5 Dividend Kings to Buy and Forget

Dividend Kings are worth considering if you are looking for stocks that can weather any market storm while quietly building wealth over time. These elite companies have hiked their dividends for 50 consecutive years or more, proving their resilience, reliability, and long-term potential.

Dividend King #1: Lowe’s Companies (LOW)

Lowe’s Companies (LOW) is one of America’s most trusted home improvement retailers and a standout Dividend King, boasting 62 years of consecutive dividend growth. Regardless of market conditions, homeowners continue to make investments in repairs, renovations, and improvements. Lowe's broad network of over 1,700 stores across the U.S., along with savvy investments in e-commerce, has enabled the company to maintain its earnings.

Lowe’s dividend payout ratio of 35% remains reasonable, supported by strong free cash flow and a commitment to share repurchases. In fact, besides paying a reasonable yield of 2.07%, Lowe’s is also aggressively buying back shares, boosting earnings per share, and rewarding long-term investors. In the third quarter, Lowe's paid out $673 million in dividends.

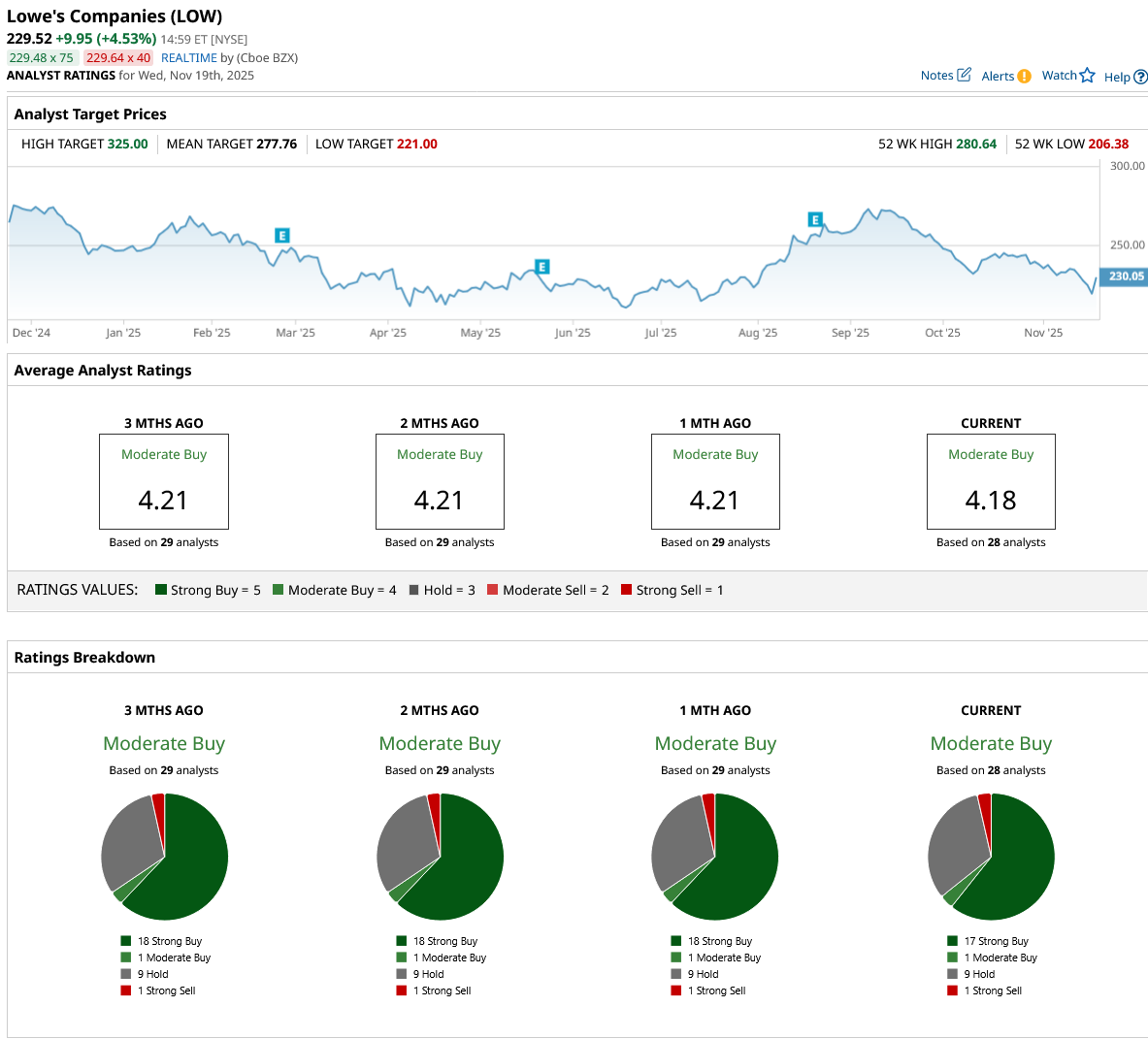

Currently, Lowe’s stock has a "Moderate Buy" rating on Wall Street. Of the 28 analysts who cover LOW, 17 have a "Strong Buy" rating, one has a "Moderate Buy" rating, nine say it is a “Hold,” and one has a "Strong Sell" rating. Based on the mean target price of $277.76, LOW stock has upside potential of 26.5% from current levels. Plus, its high target price of $325 implies an upside potential of 48% over the next 12 months.

Dividend King #2: PepsiCo (PEP)

PepsiCo (PEP) is one of the most dependable names in the consumer staples sector and is a Dividend King with more than 52 consecutive years of dividend increases. The company's strength is its diverse array of beverages and snacks, which enables it to maintain steady revenue growth even when one segment faces headwinds. PepsiCo's yield of 3.9% is significantly higher than the consumer staples average of 1.9%.

While its payout ratio of 70.6% is high, the company has pledged to pay out $7.6 billion in dividends and $1.0 billion in share repurchases in 2025.

