Nvidia’s Growth Engine Is Running Hot — Should You Get On Board?

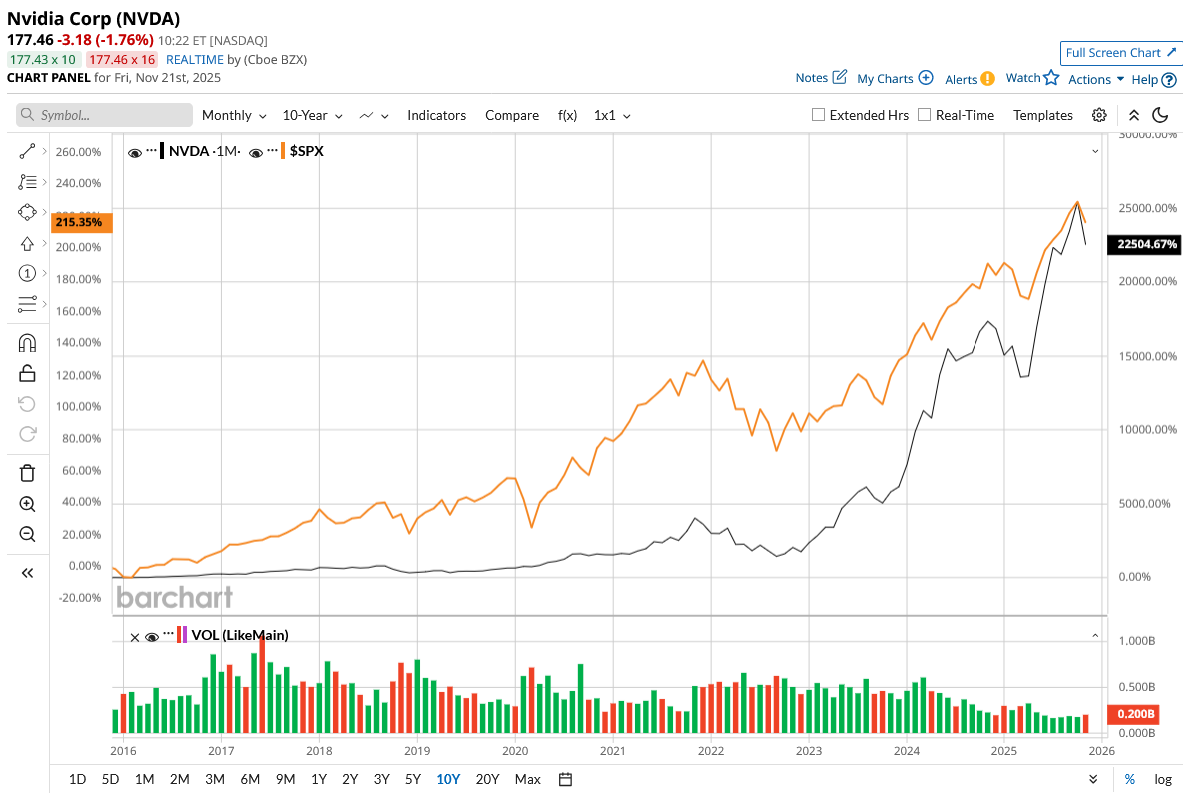

Sitting at a market cap of $4.5 trillion, Nvidia (NVDA) is the global leader in accelerated computing and artificial intelligence (AI) infrastructure, powering everything from data centers to next-generation robotics. NVIDIA stock has surged an impressive 23,420% over the last decade, driven by explosive AI demand, record-breaking data center growth, and deep partnerships across the tech ecosystem.

But with expectations sky-high, is the AI leader still a long-term bargain? Let’s find out.

Nvidia Keeps Crushing Every Earnings Quarter

Nvidia crushed another quarter, reporting $57 billion in revenue, up 62% year-over-year (YoY), with a record $10 billion sequential jump. Earnings per share rose 67% to $1.30, with adjusted gross margins exceeding expectations at 73.6%. The company continues to benefit from three massive technology shifts: accelerated computing, increasingly powerful AI models, and the rise of agentic AI applications. According to management, Nvidia is still only in the “early innings” of these transitions.

The company’s Data Center segment is the engine of growth, generating $51 billion in the quarter, a 66% YoY increase. Management highlighted that demand continues to exceed expectations, with cloud providers sold out and older-generation GPUs like Hopper and Ampere still running at full utilization. Compute sales increased by 56%, owing mostly to the rapid ramp of Blackwell's GB300, while networking revenue more than doubled due to NVLink scaling and widespread acceptance of Spectrum-X Ethernet and Quantum-X InfiniBand. The GB300 chip now accounts for two-thirds of Blackwell's revenue, overtaking the GB200. Hopper still made almost $2 billion, but H20 sales stagnated owing to geopolitical constraints in China.

Management indicated that Vera Rubin, its next major platform, is set to launch in the second half of 2026. Rubin, powered by seven chips, will provide another significant performance boost, an "X factor" advantage above Blackwell. The ecosystem has mastered Nvidia's rack-scale architecture, paving the way for a quick Rubin rollout. This quarter, Nvidia also unveiled an AI factory and large-scale infrastructure projects worth 5 million GPUs.

Coming to other segments, gaming revenue reached $4.3 billion, up 30% YoY, supported by strong demand and sustained momentum in Blackwell products. Meanwhile, automotive revenue rose to $592 million, up 32%, with Nvidia partnering with Uber to scale a Level 4-ready autonomous fleet using the Hyperion L4 robotaxi architecture.

Despite heavy investments, Nvidia maintains a sturdy balance sheet, with cash, cash equivalents, and marketable securities totaling $60.6 billion at the end of the quarter. Its debt-to-equity ratio is also low, at 0.08. It also generated positive free cash flow of $22 billion.

CUDA Remains Nvidia’s Moat

For over 25 years, Nvidia has developed CUDA to provide clients with a long usable life while minimizing the total cost of ownership. Even six-year-old A100 GPUs are still operating at full capacity thanks to ongoing software enhancements. In contrast, accelerators that do not support CUDA quickly become obsolete as model architectures improve. The world’s largest hyperscalers, transforming search, recommendation engines, and content understanding through generative AI, rely significantly on Nvidia's CUDA platform. The company added that analysts now predict top hyperscaler total CapEx to reach $600 billion in 2026, up more than $200 billion from the start of the year.

Nvidia has matured into a comprehensive AI infrastructure company, offering CPUs, GPUs, networking, software, and full-stack optimization to reduce cost per token. With the AI infrastructure market estimated to reach $3 trillion to $4 trillion per year by decade’s end, Nvidia believes its full-stack design advantage positions it as the superior platform for the long haul.

For fiscal 2027, Nvidia expects to maintain mid-70% gross margins despite rising input costs. Analysts who cover Nvidia expect revenue and earnings to increase by 63.2% and 56.5% for the full-year fiscal 2026. Revenue and earnings could further increase by 46.9% and 58.3%, respectively, in fiscal 2027.

According to CEO Jensen Huang, the world is undergoing three simultaneous platform shifts: accelerated computing, generative AI, and the rise of agentic and physical AI. Huang emphasized that Nvidia’s singular architecture is designed to power all three transformations, implying that Nvidia will lead the next tech supercycle as well.

Currently, Nvidia trades at 24 times forward fiscal 2027 earnings, lower than its five-year historical average P/E of 46x. Backed by strong fundamentals and explosive growth over the next decade, Nvidia still remains a reasonable AI stock to grab now.

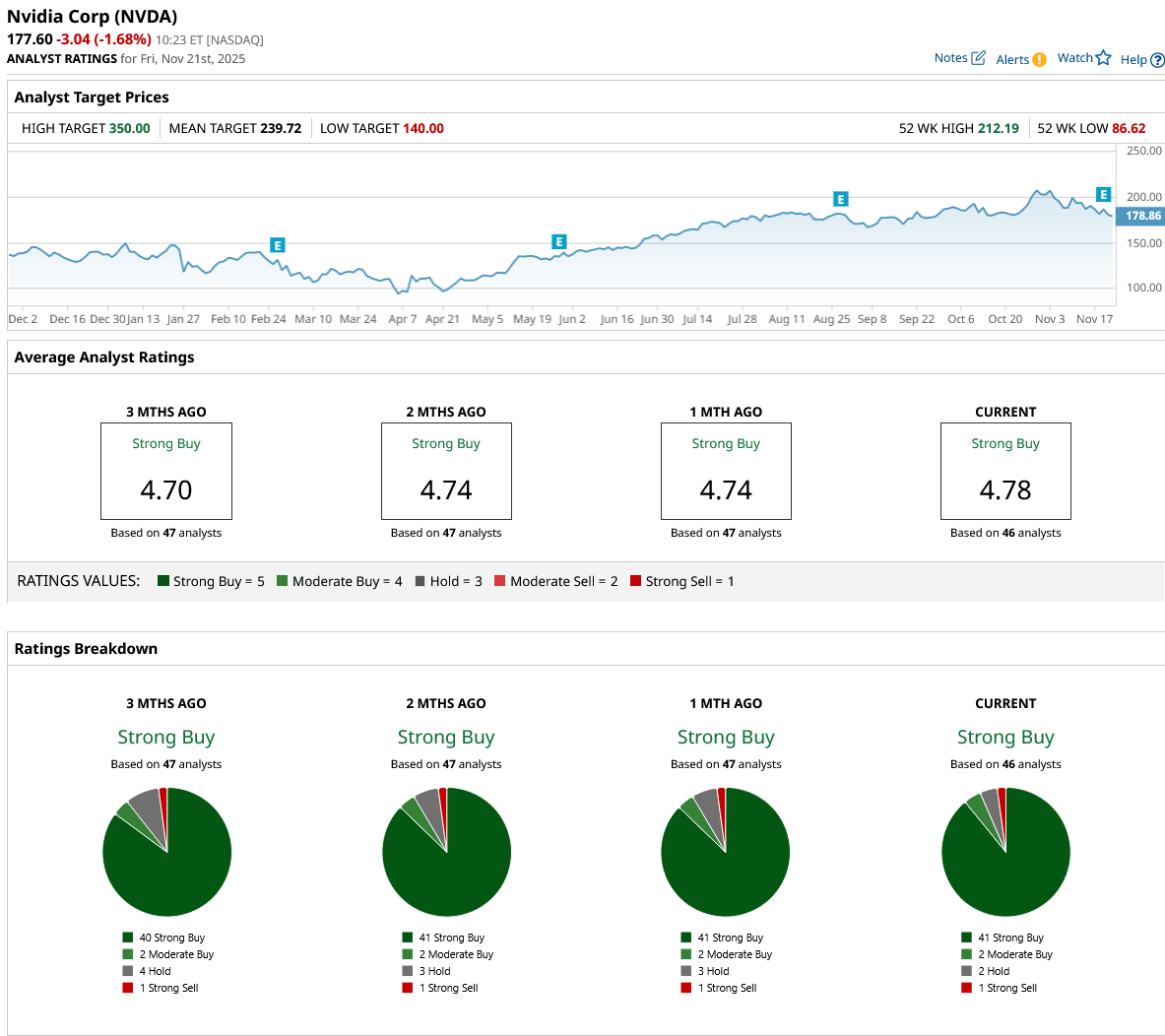

What Is the Target Price for NVDA Stock Now?

NVDA stock is up 34% year-to-date (YTD). Nonetheless, Wall Street sees potential upside of 35% from current levels based on its average target price of $239.72. Plus, the high price estimate of $350 implies an upside potential of 97% over the next 12 months. Overall, NVDA stock remains a “Strong Buy.” Out of the 46 analysts covering the stock, 41 have a “Strong Buy” recommendation, two rate it a “Moderate Buy,” two rate it a “Hold,” and one says it is a “Strong Sell.”

On the date of publication, Sushree Mohanty did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- Meta Platforms Just Lost Its Chief AI Scientist. Does That Make META Stock a Sell Here?

- Eli Lilly Stock Joins the $1 Trillion Club as LLY Hits New All-Time Highs

- Is Archer Aviation Stock a Buy on New Powertrain Supply Deal?

- This 1 Company Is the Nvidia of Quantum Computing. Should You Buy Its Stock Now?

More News

View More

Recent Quotes

View More

Quotes delayed at least 20 minutes.

By accessing this page, you agree to the Privacy Policy and Terms Of Service.