Dan Ives Is Pounding the Table on Meta Platforms Despite a ‘Capex Super Cycle.’ Should You Buy META Stock Here?

Meta Platforms (META) — the parent of Facebook, Instagram, WhatsApp, and Threads — is a digital empire that mints its wealth from advertising across its sprawling social universe. Yet for investors, Meta has always been a bit of a tempestuous companion — thrilling on the climb, unnerving on the dips. After a stellar rally heading into the third quarter of 2025, META stock has promptly surrendered its gains, up just 1% in 2025 as Wall Street balks at its spending ambitions.

To be fair, the spending is colossal. Meta is steering headfirst into a capital expenditure (capex) surge, projecting $70 billion to $72 billion in 2025 and hinting that 2026’s bill will be “notably larger,” likely vaulting past the $100 billion mark. That’s a level where cash flows start sweating and debt enters the chat — a reality that spooked investors even though the Q3 report itself was not structurally weak. The discomfort is being amplified by broader anxieties around stubborn interest rates, frothy AI valuations, and a market searching for direction.

Yet in the middle of this turbulence, Wedbush’s Dan Ives calls Meta a “table pounder” with unshakable confidence. To Ives, this is not reckless spending, but the opening act of a “CapEx super cycle,” a moment where data centers and artificial intelligence (AI) infrastructure become tomorrow’s gold mines. He calls Meta a standout, a name worth leaning into while others flinch.

So, with META stock cooling off and sentiment shaky, is this dip a warning sign? Or a chance to trust Ives’ belief in Meta’s high-octane capex cycle and pick up shares while they are marked down?

About Meta Stock

Meta Platforms began life as Facebook in 2004, and its evolution has been anything but ordinary. What started in a dorm room now commands a global digital ecosystem spanning Instagram, WhatsApp, and Messenger. Today, the company is steering hard into AI, augmented reality (AR), and a metaverse vision. A simple newsfeed has morphed into a blueprint for human–machine interaction. Meta is an infrastructure for the next wave of connectivity.

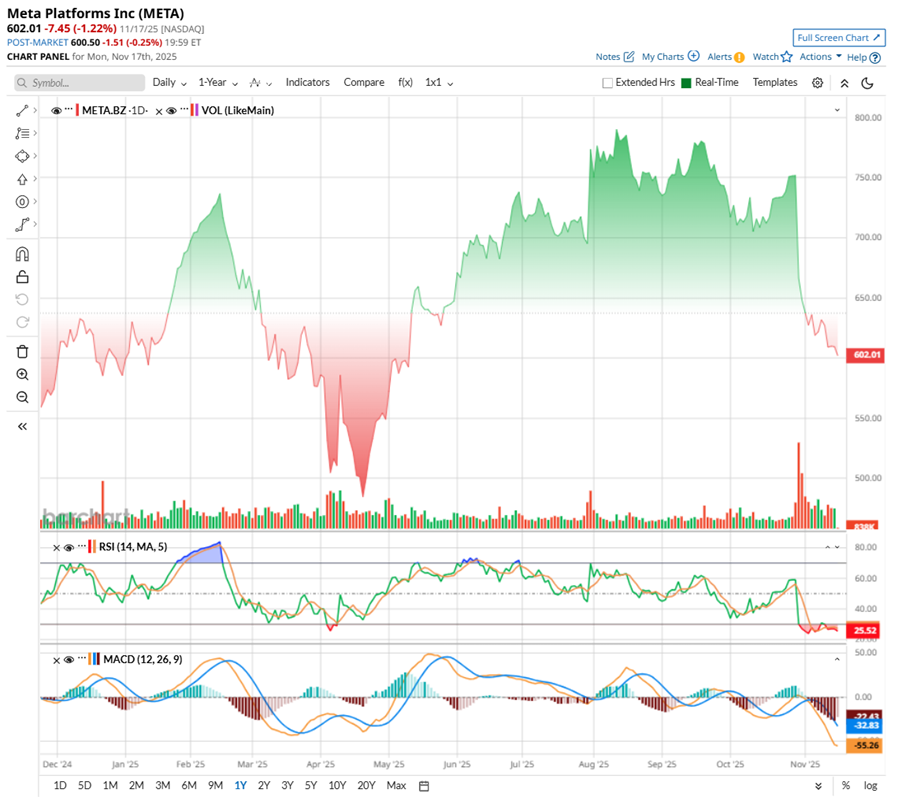

And that future-focused ambition is also visible on the charts. META stock has lived through a year of thrill, fatigue, and recalibration. After a decade-long ascent — nearly 477.5% in 10 years — Meta’s valuation stands at around $1.5 trillion by market capitalization, and it became a rightful member of the "Magnificent Seven.” But even giants stumble, and META’s recent price action has felt like a slow, uneasy exhale.

