- First and foremost, given the recent news facing the US president, it would not be surprising to see him take to social media ahead of the weekend.

- Friday is expiration day for December options. Based on the Jane Fonda Flip, this can often lead to interesting activity in the futures market.

- While many will be watching for more announced sales of US soybeans to China, some could be keeping an eye on potential bearish technical patterns on future's weekly charts.

Here we are, pre-dawn Friday morning, another busy day about to unfold before us. With next week being abbreviated by the US Thanksgiving holiday followed by first notice day for December futures contract, there are a few factors that could come into play today. First and foremost, with headlines supposedly turning against the US president, depending on one’s news source, the tendency is for him to take to social media and make broad announcements and/or threats. Will it be renewed tariffs? We’ll find out. As of this writing, the Metals sector isn’t showing much concern with December gold (GCZ25) down $24 (0.6%) and December silver (SIZ25) sliding $1.88 (3.7%). Dr. Copper (HGZ25), the economic indicator, is off 2.25 cents (0.5%). US stock index futures are mixed, after the Indexes themselves posted new 4-week lows, a bearish momentum indicator, this past Tuesday. The Energies sector is showing a solid loss, nearly across the board, with our old friend natural gas the outlier. Commercial selling is seen in crude oil, distillates, and RBOB gasoline, an interesting development ahead of the busiest travel week of the year.

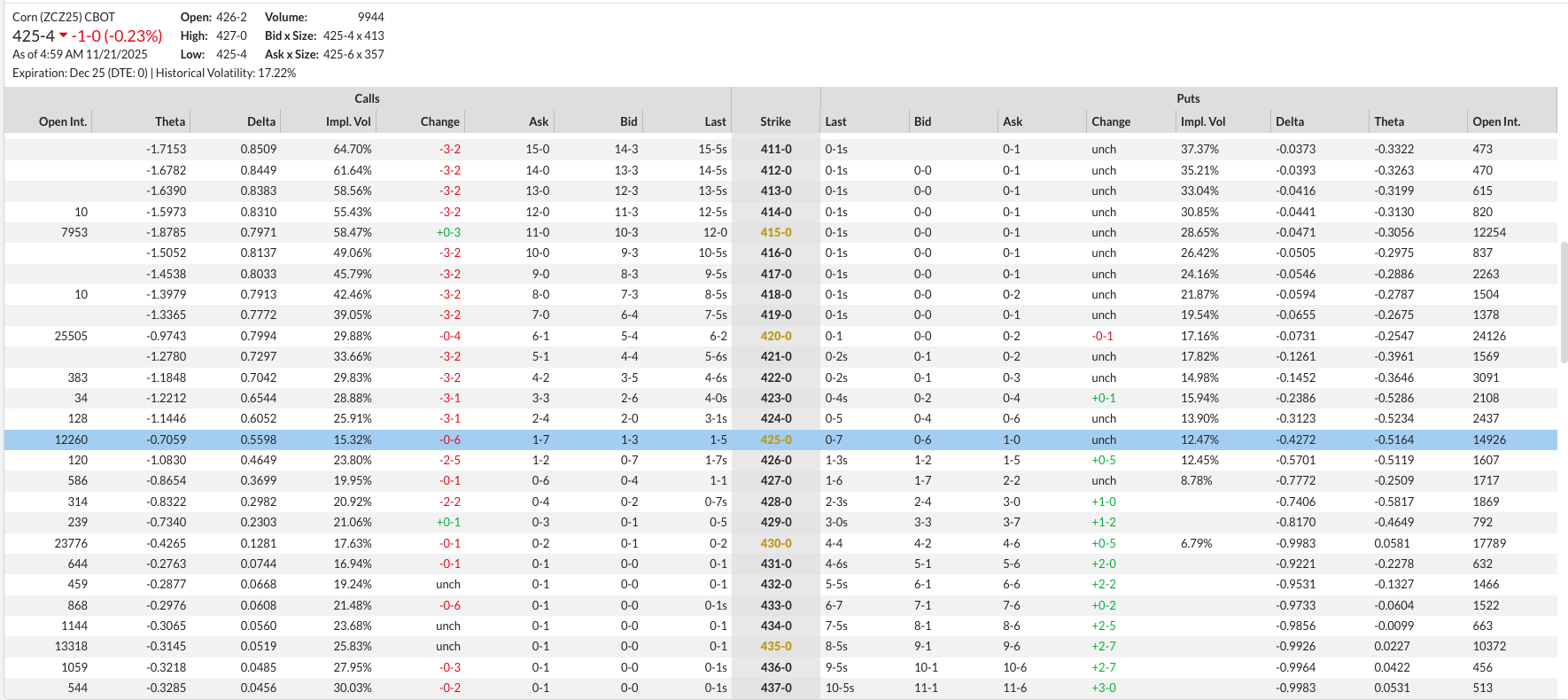

The corn market was quietly lower early Friday morning. The March issue posted a 1.75-cent trading range – that’s right, just 1.75 cents – on trade volume of fewer than 15,000 contracts as of this writing. What should we read into this activity? Nothing. Let’s see how things play out. A look back at Thursday’s session, when March, May, and July finished 3.75 cents in the red while the nearby and soon to be in delivery December closed 3.25 cents lower at $4.2650. Speaking of the Dec25 issue (ZCZ25), Friday is December option expiration day, often bringing into play what I call the Jane Fonda Flip (No gain, all pain). In other words, the futures market tends to gravitate toward the strike price that will create the most pain, at least gain, by sending the largest number of option contracts into expiration at $0. A quick look at the Dec25 corn option table shows the largest combined, calls and puts, strike price is $4.20 with a total of nearly 50,000 contracts (25,500 calls, 24,120 puts). The $4.30s are close behind at roughly 42,000 contracts. The bottom line is it would not be surprising to see Dec25 slide toward $4.20 heading toward Friday’s close.