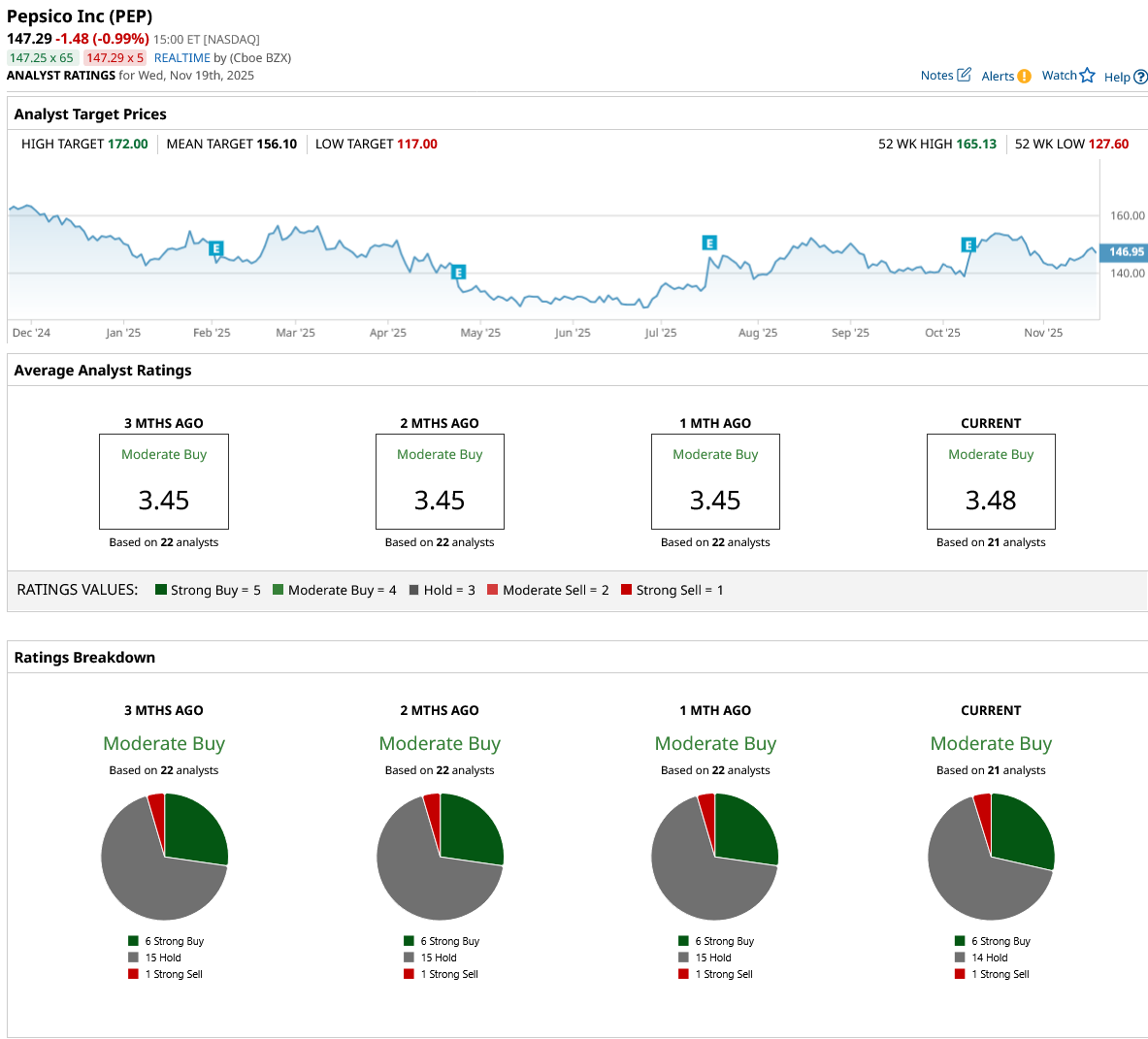

Overall, PEP stock has a "Moderate Buy" rating on Wall Street. Of the 21 analysts who cover PEP, six have a "Strong Buy" rating, 14 say it is a “Hold,” and one has a "Strong Sell" rating. Based on the mean target price of $156.10, PEP stock has upside potential of 4.9% from current levels. Plus, its high target price of $172 implies an upside potential of 15.6% over the next 12 months.

Dividend King #3: Coca-Cola Company (KO)

The Coca-Cola Company (KO) is one of the most recognizable brands with its unmatched global footprint. As a Dividend King with over 62 consecutive years of dividend increases, Coca-Cola has built a reputation for stability, resilience, and long-term wealth creation. Coca-Cola’s yield of 2.8% is supported by stable earnings and consistent free cash flow. The company also maintains a healthy payout ratio of 67.6%, leaving room for further growth.

Coca-Cola is not a fast-growing stock, but its steady appreciation and consistent dividend payment are precisely what long-term income investors seek.

