Energy recovery device manufacturer Energy Recovery (NASDAQ:ERII) fell short of the market’s revenue expectations in Q3 CY2024 as sales rose 4.2% year on year to $38.58 million. Its non-GAAP profit of $0.21 per share was 50% above analysts’ consensus estimates.

Is now the time to buy Energy Recovery? Find out by accessing our full research report, it’s free.

Energy Recovery (ERII) Q3 CY2024 Highlights:

- Revenue: $38.58 million vs analyst estimates of $39.12 million (1.4% miss)

- Adjusted EPS: $0.21 vs analyst estimates of $0.14 (50% beat)

- EBITDA: $11.6 million vs analyst estimates of $3 million (287% beat)

- Gross Margin (GAAP): 65.1%, down from 69.9% in the same quarter last year

- Operating Margin: 18.3%, down from 24.7% in the same quarter last year

- EBITDA Margin: 30.1%, up from 27.5% in the same quarter last year

- Market Capitalization: $1.01 billion

David Moon, President and CEO, commented on the financial results, “We delivered strong third quarter results, hitting the upper end of our guidance for the quarter and, although there is still work to be done, we believe we are well-positioned in this quarter to deliver on our guidance for the full year. Our core desalination business continues to demonstrate durability of growth, our wastewater business continues to expand, and we are making real progress this year in our CO2 refrigeration business.”

Company Overview

Having saved far more than a trillion gallons of water, Energy Recovery (NASDAQ:ERII) provides energy recovery devices to the water treatment, oil and gas, and chemical processing sectors.

Water Infrastructure

Trends towards conservation and reducing groundwater depletion are putting water infrastructure and treatment products front and center. Companies that can innovate and create solutions–especially automated or connected solutions–to address these thematic trends will create incremental demand and speed up replacement cycles. On the other hand, water infrastructure and treatment companies are at the whim of economic cycles. Consumer spending and interest rates, for example, can greatly impact the industrial production that drives demand for these companies’ offerings.

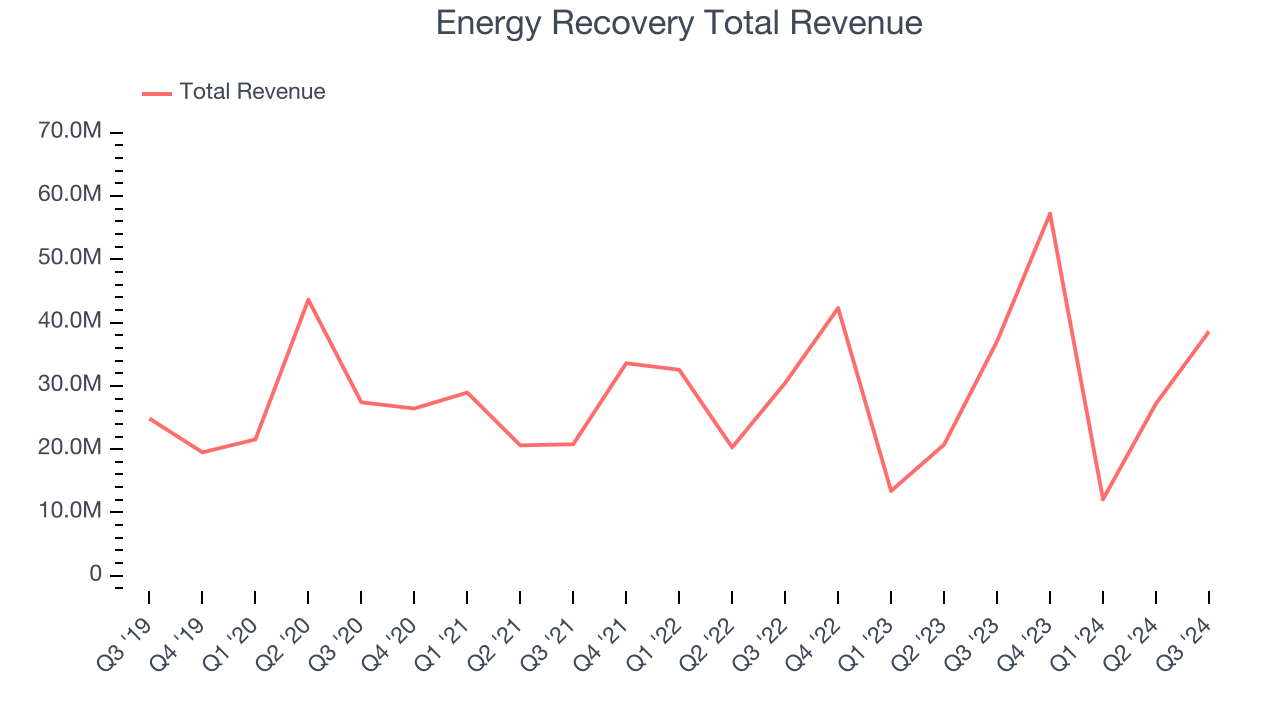

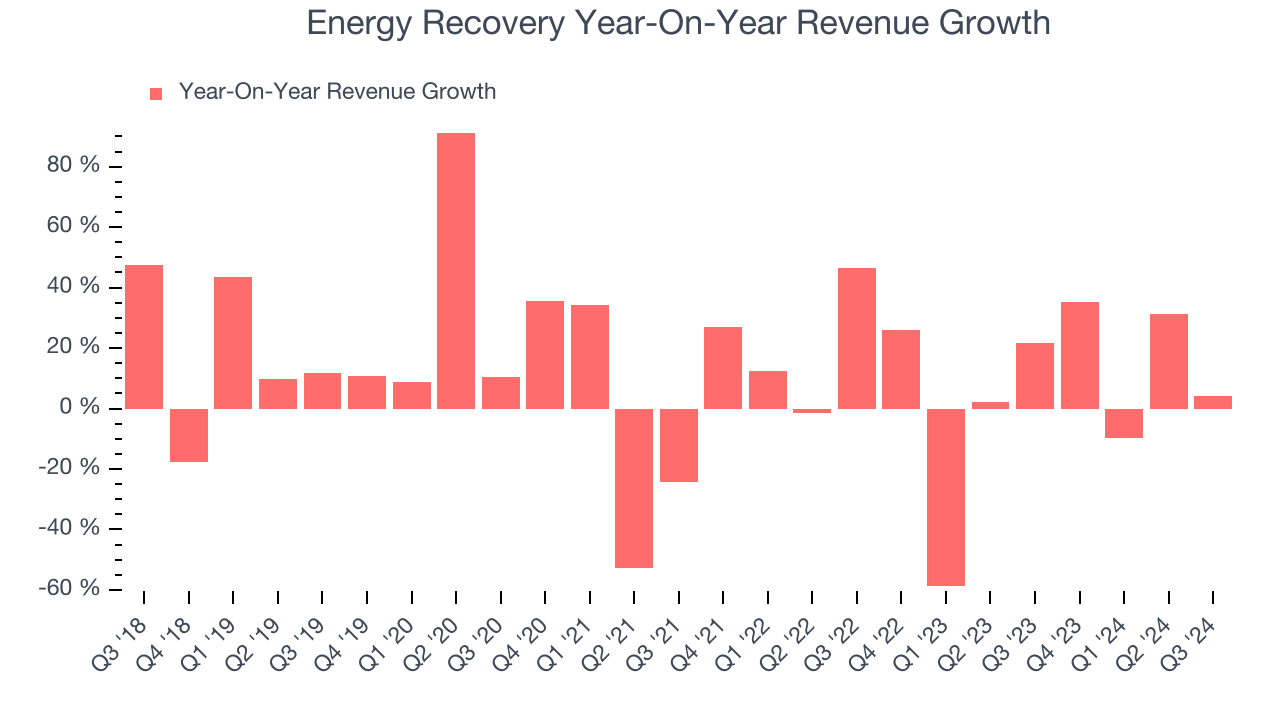

Sales Growth

A company’s long-term performance can indicate its business quality. Any business can put up a good quarter or two, but many enduring ones grow for years. Luckily, Energy Recovery’s sales grew at a solid 9.7% compounded annual growth rate over the last five years. This is encouraging because it shows Energy Recovery was more successful in expanding than most industrials companies.

We at StockStory place the most emphasis on long-term growth, but within industrials, a half-decade historical view may miss cycles, industry trends, or a company capitalizing on catalysts such as a new contract win or a successful product line. Energy Recovery’s recent history shows its demand slowed as its annualized revenue growth of 7.5% over the last two years is below its five-year trend.

This quarter, Energy Recovery’s revenue grew 4.2% year on year to $38.58 million, falling short of Wall Street’s estimates.

Looking ahead, sell-side analysts expect revenue to grow 26.9% over the next 12 months, an improvement versus the last two years. This projection is admirable and illustrates the market believes its newer products and services will fuel higher growth rates.

Unless you’ve been living under a rock, it should be obvious by now that generative AI is going to have a huge impact on how large corporations do business. While Nvidia and AMD are trading close to all-time highs, we prefer a lesser-known (but still profitable) semiconductor stock benefitting from the rise of AI. Click here to access our free report on our favorite semiconductor growth story.

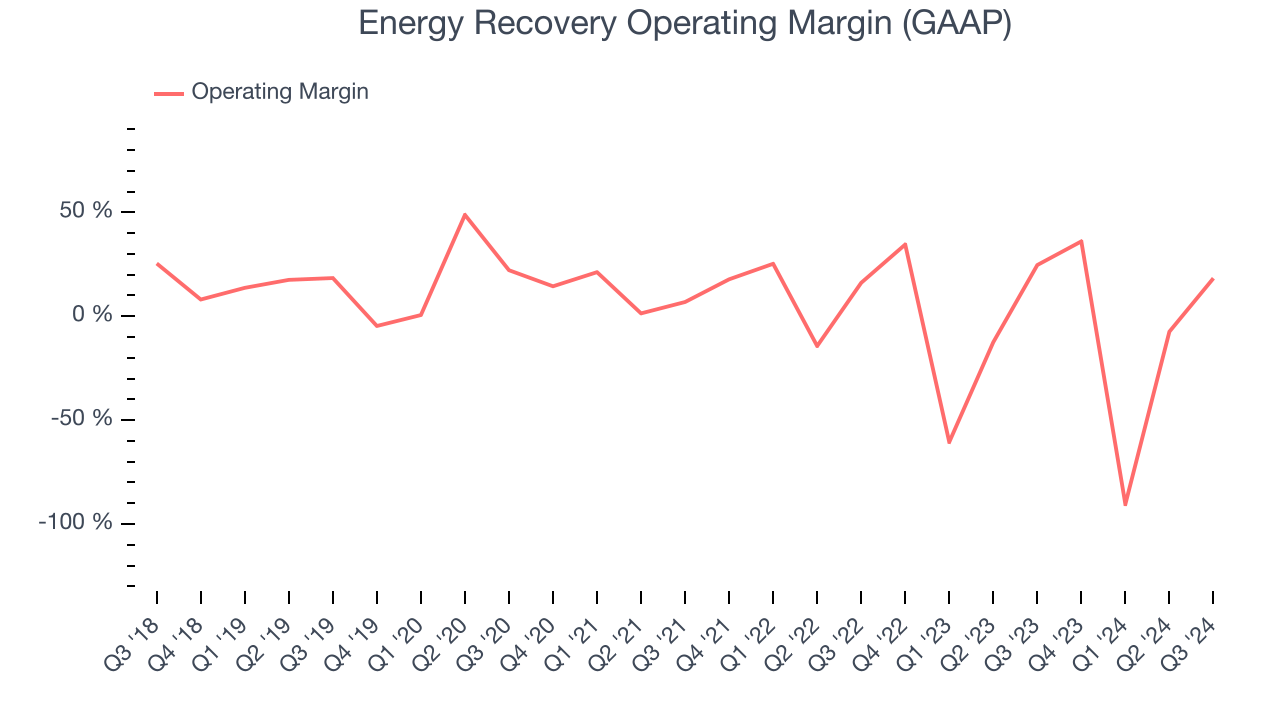

Operating Margin

Operating margin is one of the best measures of profitability because it tells us how much money a company takes home after procuring and manufacturing its products, marketing and selling them, and, most importantly, keeping them relevant through research and development.

Energy Recovery has been an optimally-run company over the last five years. It was one of the more profitable businesses in the industrials sector, boasting an average operating margin of 14.3%. This result isn’t surprising as its high gross margin gives it a favorable starting point.

Analyzing the trend in its profitability, Energy Recovery’s annual operating margin decreased by 12.8 percentage points over the last five years. Even though its margin is still high, shareholders will want to see Energy Recovery become more profitable in the future.

In Q3, Energy Recovery generated an operating profit margin of 18.3%, down 6.4 percentage points year on year. Since Energy Recovery’s operating margin decreased more than its gross margin, we can assume it was recently less efficient because expenses such as marketing, R&D, and administrative overhead increased.

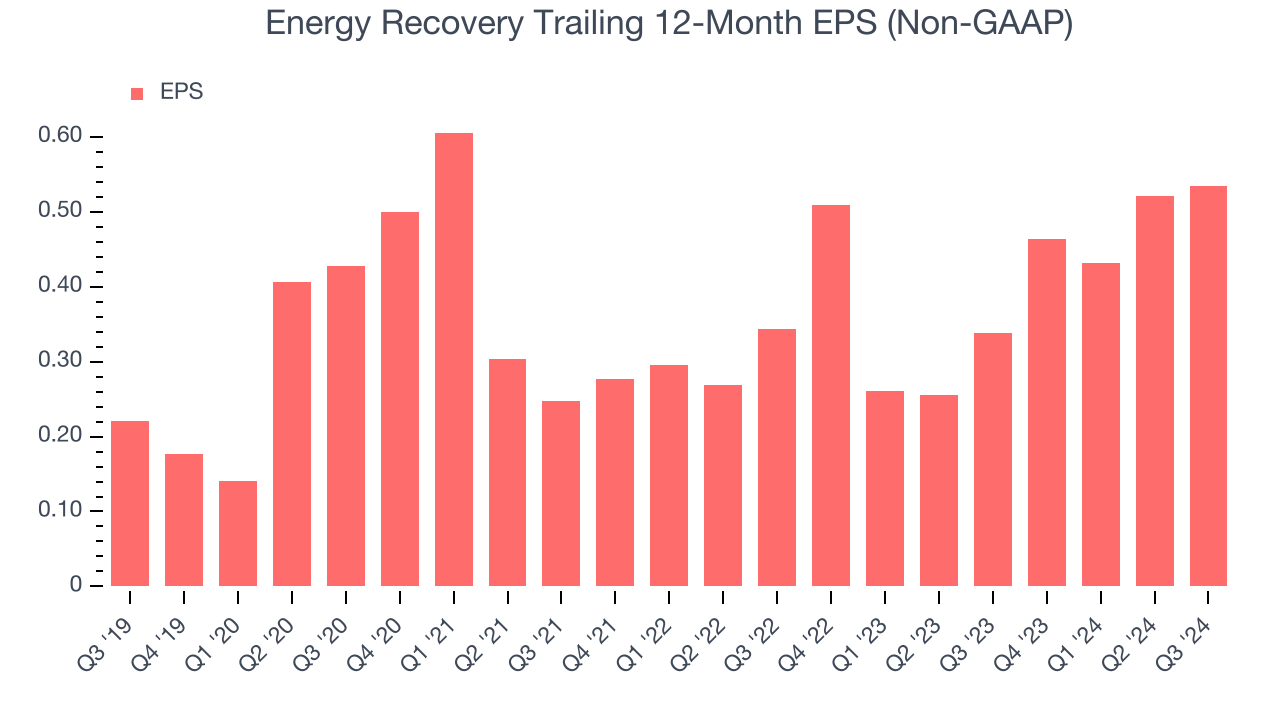

Earnings Per Share

We track the long-term change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth was profitable.

Energy Recovery’s EPS grew at an astounding 19.4% compounded annual growth rate over the last five years, higher than its 9.7% annualized revenue growth. However, this alone doesn’t tell us much about its business quality because its operating margin didn’t expand.

Like with revenue, we analyze EPS over a shorter period to see if we are missing a change in the business. Energy Recovery’s two-year annual EPS growth of 24.9% was fantastic and topped its 7.5% two-year revenue growth.

In Q3, Energy Recovery reported EPS at $0.21, up from $0.20 in the same quarter last year. This print easily cleared analysts’ estimates, and shareholders should be content with the results. Over the next 12 months, Wall Street expects Energy Recovery’s full-year EPS of $0.54 to grow by 31.1%.

Key Takeaways from Energy Recovery’s Q3 Results

We were impressed by how significantly Energy Recovery blew past analysts’ EBITDA and EPS expectations this quarter. On the other hand, its revenue missed. Overall, we think this was a decent quarter with some key metrics above expectations. The stock remained flat at $17.86 immediately following the results.

Should you buy the stock or not?If you’re making that decision, you should consider the bigger picture of valuation, business qualities, as well as the latest earnings. We cover that in our actionable full research report which you can read here, it’s free.