Home security provider Arlo (NYSE:ARLO) announced better-than-expected revenue in Q3 CY2024, with sales up 5.9% year on year to $137.7 million. On the other hand, next quarter’s revenue guidance of $121 million was less impressive, coming in 12.9% below analysts’ estimates. Its GAAP loss of $0.04 per share was 45.5% below analysts’ consensus estimates.

Is now the time to buy Arlo? Find out by accessing our full research report, it’s free.

Arlo (ARLO) Q3 CY2024 Highlights:

- Revenue: $137.7 million vs analyst estimates of $136.1 million (1.1% beat)

- EPS: -$0.04 vs analyst expectations of -$0.03 (45.5% miss)

- EBITDA: -$4.74 million vs analyst estimates of $10.83 million (144% miss)

- Revenue Guidance for Q4 CY2024 is $121 million at the midpoint, below analyst estimates of $138.9 million

- Gross Margin (GAAP): 35.2%, up from 33.2% in the same quarter last year

- Operating Margin: -4%, down from -1.8% in the same quarter last year

- EBITDA Margin: -3.4%, down from 6.2% in the same quarter last year

- Free Cash Flow Margin: 12.6%, up from 5.4% in the same quarter last year

- Market Capitalization: $1.18 billion

Company Overview

With its name deriving from the Old English word meaning “to see,” Arlo (NYSE:ARLO) provides home security products and other accessories to protect homes and businesses.

Internet of Things

Industrial Internet of Things (IoT) companies are buoyed by the secular trend of a more connected world. They often specialize in nascent areas such as hardware and services for factory automation, fleet tracking, or smart home technologies. Those who play their cards right can generate recurring subscription revenues by providing cloud-based software services, boosting their margins. On the other hand, if the technologies these companies have invested in don’t pan out, they may have to make costly pivots.

Sales Growth

A company’s long-term performance can indicate its business quality. Any business can put up a good quarter or two, but many enduring ones grow for years. Regrettably, Arlo’s sales grew at a mediocre 7.2% compounded annual growth rate over the last five years. This shows it couldn’t expand in any major way, a tough starting point for our analysis.

Long-term growth is the most important, but within industrials, a half-decade historical view may miss new industry trends or demand cycles. Arlo’s recent history shows its demand slowed as its revenue was flat over the last two years.

This quarter, Arlo reported year-on-year revenue growth of 5.9%, and its $137.7 million of revenue exceeded Wall Street’s estimates by 1.1%. Management is currently guiding for a 10.4% year-on-year decline next quarter.

Looking further ahead, sell-side analysts expect revenue to grow 4.7% over the next 12 months, an improvement versus the last two years. While this projection indicates the market thinks its newer products and services will spur better performance, it is still below the sector average. At least the company is tracking well in other measures of financial health.

When a company has more cash than it knows what to do with, buying back its own shares can make a lot of sense–as long as the price is right. Luckily, we’ve found one, a low-priced stock that is gushing free cash flow AND buying back shares. Click here to claim your Special Free Report on a fallen angel growth story that is already recovering from a setback.

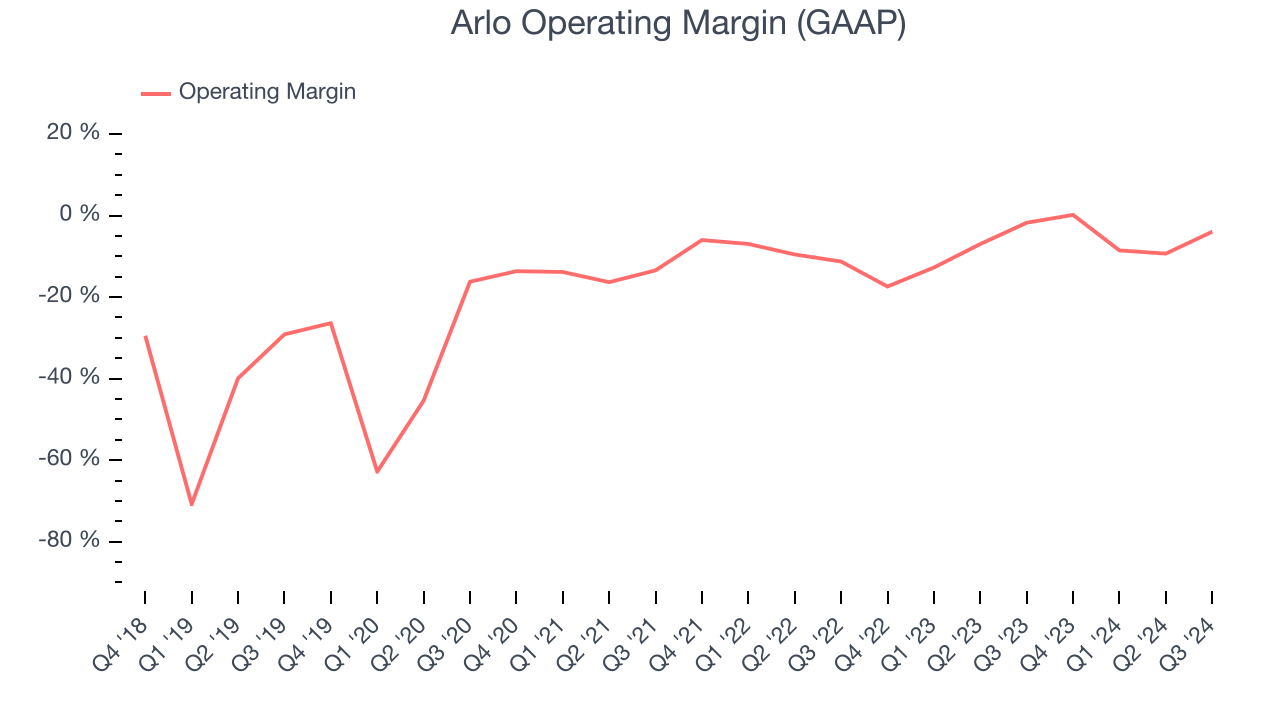

Operating Margin

Operating margin is one of the best measures of profitability because it tells us how much money a company takes home after procuring and manufacturing its products, marketing and selling them, and, most importantly, keeping them relevant through research and development.

