Power Integrations’s stock price has taken a beating over the past six months, shedding 33.9% of its value and falling to $36 per share. This might have investors contemplating their next move.

Is now the time to buy Power Integrations, or should you be careful about including it in your portfolio? Check out our in-depth research report to see what our analysts have to say, it’s free for active Edge members.

Why Do We Think Power Integrations Will Underperform?

Despite the more favorable entry price, we're swiping left on Power Integrations for now. Here are three reasons there are better opportunities than POWI and a stock we'd rather own.

1. Long-Term Revenue Growth Flatter Than a Pancake

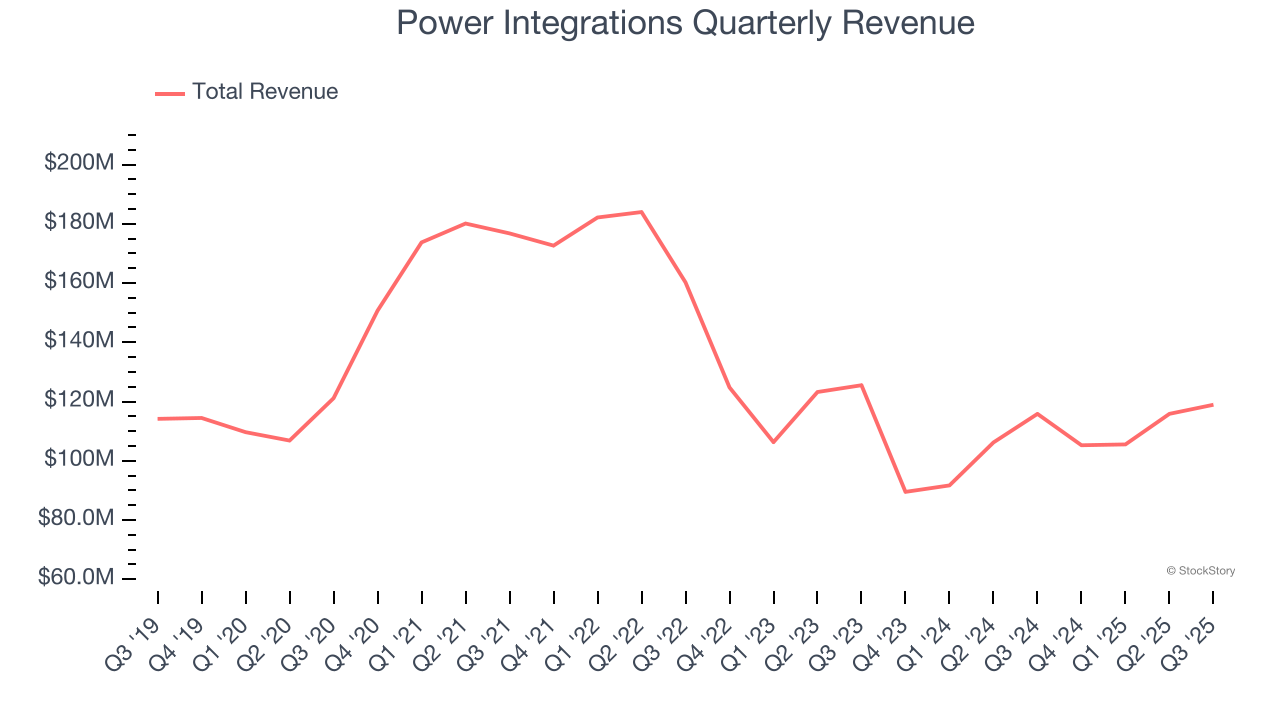

A company’s long-term sales performance is one signal of its overall quality. Any business can have short-term success, but a top-tier one grows for years. Unfortunately, Power Integrations struggled to consistently increase demand as its $445.6 million of sales for the trailing 12 months was close to its revenue five years ago. This was below our standards and signals it’s a low quality business. Semiconductors are a cyclical industry, and long-term investors should be prepared for periods of high growth followed by periods of revenue contractions.

2. Projected Revenue Growth Is Slim

Forecasted revenues by Wall Street analysts signal a company’s potential. Predictions may not always be accurate, but accelerating growth typically boosts valuation multiples and stock prices while slowing growth does the opposite.

Over the next 12 months, sell-side analysts expect Power Integrations’s revenue to rise by 1.9%. While this projection implies its newer products and services will spur better top-line performance, it is still below average for the sector.

3. Shrinking Operating Margin

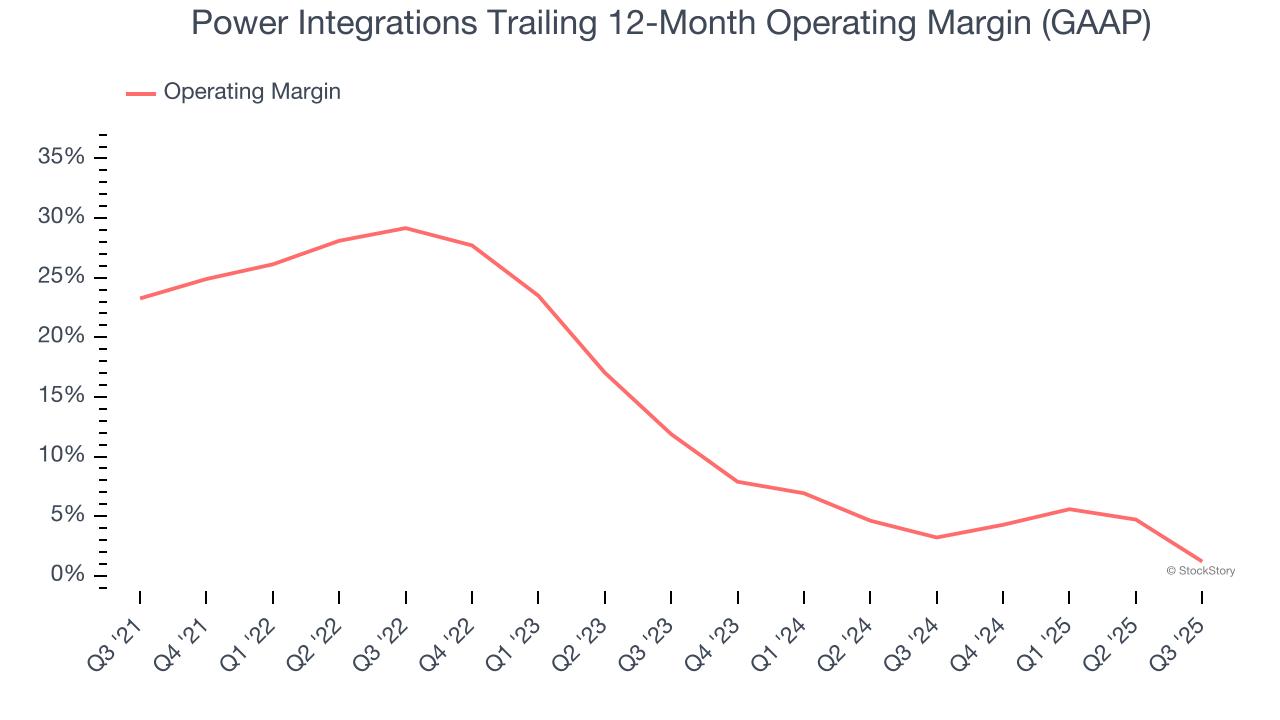

Operating margin is one of the best measures of profitability because it tells us how much money a company takes home after procuring and manufacturing its products, marketing and selling those products, and most importantly, keeping them relevant through research and development.

Looking at the trend in its profitability, Power Integrations’s operating margin decreased by 22.1 percentage points over the last five years. Power Integrations’s performance was poor no matter how you look at it - it shows that costs were rising and it couldn’t pass them onto its customers. Its operating margin for the trailing 12 months was 1.2%.

Final Judgment

We see the value of companies furthering technological innovation, but in the case of Power Integrations, we’re out. Following the recent decline, the stock trades at 31.9× forward P/E (or $36 per share). This multiple tells us a lot of good news is priced in - we think there are better opportunities elsewhere. We’d recommend looking at one of our all-time favorite software stocks.

Stocks We Would Buy Instead of Power Integrations

The market’s up big this year - but there’s a catch. Just 4 stocks account for half the S&P 500’s entire gain. That kind of concentration makes investors nervous, and for good reason. While everyone piles into the same crowded names, smart investors are hunting quality where no one’s looking - and paying a fraction of the price. Check out the high-quality names we’ve flagged in our Top 5 Strong Momentum Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 244% over the last five years (as of June 30, 2025).

Stocks that have made our list include now familiar names such as Nvidia (+1,326% between June 2020 and June 2025) as well as under-the-radar businesses like the once-micro-cap company Tecnoglass (+1,754% five-year return). Find your next big winner with StockStory today.