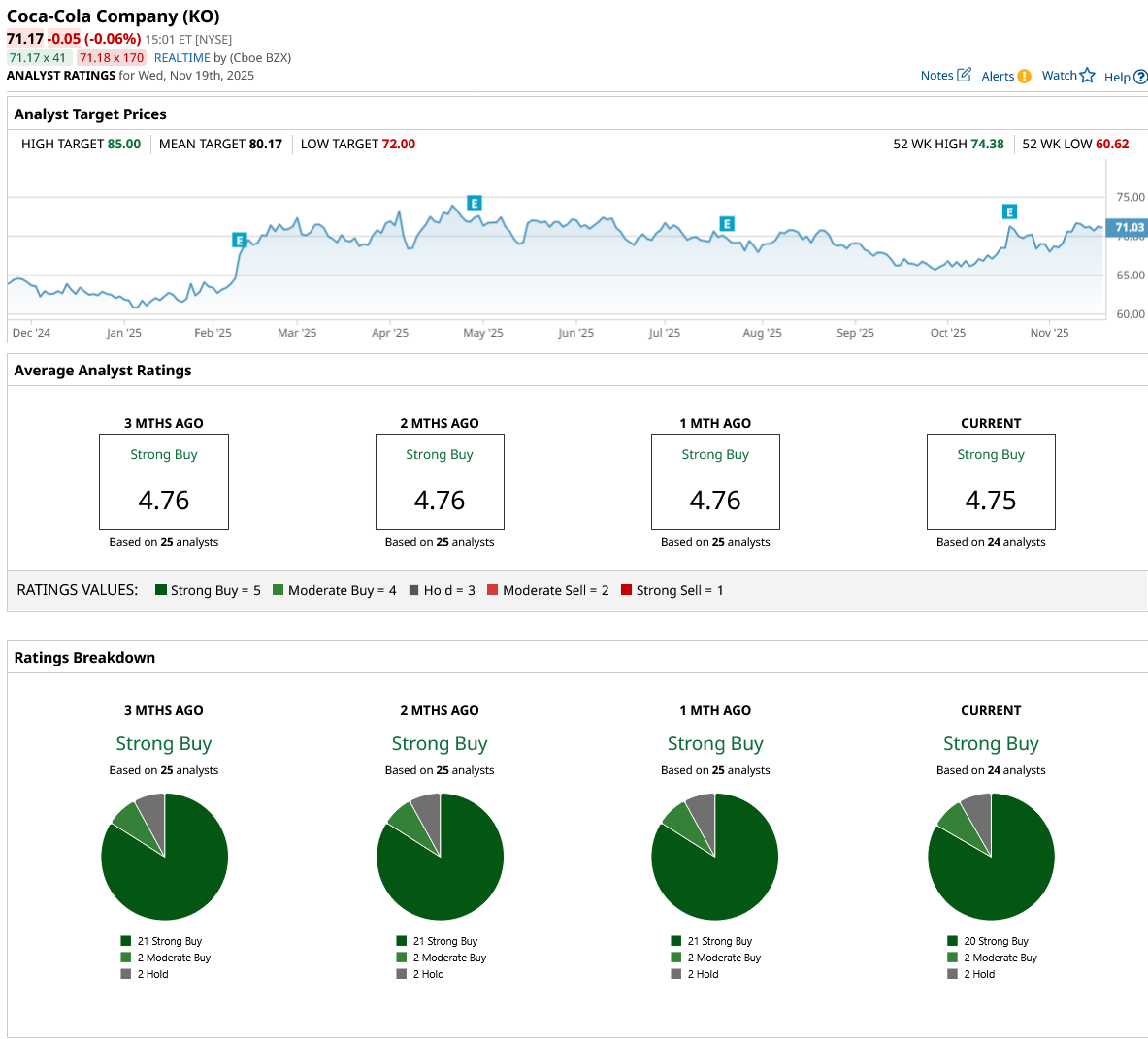

Overall, KO stock has a "Strong Buy" rating on Wall Street. Of the 24 analysts who cover KO, 20 have a "Strong Buy" rating, two say it is a “Moderate Buy,” and two rate it a “Hold.” Based on the mean target price of $80.17, KO stock has upside potential of 12.5% from current levels. Plus, its high target price of $85 implies an upside potential of 19.4% over the next 12 months.

Dividend King #4: Emerson Electric Company (EMR)

With around 68 consecutive years of dividend increases, Emerson Electric Company (EMR) stands out among the elite Dividend Kings. Emerson operates in two core areas: automation solutions and commercial/residential products. Its automation division is its backbone, helping industrial customers in optimizing operations, increasing productivity, and reducing downtime using modern automation technologies.

The company’s yield typically sits around 1.7%, supported by consistent cash flow generation and a conservative payout ratio of 35%. Recently, the company increased its quarterly dividend by 5%. The company plans to return $2.2 billion to shareholders in 2026 through dividends and share repurchases.