Arlo’s high expenses have contributed to an average operating margin of negative 12.9% over the last five years. Unprofitable industrials companies require extra attention because they could get caught swimming naked when the tide goes out. It’s hard to trust that the business can endure a full cycle.

On the plus side, Arlo’s annual operating margin rose by 28 percentage points over the last five years. Still, it will take much more for the company to reach long-term profitability.

Arlo’s operating margin was negative 4% this quarter. The company's lack of profits raise a flag.

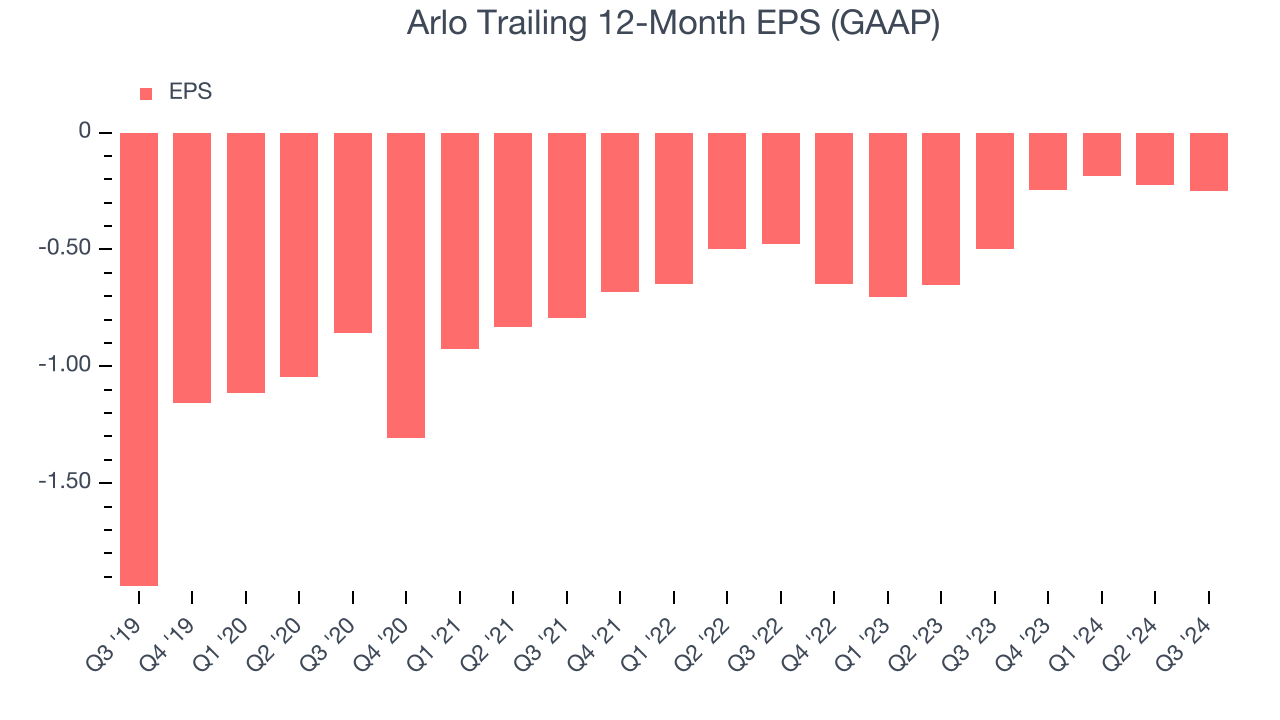

Earnings Per Share

Analyzing revenue trends tells us about a company’s historical growth, but the long-term change in its earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

Although Arlo’s full-year earnings are still negative, it reduced its losses and improved its EPS by 33.6% annually over the last five years. The next few quarters will be critical for assessing its long-term profitability. We hope to see an inflection point soon.

Like with revenue, we analyze EPS over a more recent period because it can give insight into an emerging theme or development for the business.

For Arlo, its two-year annual EPS growth of 27.5% was lower than its five-year trend. We still think its growth was good and hope it can accelerate in the future.In Q3, Arlo reported EPS at negative $0.04, down from negative $0.01 in the same quarter last year. This print missed analysts’ estimates. Over the next 12 months, Wall Street is optimistic. Analysts forecast Arlo’s full-year EPS of negative $0.25 will reach break even.

Key Takeaways from Arlo’s Q3 Results

It was good to see Arlo beat analysts’ revenue expectations this quarter. On the other hand, its revenue guidance for next quarter missed and its EBITDA fell short of Wall Street’s estimates. Overall, this was a weaker quarter. The stock traded down 14.5% to $10.41 immediately following the results.

Arlo underperformed this quarter, but does that create an opportunity to invest right now? The latest quarter does matter, but not nearly as much as longer-term fundamentals and valuation, when deciding if the stock is a buy. We cover that in our actionable full research report which you can read here, it’s free.