As the Q3 earnings season comes to a close, it’s time to take stock of this quarter’s best and worst performers in the large-format grocery & general merchandise retailer industry, including Walmart (NYSE: WMT) and its peers.

Big-box retailers operate large stores that sell groceries and general merchandise at highly competitive prices. Because of their scale and resulting purchasing power, these big-box retailers–with annual sales in the tens to hundreds of billions of dollars–are able to get attractive volume discounts and sell at often the lowest prices. While e-commerce is a threat, these retailers have been able to weather the storm by either providing a unique in-store shopping experience or by reinvesting their hefty profits into omnichannel investments.

The 4 large-format grocery & general merchandise retailer stocks we track reported a mixed Q3. As a group, revenues were in line with analysts’ consensus estimates.

In light of this news, share prices of the companies have held steady as they are up 3.2% on average since the latest earnings results.

Best Q3: Walmart (NYSE: WMT)

Known for its large-format Supercenters, Walmart (NYSE: WMT) is a retail pioneer that serves a budget-conscious consumer who is looking for a wide range of products under one roof.

Walmart reported revenues of $179.5 billion, up 5.8% year on year. This print exceeded analysts’ expectations by 1.1%. Overall, it was a satisfactory quarter for the company with a decent beat of analysts’ gross margin estimates but full-year EPS guidance meeting analysts’ expectations.

Walmart achieved the biggest analyst estimates beat of the whole group. Unsurprisingly, the stock is up 14.1% since reporting and currently trades at $114.88.

Is now the time to buy Walmart? Access our full analysis of the earnings results here, it’s free for active Edge members.

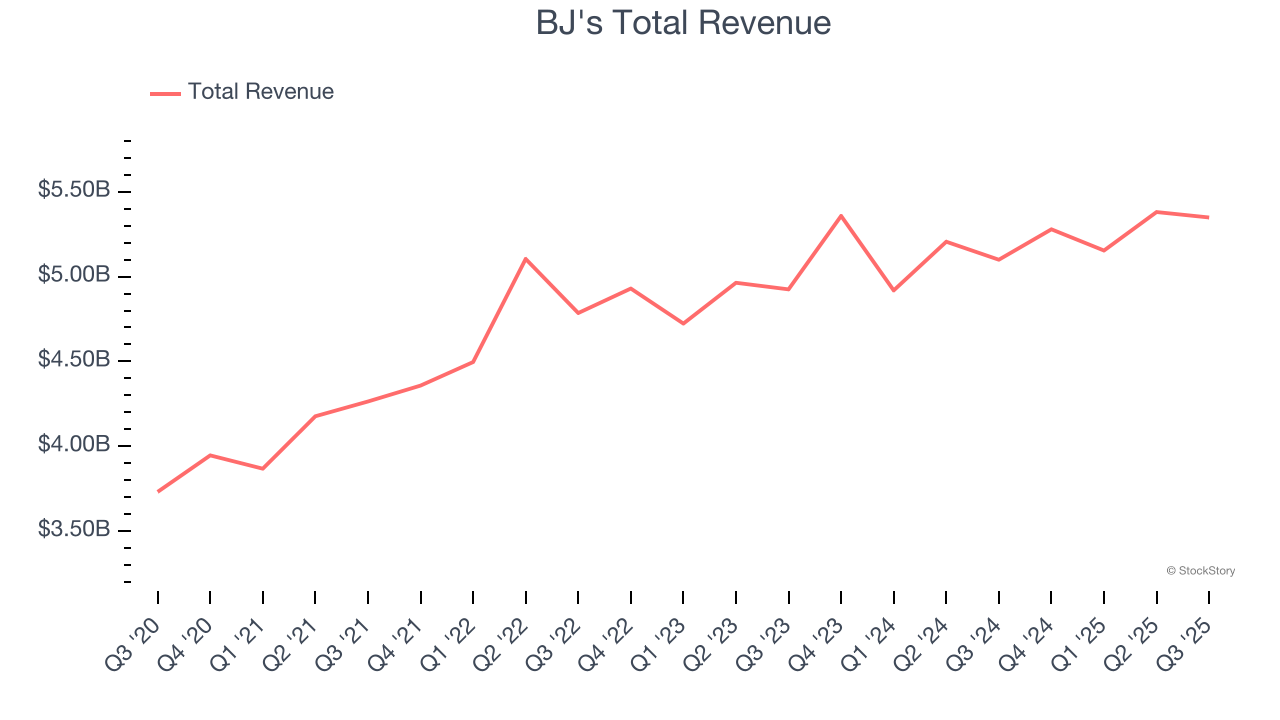

BJ's (NYSE: BJ)

Appealing to the budget-conscious individual shopping for a household, BJ’s Wholesale Club (NYSE: BJ) is a membership-only retail chain that sells groceries, appliances, electronics, and household items, often in bulk quantities.

BJ's reported revenues of $5.35 billion, up 4.9% year on year, in line with analysts’ expectations. The business performed better than its peers, but it was unfortunately a mixed quarter with a beat of analysts’ EPS estimates but a slight miss of analysts’ EBITDA estimates.

However, the results were likely priced into the stock as it’s traded sideways since reporting. Shares currently sit at $90.87.

Is now the time to buy BJ's? Access our full analysis of the earnings results here, it’s free for active Edge members.

Weakest Q3: Target (NYSE: TGT)

With a higher focus on style and aesthetics compared to other large general merchandise retailers, Target (NYSE: TGT) serves the suburban consumer who is looking for a wide range of products under one roof.

Target reported revenues of $25.27 billion, down 1.6% year on year, in line with analysts’ expectations. It was a mixed quarter as it posted full-year EPS guidance beating analysts’ expectations but a significant miss of analysts’ EBITDA estimates.

Target delivered the weakest performance against analyst estimates and slowest revenue growth in the group. Interestingly, the stock is up 3.4% since the results and currently trades at $91.54.

Read our full analysis of Target’s results here.

Costco (NASDAQ: COST)

Designed to be a one-stop shop for the suburban consumer, Costco (NASDAQ: COST) is a membership-only retail chain that sells groceries, apparel, toys, and household items, often in bulk quantities.

Costco reported revenues of $86.16 billion, up 8.1% year on year. This print was in line with analysts’ expectations. Taking a step back, it was a mixed quarter as it also produced an impressive beat of analysts’ gross margin estimates but a slight miss of analysts’ EBITDA estimates.

Costco achieved the fastest revenue growth among its peers. The stock is down 5.1% since reporting and currently trades at $895.58.

Read our full, actionable report on Costco here, it’s free for active Edge members.

Market Update

Thanks to the Fed’s rate hikes in 2022 and 2023, inflation has been on a steady path downward, easing back toward that 2% sweet spot. Fortunately (miraculously to some), all this tightening didn’t send the economy tumbling into a recession, so here we are, cautiously celebrating a soft landing. The cherry on top? Recent rate cuts (half a point in September 2024, a quarter in November) have propped up markets, especially after Trump’s November win lit a fire under major indices and sent them to all-time highs. However, there’s still plenty to ponder — tariffs, corporate tax cuts, and what 2025 might hold for the economy.

Want to invest in winners with rock-solid fundamentals? Check out our Top 5 Quality Compounder Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

StockStory’s analyst team — all seasoned professional investors — uses quantitative analysis and automation to deliver market-beating insights faster and with higher quality.