As AI Propels Alphabet Stock Upward, GOOGL Nears $4 Trillion Valuation

Alphabet (GOOGL) stock climbed to a new high on Nov. 19 before closing the day about 3% higher. The jump came after Google unveiled its newest artificial intelligence (AI) model, Gemini 3, which the company says raises the bar for AI performance by delivering more concise, improved responses. The launch has renewed optimism among investors as AI has been a key driver of Alphabet’s growth.

Notably, Alphabet is showing strong momentum across all of its core businesses, and AI is playing a key role in that progress. With a market capitalization of roughly $3.54 trillion at the time of writing, Alphabet now appears well on its way to a $4 trillion valuation as AI becomes the engine powering its next phase of expansion.

The AI-driven strength was evident when Alphabet recently reported its first-ever $100 billion revenue quarter. AI is boosting results across search, advertising, YouTube, cloud computing, and subscription services, making the technology central to its growth. Consumers’ increasing reliance on AI-enhanced search tools continues to support Alphabet’s dominant position in digital advertising. At the same time, demand for AI-driven solutions helped the cloud segment deliver another strong quarter, and its backlog jumped 46% from the previous quarter to reach $155 billion.

Alphabet’s subscription ecosystem is expanding quickly. The company now has more than 300 million paid subscribers across Google One and YouTube Premium, highlighting the strength of its recurring-revenue streams.

Investor confidence received an additional boost when Berkshire Hathaway (BRK.A) (BRK.B) disclosed a new stake in Alphabet. The conglomerate’s investment in GOOGL stock adds credibility to the bullish case for GOOGL.

Notably, GOOGL shares have already surged 80% in the past six months, but with AI continuing to accelerate the company’s growth, the rally still has plenty of room to run.

Alphabet Stock to Rise Further

Alphabet’s AI push is laying a solid foundation for long-term growth. For instance, Google’s search and other revenue reached $56.6 billion, up 15% year-over-year. The company’s new AI-driven features, such as AI Overviews and AI Mode, are making search more intuitive and commercial, helping users find relevant information faster while improving how businesses connect with potential customers. These enhancements are increasing the value of commercial queries, creating new monetization channels that could fuel advertising growth for years.

The real acceleration, however, is coming from Alphabet’s cloud business. Revenue in the segment jumped 34% to $15.2 billion, supported by the rapid adoption of enterprise AI tools. Google Cloud Platform continues to expand its footprint as companies increasingly integrate AI into operations, and the number of new GCP clients has risen sharply.

Alphabet has signed more billion-dollar cloud deals this year than in the previous two years combined, a sign of growing confidence in its AI-first strategy. More than 70% of cloud customers are using Google’s AI products, strengthening the company’s ecosystem. With over a dozen product lines now generating more than $1 billion annually and generative AI revenue up more than 200%, the cloud segment is becoming a powerful profit engine.

Alphabet is also extending its AI reach into the workplace. The recent launch of Gemini Enterprise is a strategic step toward embedding AI agents into professional workflows, and early traction, with over 2 million subscribers across hundreds of companies, suggests strong demand for AI-enabled productivity tools.

Meanwhile, YouTube continues to grow steadily, with ad revenue rising 15% as AI-powered recommendation systems drive engagement across Shorts, connected-TV, and long-form content. Gemini models are also helping creators produce and monetize content more effectively, supporting a healthier ad ecosystem.

Despite upcoming tough comparisons in advertising due to last year’s U.S. election cycle, Alphabet’s broader momentum looks durable. Expanding cloud adoption, rising demand for enterprise AI, and continued investment in next-generation models and hardware position the stock for further upside.

Analysts Are Bullish About Alphabet Stock

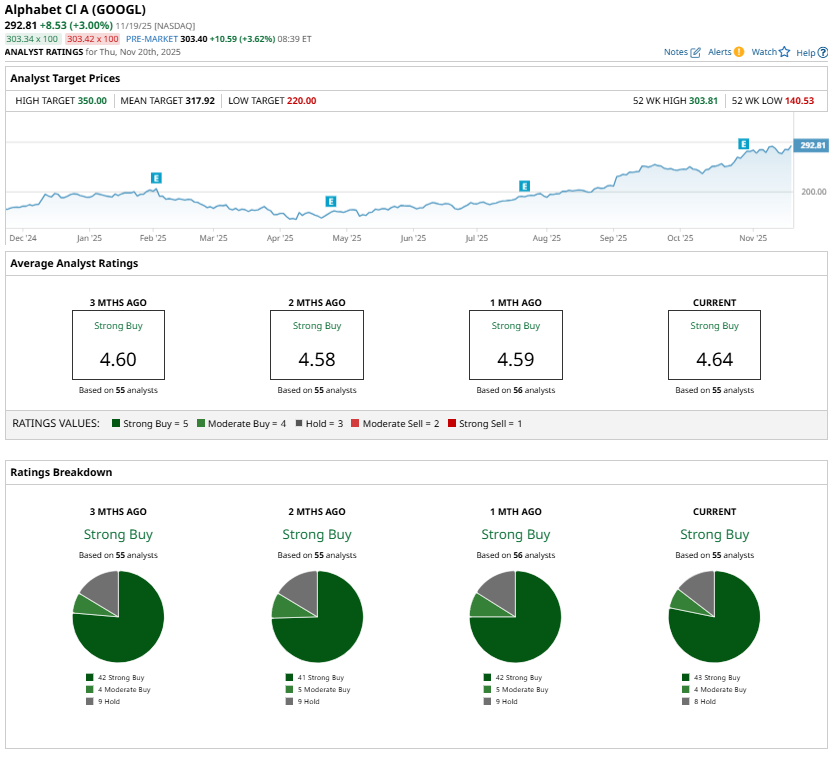

Analysts remain optimistic about Alphabet’s prospects, even after the stock’s strong rally this year. Wall Street recommends a “Strong Buy,” supported by expectations of continued growth across the company’s core businesses.

The highest price target for GOOGL stock is $350, suggesting Alphabet could still climb roughly 20% from its Nov. 19 closing price of $292.81.

Conclusion

Alphabet’s latest surge reflects how AI is powering its growth. With Gemini 3 advancing its technological lead, cloud momentum accelerating, and subscription revenue expanding, the company is firing on all cylinders. Investor confidence remains strong, supported by bullish analyst forecasts and backing from Berkshire Hathaway. While the stock has already enjoyed a significant run-up, Alphabet’s deepening AI integration across search, cloud, and content platforms suggests that its path toward a $4 trillion valuation is within reach.

On the date of publication, Amit Singh did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- Can Nvidia Stock Test Wall Street’s Price Target of $350?

- A Fannie Mae IPO Is ‘Far From Ready.’ What Does That Mean for FNMA Stock Here?

- Exact Sciences Stock Pops on $21 Billion Deal. Is It Too Late to Buy EXAS Here?

- Sonder Stock Soars Amid Bankruptcy Drama. Is It Safe to Buy SOND Stock Here?

More News

View More

Recent Quotes

View More

Quotes delayed at least 20 minutes.

By accessing this page, you agree to the Privacy Policy and Terms Of Service.