Packaged and frozen foods maker ConAgra Brands Inc. (NYSE: CAG) had a rough 2023, with shares losing 26.19% versus the S&P 500 index performance of 24.8%. The weak macroeconomic environment led to consumers pulling back on their spending, even in the consumer staples sector, often trading down for private label brands.

The company's most popular brands include Birds Eye, Healthy Choice, Reddi-Wip, Slim Jim, Hunt's, Vlasic, and Orville Redenbacher's popcorn products. ConAgra could stage a rebound in 2024 for NYSE: POST">value investors seeking a stable investment on falling interest rates. The company’s peers include Post Holdings Inc. (NASDAQ: POST) and The J.M. Smucker Co. (NYSE: SJM).

Consumer spending habits rebound.

Rising inflation stung many consumers, causing them to trade down to lower-price generics and private-label brands. The weak macroeconomic environment has led to consumers wasting less food and even consuming less food. Consumers resisted price increases and decreased their basket sizes, as evidenced by the 6.6% volume decline in ConAgra's fiscal Q1 2024. Even among consumer staples, there are discretionary convenience products like packaged goods and frozen foods that households have cut back on and shifted away from.

As inflation continues to fall, some of the pressure of tightened budgets should unwind. With the U.S. Federal Reserve (Fed) expected to cut interest rates up to 100 bps in 2024, consumers may return to their favorite popular brands as disposable income rebounds. Check out the sector heatmap on MarketBeat.

Earnings are positive as revenues continue to flake.

ConAgra reported fiscal Q1 2024 EPS of 66 cents, beating consensus analyst estimates for 60 cents by 6 cents. Diluted EPS was negative 16 cents in the year-ago period. This was its sixth consecutive earnings beat. Revenues were flat YoY at $2.9 billion but missed estimates for $2.95 billion, marking the 11th straight quarter of YoY volume declines. Operating margin increased 1,757 bps to 16.8%. Adjusted operating margin improved 297 bps to 16.7%.

Metrics by segment

Its Refrigerated and Frozen segment was the weakest, with a 4.6% YoY decline in revenues to $1.2 billion and a 10.2% decline in volume. Grocery and Snacks saw a 1.2% YoY rise in revenues driven by a 5.6% price increase. Foodservice saw revenues rise 5.2% following a 10.3% increase in prices.

International sales rose 11.4% to $260 million on a 0.3% volume increase on top of its 7.9% price increases. The 0.3% decrease in organic net sales was largely driven by the decrease in volume amid an industry-wide slowdown in consumption.

Reaffirmed guidance

ConAgra reaffirmed fiscal 2024 guidance reflecting 1% YoY organic net sales growth. Full-year EPS is expected to be between $2.70 and $2.75 versus $2.71, according to consensus analyst estimates. Shares of ConAgra fell to 52-week lows at $24.84 in response but staged a rally after making new lows. Get AI-powered insights on MarketBeat.

CEO comments on consumer behavior

ConAgra CEO Sean Connolly commented, “As you've seen for some time now, with the notable exception of summer travel, discretionary purchases have been down almost across the board. Consumers have also been actively reducing remnant household inventory from the pandemic.

Within food, convenience-oriented items, typically a top consumer priority, have lagged as shoppers have turned to more hands-on food prep to get additional bang for their buck.”

Analyst actions

On Dec. 11, 2023, Evercore ISI downgraded its rating on ConAgra shares from Outperform to In-line. The following day, Wells Fargo started coverage on ConAgra with an Equal Weight rating and a $31 stock price target.

Conagra Brands analyst ratings and price targets are at MarketBeat. ConAgra Brands' peers and competitor stocks can be found with the MarketBeat stock screener.

