I’ll admit it. I love horse racing. I’m not a big-dollar gambler, but the sport appeals to me. That might be because I happen to live in one of the only places where they race live 12 months a year, in the sunshine.

But as horsemen in most U.S. states know, racetracks are tied at the hip with casinos. Because that’s what brings in the really huge dollars. So racing and gaming get “coupled” in many locales. And there’s no denying that casinos, sports books, and other forms of “gaming” are about as hot an industry as we’ve seen in the 21st century.

And, in typical modern parlance, a just-announced decision from VanEck ETFs to rename its VanEck Gaming ETF (BJK) next April is right in line with the trend toward self-deprication humor that has become part of the gaming and crypto genres. The new name is the VanEck Degen Economy ETF, short for “degenerate.” What could possibly go wrong?

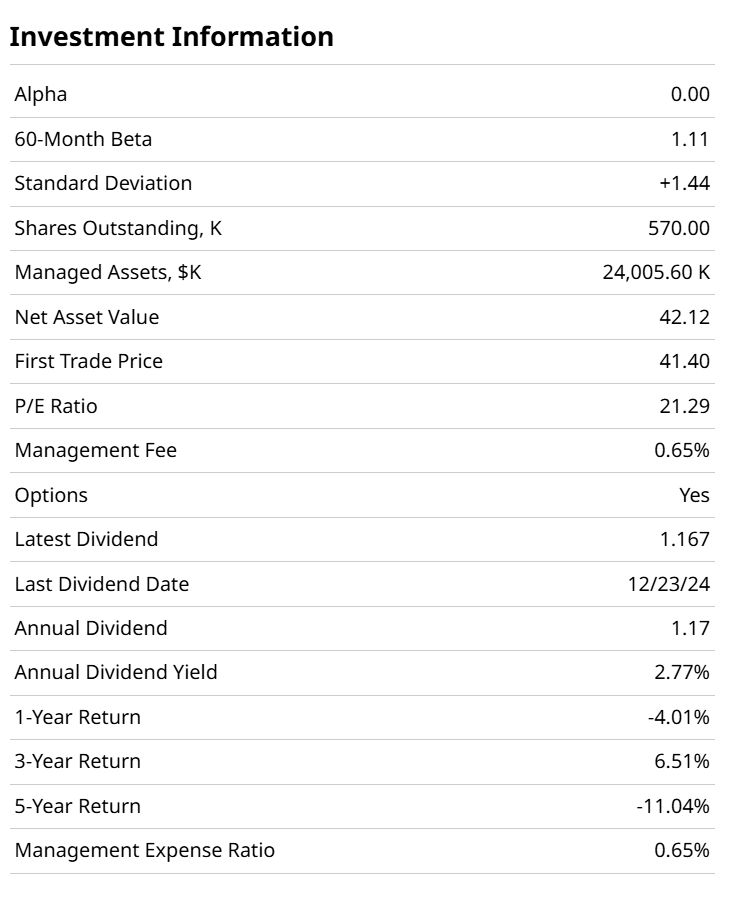

Seriously though, a name change on a 17-year old ETF which has accumulated just $24 million in assets is notable. However, it does not change the fund’s objectives. Nor would we expect the type of stocks it owns to vary much, if at all, from the present-day BJK.

But with that current ticker symbol being a short-cut for “blackjack,” perhaps this subtle move by VanEck is more telling than at first glance. Card games around a table for big money, in rooms that don’t have clocks, are a tenured part of the gaming entertainment industry.

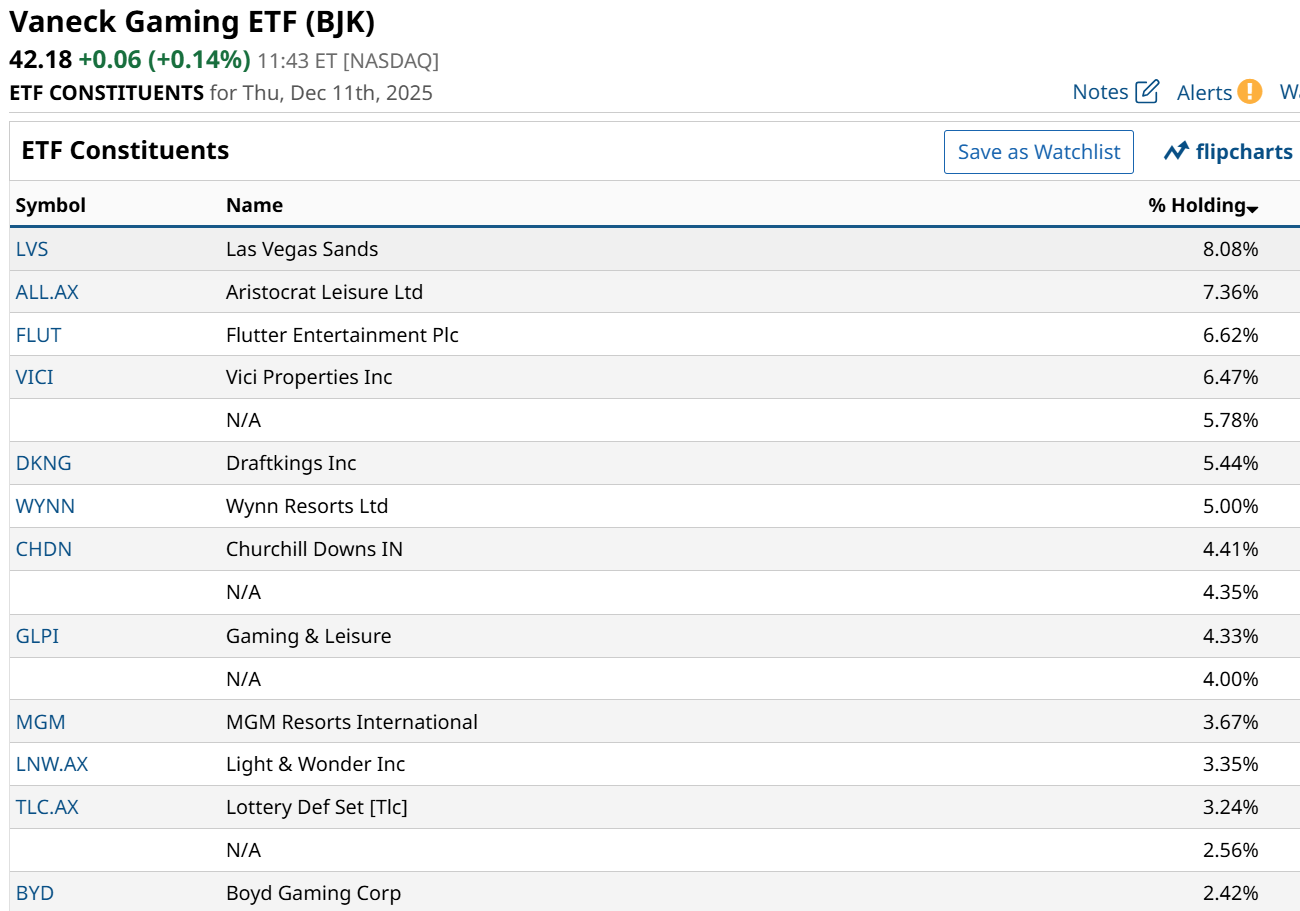

Instead, online gaming, legalized sports betting, and even prediction markets are conspiring to capture the hearts, minds and wallets of a new generation.

This is one reason that horse racing’s annual revenue in the U.S. has been slipping for some time. Lots of competition now. And while you can bet on races from your phone, just as you play other for-dollars games, I’ve actually heard from several people that racing is “too slow, not enough action” compared to the dopamine parade of modern handheld gambling methods. Yes, 25 minutes between races. It’s like an eternity!

Investment-wise, BJK has performed like many baskets of non-mega-cap stocks. Poorly, relative to the S&P 500 ($SPX) and Nasdaq-100 ($IUXX) indexes. But at 21x trailing earnings, and with the secular growth potential of this industry, the odds are that investors could parlay their chips into a bigger stake. OK, that’s all the gambling puns in a single sentence, to save you time.

