In February, Netflix, Inc. (NFLX) enacted a price reduction for its subscription plans in selected countries. Simultaneously, the company announced a plan to crack down on password sharing by subscribers, implemented across over 100 nations by May. This tightening of account security seems to be bolstering user growth.

While its recent moves represent opportunities, uncertainties remain as Chief Financial Officer Spencer Neumann recently said the company isn’t expecting dramatic growth in average revenue per member this year, while its advertising initiative is “not that material yet.”

NFLX also intends to raise the price of its ad-free service following the resolution of the ongoing Hollywood strikes. This decision might not sit well with all customers.

Even though Netflix's strategic focus revolves around profitable growth, the stock could witness considerable volatility due to these imminent uncertainties. As the streaming heavyweight prepares to disclose its third-quarter earnings, it might be astute to await a more opportune entry point in the stock.

Data compiled by Bloomberg indicates that recent earnings have negatively influenced Netflix's shares, with the stock dropping after seven of the past ten most recent reports. Let’s analyze some of its key metrics to understand the situation.

Netflix Financials Overview: An Analysis of Growth, Fluctuation and Trends (2020-2023)

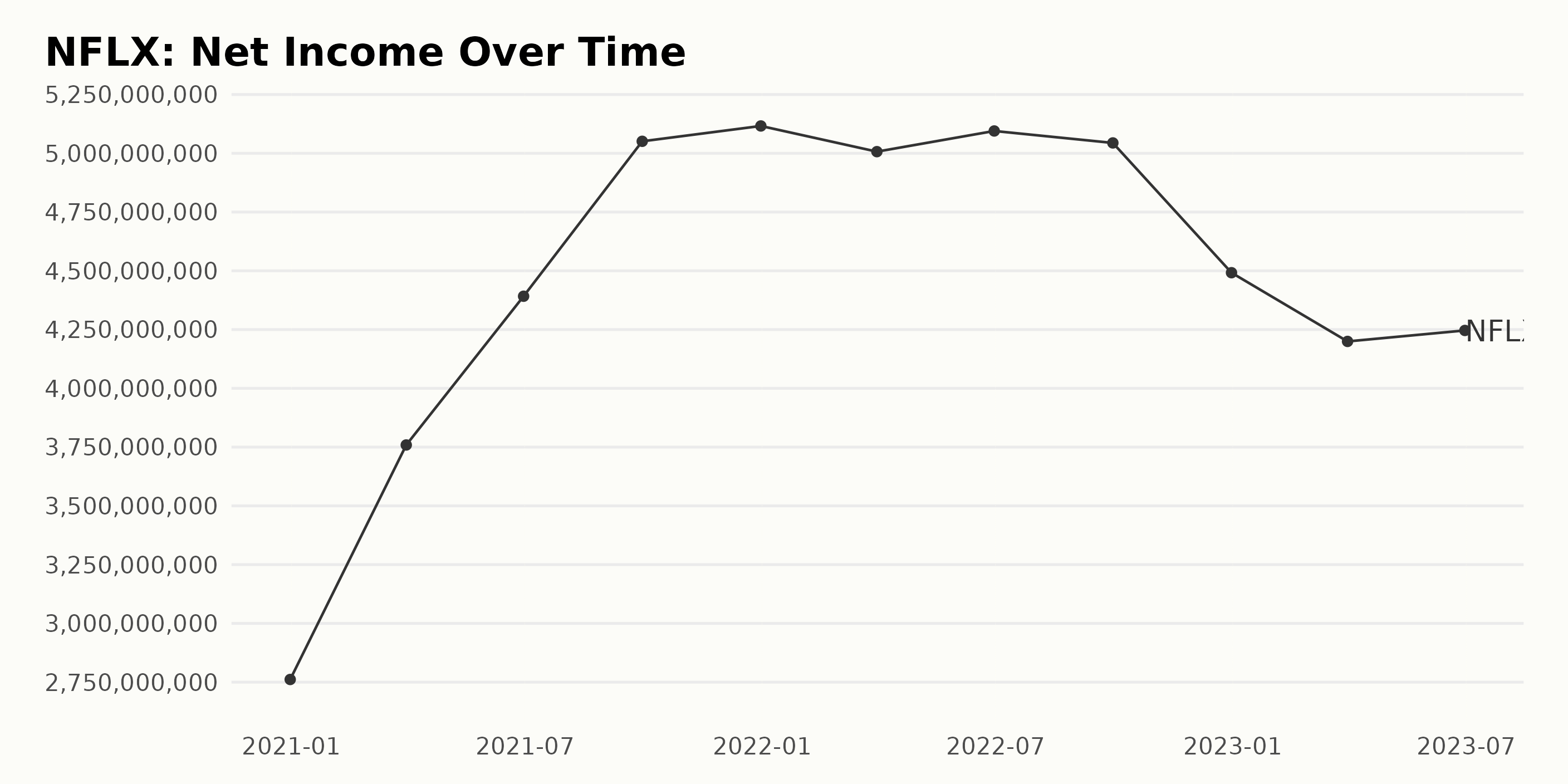

The trailing-12-month net income of NFLX has seen both growth and fluctuation over the last few years:

- On December 31, 2020, the net income was at $2.76 billion.

- The year 2021 showed a steady increase in the net income throughout its course, with the highest value recorded on December 31, 2021, at $5.12 billion.

- In 2022, however, the trend saw a slightly reversed direction. The company's net income initially rose to $5.09 billion by June 30, but it dropped to $4.49 billion by the end of the year (December 31, 2022).

- As of the second quarter of 2023 (June 30, 2023), the net income stands at $4.25 billion.

Overall, while there have been certain fluctuations, the net income shows a substantial growth of approximately 54% when measuring from the first value ($2.76 billion on December 31, 2020) to the last value in the series ($4.25 billion on June 30, 2023). Please note that emphasis is placed on the more recent data, and the calculation for the growth rate is based on the last value from the first value.

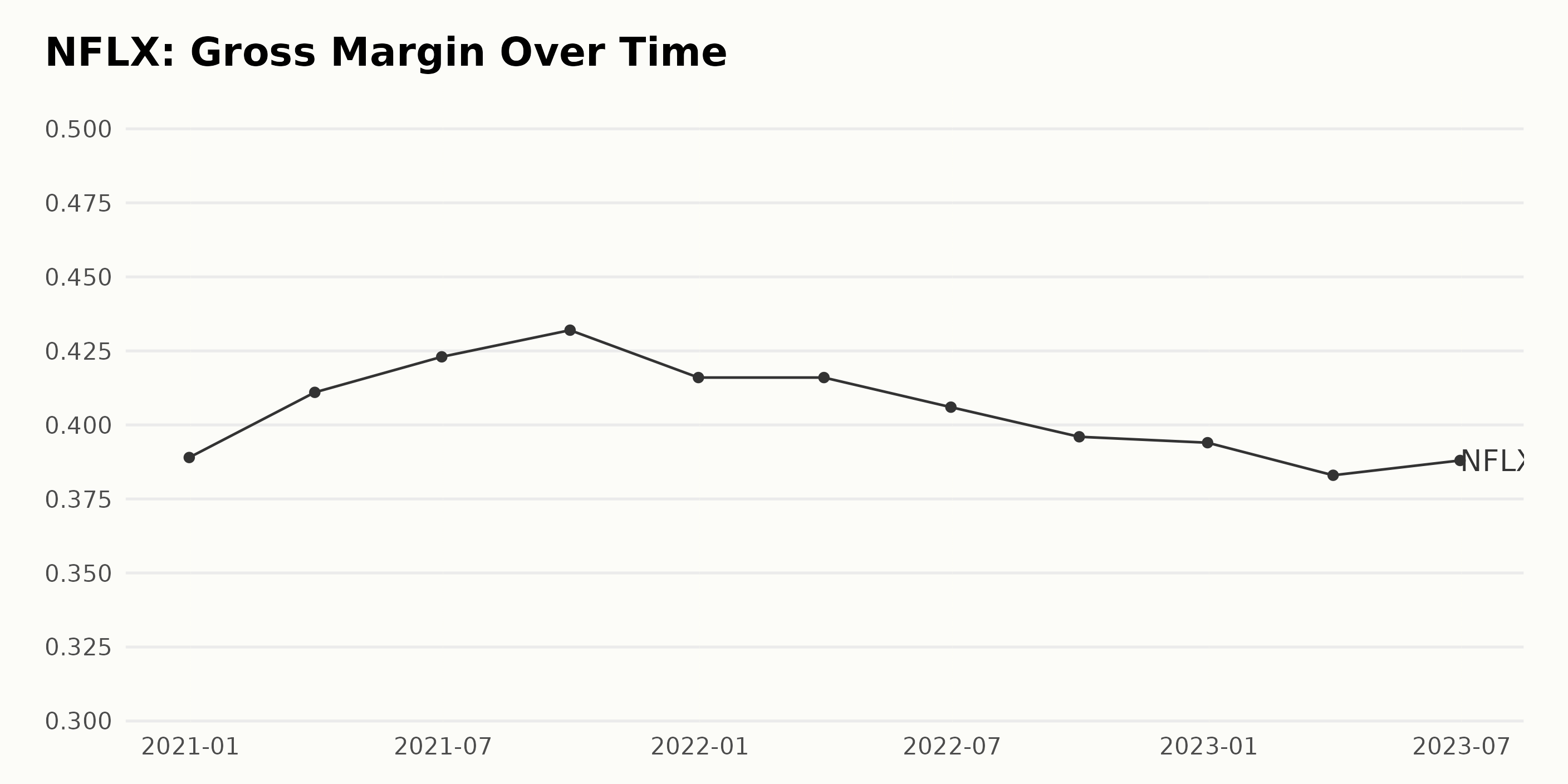

The Gross Margin of NFLX showed a trend of moderate fluctuation in the year 2020 to 2023:

- At the end of the fourth quarter in 2020, the Gross Margin was 38.9%

- There was a steady growth through 2021, peaking at 43.2% in September

- The value dropped slightly to 41.6% by the end of December 2021 but remained static at that level till the end of March 2022

- Subsequently, the Gross Margin started a slow decline over the next few months, lowering to 40.6% by June 2022 and further to 39.6% by September 2022

- The value nearly plateaued towards the end of the year 2022, with a slight drop to 39.4% by December

- The trend continued in early 2023, further decreasing to 38.3% in March before showing a minor upturn to 38.8% in June 2023

Overall, from December 2020 to June 2023, Netflix's Gross Margin has seen a decrease of approximately 0.1%, or 10 basis points. However, given the greater emphasis on recent data, we can observe a more substantial drop from its highest value (43.2% in September 2021) to the most recent value (38.8% in June 2023). This represents a decrease of approximately 4.4 percentage points over this period.

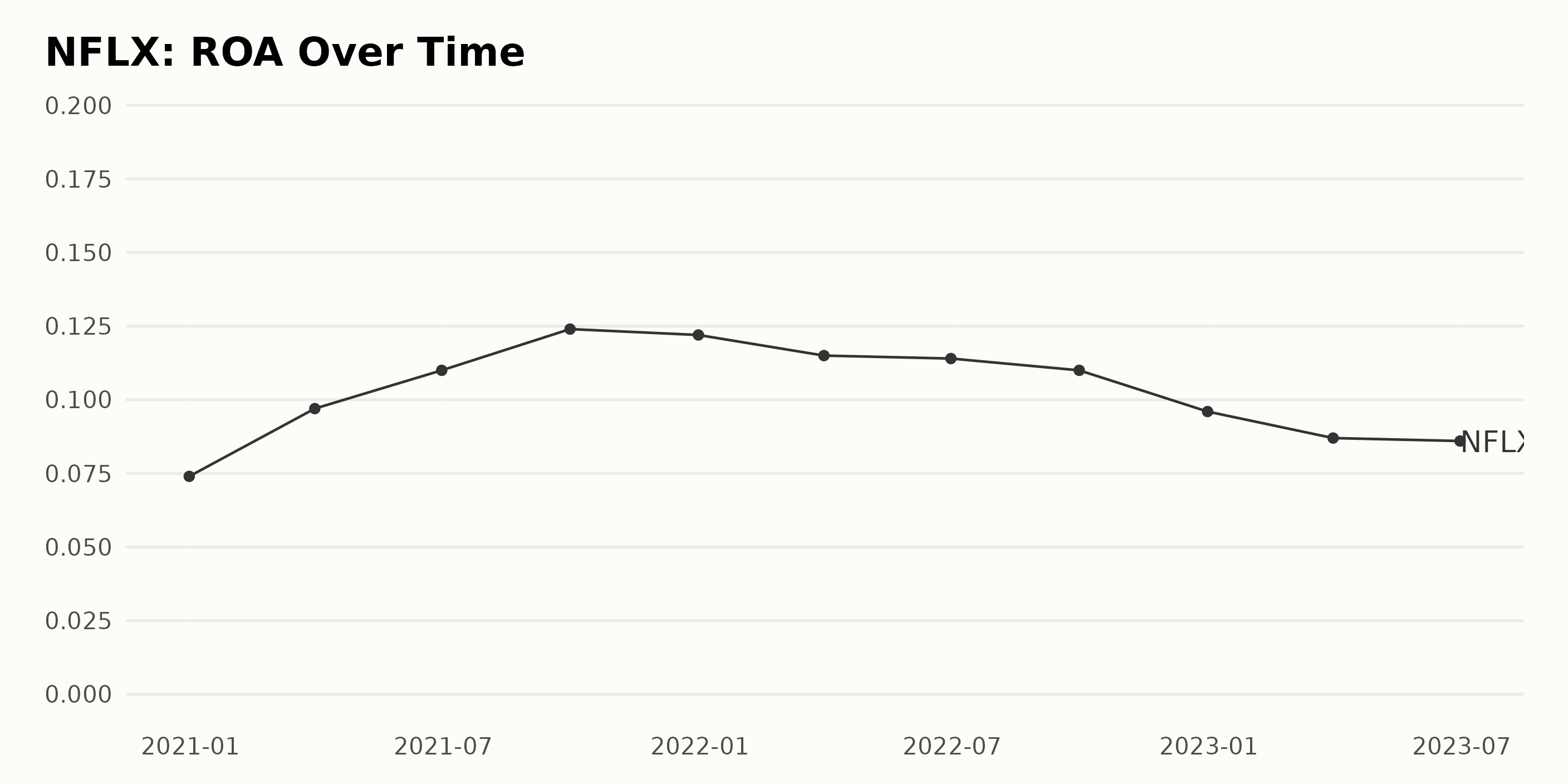

The ROA of NFLX demonstrated a trend of fluctuations over the stated period. To provide an overview:

- On December 31, 2020, the ROA stood at 7.4%

- There was an appreciable increase in the quarterly ROA throughout 2021 reaching its peak by September 30, 2021, at 12.4% before experiencing a slight dip to 12.2% on December 31, 2021.

- From the first quarter of 2022, the ROA fell gradually each quarter, settling at 9.6% as of December 31, 2022.

- Over the following year from the first quarter through to the second of 2023 it marked a further descent, falling to 8.6% as of June 30, 2023.

It is worth noting that when comparing the last value in the series (8.6% as of June 2023) with the first value (7.4% as of December 2020), we see a growth rate of around 16.2%. This indicates that despite the noticeable fluctuations over the period, there was a modest overall growth when book-ending the first and last values. Observers should place greater emphasis on more recent data, like the consistent descent in ROA seen in 2022 and into 2023.

