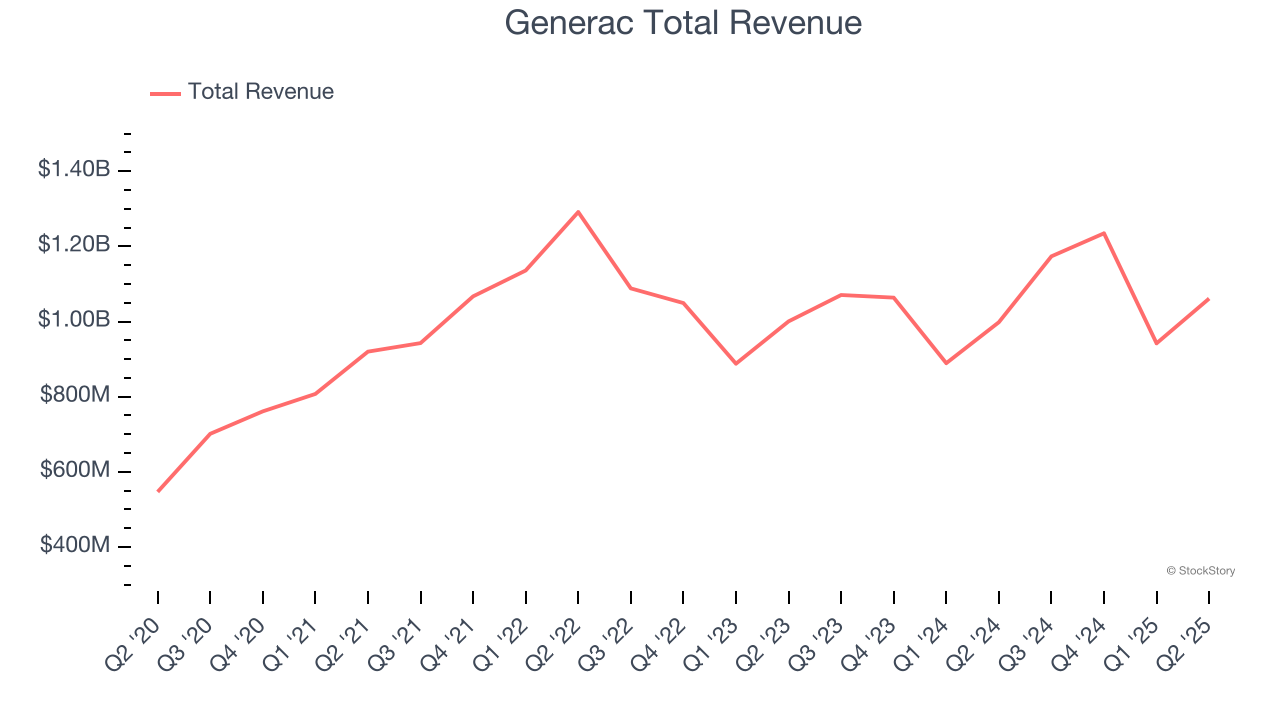

Best Q2: Generac (NYSE: GNRC)

With its name deriving from a combination of “generating” and “AC”, Generac (NYSE: GNRC) offers generators and other power products for residential, industrial, and commercial use.

Generac reported revenues of $1.06 billion, up 6.3% year on year, outperforming analysts’ expectations by 3.4%. The business had an incredible quarter with a solid beat of analysts’ EBITDA estimates and an impressive beat of analysts’ adjusted operating income estimates.

The market seems happy with the results as the stock is up 18.6% since reporting. It currently trades at $179.50.

Is now the time to buy Generac? Access our full analysis of the earnings results here, it’s free.

Weakest Q2: Plug Power (NASDAQ: PLUG)

Powering forklifts for Walmart’s distribution centers, Plug Power (NASDAQ: PLUG) provides hydrogen fuel cells used to power electric motors.

Plug Power reported revenues of $174 million, up 21.4% year on year, exceeding analysts’ expectations by 10.4%. Still, it was a softer quarter as it posted a significant miss of analysts’ adjusted operating income estimates and a significant miss of analysts’ EBITDA estimates.

As expected, the stock is down 6.6% since the results and currently trades at $1.49.

Read our full analysis of Plug Power’s results here.

American Superconductor (NASDAQ: AMSC)

Founded in 1987, American Superconductor (NASDAQ: AMSC) has shifted from superconductor research to developing power systems, adapting to changing energy grid needs and naval technology requirements.

American Superconductor reported revenues of $72.36 million, up 79.6% year on year. This result surpassed analysts’ expectations by 11.4%. Overall, it was a stunning quarter as it also recorded EPS guidance for next quarter exceeding analysts’ expectations and a beat of analysts’ EPS estimates.

American Superconductor scored the fastest revenue growth among its peers. The stock is up 11.2% since reporting and currently trades at $48.87.

Read our full, actionable report on American Superconductor here, it’s free.

EnerSys (NYSE: ENS)

Supplying batteries that power equipment as big as mining rigs, EnerSys (NYSE: ENS) manufactures various kinds of batteries for a range of industries.

EnerSys reported revenues of $893 million, up 4.7% year on year. This number topped analysts’ expectations by 5.3%. It was a very strong quarter as it also produced an impressive beat of analysts’ sales volume estimates and a solid beat of analysts’ adjusted operating income estimates.

The stock is up 12% since reporting and currently trades at $102.25.

Read our full, actionable report on EnerSys here, it’s free.

Market Update

Thanks to the Fed’s rate hikes in 2022 and 2023, inflation has been on a steady path downward, easing back toward that 2% sweet spot. Fortunately (miraculously to some), all this tightening didn’t send the economy tumbling into a recession, so here we are, cautiously celebrating a soft landing. The cherry on top? Recent rate cuts (half a point in September 2024, a quarter in November) have propped up markets, especially after Trump’s November win lit a fire under major indices and sent them to all-time highs. However, there’s still plenty to ponder — tariffs, corporate tax cuts, and what 2025 might hold for the economy.

Want to invest in winners with rock-solid fundamentals? Check out our Hidden Gem Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

StockStory is growing and hiring equity analyst and marketing roles. Are you a 0 to 1 builder passionate about the markets and AI? See the open roles here.

More News

View More

Recent Quotes

View MoreQuotes delayed at least 20 minutes.

By accessing this page, you agree to the Privacy Policy and Terms Of Service.