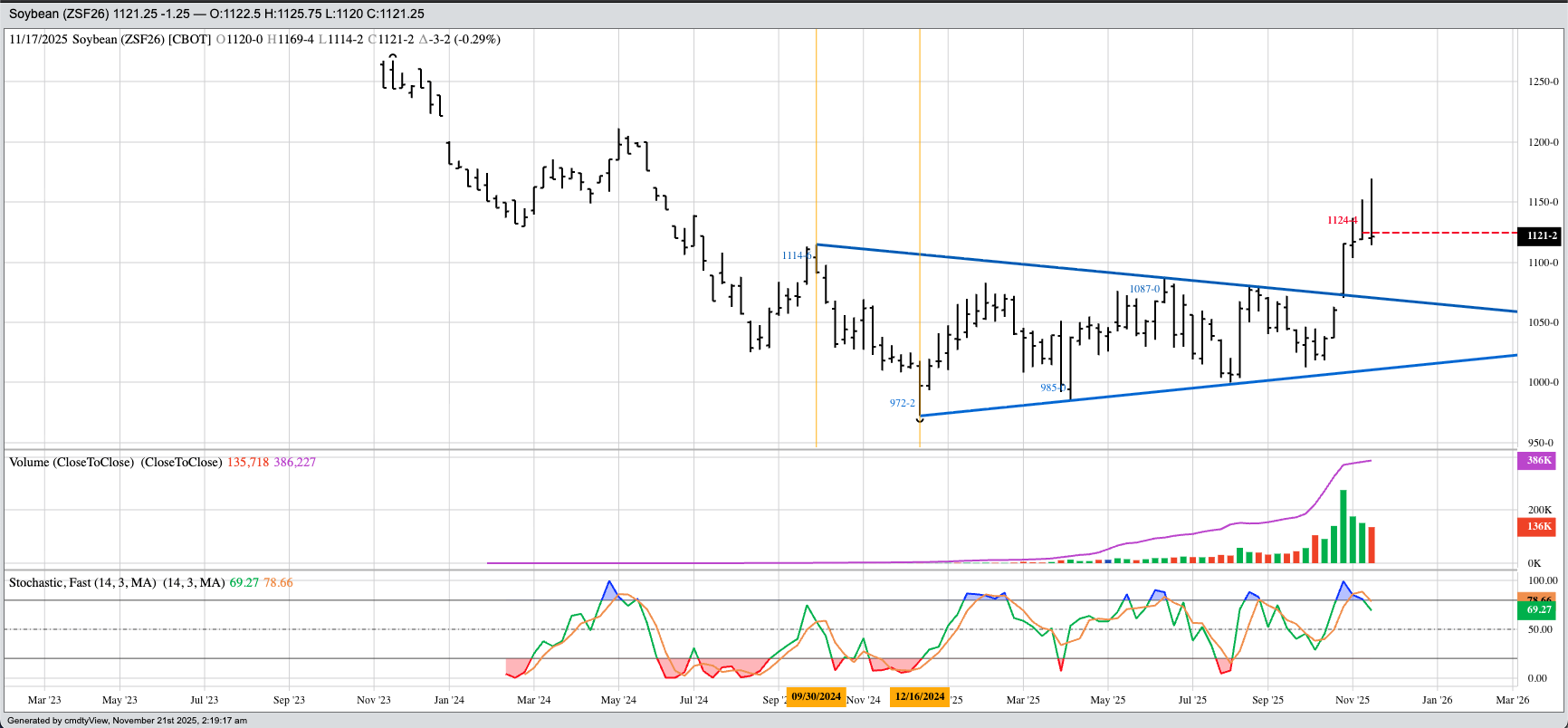

The soybean market was back in the red pre-dawn, also on light trade volume. The January issue (ZSF26) was sitting 3.25 cents lower after posting a trading range of 8.5 cents, from up 3.25 cents to down 5.25 cents while registering about 18,000 contracts changing hands. While nothing in that mix of numbers indicates the world’s largest buyer was showing interest overnight, USDA could still announce new sales based on activity seen over the past number of weeks. Recall January closed 13.75 cents lower Thursday followed by the National Soybean Index down roughly 13.5 cents for the day indicating national average basis firmed again. Those on the technical side of the analysis and commentary game could be keeping an eye on weekly charts for the first four 2026 futures contract (January, March, May, and July). Each is in position to complete bearish key reversals on their respective charts, needing lower weekly closes to finish off the patterns. If so, then the technical argument would be intermediate-term trends have turned down. The problem with this technical argument is that trading algorithms, aka Watson, don’t necessarily pay attention to classic technical patterns. And if Watson isn’t watching, how much attention should we pay to chart patterns?

