Apple (AAPL), which failed to make a mark with the iPhone 16, its first handset with the flagship “Apple Intelligence” features, seems to be making a comeback with its successor, the iPhone 17. Counterpoint Research predicts that the Cupertino-based company will become the world’s biggest smartphone seller in 2025, achieving that feat after a 14-year wait. The firm expects Apple to maintain its lead over the current market leader, Samsung (SMSN.L.EB) for the next four years.

Apple Is Expected to Become the Biggest Smartphone Seller in 2025

IDC is also quite bullish on Apple and expects the company to ship a record number of smartphones this year, thanks to the strong demand for its iPhone 17. The previous record rests with the iPhone 13, whose sales were boosted by several factors, including the 5G upgrade supercycle and a vast pool of existing devices due for upgrades. Huawei’s woes due to U.S. sanctions and meaningful upgrades in the iPhone 13 as compared to its predecessor also helped drive the sales.

In some ways, the iPhone 17 is similar to the iPhone 13, as the upgrade cycle (this time around due to AI) began with its predecessor and gained traction with the following model. Apple reported strong iPhone sales in its most recent quarter, and the guidance calls for continued growth in the current quarter as well.

To be sure, rising iPhone sales haven’t gone unnoticed by the markets as well as the analyst community. AAPL stock is up 17% over the last three months and recently hit its record highs. The YTD gains of 12% might look somber and trail that of the average S&P 500 Index ($SPX) constituent but should be seen in perspective. Apple shares were frail in the first half of the year, and if not for the strong reception to iPhone 17, it might have been in the red even now, as it was for a large part of this year.

Executive Departures Hit Apple

Meanwhile, even as the rise in iPhone sales, continued growth in Services, and gross margin expansion (despite the tariff hit) have helped support Apple’s rally, the company has been hit by the exit of top executives. Here is the list of some of the prominent executives who have announced their departure from the iPhone maker.

- Alan Dye, who was Apple’s head software designer, recently quit to join Meta Platforms (META), where he will lead a new design studio for Reality Labs. Meta CEO Mark Zuckerberg has been on a poaching spree, hiring AI talent from different companies, and Dye is the latest addition to the list. Apple designers have incidentally been in hot demand, and OpenAI acquired Jony Ive’s startup, io Products, earlier this year. Ive was a former chief design officer at Apple, where he helped design the iPhone.

- John Giannandrea, who was Apple’s senior vice president for machine learning and AI strategy, has also abruptly announced his retirement. The move comes at a time when Apple is still seen as lagging on AI, losing the first-mover advantage in digital assistants that it had with Siri.

- Lisa Jackson, Apple’s vice president for environment, policy, and social initiatives, is also retiring, and so is general counsel Kate Adams.

Notably, a section of the market was even gunning for CEO Tim Cook’s head as AAPL stock was underperforming terribly amid what many saw as due to its lackadaisical approach to artificial intelligence (AI). However, the company has been slowly but surely making up and has upped its game. It hasn’t ruled out the possibility of an acquisition to bolster its AI capabilities.

AAPL Stock Forecast

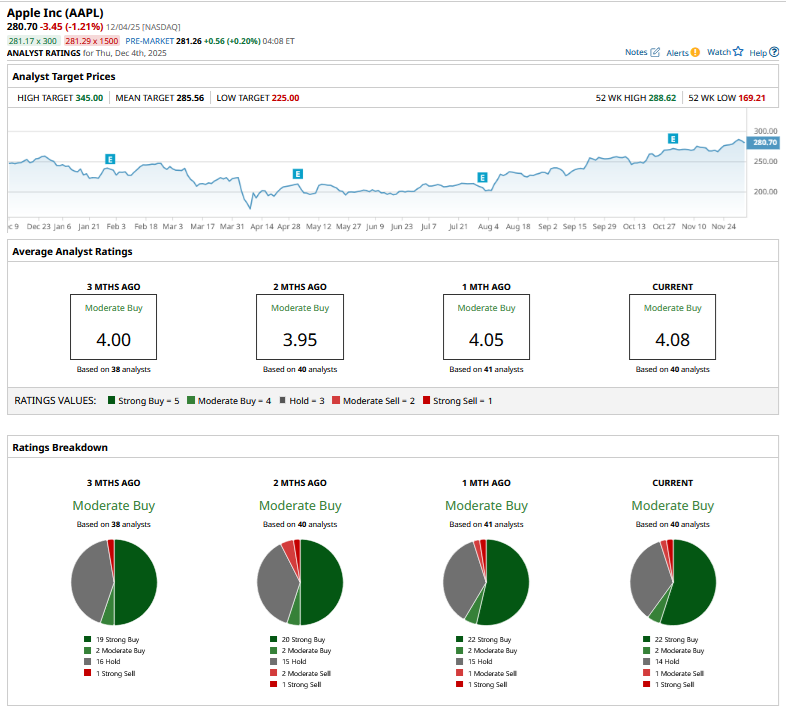

Apple’s mean target price of $285.56 is only slightly higher than the current price levels. The recent target price updates have been in the range of $300 to $325, while the Street-high target price via Melius is $345.

While I find Apple’s outlook reasonably positive for 2026, its valuations remain a breaking point, as the current growth outlook is not in sync with the 35x forward price-to-earnings that the stock trades at. It especially holds as the race for the next computing platform heats up with companies like Alibaba (BABA), Meta Platforms, and, apparently, even OpenAI looking to crack the code with smart glasses. Overall, I expect Apple to still rise from these levels, but one shouldn’t really expect outsized returns from the Tim Cook-led company in 2026, given the rich valuations.

On the date of publication, Mohit Oberoi had a position in: AAPL , META , BABA . All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- Meta Platforms Has Lost $73 Billion on Reality labs. Are Its Spending Cuts Enough for META Stock?

- UBS Analysts Think This Former Meme Stock Has Become a Disruptor -- And That It Can Gain 20% from Here

- Tesla Just Jumped in Annual Automaker Rankings. Is That a Buy Signal for TSLA Stock?

- Cathie Wood Is Still Buying Meta Platforms Stock. Should You?