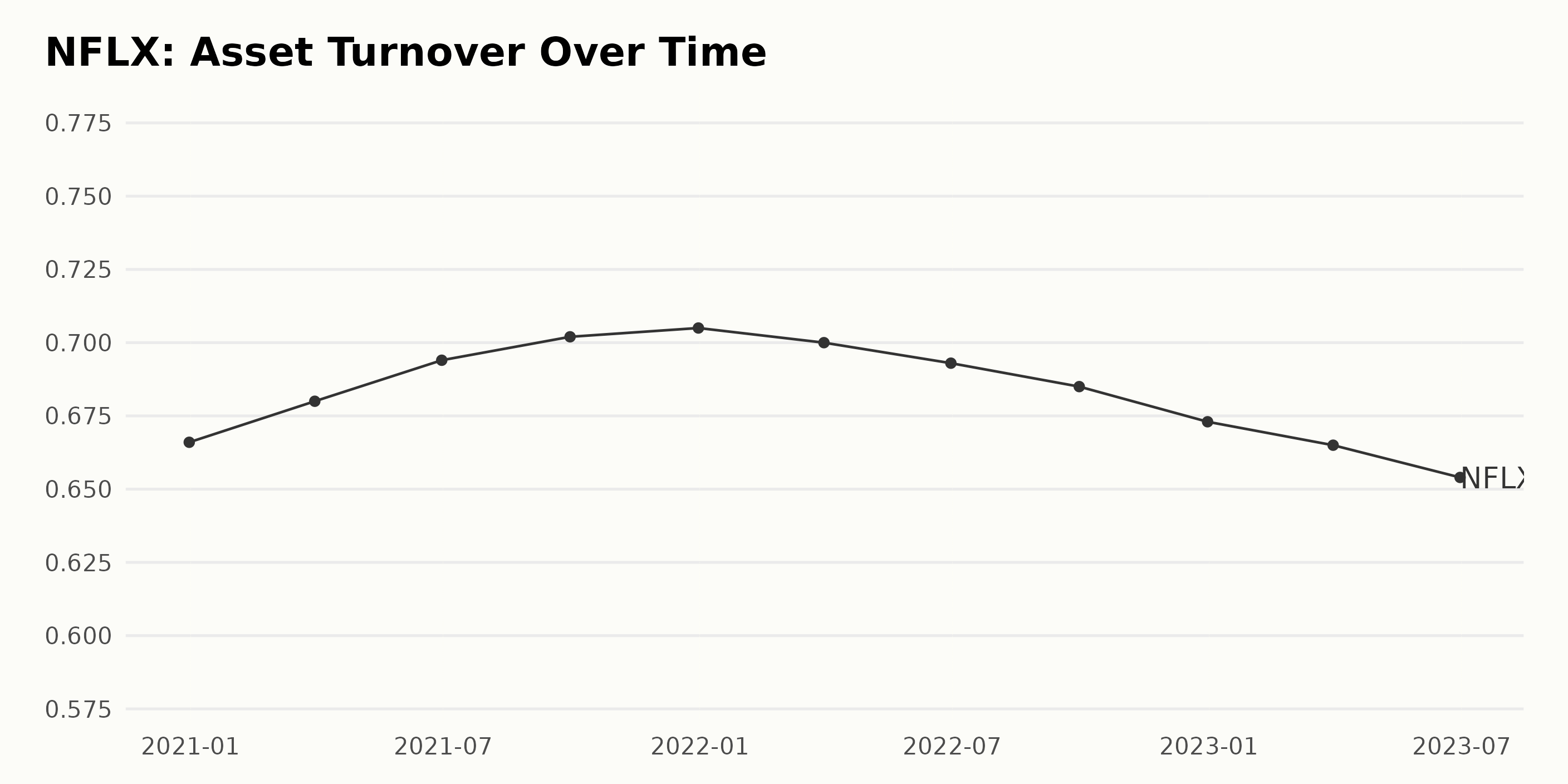

Based on the data provided for NFLX, a fluctuating pattern emerges in the company's Asset Turnover from the end of 2020 through mid-2023.

- Starting at 0.67 at the end of December 2020, NFLX's Asset Turnover shows a steady increase, peaking at 0.71 at the end of 2021.

- This uptrend reverses in Q1 2022, and the value starts a gradual descent, first slightly dropping to 0.7 by the end of March 2022.

- This mild downward trend becomes more pronounced and continuous over the next year, with the Asset Turnover falling to 0.65 by June 2023.

Through this period, the Asset Turnover drops by approximately 2%, translating into a growth rate of -0.02. This reflects the ratio between NFLX's sales or revenues and its total assets. In summary, while a positive trend characterised Netflix's Asset Turnover throughout 2021, an opposite tendency set in from 2022, leading to a gentle but sustained decline through to mid-2023. These fluctuations hint towards changes in how efficiently Netflix is utilising its assets to generate revenue, with the latter period seeing decreased efficiency. Notably, though, the variations remain relatively slight, indicating overall stability across the multi-year span. In light of this data, it will be interesting to further monitor and analyse these subtle shifts in Netflix's operations.

