While the S&P 500 is up 13.1% since June 2025, Ellington Financial (currently trading at $13.64 per share) has lagged behind, posting a return of 6.2%. This might have investors contemplating their next move.

Is there a buying opportunity in Ellington Financial, or does it present a risk to your portfolio? See what our analysts have to say in our full research report, it’s free for active Edge members.

Why Do We Think Ellington Financial Will Underperform?

We're cautious about Ellington Financial. Here are three reasons you should be careful with EFC and a stock we'd rather own.

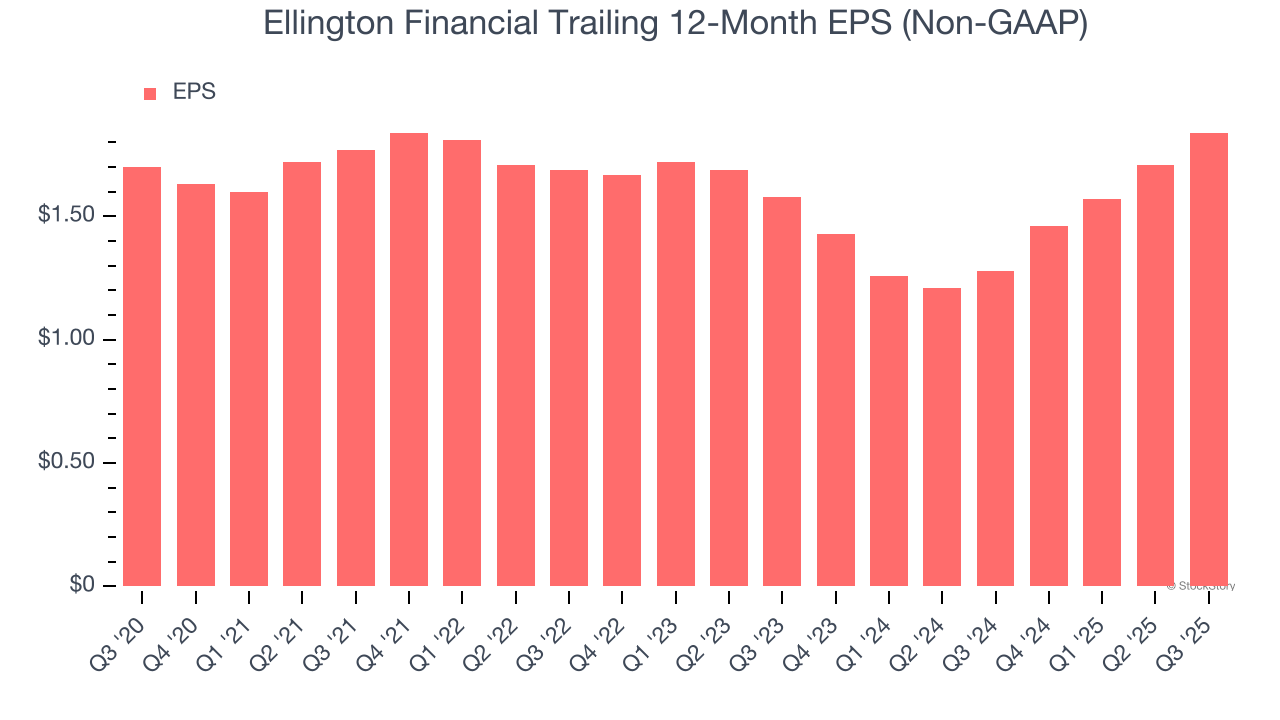

1. EPS Barely Growing

Analyzing the long-term change in earnings per share (EPS) shows whether a company's incremental sales were profitable – for example, revenue could be inflated through excessive spending on advertising and promotions.

Ellington Financial’s EPS grew at a weak 1.6% compounded annual growth rate over the last five years, lower than its 14.8% annualized revenue growth. This tells us the company became less profitable on a per-share basis as it expanded.

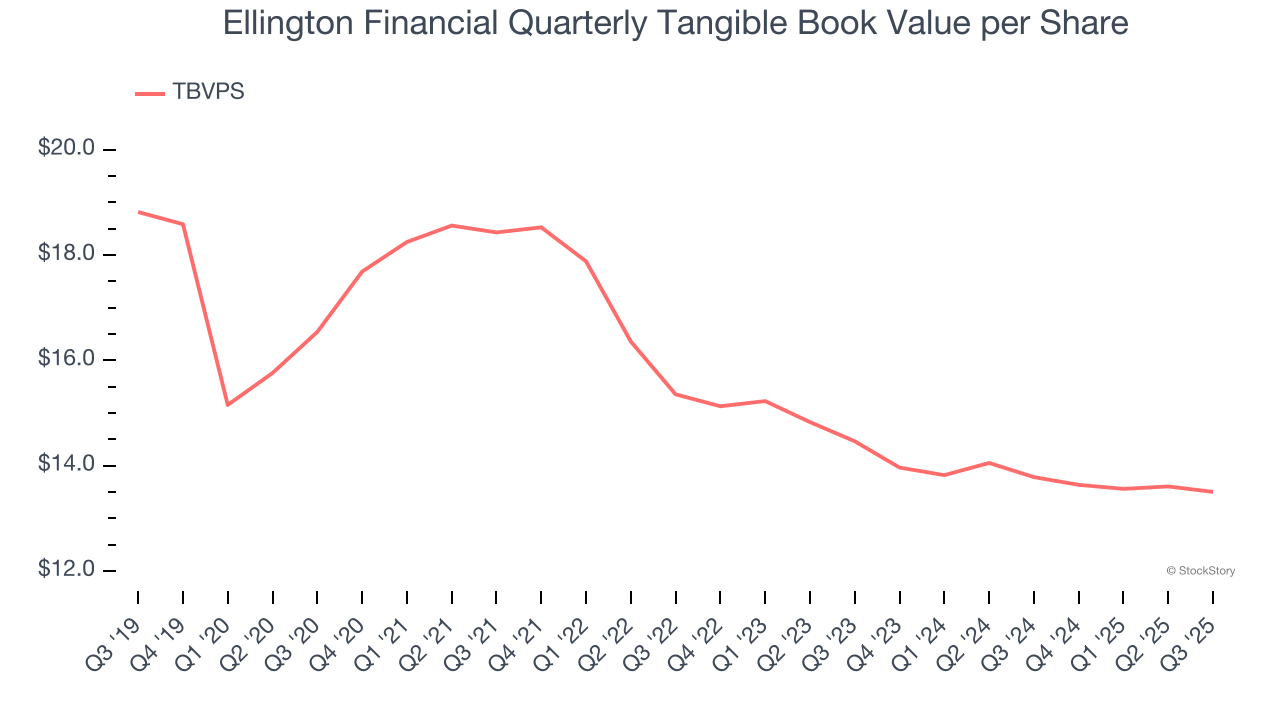

2. Declining TBVPS Reflects Erosion of Asset Value

For banks, tangible book value per share (TBVPS) is a crucial metric that measures the actual value of shareholders’ equity, stripping out goodwill and other intangible assets that may not be recoverable in a worst-case scenario.

To the detriment of investors, Ellington Financial’s TBVPS declined at a 3.4% annual clip over the last two years.

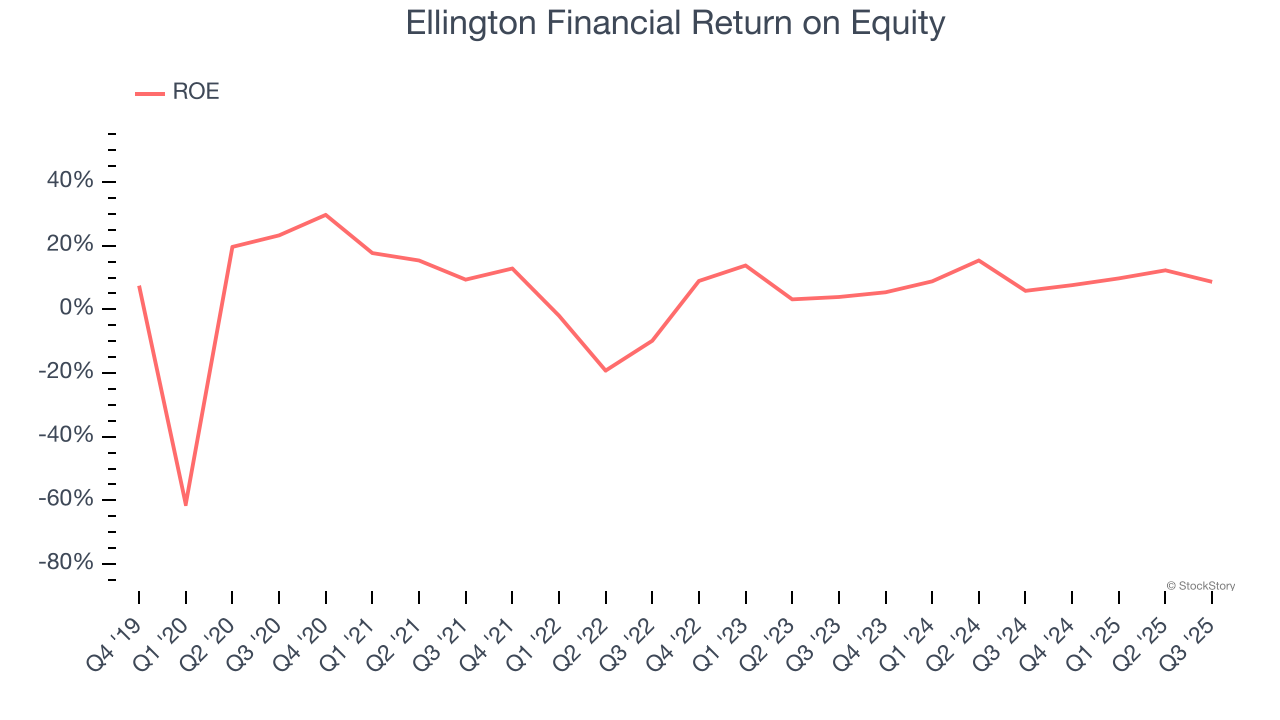

3. Previous Growth Initiatives Haven’t Impressed

Return on equity, or ROE, tells us how much profit a company generates for each dollar of shareholder equity, a key funding source for banks. Over a long period, banks with high ROE tend to compound shareholder wealth faster through retained earnings, buybacks, and dividends.

Over the last five years, Ellington Financial has averaged an ROE of 7.9%, uninspiring for a company operating in a sector where the average shakes out around 7.5%.

Final Judgment

Ellington Financial doesn’t pass our quality test. With its shares underperforming the market lately, the stock trades at 1× forward P/B (or $13.64 per share). This valuation tells us it’s a bit of a market darling with a lot of good news priced in - you can find more timely opportunities elsewhere. We’d suggest looking at one of our top digital advertising picks.

Stocks We Like More Than Ellington Financial

If your portfolio success hinges on just 4 stocks, your wealth is built on fragile ground. You have a small window to secure high-quality assets before the market widens and these prices disappear.

Don’t wait for the next volatility shock. Check out our Top 6 Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 244% over the last five years (as of June 30, 2025).

Stocks that have made our list include now familiar names such as Nvidia (+1,326% between June 2020 and June 2025) as well as under-the-radar businesses like the once-micro-cap company Kadant (+351% five-year return). Find your next big winner with StockStory today.