With just weeks left before the calendar rolls into another year, the stock has slipped deep into negative territory over the past six months. The selloff intensified after Meta’s Q3 2025 earnings on Oct. 29, when shares cratered 11% in the following session. The pressure did not stop there. META stock is now down roughly 22% post-earnings and 21% over the past three months, sitting 26% below its year-to-date (YTD) peak of $796.25.

The market’s worry loop keeps circling back to the same themes — ad durability, AI-driven spending, and Meta’s willingness to torch cash in pursuit of future primacy.

The technicals capture that unease with brutal clarity. The 14-day RSI has slipped into oversold territory. Meanwhile, the MACD paints a similarly grim picture, with the yellow MACD line sliding below the blue signal line and the histogram printing deep red bars — classic indications of sustained downward momentum.

In terms of valuation, it looks lofty. META is priced at 20.7 times forward earnings. Yet that premium buys scale, innovation, and momentum. Meta is not just an ad machine anymore, but is storming into AI, robotics, and the metaverse.

Investors Are Spooked After Meta’s Q3 Report

Meta’s Q3 report, released on Oct. 29, delivered the kind of numbers that would typically send a stock soaring. Revenue surged 26% year-over-year (YOY) to $51.2 billion, crushing expectations. The engine behind this growth was the company’s relentless advertising machine, strengthened by AI-powered targeting, the monetization of Reels, a healthier ad market, and rising user engagement.

Meta noted that its AI recommendations alone drove a 5% increase in time spent on Facebook and a 10% rise on Threads. Even earnings, when adjusted for a deferred tax valuation charge, came in strong — EPS would have climbed to $7.25 from $6.20, compared to the reported diluted EPS of $1.05.

In Q3, ad impressions grew 14%, and average ad prices rose 10% YOY, driven by rising advertiser demand, fueled by improved ad performance. This was partially offset by impression growth, particularly from lower-monetizing regions and surfaces. Family daily active people (DAP) increased 8% YOY, reinforcing that Meta’s platforms remain deeply woven into global digital life.

Yet the applause abruptly faded. Investors were not rattled by the results, but by what’s coming up. Meta’s guidance points to a solid Q4, expecting the topline to land somewhere between $56 billion and $59 billion. But the real shock came from an anticipated capex surge that's so large it practically echoed through the market.

For 2025, management expects total expenses between $116 billion and $118 billion and capex between $70 billion and $72 billion — a dramatic leap from 2024’s $39.2 billion. What's more, 2026’s spending is expected to be “notably larger.” The spending is being funneled into data centers, AI infrastructure, and the computing power required to anchor Meta’s future experiences.

Free cash flow already felt the pressure in Q3, falling to $10.6 billion from $15.5 billion a year earlier. Costs and expenses climbed 32% to $30.7 billion, with research and development alone consuming nearly 30% of revenue. Cash and marketable securities slipped to $44.45 billion, while long-term debt remained steady at $28.83 billion.

CEO Zuckerberg made it clear that management is not worried about “overbuilding,” framing the spending spree as the groundwork for an AI-powered future that Meta refuses to be late to.

Investors, however, heard the story differently. Despite a stellar operational quarter, META stock sank over 11% as the market digested the scale of the coming investment wave, the ongoing Reality Labs losses, and the likelihood that Meta may tap debt to fuel its ambitions. In the end, Q3 revealed a company firing on every cylinder today while choosing to sprint headfirst into an extremely capital-heavy tomorrow — a strategic gamble that inspires long-term confidence for some and short-term nerves for others.

Analysts monitoring Meta project its revenue for Q4 to be around $58.3 billion. EPS for the quarter is anticipated to rise by 1.8% YOY to $8.16. Fiscal 2025 EPS is expected to climb to $28.91, up 21% annually, before surging by another 4% YOY to $30.19.

What Do Analysts Expect for Meta Stock?

Wedbush analyst Dan Ives believes that the market’s nerves around rates and AI valuations are “shortsighted,” insisting the tech bull run still has at least two strong years left. He points to a capex super cycle, surging semiconductor demand, and an AI revolution still in its “second or third inning,” arguing that every dollar of capex today could return $8 to $10 over time. And in that landscape, Ives calls Meta a full-blown “table pounder.”

That confidence feeds directly into Wedbush’s $920 price target — a target the brokerage firm reaffirmed as it added the stock to its Best Ideas list. Wedbush says sentiment has actually brightened since Meta’s Q3 print, even if investors are still tiptoeing around the company’s heavy capex and expense roadmap. In the firm's view, that spending is strategic, justified, and already showing results as AI quietly rewires Meta’s ad engine and recommendation systems.

Ives highlighted signs of steady, underlying demand in Meta’s core business and praised management’s refusal to sacrifice long-term positioning for short-term comfort. He pointed to robust ad growth, encouraging updates from Meta AI and Superintelligence Labs, and early momentum from the company’s new AI-driven hardware.

Valuation-wise, Meta trades at a slight discount to some tech giants, which the analyst sees as unusually attractive after the recent pullback. The risk-reward now looks “compelling,” with downside appearing limited according to Wedbush.

The Street’s most bullish voice comes from Rosenblatt analyst Barton Crockett, who pushed Meta’s target to a towering $1,117 after Q3, maintaining a “Buy” rating. He praised the quarter’s double-digit revenue lift and sturdy EBITDA margins, arguing Meta’s heavier 2026 capex and faster expense ramp are justified by powerful AI returns. Crockett even raised his EBITDA and EPS forecasts, anchoring his target on strong multi-year growth.

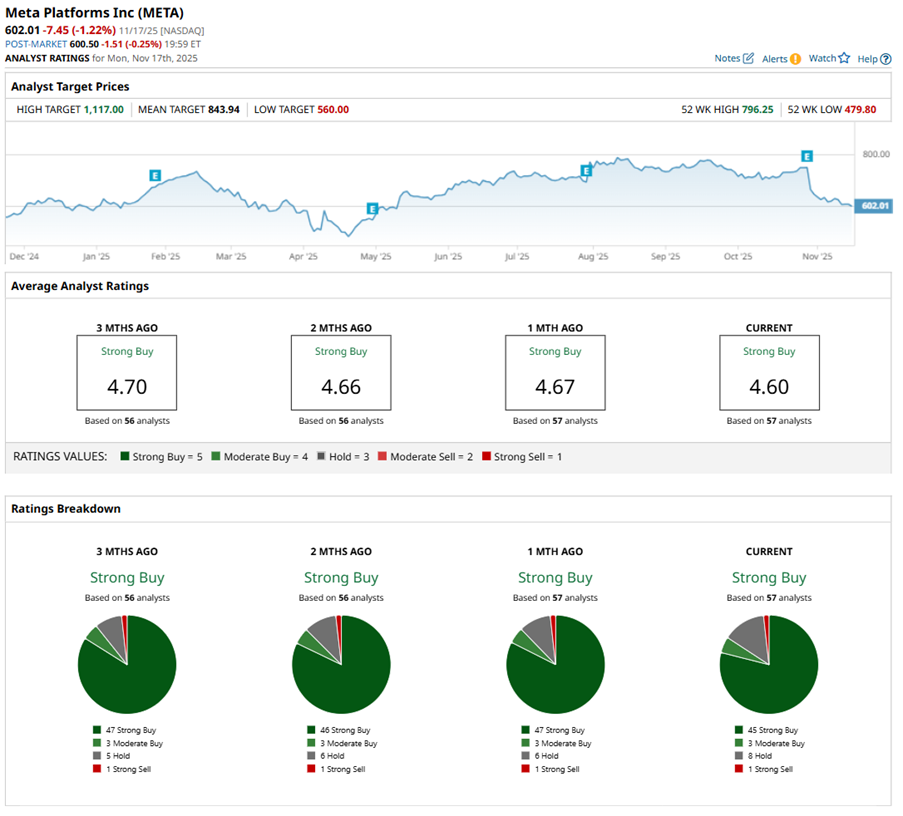

Overall, Wall Street is flashing the green flag for META stock, with a “Strong Buy” consensus reflecting widespread optimism about its growth prospects. Of the 56 analysts offering recommendations, 43 give it a solid “Strong Buy,” three suggest a “Moderate Buy,” nine give a “Hold,” and only one advocates for a “Strong Sell" rating.

META stock’s average analyst price target of $843.13 implies 43% potential upside. Meanwhile, Rosenblatt’s Street-high price target of $1,117 suggests that the stock can still rally as much as 90% from here.

On the date of publication, Sristi Suman Jayaswal did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- Nvidia Just Waved a Big ‘Green Flag’ for Taiwan Semi. Buy TSM Stock Here, Says Wedbush.

- Nvidia’s Growth Engine Is Running Hot — Should You Get On Board?

- Nvidia Stock Breaks 100-Day Moving Average on Q3 Earnings Selloff. Should You Buy the NVDA Dip?

- Nvidia Is a Leader in AI Computing, But Is NVDA Stock a Buy Now?

More News

View More

Recent Quotes

View More

Quotes delayed at least 20 minutes.

By accessing this page, you agree to the Privacy Policy and Terms Of Service.