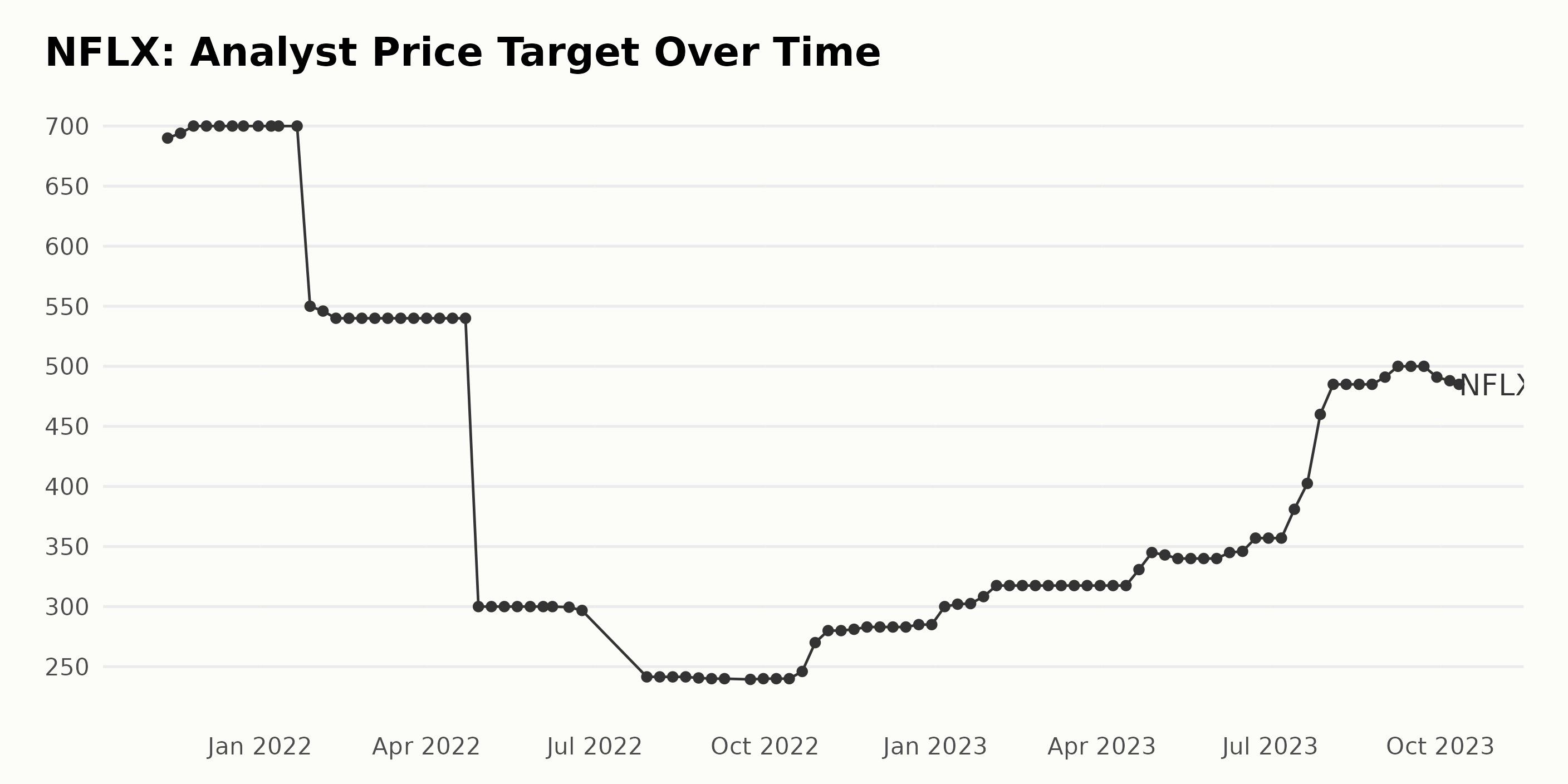

The series represents the fluctuation of the Analyst Price Target for NFLX from November 12, 2021, to October 11, 2023. Here are some notable points:

- On November 12, 2021, the Analyst Price Target was set at $690.

- By November 26, 2021, it had risen to $700 and stayed consistent till January 21, 2022.

- Notable dips were witnessed throughout 2022, with a significant drop to $550 on January 28, further decreasing to $540 by February 11, and reaching as low as $240 by September 9, 2022.

- The lowest point in the series is $239.4 on September 23.

- A gradual increase is observed from October 21, 2022, with the Analyst Price Target reaching $246, and subsequently $280 by November 4, 2022.

- By April 28, 2023, the Analyst Price Target had increased to $345 before lowering to $340 on May 12, 2023.

- A sharper rise can be identified from July 14, 2023, increasing from $381 and reaching as high as $500 by September 8, 2023.

- The last value in the series is $485 on October 11, 2023.

Overall, the NFLX Analyst Price Target showcased fluctuating behaviour, with significant drops throughout 2022, but then gradually rising again, reaching its peak in September 2023. The growth rate, measuring from the first value to last, shows an overall decrease of around 30%.

