It was once famously said as General Motors (NYSE: GM) goes so goes the nation. Today, investors who are looking at which direction the nation, or at least the national economy, is moving may want to look at Dollar Tree Inc. (NASDAQ: DLTR). If that theory is true, the predictions of an upcoming recession may be correct.

Dollar Tree reported weaker-than-expected numbers on the top and bottom line, with earnings per share (EPS) of 97 cents on revenue of $7.31 billion. Dollar Tree earnings estimates on MarketBeat called for EPS of $1.01 on revenue of $7.4 billion.

In the all-important category of comparable store (i.e., same store) sales, Dollar Tree also came in light with 3.9% growth far below analysts' expectations of 5.3%.

Shares of DLTR stock surged higher in the pre-market on expectations of a better report. At one point shares had surged 4% from their November 28 closing price. But shares are falling after the company's report and earnings call.

As you'll see, at first glance, the story seems pretty cut and dry. It's a bearish narrative when even dollar stores are seeing reduced sales volume. These companies attract low- to middle-income consumers whose spending habits are often the harbinger of good or bad news for the economy. On the other hand, there were some bright spots in the report that may make DLTR stock attractive, but perhaps not right now.

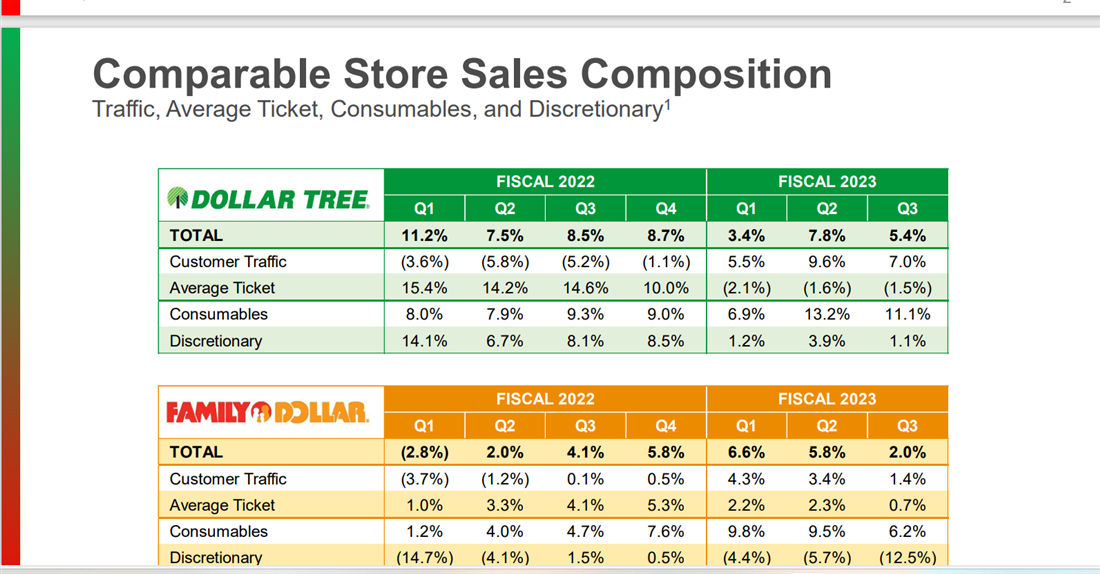

The one chart that says it all

Here's a chart from Dollar Tree's earnings presentation. As an investor, it tells you all you need to know. Traffic for both Dollar Tree and Family Dollar stores is up from 2022, but the total amount that consumers are buying (i.e. average ticket) is down. This also points out what many retailers have said this earnings season: consumers are clearly prioritizing consumables (i.e., consumer staples) over discretionary items.

On the earnings call, Dollar Tree CEO Rick Dreiling remarked, "We saw a notable pullback in spending particularly in higher margin discretionary categories." To help quantify that, the company reported a 12.5% decline in discretionary categories such as home décor, electronics, and toys.

Shrink remains an issue

Inventory shrink, which is the current euphemism for retail theft, has been a recurring theme in retail earnings reports. Dollar Tree is no exception. While operating margins improved slightly in the quarter, shrink as a line item was one of the largest drags on margins. Simply put, the cost to replace stolen goods increases production costs. And taking measures to stop shrink can eat into revenue and earnings as well.

In another recurring theme, payroll expenses are eating into margin as the company is offering higher wages to attract and keep employees.

All hope isn't lost

Another chart in the company's presentation offers more hope for investors. It shows that Dollar Tree stores are taking a higher percentage of market share for consumers shopping for staple items. That's not much comfort when revenue and earnings are lower than estimates. Still, it potentially makes Dollar Tree – and other dollar stores – the best places to be in a generally bad retail environment.

Another bright spot, at least temporarily, is that fuel costs are down. This is helping to offset some of the margin pressures. The question is how long that will last.

Truist may have it right

On November 27, 2023, Truist Financial Corporation (NYSE: TFC) reiterated its Buy rating for DLTR stock with a price target of $129. That price target is significantly lower than the consensus price target of $148.39. However, since that target was set before the earnings report, the Truist number seems more accurate. That also correlates with activity on the MarketBeat Options Chain for early January.

If you believe the stock formed a bottom in October of this year and bought that dip, you're sitting on a gain. That's better than many retail stocks. However, without a dividend, it's tough to make Dollar Tree a hold. It could be an opportunity to offset that gain with some losses as part of a tax harvesting strategy.