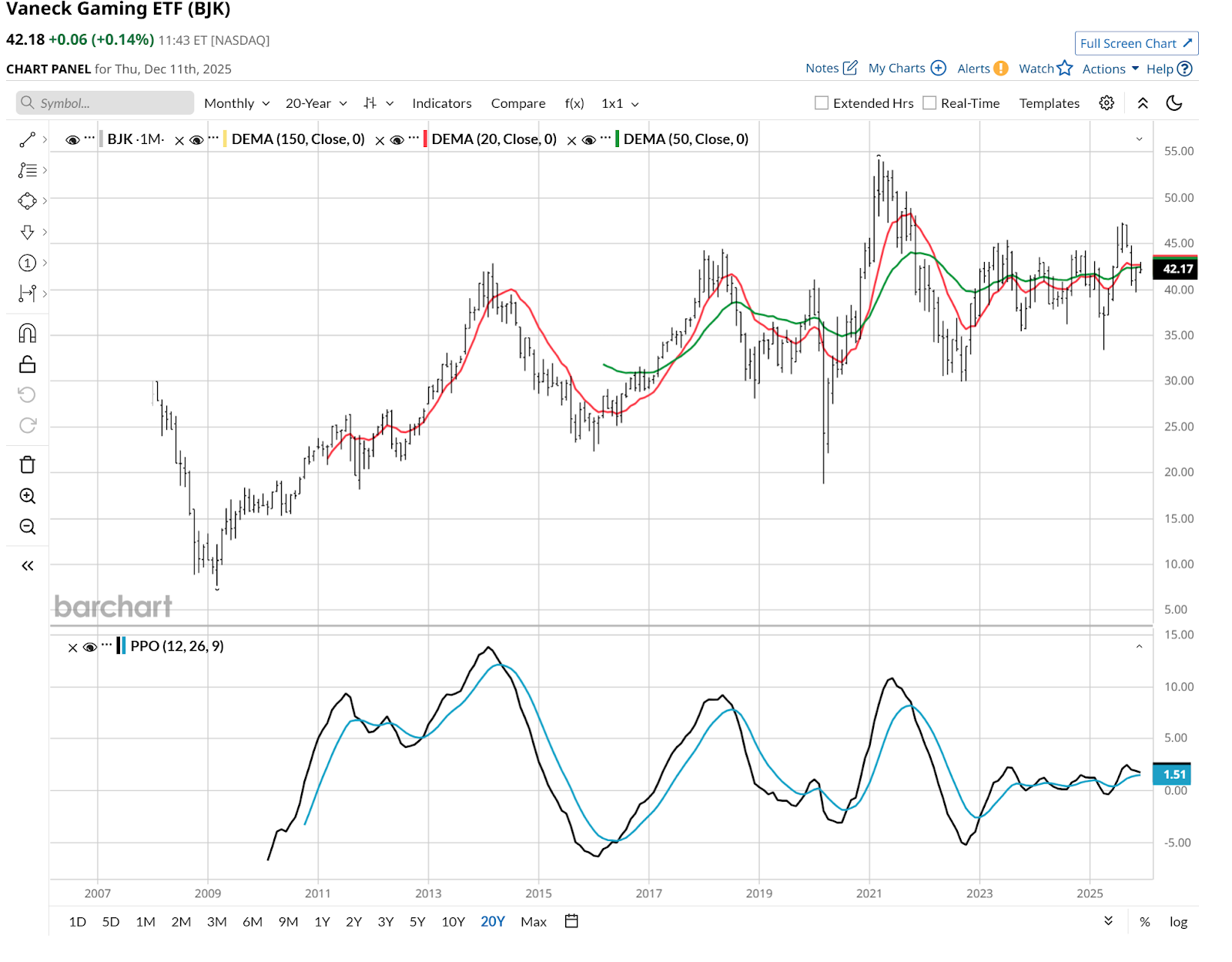

The near-term (daily) chart shows a budding breakout, but only if the rest of the market cooperates. Even so, upside potential might be limited to that $46 area it peaked at before.

I skipped the weekly to show the monthly, since this ETF has a long enough history for that picture to be analyzed. On the one hand, it is steady, and not wildly volatile. However, it also trades at the same price it did in early 2014.

Part of that malaise could be due to the fund’s non-U.S. holdings, as international stock markets have been persistent laggards.

However, the key to this ETF and the gaming industry… er, Degen Economy, is what lies ahead. A much stronger endorsement of, and interest in, expanding the reach of online and in-person entertainment that involves gambling.

Maybe some are not in favor of that, which is quite understandable. But in the world of vice investing, that rarely seems to matter. BJK will have a new name next April, but the opportunity and risk remains the same.

Rob Isbitts, founder of Sungarden Investment Publishing, is a semi-retired chief investment officer, whose current research is found here at Barchart, and at his ETF Yourself subscription service on Substack. To copy-trade Rob’s portfolios, check out the new Pi Trade app.

On the date of publication, Rob Isbitts did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart