Newspaper and digital media company The New York Times (NYSE:NYT) met Wall Street’s revenue expectations in Q4 CY2024, with sales up 7.5% year on year to $726.6 million. Its non-GAAP profit of $0.80 per share was 6.3% above analysts’ consensus estimates.

Is now the time to buy The New York Times? Find out by accessing our full research report, it’s free.

The New York Times (NYT) Q4 CY2024 Highlights:

- Revenue: $726.6 million vs analyst estimates of $727.7 million (7.5% year-on-year growth, in line)

- Adjusted EPS: $0.80 vs analyst estimates of $0.75 (6.3% beat)

- Adjusted EBITDA: $167.7 million vs analyst estimates of $175.6 million (23.1% margin, 4.5% miss)

- Operating Margin: 20.2%, up from 19.1% in the same quarter last year

- Free Cash Flow Margin: 19.8%, similar to the same quarter last year

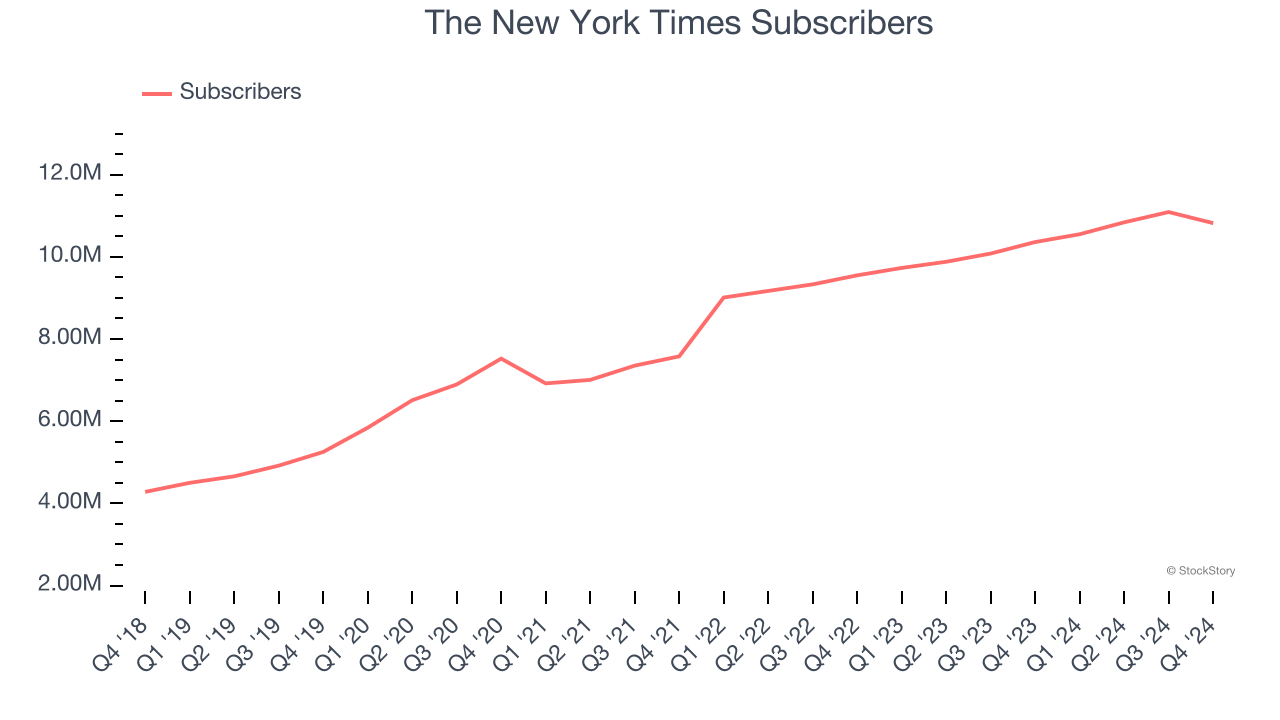

- Subscribers: 10.82 million, up 460,000 year on year (miss)

- Market Capitalization: $9.16 billion

Company Overview

Founded in 1851, The New York Times (NYSE:NYT) is an American media organization known for its influential newspaper and expansive digital journalism platforms.

Media

The advent of the internet changed how shows, films, music, and overall information flow. As a result, many media companies now face secular headwinds as attention shifts online. Some have made concerted efforts to adapt by introducing digital subscriptions, podcasts, and streaming platforms. Time will tell if their strategies succeed and which companies will emerge as the long-term winners.

Sales Growth

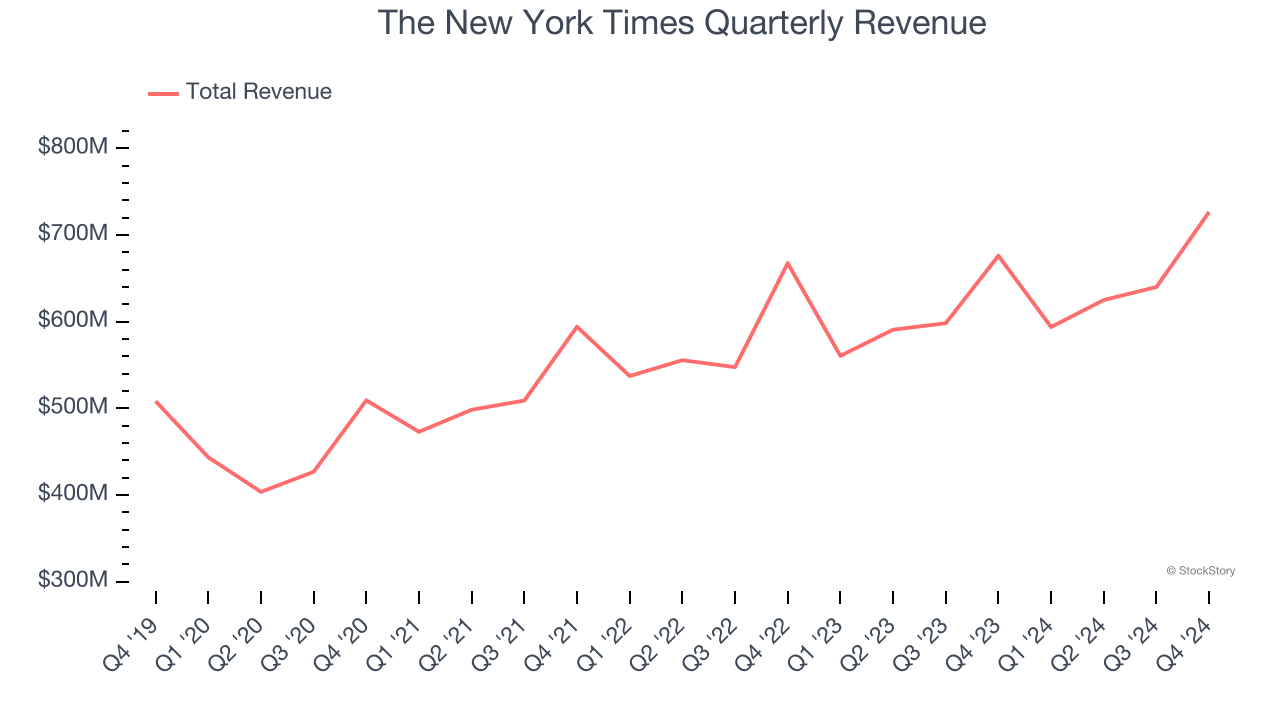

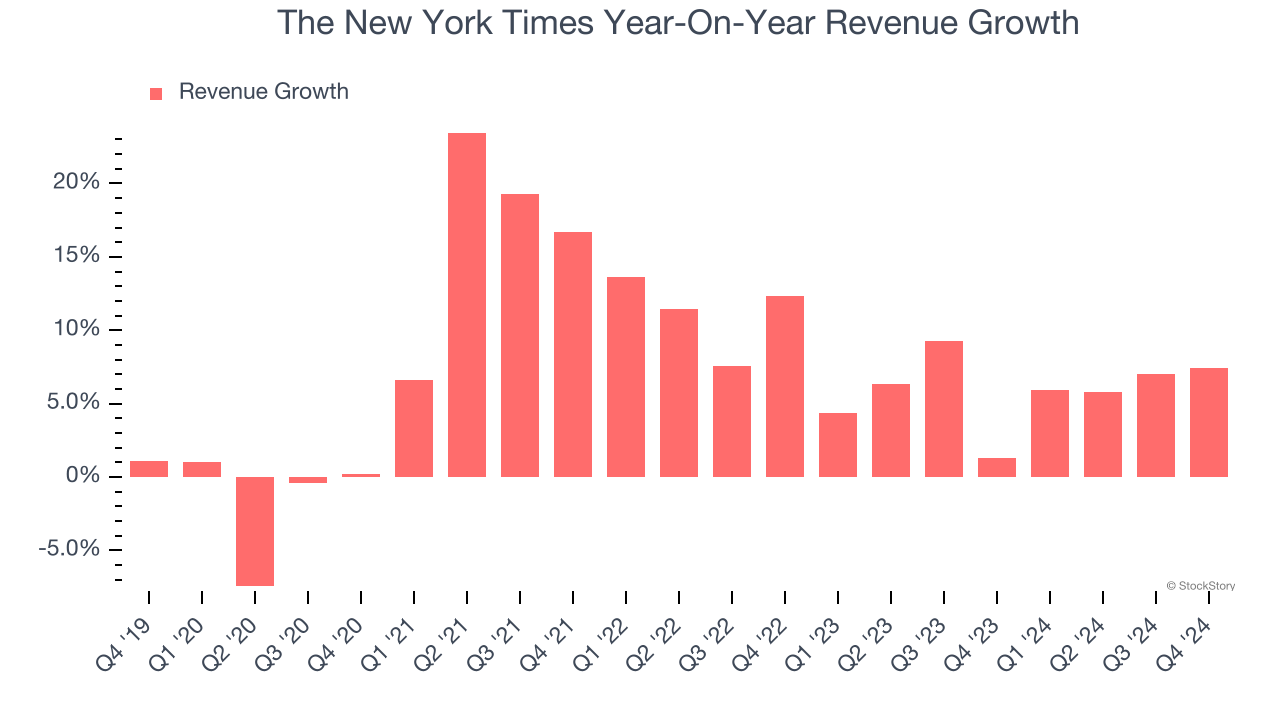

Reviewing a company’s long-term sales performance reveals insights into its quality. Any business can have short-term success, but a top-tier one grows for years. Unfortunately, The New York Times’s 7.4% annualized revenue growth over the last five years was sluggish. This fell short of our benchmark for the consumer discretionary sector and is a rough starting point for our analysis.

Long-term growth is the most important, but within consumer discretionary, product cycles are short and revenue can be hit-driven due to rapidly changing trends and consumer preferences. The New York Times’s recent history shows its demand slowed as its annualized revenue growth of 5.8% over the last two years is below its five-year trend.

We can better understand the company’s revenue dynamics by analyzing its number of subscribers, which reached 10.82 million in the latest quarter. Over the last two years, The New York Times’s subscribers averaged 8.1% year-on-year growth. Because this number is higher than its revenue growth during the same period, we can see the company’s monetization has fallen.

This quarter, The New York Times grew its revenue by 7.5% year on year, and its $726.6 million of revenue was in line with Wall Street’s estimates.

Looking ahead, sell-side analysts expect revenue to grow 6.6% over the next 12 months, similar to its two-year rate. This projection doesn't excite us and implies its newer products and services will not catalyze better top-line performance yet.

Today’s young investors won’t have read the timeless lessons in Gorilla Game: Picking Winners In High Technology because it was written more than 20 years ago when Microsoft and Apple were first establishing their supremacy. But if we apply the same principles, then enterprise software stocks leveraging their own generative AI capabilities may well be the Gorillas of the future. So, in that spirit, we are excited to present our Special Free Report on a profitable, fast-growing enterprise software stock that is already riding the automation wave and looking to catch the generative AI next.

Cash Is King

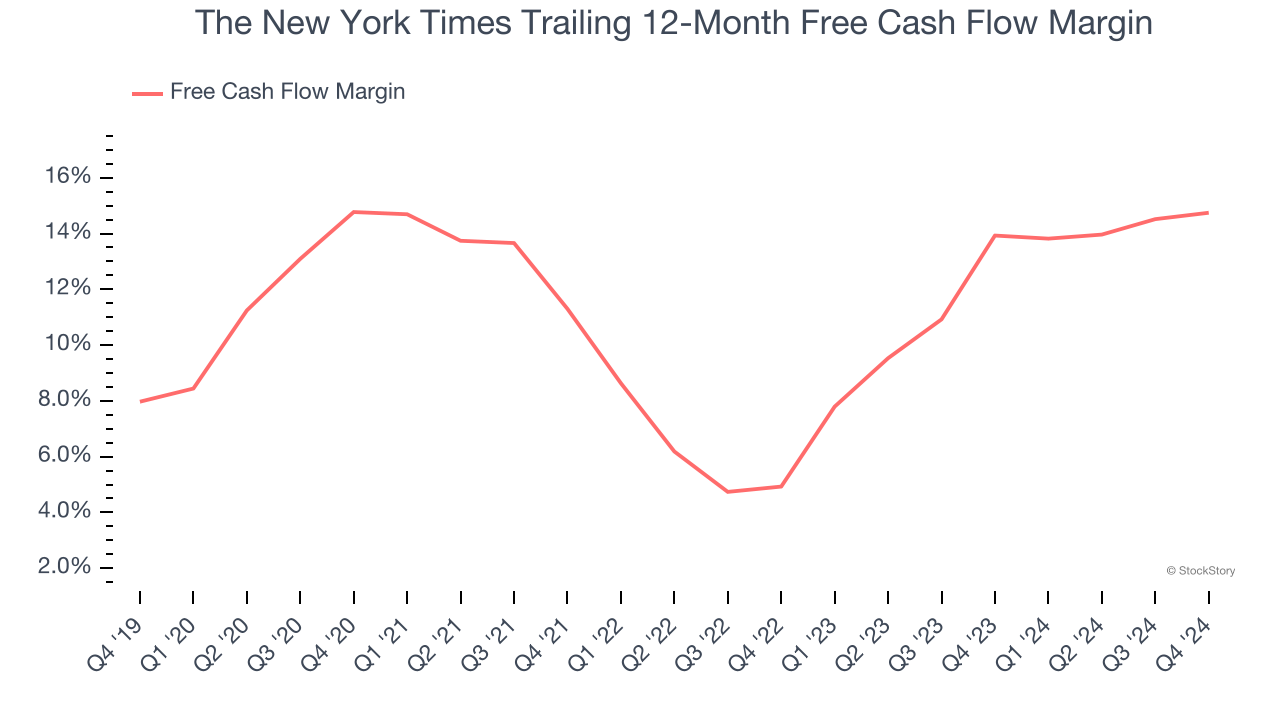

Free cash flow isn't a prominently featured metric in company financials and earnings releases, but we think it's telling because it accounts for all operating and capital expenses, making it tough to manipulate. Cash is king.

The New York Times has shown impressive cash profitability, giving it the option to reinvest or return capital to investors. The company’s free cash flow margin averaged 14.4% over the last two years, better than the broader consumer discretionary sector.

The New York Times’s free cash flow clocked in at $143.6 million in Q4, equivalent to a 19.8% margin. This cash profitability was in line with the comparable period last year and above its two-year average.

Key Takeaways from The New York Times’s Q4 Results

It was encouraging to see The New York Times beat analysts’ EPS expectations this quarter. On the other hand, its number of subscribers missed. Overall, this quarter was mixed. The stock traded up 2.2% to $57.19 immediately after reporting.

Is The New York Times an attractive investment opportunity at the current price? We think that the latest quarter is only one piece of the longer-term business quality puzzle. Quality, when combined with valuation, can help determine if the stock is a buy. We cover that in our actionable full research report which you can read here, it’s free.