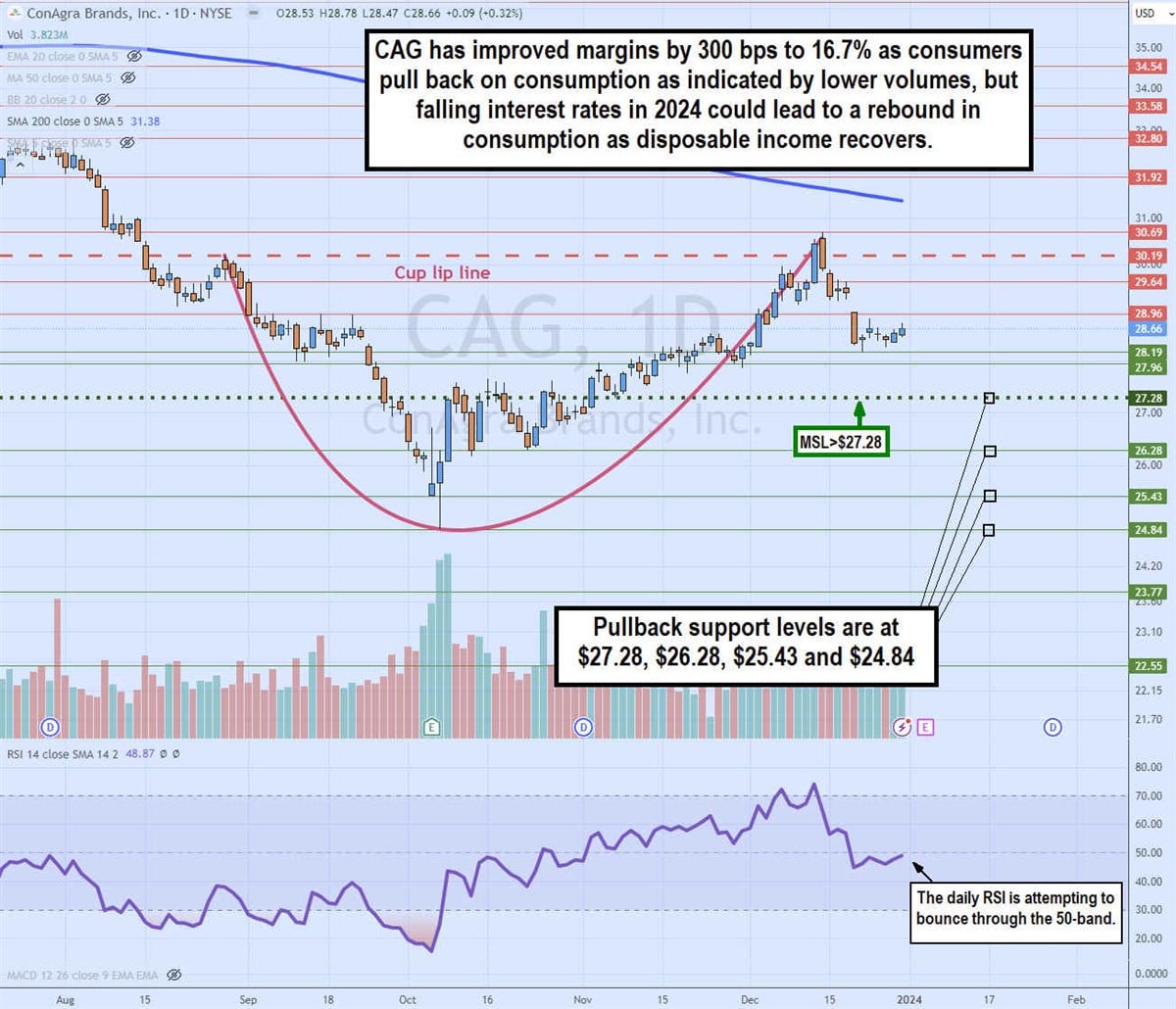

Daily cup and handle pattern

The daily candlestick chart on CAG illustrates a potential cup and handle pattern. The cup lip line commenced at $30.19 on Aug. 29, 2023. CAG fell to a low of $24.84 on October 6, 2023. CAG formed a market structure low (MSL) buy trigger at $27.28. The MSL breakout occurred on November 2, 2023, on an ascending triangle pattern.

CAG shares have been grinding higher until they overshot through the cup lip line to peak at $30.69 on December 14, 2023. Shares fell back down to $28.19 in an attempt to form a potential handle. The daily relative strength index (RSI) is attempting to bounce through the 50-band. Pullback support levels are at $27.28, $26.28, $25.43 and $24.84.