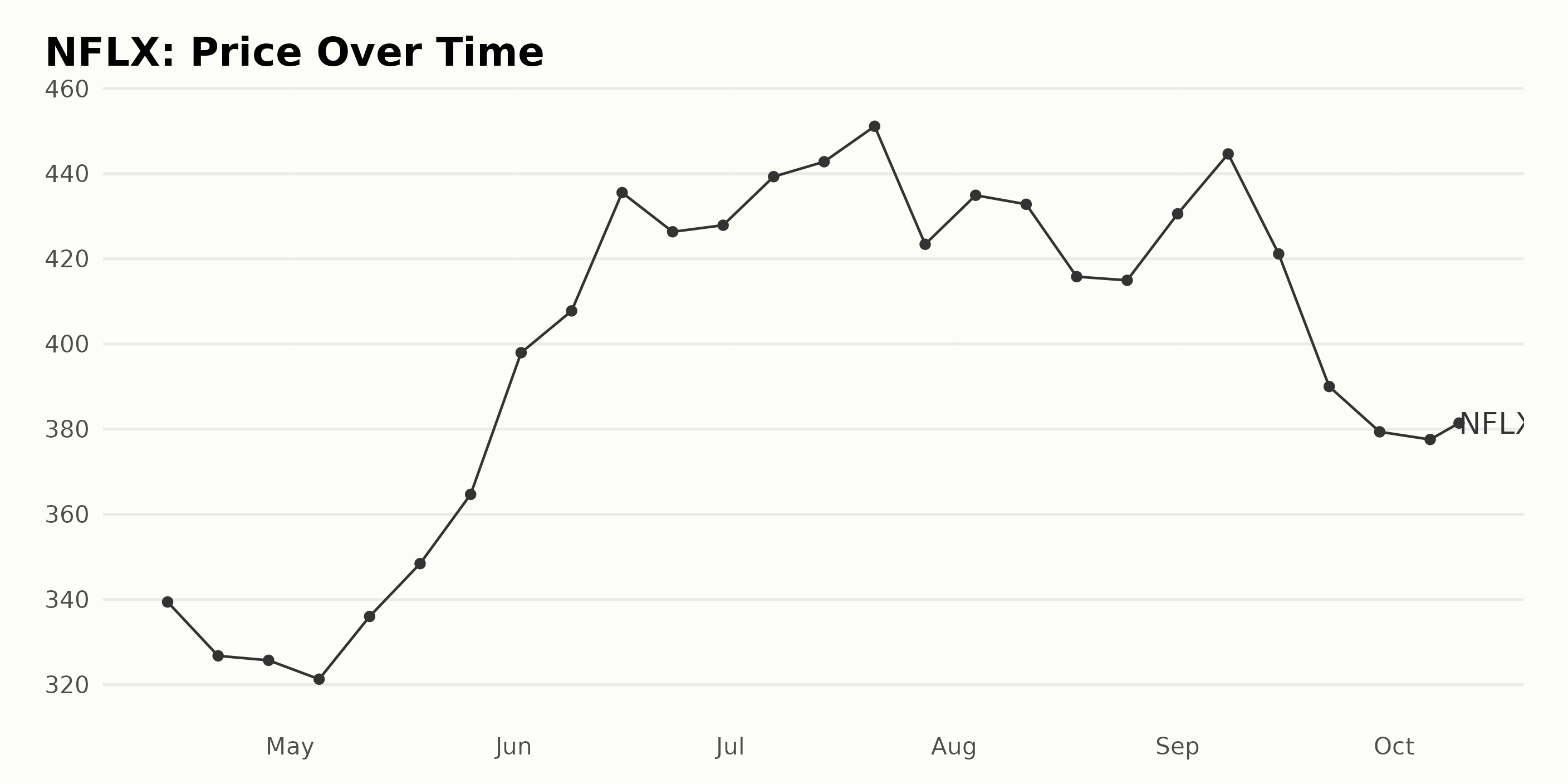

Analysis of Netflix (NFLX) Share Price Trends and Growth Rate Fluctuations in 2023

Below is a bullet-point-based summary of the data of NFLX's share price trend over time and its respective growth rate:

- On April 14, 2023, the share price of NFLX began at $339.41.

- There was a slight dip in the stock price in late-April, reaching a low of $321.27 by May 5, 2023.

- From May 12 until June 16, 2023, NFLX experienced considerable growth, with the share price climbing from $336.01 to a high of $435.56. This uptrend represents an accelerating growth period for NFLX.

- Despite a insignificant drop on June 23, 2023, to $426.35, the company's shares continued their upward trajectory, reaching another peak of $451.14 by July 21, 2023.

- There was a notable downward shift in the price between July 28 and August 18, 2023, with the stock price falling from $423.42 to $415.82. This period marks a decelerating phase in the share price trend.

- The stock encountered slight fluctuations in late-August but returned to an increasing trend by early-September, achieving a value of $444.65 on September 8, 2023.

- A substantial decline in the stock's price took place from mid-to-late September, with the share price falling from $421.17 on September 15, 2023, to $379.37 by the end of the month. This shows another period of deceleration in NFLX's share price.

- In early October 2023, the stock underwent minor fluctuations, ending the observed period at $381.43 on October 6, 2023.

Overall, the given data exhibits a net increasing trend in the share price of NFLX across the analyzed period. However, significant accelerations and decelerations in its growth rate occurred sporadically. Here is a chart of NFLX's price over the past 180 days.

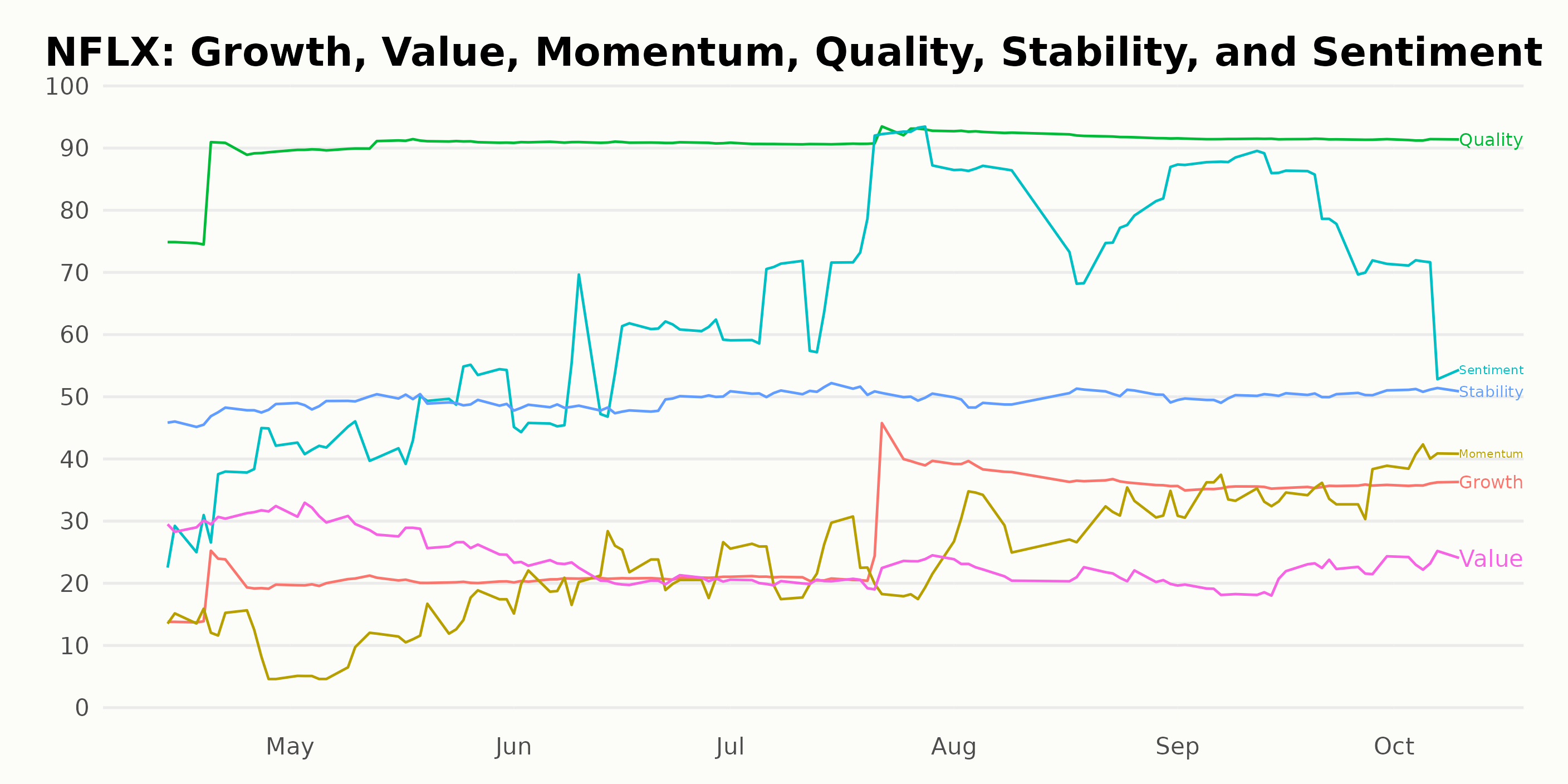

Analyzing Netflix's Performance: Quality, Momentum, and Sentiment Trends Unveiled

NFLX has an overall C rating, translating to a Neutral in our POWR Ratings system. It is ranked #23 out of the 57 stocks in the Internet category.

The POWR Ratings for NFLX reveal distinct trends in three primary dimensions: Quality, Momentum, and Sentiment.

Quality

Netflix's Quality consistently receives the highest ratings among various dimensions. From April 29 to October 10, 2023, Netflix's Quality score begins at 85, peaking at 92 by August. It then maintains a stable rating of 91 from May through October, highlighting a consistently high-benchmark performance in this regard.

Momentum

In the Momentum dimension, Netflix exhibits steady growth over the specified six-month timeframe. On April 29, 2023, Momentum initiates at a relatively low point of 12 but increases substantially to 41 by October 10, indicating a clear positive trend.

Sentiment

A pattern of marked improvement is also seen in the Sentiment dimension. The Sentiment score starts at 35 in April 2023 and gradually increases to reach 83 by September, establishing an upward trajectory. However, there is a slight drop to 66 in October. In summary, NFLX demonstrates commendable Growth and Momentum while maintaining excellent Quality as indicated by the POWR Ratings.

How does Netflix Inc. (NFLX) Stack Up Against its Peers?

Other stocks in the Internet sector that may be worth considering are Yelp Inc. (YELP), Travelzoo (TZOO), and Despegar.com Corp. (DESP) -- they have better POWR Ratings.

What To Do Next?

Get your hands on this special report with 3 low priced companies with tremendous upside potential even in today’s volatile markets:

3 Stocks to DOUBLE This Year >

NFLX shares were trading at $366.99 per share on Wednesday afternoon, down $6.33 (-1.70%). Year-to-date, NFLX has gained 24.45%, versus a 14.75% rise in the benchmark S&P 500 index during the same period.

About the Author: Subhasree Kar

Subhasree’s keen interest in financial instruments led her to pursue a career as an investment analyst. After earning a Master’s degree in Economics, she gained knowledge of equity research and portfolio management at Finlatics.

The post Netflix (NFLX) Stock: To Buy or Not to Buy This Week? appeared first on StockNews.com