Badger Meter has gotten torched over the last six months - since June 2025, its stock price has dropped 24.1% to $184 per share. This might have investors contemplating their next move.

Given the weaker price action, is now the time to buy BMI? Find out in our full research report, it’s free for active Edge members.

Why Are We Positive On Badger Meter?

The developer of the world’s first frost-proof water meter in 1905, Badger Meter (NYSE: BMI) provides water control and measure equipment to various industries.

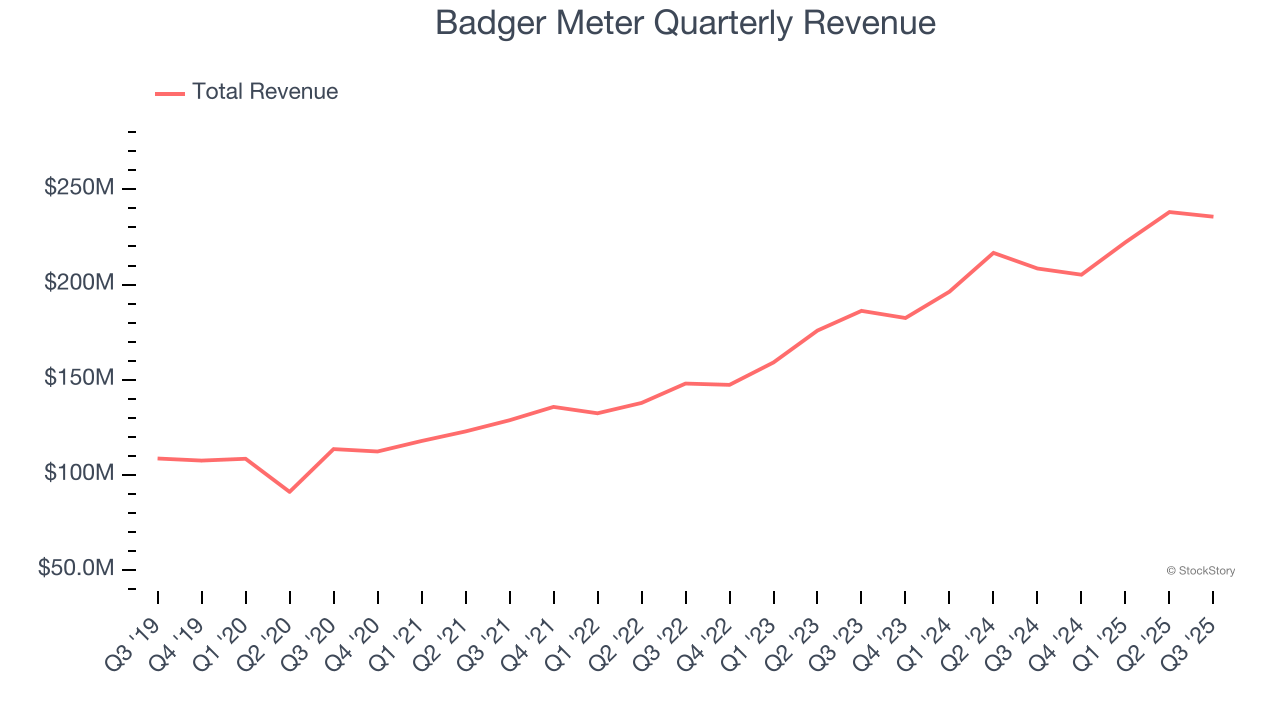

1. Skyrocketing Revenue Shows Strong Momentum

Examining a company’s long-term performance can provide clues about its quality. Any business can experience short-term success, but top-performing ones enjoy sustained growth for years. Luckily, Badger Meter’s sales grew at an incredible 16.5% compounded annual growth rate over the last five years. Its growth beat the average industrials company and shows its offerings resonate with customers.

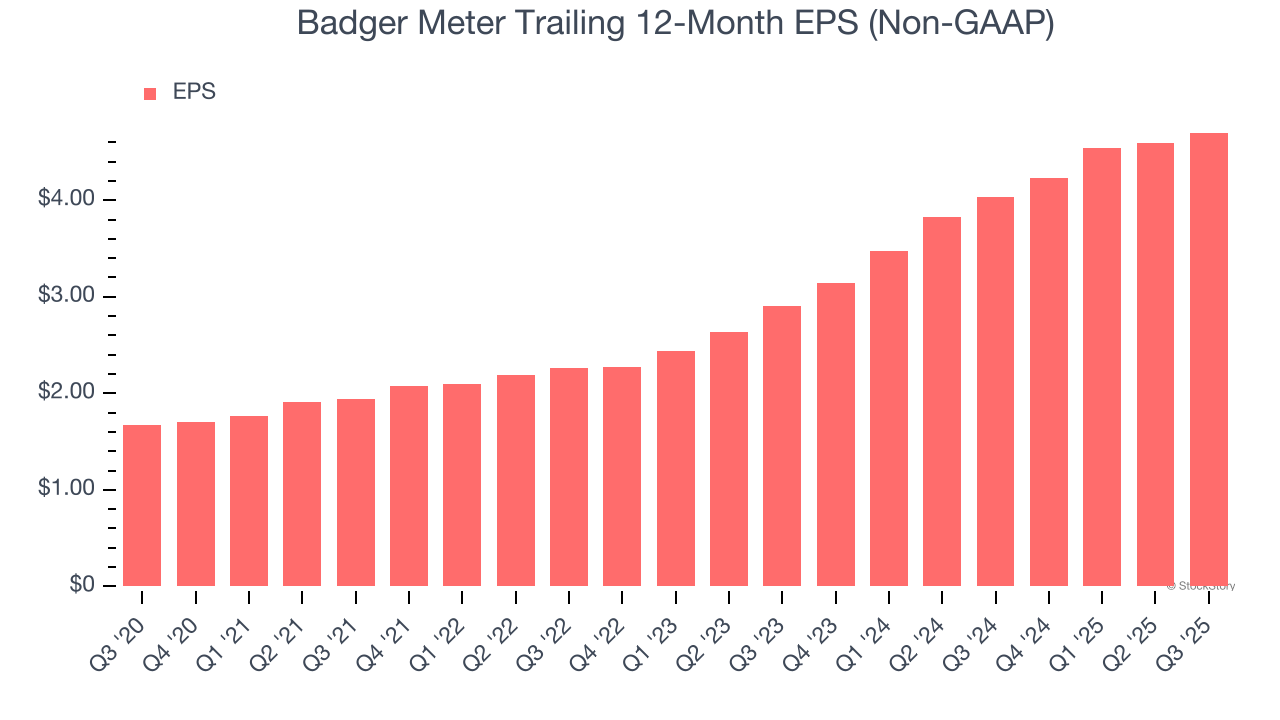

2. Outstanding Long-Term EPS Growth

We track the long-term change in earnings per share (EPS) because it highlights whether a company’s growth is profitable.

Badger Meter’s EPS grew at an astounding 23% compounded annual growth rate over the last five years, higher than its 16.5% annualized revenue growth. This tells us the company became more profitable on a per-share basis as it expanded.

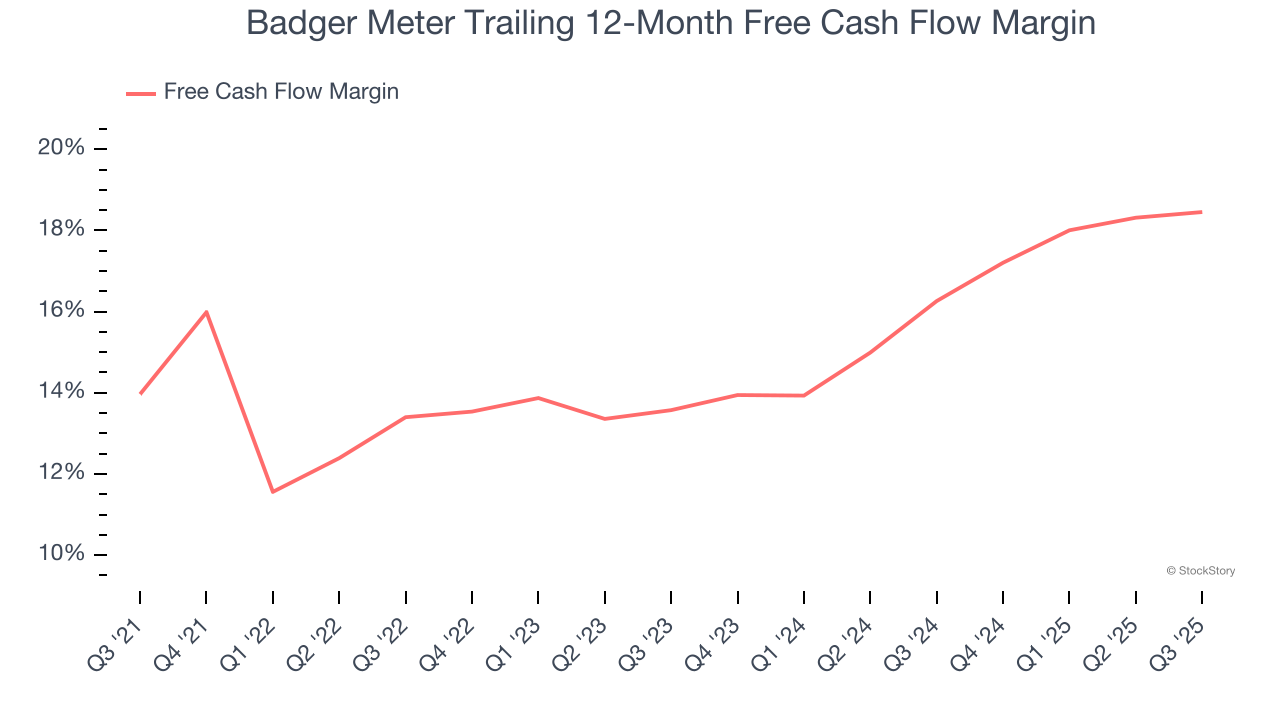

3. Excellent Free Cash Flow Margin Boosts Reinvestment Potential

Free cash flow isn't a prominently featured metric in company financials and earnings releases, but we think it's telling because it accounts for all operating and capital expenses, making it tough to manipulate. Cash is king.

Badger Meter has shown terrific cash profitability, putting it in an advantageous position to invest in new products, return capital to investors, and consolidate the market during industry downturns. The company’s free cash flow margin was among the best in the industrials sector, averaging 15.5% over the last five years.

Final Judgment

These are just a few reasons why we're bullish on Badger Meter. After the recent drawdown, the stock trades at 34.8× forward P/E (or $184 per share). Is now the time to initiate a position? See for yourself in our in-depth research report, it’s free for active Edge members.

High-Quality Stocks for All Market Conditions

If your portfolio success hinges on just 4 stocks, your wealth is built on fragile ground. You have a small window to secure high-quality assets before the market widens and these prices disappear.

Don’t wait for the next volatility shock. Check out our Top 6 Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 244% over the last five years (as of June 30, 2025).

Stocks that have made our list include now familiar names such as Nvidia (+1,326% between June 2020 and June 2025) as well as under-the-radar businesses like the once-small-cap company Exlservice (+354% five-year return). Find your next big winner with StockStory today.