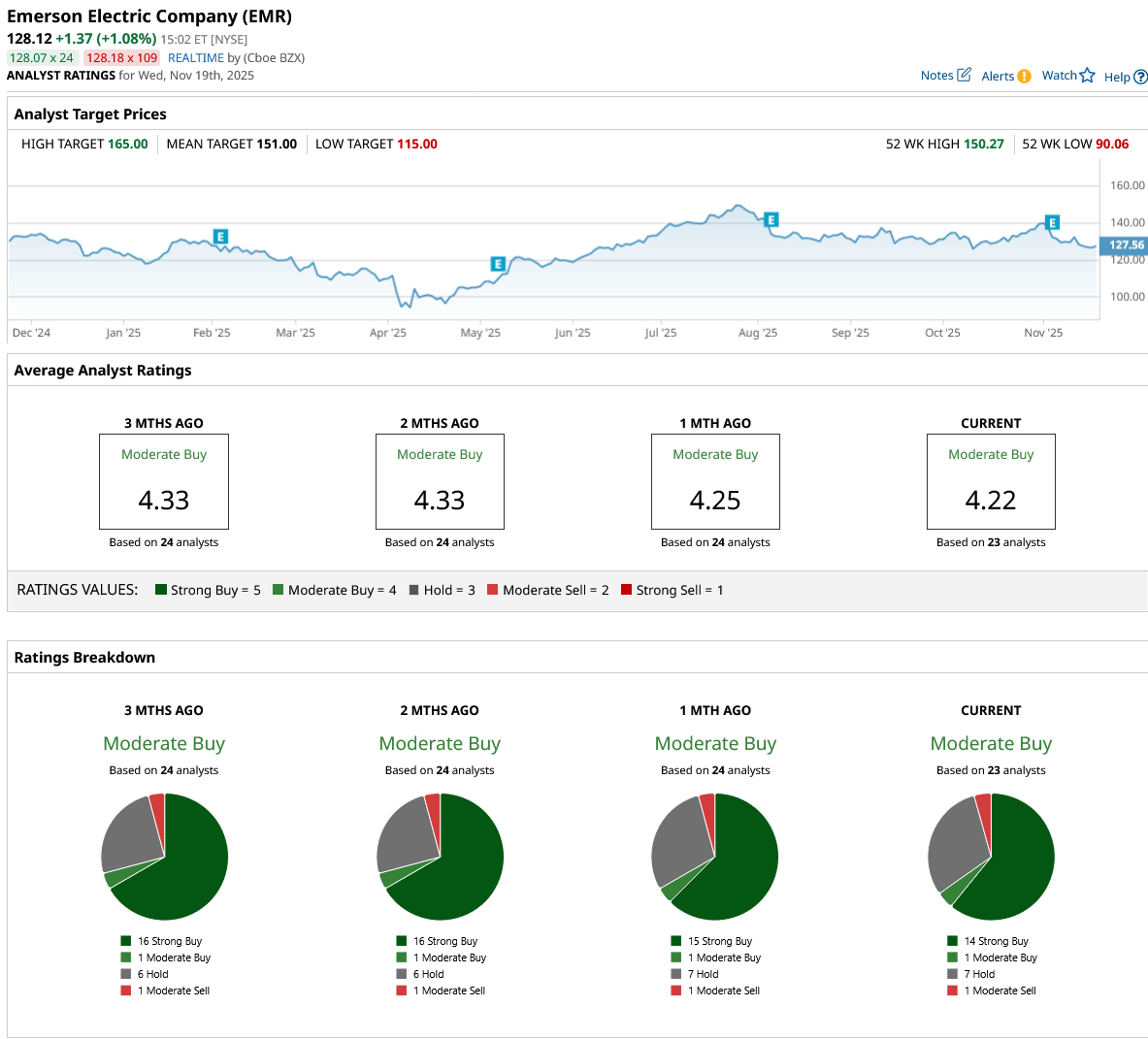

Currently, Emerson stock holds a "Moderate Buy" rating on Wall Street. Of the 23 analysts who cover EMR, 14 have a "Strong Buy" rating, one says it is a Moderate Buy,” seven rate it a “Hold,” and one says it is a “Moderate Sell.” Based on the mean target price of $151, EMR stock has upside potential of 19.1% from current levels. Plus, its high target price of $165 implies an upside potential of 30.1% over the next 12 months.

Dividend King #5: Procter & Gamble Company (PG)

Procter & Gamble (PG) is a global consumer company with a strong portfolio of everyday household brands, including Tide, Pampers, Gillette, Head & Shoulders, Ariel, Oral-B, and Olay. These products are vital, repeat-purchase items that consumers rely on regardless of economic cycles, making P&G's revenue base extremely stable.

With almost 69 consecutive years of dividend increases, P&G has established a track record of stability, durability, and consistent shareholder returns. In the first quarter of fiscal 2026, P&G returned $3.8 billion in cash to shareholders, including $2.55 billion in dividends and $1.25 billion in share repurchases.

With a yield of over 2.8% and decades of consistent increases, P&G has shown its commitment to repaying money to shareholders. The company maintains a conservative payout ratio of 57% and generates significant free cash flow, giving it both the capacity and consistency to grow its dividend year after year.

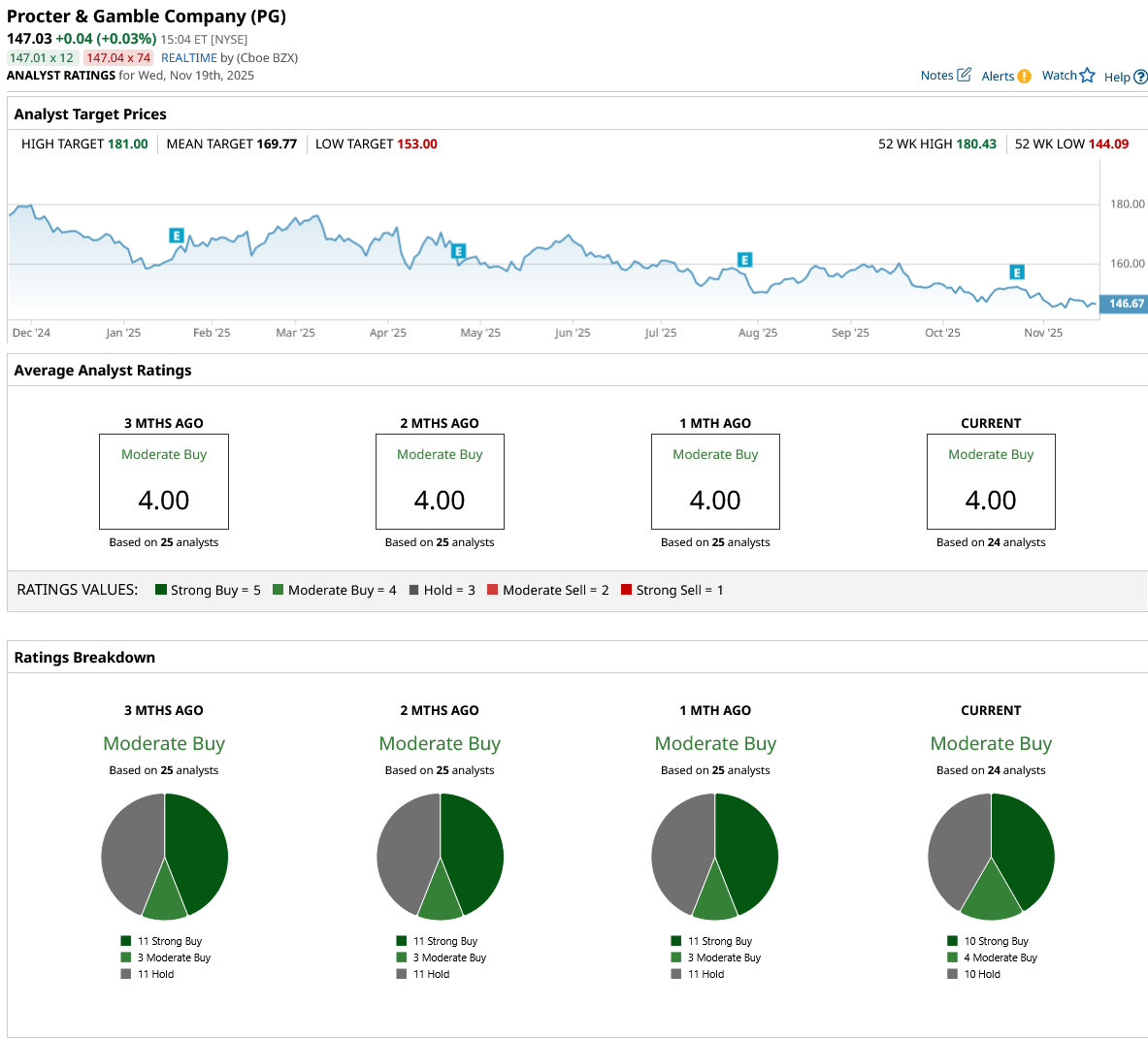

Currently, PG stock holds a "Moderate Buy" rating on Wall Street. Of the 24 analysts who cover PG, 10 have a "Strong Buy" rating, four say it is a “Moderate Buy,” and 10 rate it a “Hold.” Based on the mean target price of $169.77, PG stock has upside potential of 15.5% from current levels. Plus, its high target price of $181 implies an upside potential of 23.1% over the next 12 months.

On the date of publication, Sushree Mohanty did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- 5 Dividend Kings to Buy and Forget

- Find Breakout Stocks & Winning Option Trades with Our TTM Squeeze Lesson for Beginners

- Oscar Health Jumps in Hopes of Obamacare Extensions. Should You Buy OSCR Stock Here?

- I Paid for Michael Burry’s New $400 Substack So You Don’t Have To

More News

View More

Recent Quotes

View More

Quotes delayed at least 20 minutes.

By accessing this page, you agree to the Privacy Policy and Terms Of Service.