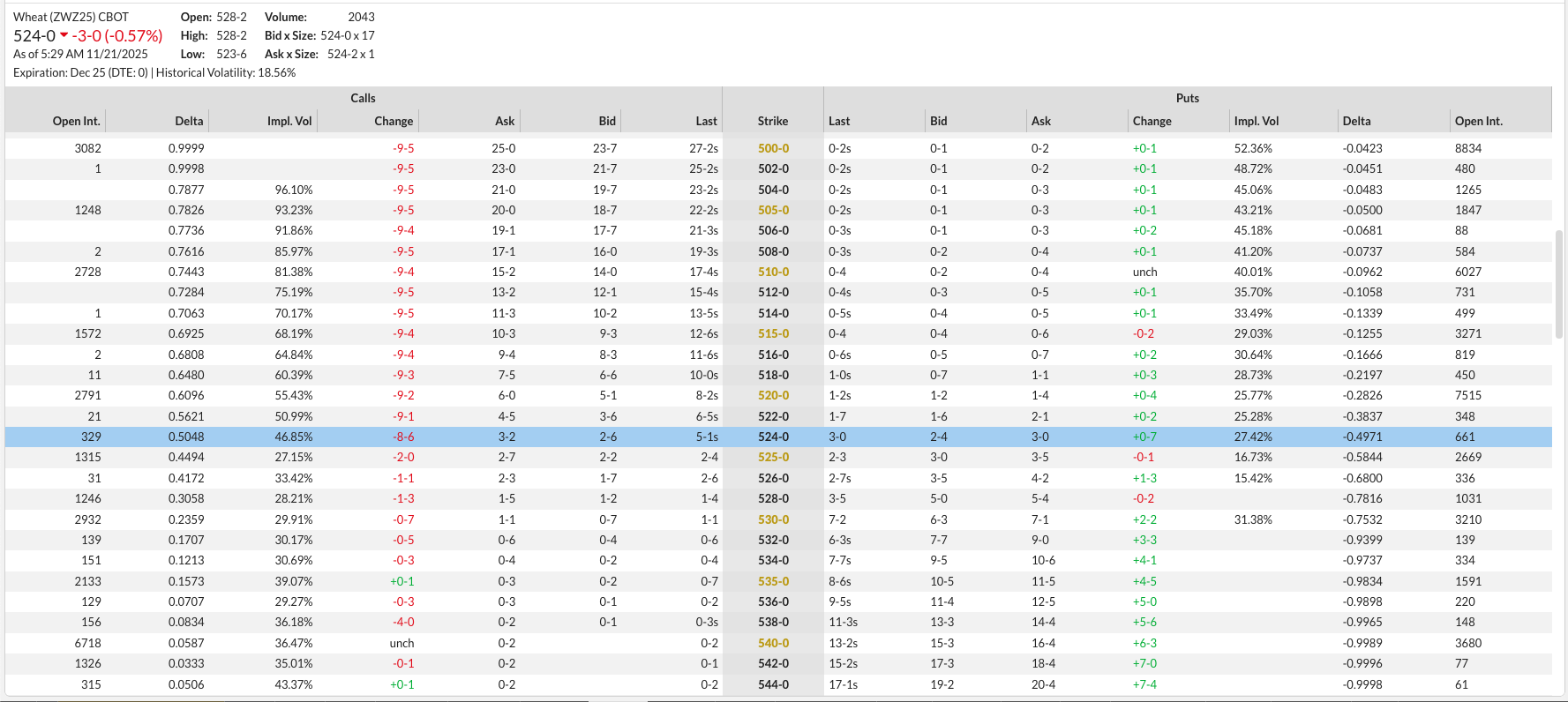

The wheat sub-sector was also in the red to start the day, though based on light trade volume in winter wheat markets it seems it would take little more than a sneeze from Watson to rally SRW and HRW into Friday’s intermission. Pre-dawn Friday finds the December HRW issue down 1.75 cents at $5.0450 with the $5.10 strike price showing the largest combined open interest (980 calls, 1,670 puts). Over in SRW the December issue is down 3.0 cents at $5.24 at this writing. Here we see the strike with the most open interest heading into Friday’s session is $5.40 (6,718 calls, 3,680 puts). Do I think Dec SRW (ZWZ25) could rally 13.0 cents from Thursday’s close of $5.27? While not probable, it is possible. After all, we are talking about wheat meaning nothing is impossible, no matter how improbable. Grab your popcorn, it should be a fun session. Fundamentally, not much has changed with National Indexes for both winter markets continuing to run below previous 5-year low end of November prices. As for HRS, the December issue is down 2.5 cents early Friday while March is off 0.75 cent on trade volume of 250 contracts. As I’ve said before, that is decent activity for spring wheat during the overnight session.

On the date of publication, Darin Newsom did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart